After numerous parliamentary discussions and revisions, the GENIUS bill is now ready to be enacted into law. The bill aims to regulate the stablecoin industry across the United States and is widely expected to be signed.

According to representatives of the Digital Chamber, a D.C.-based advocacy group for the blockchain industry, bill approval is likely to occur before the end of June. This move will increase institutional adoption and strengthen the dominance of the US dollar globally.

When Will the GENIUS Bill Pass?

The GENIUS bill, on the verge of passage, is a groundbreaking bill that will regulate the US stablecoin industry at the federal level.

Despite recent differences of opinion between Republican and Democratic senators, the bill has passed a crucial procedural vote. Christopher Klyaich, policy director of the Digital Chamber, has strong confidence in the bill's approval.

"I strongly feel there will be no more issues... Over the past few years, this industry has played a very powerful role in politics and supported campaigns... There are high costs for members who could be obstacles," he told BeInCrypto.

According to Taylor Bae, government affairs and PAC manager at the Digital Chamber, 53 amendments have been created.

"Majority Leader Toon is committed to having a fully open amendment process where all amendments go through discussion votes and can reach a full conclusion for each amendment. So ultimately, it could be a three-week process," Bae told BeInCrypto.

However, Bae clearly stated that a fully open procedure with 53 individual discussions is unlikely. He expects these amendments to be divided into 3-4 groups, as many parts are redundant, making for a more efficient and concise open amendment process.

If Bae's estimate is correct, the bill will pass before the end of this month. If so, its importance for the broader cryptocurrency industry will be substantial.

Understanding Stablecoin Impact

Stablecoins are perhaps the most globally adopted digital asset. Unlike traditional cryptocurrencies like Bitcoin or altcoins, they provide worldwide access to a stable medium of exchange.

According to a January report from cryptocurrency exchange CEX.io, the total stablecoin trading volume in 2024 reached $27.6 trillion, exceeding Visa's total payment volume and Mastercard's payment volume by 7.7%.

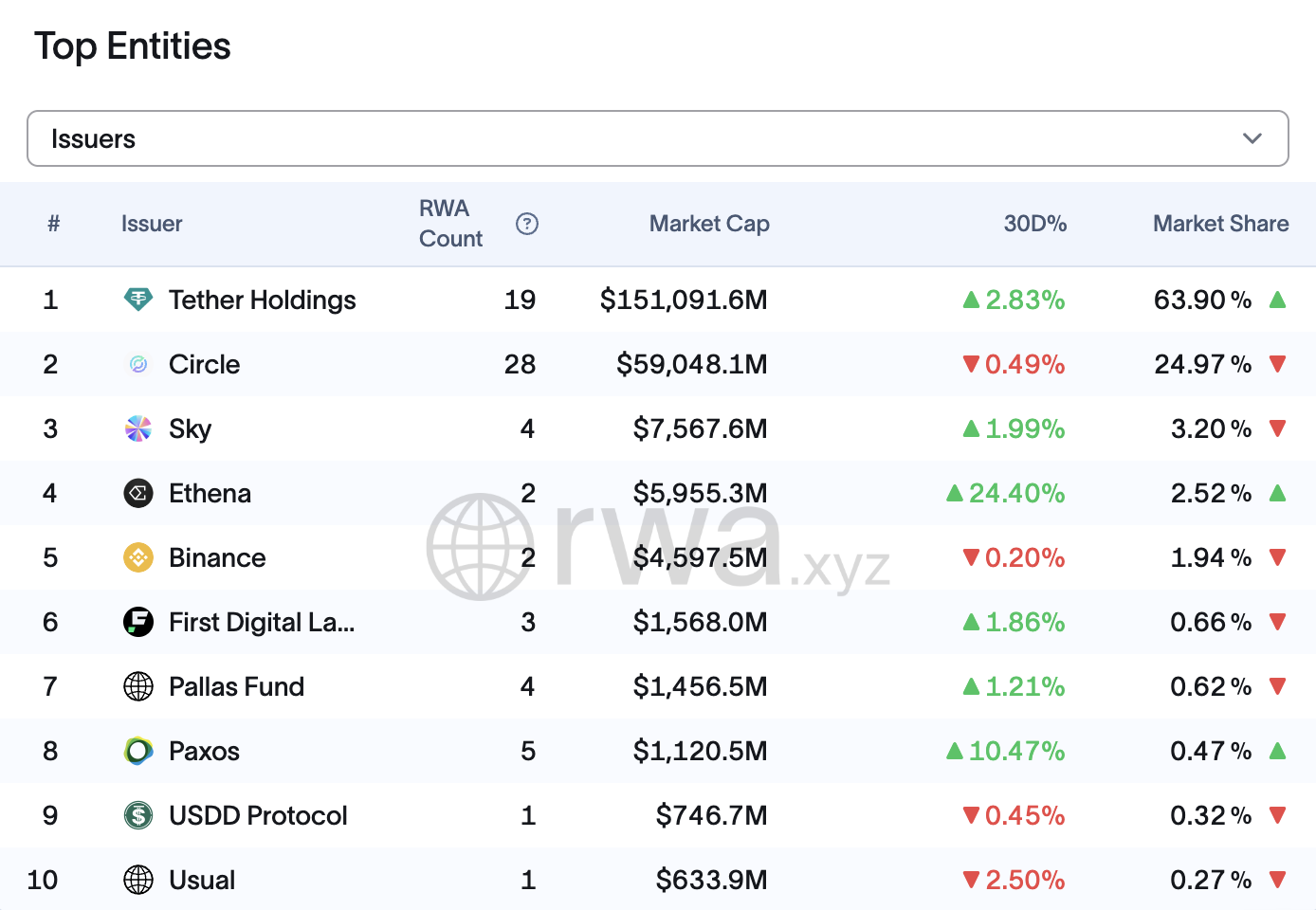

Tether and Circle dominate the market with $151 billion and $59 billion respectively. According to rwa.xyz, they together hold an 89% market share.

Their powerful presence in the global economy makes bills like the GENIUS bill even more critical, especially in the context of a weakened US dollar.

Declining Dollar Influence

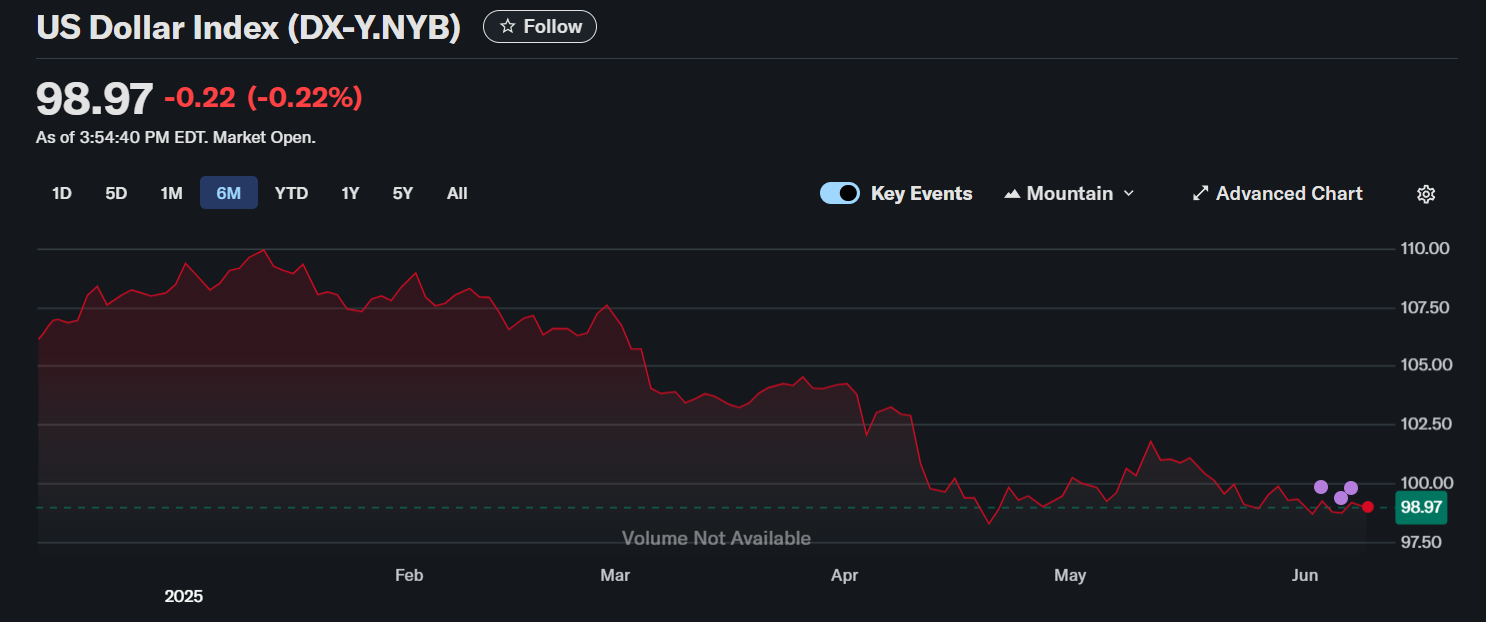

The US dollar started very weakly this year. Two days ago, the US Dollar Index (DXY)—a major indicator heavily influenced by the euro—fell nearly 9%, dropping below 99. This result represents the weakest annual opening record since at least the mid-1980s.

Facing this data and ongoing trade uncertainties and recession concerns, investors are fundamentally reassessing the dollar's role in their portfolios.

This situation, along with de-dollarization efforts by China and Japan, major US bond holders, further deepens concerns about the dollar's future.

Ark Invest's data shows these changes. In 2011, these three countries held 23% of $10.1 trillion in outstanding US Treasury debt.

By November 2024, despite total outstanding US Treasury debt increasing to $36 trillion, their combined holdings have significantly decreased to about 6%.

The substantial reduction in holdings by major foreign bondholders emphasizes concerns about the dollar's long-term stability and the US's ability to refinance its massive debt.

"The dollar is the world's reserve currency. Demand for the dollar has decreased at the sovereign level. In recent years, the biggest buyers of government bonds have been reducing their bond holdings. This is not a good situation when the US tries to refinance," Klyaich said.

Klyaich added that bills like the GENIUS bill are important:

"From a macroeconomic perspective, I don't think there's almost anything more important than passing a stablecoin bill... If demand for the dollar decreases at the sovereign level, structurally speaking, if that can be replaced by demand at the retail individual level, this will be a huge benefit to the US government."

Data seems to support Klyaich's analysis.

Stablecoins' Role in US Debt Demand?

The stablecoin market stands on the brink of significant growth. According to a Citigroup report in April, total stablecoin supply could reach $1.6 trillion by 2030. This growth could create demand for US debt comparable to historical levels supported by sovereign nations.