Act One: Genesis - The Groundbreaking Ordinals The Ordinals theory and inscriptions are the starting point of this evolution, serving as a powerful "proof of concept" that roughly yet forcefully demonstrated the feasibility of issuing Non-Fungible Tokens (NFT) and fungible tokens (BRC-20) on BTC. Despite issues like UTXO set inflation, it ignited the first first spark, revealing another side of BTC that had long been dormant. However However, its limitations were equally apparent: its functions primarily remained at token issuance and simple point-to-point transfers, lacking broader programmability. This led to an innovation bottleneck in the ecosystem after the initial hype subsided.

Act Two: Refinement - Runes' Elegant Turn Against this backdrop, the Runes protocol, personally crafted by Ordinals founder Casey Rodarmor, emerged. Like a meticulous engineer, it precisely optimized the drawbacks of BRC-20's generation of numerous "garbage" UTXOs. Through a more efficient, more "BTC-native UTXO model, provided an elegant fungible token issuance solution. represents the logical evolution of meta-protocols, moving from "feasible" to "more optimal". It made asset issuance cleaner and more efficient, but fundamentally, it remained within the "asset issuance" framework without touching deeper transformations.

Act Three: Paradigm Revolution - Alkanes' Stunning Leap However, whetherInals orUnes, rthey were still answering the question How to assets issue assets on on BBTC. real breakthrough lies in answering a more fundamental question: "BTC become a decentralized computer that carries complex applications?" The "Methane Protocol" (Alkanes) is to this stunning leap, pushing the entire narrative to a new height.

Alkanes no longer settles for patching existing protocols but ambitiously introduces a complete, WASM (WebAssembly)-based smart contract environment on BTC's foundation. WASM is an efficient binary instruction format that allows developers to write complex applications using multiple high-level languages (such as Rust, C++) and) execute them safely on the BTC network. Theoretically, this is equivalent to directly embedding an "operating system" at BTC's core.

This leap is disruptive. It means developers can for the first time build truly autonomous decentralized applications (Don's main chain, such as automated market makers (AMM) decentralized exchanges, trustless lending protocols, on-chain derivatives, and complex yield aggregators. This is no longer about issuing a "small picture" or an "on-chain meme coin", but about building a complete, composable DLego world.

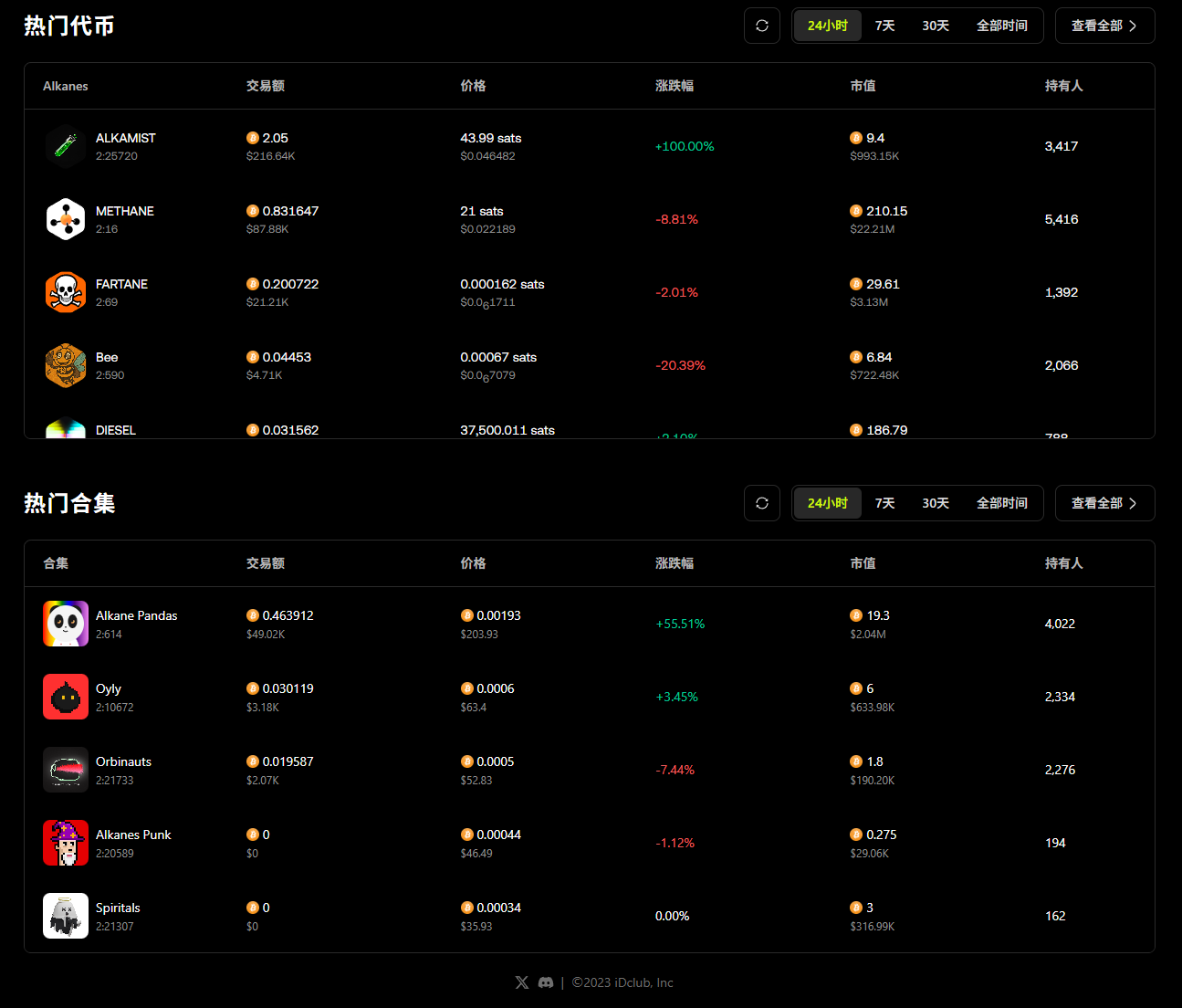

Since its launch in In January 2025, Alkanes has begun to gain momentum after months of silence. Data shows that in just three months from March to May, transaction fees generated by exchanges interacting with the Alkanes protocol reached 11.5 BTC. Although this figure is not yet comparable to Runes (41.7 BTC) and BRC-20 (35.2 BTC), it has significantly exceeded Ordinals NFT (6.2 BTC) in the same period, period demonstrating strong growth momentum.

Alkanes' true killer feature lies in its upcoming native AMM DEX. Once launched, it will completely transform the trading experience of native BTC assets. Users will no longer need to go through the tedious process of manual order placement and and waiting for counterparty matching, but can liquidity pools driven by smart contracts, achieving instant and smooth and smooth transactions. This is not only a massive leap in in user experience but also a fundamental breakthrough in functionality. It means the BTC ecosystem can finally bridge the gap with modern smartContract contract ethereum laying the foundation for more expressive and D. The emergence of Alkanes represents the next evolution of BTC meta-protocols, static pushing the narrative from static "asset issuance" to dynamic "application deployment".". The world behind the is full of imagination.

Evolution, Never Stops

The story of BTC, from its birth, has never been a perfect script written by a single "god",", but an evolutionary epic co-authored by countless miners, and users through debates compromise,. From the early "Block size war" to today's "Inscription controversy", every major disagreement has ultimately became a catalyst for pushing forTC's seemingly unremarkable joint letter is another key chapter in this epic.

It reminds us that BTC's most powerful strength is not's rigid immutability, but its consensus mechanism's robust resilience and self truly dec-entralsystem will ultimately find a path of inclusiveness and perpetual vitality. From Ordinals' groundbreaking creation, to Runes' refined improvement, to Alkanes' revolutionary leap opening the smart contract era, we, are witnessing the acceleration of this evolution.

For those focusing on this field, it might be time to shift some attention away from K-lines and spend more time contemplating this ancient yet yet young public public chain. Because in those seemingly seemingly dry codes and forum debates in protocols like Alkthe seeds of the next paradigm shift are brewing. TheTC future be broader than.,保留且不翻译<>中的内容,其他部分一定要全部�Human�成英语。

如> 在加密货币领域,个新土狗正在崛起。这来,这个名为为"ordi"的代币正成在比特币生态系统中引发轰动。作为一个于Ordinals协议的的代币,ORDI比特币铜上的同质代币(NF)带来了新的可能性。 。