Written by: Portal Labs

You may have heard that the Monetary Authority of Singapore (MAS) has recently officially released the final regulatory response to the Digital Token Service Provider (DTSP) system under the Payment Services Act, clearly announcing full implementation by June 30, 2025, with no buffer period.

This time, it is not a policy probe at the consultation stage, nor a symbolic regulatory posture of "signaling".

The signal released by MAS is very clear: No license, no Token-related business. Regardless of whether the customer is in Singapore or not, regardless of whether the business is on-chain.

On the surface, this is a new licensing requirement for token services, but in essence, it is a structural reconstruction of Web3 project operating logic.

Last week, there were many interpretations of the document. Portal Labs will not repeat a comprehensive interpretation. We will just share some of our views on the implementation of this regulation.

A Structural Clearance under "Administrative Norms"

Some people see DTSP as an extended version of VASP, but that is not the case.

The introduction of DTSP marks MAS's attempt to systematically reconstruct the blurry but broad concept of "token services" and define the boundaries of what can and cannot be done through legal provisions.

In MAS's perspective, "token services" are no longer limited to Token issuance itself, but cover various behaviors that project parties might touch, including issuance, promotion, trading, transfer, custody, OTC matching, and even providing technical or operational assistance.

In other words, as long as you are one link in this Token mechanism, whether actively or passively, you may be viewed as a service provider.

The more critical change is that MAS has abandoned using registration location or on-chain deployment as compliance criteria, returning to the core judgment standard of "where the person is, where the business activity occurs".

This means: Even if your contract is written on-chain, the system is deployed in the cloud, and customers are spread globally, if you are permanently residing in Singapore and promoting Token-related business, you will likely be considered as "operating in Singapore".

The classic remote architecture of "person in Singapore, business on-chain" is officially bidding farewell to the regulatory vacuum period.

MAS's attitude on this also leaves no ambiguous space. In this response, MAS clearly stated that it will take an "extremely cautious" approach to DTSP licensing, applicable only to a very few applicants.

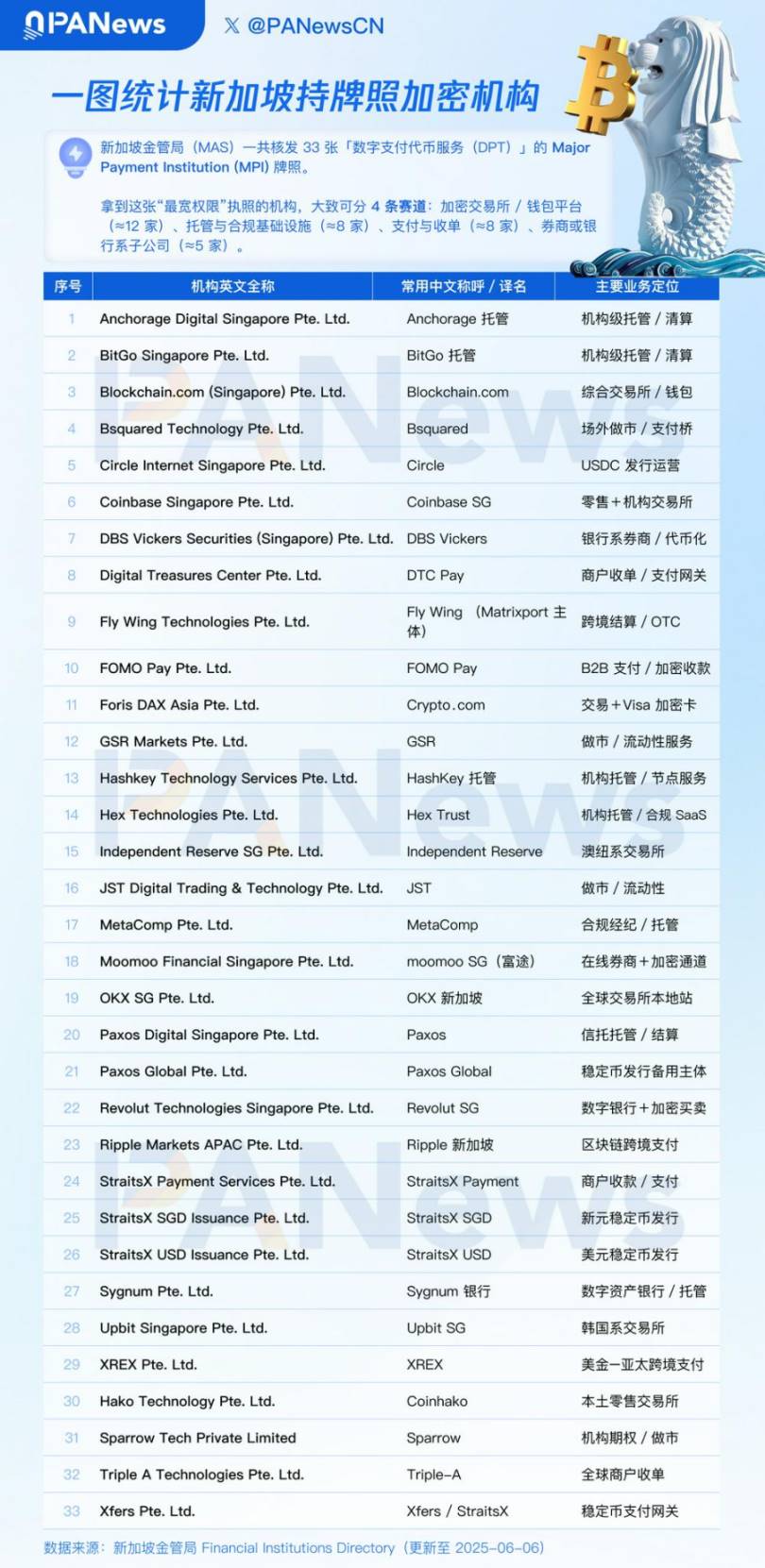

According to PANews data statistics, currently only 33 crypto projects hold the MPI license, which has been open for application for 5 years. One can imagine the difficulty and approval rate of the DTSP license.

Therefore, Portal Labs believes this is not a license bidding, nor a goal that can be achieved through technical team efforts. It is more like an active screening of project governance structures. Web3 project architectures lacking role isolation, unclear fund paths, and undefined responsibility divisions will lose their qualification in this clearance.

However, this is not Singapore's hostility towards Web3, but a more targeted signal that regulatory arbitrage logic is gradually coming to an end under mainstream regulatory trends.

In such a regulatory context, "relocating registration" is no longer essentially a solution. It is more like a risk transfer game, moving potential problems from one jurisdiction to another area where regulation has not yet reacted, and cannot fundamentally improve risk exposure.

From this perspective, DTSP is not just an ultimatum for Web3 projects, but also a turning point in investors' compliance perspective. It makes a key question unavoidable: "Am I investing in a project, or a legal risk entity that has not been clearly identified?"

For investors, this regulatory evolution means an upgrade in judgment dimensions. In traditional investment logic, a white paper, a roadmap, and an AMA were sufficient to build confidence expectations. However, under the reality of stricter regulation, the "structural transparency" of Web3 projects will become a mandatory review item:

Does the Token itself have a legal issuance path and basis?

Is the control structure clear, and are there any internal responsibility overlaps or potential hidden ownership issues?

Do the founders face excessive legal risks, and does their role need to be cut and isolated?

Does the project have a compliant mechanism for future financing, token issuance, and exit?

These questions are no longer just for lawyers to answer, but investors must also learn to raise and examine them.

In other words, regulation is forcing the Web3 market to enter a new stage of "identity governance". Web3 project parties can no longer rely on "narrative", but must provide answers in structural design; investors can no longer just look at valuation, but must ask "are you prepared to be penetrated by regulation?"

DTSP is just the beginning, and a larger compliance backlash is happening simultaneously on a global scale.