Author: @dethective, Chain Detective

Translated by: Ismay, BlockBeats

Original Title: A Loss of $90 Million Just a Smokescreen? On-Chain Evidence Exposes James Wynn's Double Account Hedging Scam

Through on-chain data and account behavior analysis, this article reveals the carefully arranged hedging operation behind James Wynn's "loss persona" KOL: seemingly liquidated with a loss, but actually profiting in secret. In the crypto world, identity and funds can be easily hidden, but transaction records never lie.

Original Content:

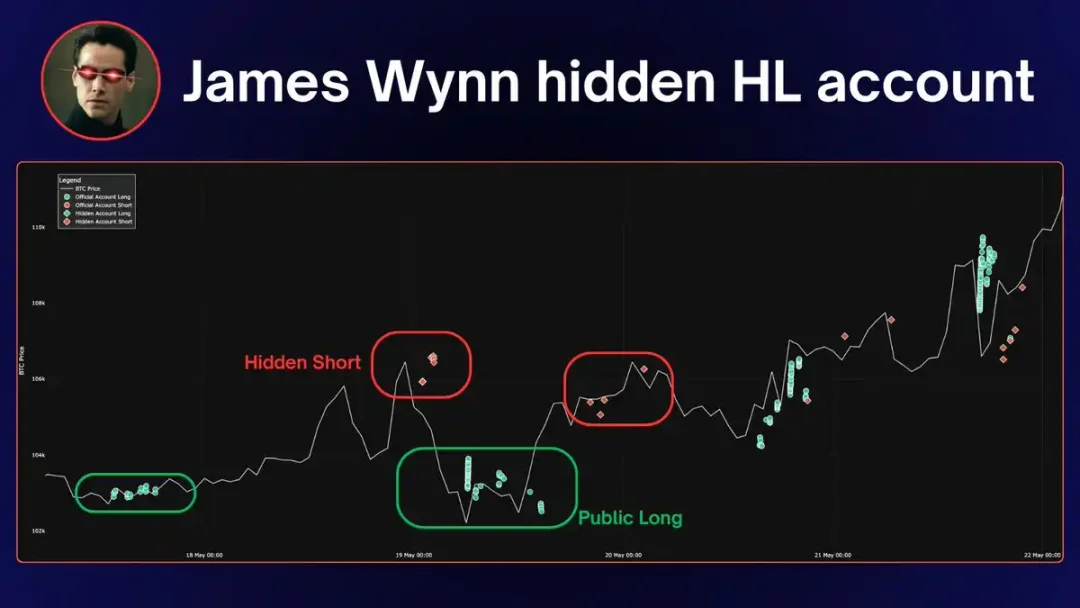

I found the Hyperliquid account James Wynn has been using to bet against himself.

Long Bitcoin on one side

Short Bitcoin on the other side

People have long suspected this, and now I have solid evidence.

How did I find this wallet?

I noticed James earned $44,000 from referral commissions; $16,000 of which came from a single wallet; this wallet's trading volume reached $1 billion;

More critically, this wallet was registered earlier than when James started sharing invitation links.

A coincidence?

Diving into the trading situation, these two wallets are trading almost the same set of tokens.

Another coincidence?

Next, a deep dive into Bitcoin trades. Everyone knows he became famous through a series of crazy Bitcoin trades.

I marked the trades of two accounts:

Representing trades of the hidden account

Representing trades of the public account

You can see they are always on opposite sides.

On that hidden account, he is making money, yes, this account has no liquidation records.

Currently, the account profit is as high as $4.2 million.

Current position: He is currently long ETH with 25x leverage.

Interestingly, this trade is almost identical to his friend Andrew Tate's trade.

As everyone has suspected, he actually didn't lose much money, and now we finally have evidence. But the problem is - his "miserable loss persona" has become a very effective marketing strategy.

Now he has:

370,000 followers

2,360 "smart fans" (please, stop following him)

Yaps he'll never earn in a lifetime

All of this has given him enough "credibility" to sell his MEME coins, peddle courses, and find every possible way to continue monetizing.

Whenever such things go viral online, I always see the same comment:

"Didn't he lose $90 million, and now only earn $4 million?"

Let me explain:

He didn't lose $90 million. That was just his unrealized gains at a certain point during the day, not actual money in hand.

When his main account showed a profit of $90 million, other accounts were actually losing money (this is the basic principle of hedging).

Yes, the hedging position sizes might not be exactly the same, I acknowledge that.

If he placed this order on Hyperliquid, he likely made the same operation on other platforms (like Binance, where he frequently transfers).

He became famous because people saw that exaggerated "$90 million" number and believed it just by reading the headline.

If we judge a trade by "highest unrealized gains", then basically everyone has "lost" millions at some point.

Seeing even experienced and background-strong people easily fooled by such emotional marketing shows - this trick really works. As long as he can leverage it, he will