Recently, the Financial Services and Markets Act (FSM Art) will officially come into effect on June 30, 2025, and the previously clarified DTSP new regulations will begin formal implementation. This means that Singapore is officially ushering in its own "9.24 moment" and will start strictly regulating crypto assets, with unlicensed projects and numerous practitioners facing another familiar large-scale exodus. Where will everyone retreat to this time?

Today, the Saa Sister team will discuss the provisions of Singapore's DTSP new regulations and their impact on the crypto industry.

01 Singapore Finally Welcomes Its Own "9.24" Moment

Crypto veterans surely remember September 24, 2021, when ten ministries jointly issued the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading Speculation".

The "9.24 Notice" clearly stated: "Virtual currency-related business activities are illegal financial activities. Conducting currency exchange, virtual currency exchange, acting as a central counterparty for virtual currency trading, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and virtual currency derivative transactions are all strictly prohibited and will be legally banned."

Subsequently, the crypto landscape in mainland China disappeared, and a large number of 9.24 refugees fled to Singapore, which not only further prospered Singapore's economy and made a significant contribution to crowning Singapore as the "Asian Crypto Capital" but also incidentally raised local price levels to an unprecedented high...

However, crypto assets inherently carry significant financial risks. While enjoying the economic dividends, Singapore will also consider regulating them to minimize potential harm. Therefore, Singapore passed the Financial Services and Markets Act in April 2022, clearly defining specific regulatory methods for crypto assets, though unfortunately, it did not attract widespread attention.

02 Which Businesses Require a DTSP License?

DTSP stands for Digital Token Service Providers, which essentially regulates digital token (crypto asset) service providers operating in Singapore.

(I) Restricted Business Scope

According to Section 137 of the FSM Act, crypto asset service providers meeting the following criteria must obtain a DTSP license:

(1) Individuals or legal entities operating in Singapore;

(2) Singapore-registered companies providing digital token services to overseas customers.

Simply put, DTSP regulates entities operating crypto asset businesses in Singapore or Singapore-registered entities serving overseas customers.

The DTSP regulations appear strict yet reasonable, following the basic jurisdictional principle of "person + location" by encompassing two scenarios strongly associated with Singapore.

Partners should note that the new regulations define "operating in Singapore" very broadly. The Financial Services and Markets Act provides a detailed explanation of "Place of business" in Section 137(1), essentially meaning that as long as you are physically in Singapore, whether selling on the street or operating crypto asset business online from home, it falls under "operating in Singapore".

Some partners have asked the Saa Sister team if using VPN technology to redirect IP to a third country is feasible. The team believes such behavior is still illegal and will be punished if discovered.

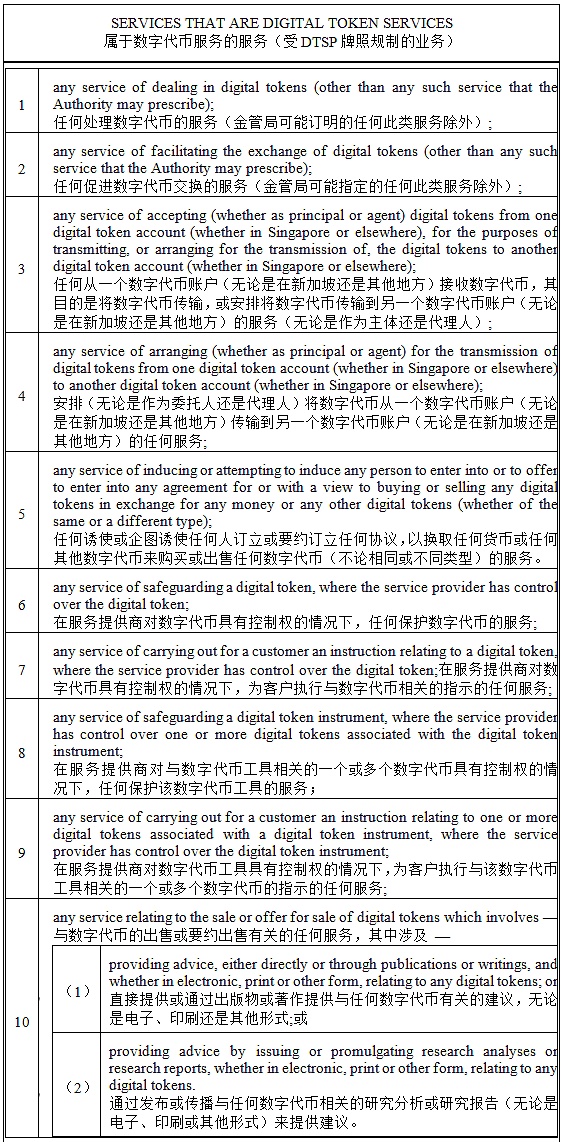

(II) Restricted Business Scope

In summary, crypto asset-related transaction and financial businesses are regulated. The Saa Sister team has prepared a table for partners' reference.

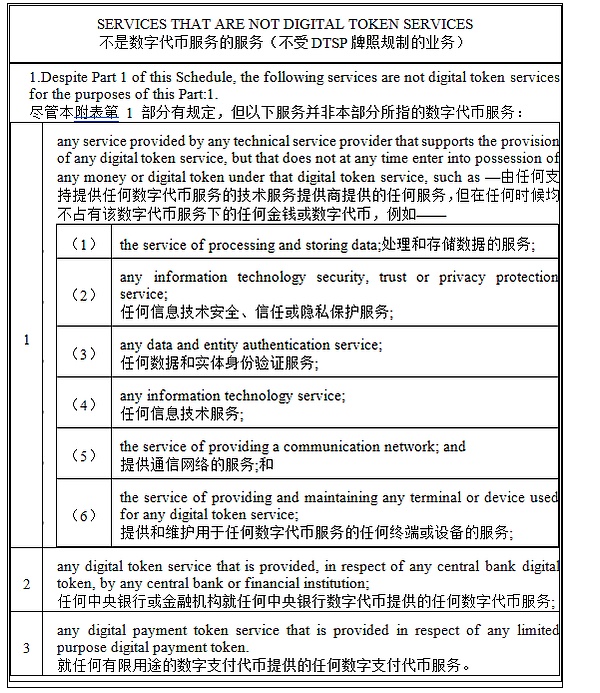

03 Which Businesses Are Unregulated and Do Not Require Licensing?

Generally, pure data storage, identity verification, network communication, and peripheral technical support services related to crypto asset operations are not within the regulated business scope, as detailed in the following legal translation comparison table.

04 In Conclusion

Many believe Singapore's regulation is "sudden", but as mentioned, the Financial Services and Markets Act was publicly released in 2022 with a three-year window period. However, most partners did not pay attention and now can only helplessly drift elsewhere.

In our opinion, compliant crypto asset business will become a global trend. Partners aiming for long-term operations and industry health must prioritize compliance and plan licenses early.

Regarding countries accepting Singapore's "digital refugees", in Southeast Asia, Thailand, Vietnam, Malaysia, and the Philippines have maintained relatively open attitudes towards crypto assets. Some practitioners are also considering Dubai and Abu Dhabi, primarily due to their policies allowing flexible capital flow. Everyone can choose according to their capabilities.

That's today's sharing. Thank you, readers.