By Tigran Bolshoi and Mike Shishko on behalf of Swaps.io

Disclaimer

Development is actively ongoing. Many of the components and features described below are WIP and may be subject to change.

For the latest implementation details, refer to the smart contracts repository: github.com/swaps-io/flex-pool-contracts

github.com/swaps-io/flex-pool-contracts

Background

In recent years, the DeFi ecosystem has seen an accelerated shift from

direct on-chain interactions to architectures based on intents –

user-defined desired outcomes executed by a decentralized network of

solvers. Protocols such as UniswapX, 1inch Fusion, CowSwap, Bebop and Velora are

increasingly replacing traditional DEX interfaces by enabling users to

delegate execution logic to professional actors.

One of the key drivers behind this transition has been the need to

abstract away low-level transactional complexity from users, eliminating

the requirement to manually manage routing, bridge and DEX selection,

and transaction execution. Studies of intent-based execution models show

that solver-based competition leads to better price discovery through

price auctions, while mitigating direct MEV extraction.

This trend has also expanded into the cross-chain domain with

intent-based protocols like Across, 1inch Fusion+, Swaps.io, Squid,

Mayan and others. However, despite their growing adoption, the

supporting liquidity infrastructure remains fragmented and

non-standardized.

Operational Bottlenecks for Cross-Chain Solvers

Although the intent paradigm offers clear advantages in execution

efficiency and complexity abstraction, it places a substantial

operational overhead on solvers.

Capital and Liquidity Fragmentation

In most existing cross-chain protocols, solvers must pre-fund liquidity

across multiple chains, manage asset rebalancing, and bear the risks

associated with custody and cross-chain execution. These

responsibilities are not only technically demanding but also

capital-inefficient and economically risky.

Counterparty and Credit Dependencies

To operate efficiently, solvers often seek external credit arrangements

to support their inventory needs, forcing them to operate under the

logic of traditional financial instruments. This effectively places them

in the role of institutional borrowers, taking on the complexity of

credit negotiations and repayment management. These arrangements involve

trusted lenders with fixed-rate terms that are inefficient when capital

is unused.

Regulatory and Legal Exposure

Engaging with trusted and regulated entities, adhering to compliance

procedures significantly increases exposure to legal and financial

regulation. In many cases, it requires broker licenses and may lead to

legal liabilities in case of disputes. Such requirements stand in direct

contrast to the principles of permissionless and decentralized systems.

Need for a Unified Liquidity Layer

What is missing is a unified, permissionless, and programmable liquidity

layer that enables solvers to borrow capital permissionlessly, securely,

and on demand, while allowing liquidity providers to earn additional

yield from solver execution activity in a transparent and risk-isolated

environment. Flex Pools is designed to address this gap.

Flex Pools: Unified Liquidity for the Solver Economy

Flex Pools introduces a unified, cross-chain liquidity layer designed

for intent-based protocols. Instead of relying on fragmented,

self-managed inventories or centralized credit lines, solvers can borrow

and return assets through various providers that access liquidity (i.e.

borrow and return it) in standardized way. Liquidity providers, in turn,

earn additional yield from solver execution flows in a secure,

permissionless environment.

The system aligns the interests of three core participant groups:

Solvers gain instant, on-demand access to liquidity with no need

to manage cross-chain inventory or borrow from external creditors.

Each interaction follows transparent on-chain contract logic, with the

solver accessing liquidity only at the moment it is needed and paying

solely for the duration of use. This eliminates long-term debt, fixed

interest obligations, and regulatory exposure. The protocol

abstracts away inventory management, rebalancing, and cross-chain

verification, allowing solvers to focus purely on execution algorithms

and routing logic – similar to on-chain solving.Liquidity Providers benefit from a scalable, multi-chain

investment model with on-chain guarantees replacing legal liabilities.

Flex Pools offer programmable liquidity and capital efficiency that

goes beyond what common liquidity pools can offer, enabling LPs to

earn additional yield from solvers’ activity.Solver-based systems and infrastructures – including

intent-driven protocols and networks, chain-abstraction smart wallets

and dapps, fast-fill bridges, and clearing layers – gain access to a

shared liquidity infrastructure that lowers entry barrier and improves

execution efficiency. By decoupling liquidity from solvers and clearly

separating roles, Flex Pools enables greater decentralization and

composability across the intent-based stack.

Architecture

Overview

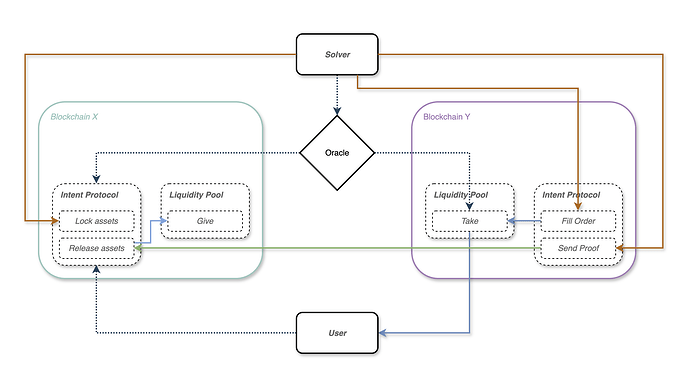

Flex Pools is a modular liquidity protocol designed for intent-based

cross-chain execution. It allows solvers to borrow assets on one chain

and return them on another using standardized borrow-and-return

operations. These operations are carried out through a variety of secure

whitelisted taker adapters to third-party providers.

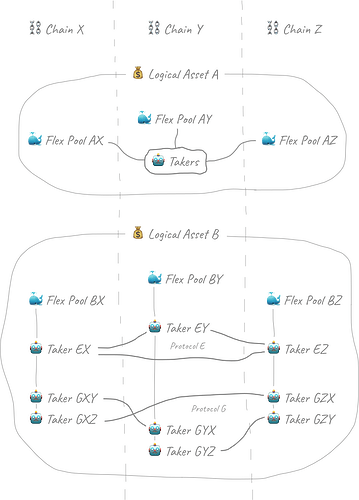

The system is organized into enclaves – sets of EIP-4626 tokenized

vaults deployed across multiple chains for a single logical asset. Each

vault manages deposits, withdrawals, and share accounting on its

respective chain. The vaults within an enclave are connected through a

common infrastructure that handles cross-chain messaging and

verification, leveraging event verifiers backed by oracles to ensure

execution validity.

The protocol is designed to be composable, enabling integration with

various taker adapters, event verifiers, and tuners defining fee

models.

Infrastructure

The core of the infrastructure is the FlexPool contract, which

maintains a strict whitelist of approved taker adapters. Each taker is

linked to a specific third-party provider and paired with a tuner that

defines execution and rebalancing fees. Together, the taker-tuner pair

governs how liquidity is moved across chains for a given provider and

enclave.

Taker contracts are typically scoped to a specific chain-to-chain

channel for better security. In many cases, the taker relies on a helperGiver contract deployed on the opposite chain, which emits verifiable

events to prove that liquidity has been locked and committed for return

to the pool. As a result, there may be several instances of one provider

in the router – each deployed with different parameters to serve a

specific enclave chain.

Some providers require validation of events from other chains to confirm

asset return. To support this, the protocol uses an IEventVerifier

abstraction that validates cross-chain proofs and ensures the

correctness of take and related operations.

Enclave Model

An enclave is a set of vaults deployed across multiple chains that

manage liquidity for a single logical asset (e.g., USDC, ETH). Each

chain hosts one vault – a standalone FlexPool contract – which

operates independently but shares accounting logic with other vaults in

the same enclave.

Enclaves are liquidity-isolated by design: assets deposited into a vault

remain on that chain unless explicitly moved via a take operation and

later returned either through a give call in a Giver helper contract

or by direct token transfer back to the pool address.

While enclaves operate independently, they are logically connected

through the protocol’s infrastructure. If liquidity becomes unevenly

distributed – for example, when one chain is drained due to solver

activity – the rebalancing mechanism incentivizes redistribution back

to equilibrium.

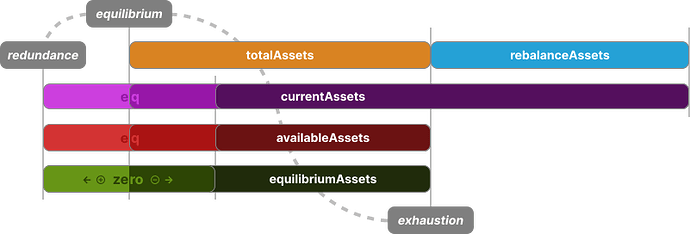

Asset Accounting

Each FlexPool vault manages a single ERC-20 token. Across chains, the

same logical asset (e.g., USDC) may have different token contracts, but

must retain equivalent value and fungibility. The protocol supports

varying decimals and optionally wrapped or yield-bearing tokens.

Each pool tracks the following key asset states:

Total Assets: The total amount of the asset managed by the pool,

including all deposits and protocol fees. Represents the full

obligation to liquidity providers.Current Assets: The amount of the asset currently held in the

vault on the local chain. Includes both available liquidity and the

rebalance reserve.Available Assets: The portion of current assets that is not

reserved and can be used immediately fortakeorwithdraw.Rebalance Assets: A separate reserve held within the vault and

used to pay solvers for restoring cross-chain balance. Funded fromtakeoperations that increase imbalance.Equilibrium Assets: The difference between the vault’s current

asset balance and its ideal share of the total liquidity. A positive

value means the vault holds excess liquidity; a negative value means

it is underfunded relative to the enclave total. This metric is used

by tuners to calculate rebalancing incentives duringtake.

Together, these values ensure accurate accounting and safe liquidity

usage across chains. They also serve as inputs for protocol fee logic

and share-to-asset conversion formulas.

Operations

Flex Pools implement both standard EIP-4626 vault operations and

cross-chain liquidity transfer mechanics.

Vault operations

Liquidity providers interact with the pool through familiar functions:

deposit / mint: deposit assets in exchange for shareswithdraw / redeem: burn shares to receive underlying assets- Preview and limit functions (

previewDeposit,maxWithdraw, etc.)

follow the EIP-4626 spec

Shares are ERC-20 tokens representing proportional ownership. Their

value increases over time as protocol fees accumulate from solver

activity.

Cross-chain operations

take: transfersassetsfrom the pool to a whitelistedtaker

caller. The taker is responsible for forwarding or locking these

assets on the current chain and ensuring a corresponding return

(minGiveAssets) on another chain. Associated fees

(protocolAssets, rebalanceAssets) are calculated by the assigned

tuner.give: returns liquidity back into an enclave. In most cases, this is

implemented as a simple ERC-20 transfer to the vault, optionally

wrapped in a helper giver contract to emit proof-validatable events.- Rebalancing is handled implicitly via the

rebalanceAssetsvalue in

thetakeoperation. Solvers that relieve excess liquidity may

receive a rebate, while those that increase imbalance may incur an

additional fee.

These operations form the core lifecycle of liquidity in Flex Pools –

from provisioning and usage to redistribution across chains.

Takers & Givers

Takers are adapter contracts responsible for handling the execution

logic of a take operation. Each taker is linked to a specific

third-party provider or routing system and is approved through the

pool’s internal whitelist. Takers receive the borrowed assets from the

pool and must guarantee that a corresponding repayment occurs on another

chain.

Takers may rely on paired Giver contracts deployed on the opposite

chain. These contracts wrap a give operation, emitting verifiable

events used to confirm that liquidity has been returned. Givers may

enforce additional logic or safety checks required by the taker’s

provider.

Tuner System

Tuners define the economic parameters of each take operation. They are

modular contracts assigned per taker and are responsible for

calculating:

- Protocol Fee (

protocolAssets) – the portion of assets paid to

the pool, distributed to liquidity providers - Rebalance Fee (

rebalanceAssets) – the incentive or penalty

based on how the operation affects cross-chain liquidity balance

Tuners implement a standardized interface:

tune(assets) → (protocolAssets, rebalanceAssets)

The most basic implementation is the current LinearTuner, which

applies:

- A fixed fee component

- A percentage-based fee on the requested

assets - A dynamic rebalance adjustment based on the enclave’s

equilibriumAssets

More advanced tuner types – such as multi-slope models or tuners with

off-chain inputs (e.g. market data, solver scoring) – can be plugged in

without changing the pool logic.

Tuners ensure that fees are adaptive, fair, and aligned with current

liquidity conditions across chains. They also serve as the mechanism for

redistributing execution cost and maintaining systemic balance.

Verifier Layer

Most taker providers require proof that a give operation has occurred

on another chain before allowing a take. To support this, Flex Pools

use a pluggable IEventVerifier interface – an abstract verification

layer that checks cross-chain proofs that confirm the presence of

specific events, exposing a single function:

verifyEvent(chain, emitter, topics, data, proof)

If the event is valid and final, the call succeeds; otherwise, it

reverts. This mechanism allows takers to safely depend on cross-chain

execution results without introducing trust assumptions or centralized

relayers.

Multiple verifier implementations can coexist, enabling support for

different proof systems and oracles.

Rebalancing Logic

As solvers move liquidity across chains using take and give,

imbalances can occur within an enclave. To correct this, the protocol

includes a built-in rebalancing incentive mechanism, fully integrated

into the take operation. Each take call returns a rebalanceAssets

value from the tuner:

Positive – the solver pays an additional fee, increasing the

enclave’s rebalance reserveNegative – the solver is rewarded with surplus assets from the

reserve for restoring balance

These incentives are based on the enclave’s equilibriumAssets, which

measure how far the current state deviates from ideal state – where all

total assets on the chain are fully available for take and withdraw

operations.

In addition to solver-driven arbitrage, the protocol is designed to

support native rebalancing via external bridges – like Circle CCTP,

LayerZero, and Everclear, allowing direct movement of assets within

enclaves. Each enclave may be configured with its own set of

rebalancers, enabling flexible strategies per asset and chain.

Provider Integration

The system supports integration with multiple execution providers, each

with their own Taker and optional Giver contracts. These adapters

implement strict on-chain validation flows, often relying on event

proofs or deterministic conditions to ensure solvency and delivery

guarantees. Currently, native support exists for direct asset transfers,

1inch Fusion+, and Across. Future integrations are planned for protocols

like Swaps.io, Debridge, Squid, Mayan and others.

The system may also support universal, provider-agnostic collateral

models, where solvers lock collateral once and access multiple taker

routes across chains and providers.

Liquidity Extensions

To improve capital efficiency and reduce idle funds, Flex Pools are

designed to support advanced liquidity sources beyond static ERC-20

balances. Planned extensions include:

Yield-bearing asset support

Pools may accept deposits in wrapped or interest-generating tokens such

as aTokens (AAVE), cTokens (Compound), LST/LRT, ERC-4626 vault

shares and others. These assets can be automatically unwrapped when used

for take operations, allowing the pool to earn passive yield while

maintaining on-chain availability.

Dynamic buffer management

A background allocator adjusts the ratio between yield-bearing tokens

and native assets based on on-chain and off-chain signals (e.g.,

utilization, volatility, rebalance demand). This ensures that each

enclave always holds an accessible buffer of base liquidity for

immediate solver usage.

Execution Coordination

In high-load or adversarial environments, coordinating access to shared

liquidity becomes critical. Flex Pools are designed to optionally

support external coordination layers that manage the timing and fairness

of take and give operations.

Take Sequencer

An optional mechanism to queue or rate-limit take operations across

solvers. This can help avoid race conditions, overlapping intents, or

liquidity exhaustion in highly contested environments. It can operate

off-chain and coordinate access based on fairness or solver priority

rules.

Give Pre-Approver

A validation mechanism for inbound give operations ensures that

returned assets match expectations and align with prior take activity.

When combined with take coordination, it can help prevent liquidity

shortfalls caused by competing solvers by maintaining an ordered queue

of give and take operations based on actual availability.

Multi-Token Support

A transition to a single pool per chain with multi-token support –

replacing multiple isolated enclaves – is being considered for future

implementation. This would enable more efficient liquidity management

and unified accounting across assets with shared valuation logic, such

as stablecoins.

Risk Management

Flex Pools incorporate multiple mechanisms to reduce operational and

protocol-level risks across chains and integrations:

Event Validation and Finality Thresholds

All events are verified through the abstract IEventVerifier interface,

which delegates proof checking to the underlying oracle. The finality

threshold – the number of confirmations required before accepting a

proof – should be configured at the oracle level, allowing flexibility

per chain without modifying the verifier itself. This setting must

balance fast solver execution with protection against chain reorgs.

Event verifiers provide common event verification logic, which is

agnostic from taker implementation specifics. The verifier interface

requires a taker to provide basic components of an expected event:

emitter contract and chain, event topics and data, as well as a

proof (usually forwarded from call params). Event verifiers can be

upgraded, audited, or replaced independently, subject to governance via

a DAO voting or multisig. All changes may include time delays or staging

mechanisms to prevent sudden trust shifts and allow monitoring before

activation.

Liquidity Provider Scoping

In future versions, liquidity providers may define the set of takers or

providers they trust when depositing into a pool. For example, a

provider may choose to support only 1inch Fusion+, only Swaps.io, or

both. This trust scope is enforced during take operations, ensuring

that a provider’s capital is only used within approved execution flows.

Liquidity Buffers and Withdraw Queue

To protect solvency, each enclave maintains a buffer of available

liquidity. Withdrawals are placed into a queue when instant fulfillment

is not possible. This mechanism ensures that solver operations and

withdraw requests do not exhaust funds simultaneously.

Emergency Controls

Core contracts include pausability features for emergency response. In

case of unexpected behavior, security threats, or verifier failures, the

protocol can:

- Pause

takeflows per enclave - Disable specific takers or verifiers

- Temporarily restrict withdrawals

A dedicated emergency role may be authorized to execute critical pauses

instantly, enabling rapid response to active threats or ongoing attacks.

Fair Frontrunning-Resistant Rewards

The initial implementation is built on the ERC-4626 standard, which

inherently carries a frontrunning issue – where large deposits can

manipulate the share price to their advantage. To address this, our

roadmap includes the introduction of a time-based reward distribution

mechanism, based on insights from the 1inch team and their farming

contracts design.

This mechanism will ensure that rewards are allocated continuously and

proportionally, based not only on the staked amount but also on the

duration of each deposit. By incorporating time-weighted distribution,

we aim to eliminate frontrunning incentives while preserving the core

mechanics of ERC-4626.

Fee Model

Each take operation incurs a fee calculated by the assigned tuner.

This fee can include:

- Protocol fee, directed to the pool as retained value

- Rebalance fee, if applicable. Used to incentivize rebalancers

and maintain cross-chain liquidity balance - Solver reward, if applicable.

The exact structure is defined by the tuner assigned to the taker and

may be fixed, percentage-based, or dynamically calculated.

Liquidity providers earn returns through:

- Accumulation of protocol fees within the pool

- Optional yield from yield-bearing tokens or integrated LP positions

- Potential partner incentives from integrated protocols

As the pool grows and is used more actively, the value of LP shares

increases, reflecting both base asset accumulation and system-level

integrations.

Ecosystem Growth

Flex Pools are designed as foundational infrastructure for the growing

ecosystem of intent-based protocols, enabling scalable cross-chain

execution with shared liquidity. The protocol is positioned to evolve

along multiple strategic directions:

Intent Protocol Integration

Flex Pools provide a universal liquidity infrastructure for different

protocols like Fusion+, Swaps.io, Across, Squid and others. Any project

can plug into the give/take model without managing its own inventory.

As user demand for intent-based execution grows across domains like

swaps, bridging, and automation, more protocols emerge to support these

flows, and more solvers enter the market seeking efficient access to

capital. Flex Pools serve as a shared liquidity layer for this expanding

ecosystem – the more protocols integrate, the more demand for solver

liquidity rises – driving organic growth of the pools themselves as LPs

respond to yield opportunities linked to real liquidity demand.

Project Bootstrapping

Projects can deploy native Flex Pools to bootstrap cross-chain liquidity

for their tokens, enabling seamless use across networks and protocols.

These pools allow solvers to access project tokens for execution,

supporting permissionless trading and automated rebalancing.

Flex Pools supports major standards – including OFT (LayerZero),

NTT (Wormhole), Warp (Hyperlane), CCT (Chainlink), ITS (Axelar),

xERC20, and more – enabling compatibility with external DeFi and

bridge infrastructure.

This approach lets projects make their tokens natively available across

chains, enabling seamless access and flexible exchange for users –

without relying on centralized market makers or delayed bridging

solutions.

Partner Pools

Flex Pools can integrate with partner liquidity pools, which can offer

users the option to auto-deposit their yield-bearing tokens into

existing Flex Pools that support those assets, enabling additional yield

from solver activity.

This creates a win-win dynamic:

- Flex Pools attract liquidity from partner ecosystems

- Partners enhance yield returns for their LPs

- Providers earn dual yield with minimal setup

OpenIntents (ERC-7683) Support

Flex Pools are designed with forward compatibility for OpenIntents-based

protocols via an abstract IEventVerifier that validates standardized

Open events emitted as part of the OpenIntents specification. This

design allows solvers to interact with Flex Pools across any

OpenIntents-compliant protocol through a unified interface –

simplifying integration, enabling shared liquidity access, and reducing

the cost of supporting new protocols.

Beyond EVM

Flex Pools are designed to operate on any network with a programmable

VM. While initial deployments focus on EVM-compatible chains, expansion

to high-performance environments like Solana is a priority.