Quick Overview:

- Sygnum states that strategic BTC acquisition companies are accumulating excess BTC holdings through leverage, thereby weakening Bitcoin's suitability as a central bank reserve asset.

- The regulated digital asset bank indicates that these strategies distort liquidity and sentiment, posing long-term risks to Bitcoin's stability and broader institutional adoption.

A report released by Bitcoin-compliant digital asset bank Sygnum points out that Bitcoin acquisition tools like Strategy (formerly MicroStrategy) have significantly boosted institutional demand for Bitcoin, but their increasingly aggressive and highly leveraged accumulation methods may undermine Bitcoin's credibility as a central bank reserve asset.

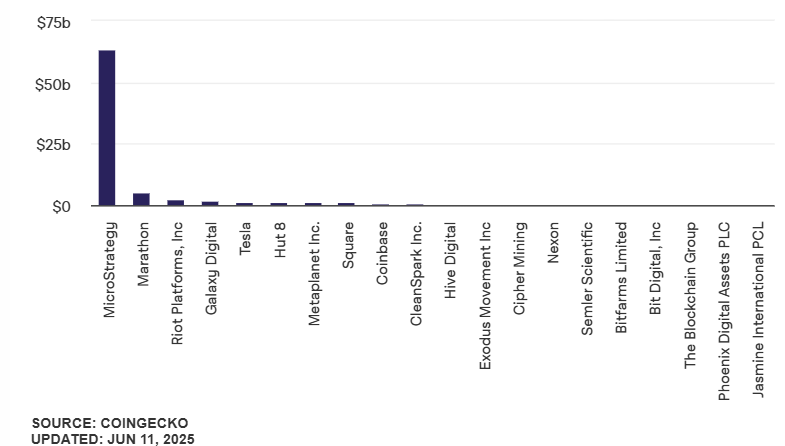

On Monday this week, Strategy announced another purchase of 1,045 Bitcoins, spending approximately $110.2 million, with an average price of $105,426 per Bitcoin. This brings its total Bitcoin holdings to 582,000, with a total value exceeding $63 billion, representing about 2.8% of Bitcoin's total 21 million supply, with an unrealized gain of around $22 billion.

Currently, 144 companies have adopted some form of Bitcoin reserve strategy, with 114 being publicly listed. Companies like Twenty One, Nakamoto, Trump Media, GameStop, and K33, supported by Tether, have recently joined the Bitcoin holdings lineup, following the model pioneered by Strategy co-founder Michael Saylor, alongside previously active companies like Metaplanet, Semler Scientific, and KULR. Bernstein analysts predict that under a more crypto-friendly Trump administration, Strategy and its corporate imitators could potentially increase Bitcoin reserves by $330 billion in the next five years.

Sygnum warns that as Strategy plans to further expand its Bitcoin position through multiple billion-dollar financial projects, this centralization trend will introduce systemic vulnerabilities that may deter central banks from adopting Bitcoin as a reserve asset due to concerns about liquidity, volatility, and concentrated control.

Sygnum analysts stated: "Large-scale concentration of any asset is a risk, and Strategy's holdings are now approaching a concerning critical point—currently holding nearly 3% of Bitcoin's historical total issuance, with an even higher proportion in actual circulating supply. Their plan to acquire 5% of total issuance raises serious concerns, especially as these institutions continue to converge supply, undermining Bitcoin's safe-haven asset properties. When a private company controls such a large proportion of existing supply, Bitcoin becomes unsuitable as a central bank reserve asset."

Corporate Bitcoin Acquisition Model is Transforming

Sygnum indicates that since 2020, companies initially adopted Bitcoin as an inflation-hedging financial strategy, which has gradually evolved into a speculative investment tool model. Companies like Strategy, Twenty One Capital, and Nakamoto Holdings have begun using various debt instruments—such as convertible bonds, preferred shares, and even perpetual financial instruments—to further leverage Bitcoin purchases beyond their core business scale. These companies now operate more like closed-end funds, raising questions about whether this can still be classified as "corporate financial management".

Sygnum added: "The sharp reduction in circulating supply could potentially reverse the current structural trends of decreasing Bitcoin volatility and increasing liquidity"—both indicators that institutional investors and central banks have viewed as prerequisites for incorporating Bitcoin into reserve assets. Analysts believe these trends are currently being distorted by highly leveraged acquisition tools, squeezing natural market demand.

Apart from a few isolated cases like El Salvador, almost no central banks currently have concrete plans to incorporate Bitcoin into reserve assets, with even fewer taking actual action. However, in March this year, US President Trump signed an executive order establishing the "US Strategic Bitcoin Reserve", initially based on approximately 200,000 Bitcoins (valued around $22 billion) currently held by the government from criminal or civil seizures, and instructed Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick to develop a strategy for further Bitcoin acquisition within a budget-neutral framework. Relevant authorities in the Czech Republic, Bhutan, and Pakistan have also shown strong interest.

Leveraged Strategies May Squeeze Stable Corporate Holdings and Amplify Downside Market Risks

Sygnum noted that while these leveraged Bitcoin acquisition strategies initially benefited from strong bullish sentiment and helped reduce market circulating supply in the short term, they are not sustainable in the long run. Analysts suggest that many companies' stock prices are at risk of eroding premiums relative to their Bitcoin holdings, or even converting to discounts, especially as more similar tools emerge and investor demand becomes saturated. In a bear market or financing difficulties, these companies might be forced to sell Bitcoin, potentially exacerbating price declines and further dampening market sentiment.

Sygnum also believes this trend might squeeze more rational and stable corporate Bitcoin allocation methods. Unlike speculative hoarding, smaller Bitcoin positions can serve as a robust hedging tool during global financial system volatility. However, these highly leveraged tools may create an impression that Bitcoin is inherently linked to speculative behavior, thereby weakening institutional investors' willingness to adopt it rationally.

The analysts concluded: "These tools have to some extent generated investment demand from those who cannot or are not yet able to directly enter the crypto market, functioning similarly to Bitcoin ETFs. They also benefit shareholders—with funds invested in a safe-haven asset rather than continuously declining core business. However, as demand stabilizes and supply dilution risks increase, these companies' stock valuations relative to their Bitcoin assets may be reassessed. Additionally, these strategies introduce certain risks to the entire crypto market."

Strategy: Can Withstand a 90% Bitcoin Price Crash?

On the other hand, Strategy co-founder Michael Saylor expressed strong confidence. In a recent interview with the Financial Times, he stated that Strategy's capital structure is designed to withstand a 90% Bitcoin price crash and sustain for 4-5 years. This is due to the company's use of a combination of financing tools including equity, convertible bonds, and preferred shares—though he also acknowledged that shareholders would "suffer significant losses" in such a scenario.

Bernstein analysts noted that Strategy's overall debt level is low, with no repayment pressure until 2028, thus keeping its leverage within a controllable range.

However, this confidence may not apply to the many companies currently emulating Strategy's model, especially those with weaker balance sheets, low investor stickiness, thin core revenues, and difficulty withstanding market shocks. As more companies enter this space, Bitcoin's price stability and the sustainability of this corporate hoarding model may face more severe tests if the market experiences a sharp pullback.