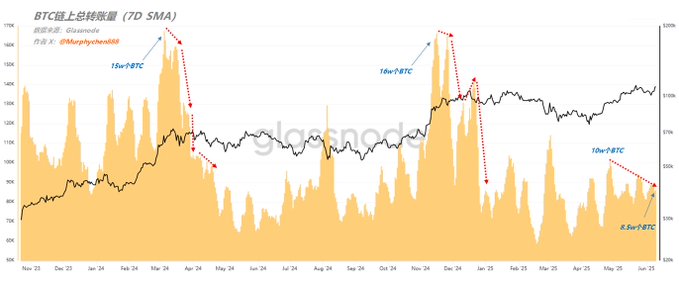

Currently, both on-chain and exchange liquidity are terrifyingly low... If we compare the peak values of the previous two market cycles, we can see a huge difference. During the peak in March 2024, 150,000 BTC were exchanged daily on-chain (7d sma), 160,000 BTC during the peak in November 2024, but now only 85,000 BTC are exchanged daily.

(Image 1) More remarkably, on April 28th when BTC rebounded to $95,000, it was the day with the best on-chain liquidity in this market cycle. $95,000 happened to be near the average cost line for short-term holders, where many short-term chips likely chose to exit and avoid risks. Afterward, although BTC's price continued to rise, the trading volume kept declining.

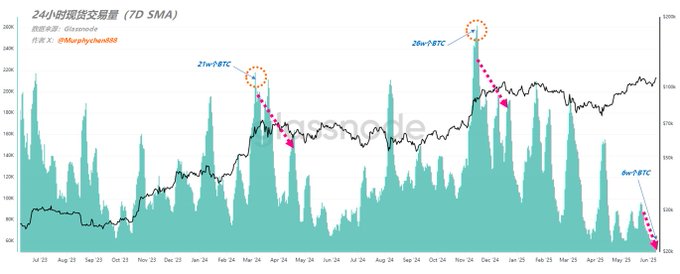

(Image 2) Spot trading volume on exchanges is similar. During the peaks in March and November 2024, daily trading volumes were 210,000-260,000 BTC (7d sma), but now it's only around 60,000 BTC. Especially after BTC first reached $110,000 on May 22nd, trading volume continued to decline, and even when it rebounded to $110,000 on June 9th, there was no improvement. This indicates that market participants are becoming increasingly cautious. In this low-liquidity environment, short-term price fluctuations will become more "arbitrary", especially influenced by sentiment. A small amount of funds can drive prices up, and a small number of chips can drive prices down. However, the severe liquidity contraction is something we must pay high attention to, as it is an indispensable driving force for a sustainable market trend.

My sharing is for learning and communication purposes only and should not be considered investment advice.