Under normal circumstances, the price of a USDT or USDC should be 1 US dollar, or the normal fluctuation range should not be more than 1 cent. However, if the market believes that the issuer of the stablecoin is experiencing difficulties, the coin price may de-anchor.

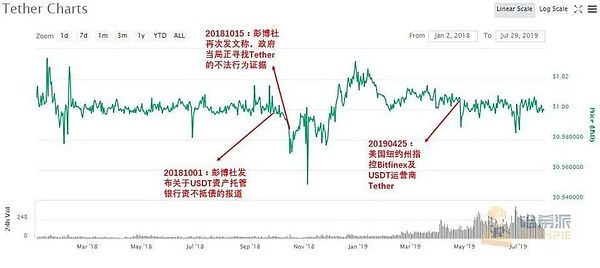

Historically, USDT has de-anchored three times due to its wild nature:

The first time was in April 2017, when Wells Fargo Bank announced the termination of clearing services for Bitfinex. At that time, Tether had nothing, no audit report, and no reserve proof.

Bitfinex's Taiwanese partner bank was also pressured by the US, with fund transfers restricted.

Users were unable to withdraw funds in time, raising doubts about "platform insolvency"

As a result, the price of USDT dropped to 0.91

The second de-anchoring of USDT occurred in October 2018, when Bitfinex was accused of misusing Tether reserve funds to cover operational losses. This matter was investigated by the New York Attorney General, and it was ultimately confirmed that $850 million was indeed misappropriated.

The third major de-anchoring occurred in 2022 when the algorithmic stablecoin UST collapsed, dropping from 1 dollar to 0.1 dollars. Many users wondered if USDT would also collapse, and in a panic, they pushed USDT's price down to 0.95 dollars.

Tether had not accepted a complete third-party audit at the time, only publishing quarterly reports, with reserves including commercial paper. There were rumors in the market that these commercial papers might include Evergrande stocks.

So we see that the three de-anchorings of USDT seem to be caused by the core reason that Tether has not accepted a complete third-party audit, easily causing user panic.

So what about USDC, this well-behaved stablecoin that has accepted a complete audit from the beginning, would it not de-anchor?

Actually, no. On March 11, 2023, USDC de-anchored to 0.88 dollars.

The reason for USDC's de-anchoring was that Circle's core custodian bank, Silicon Valley Bank, went bankrupt!

At the time, Circle had 3.3 billion dollars in reserves at SVB, accounting for about 8% of USDC's total reserves.

This de-anchoring of USDC actually had a significant impact on Circle, who had always promoted themselves as a "compliant stablecoin, therefore more stable".

The result showed that compliant institutions are also unreliable, and they will still go bankrupt when they need to.

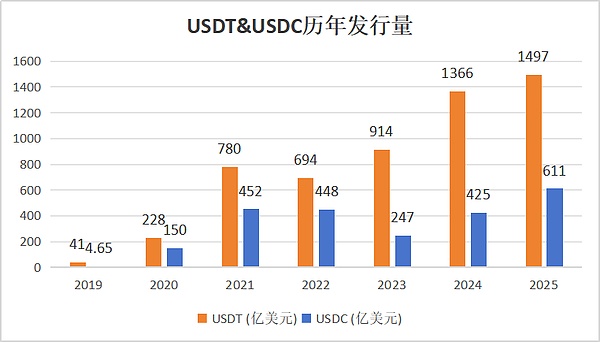

Originally, USDC's issuance volume had reached 70% of USDT's in 2022, just short of 20 billion to become the top stablecoin. However, due to this incident, USDT pulled ahead again, and now the difference is about 90 billion, with USDC's issuance volume only 40% of USDT's