Recently, a few well-known projects have launched (or plan to launch) dedicated chains based on the Avalanche technical architecture.

Why choose Avalanche over Ethereum?

The answer starts with Avalanche9000, the largest network upgrade in history implemented last December, which can be considered the "The Merge" of Avalanche, completely restructuring the validator economic model.

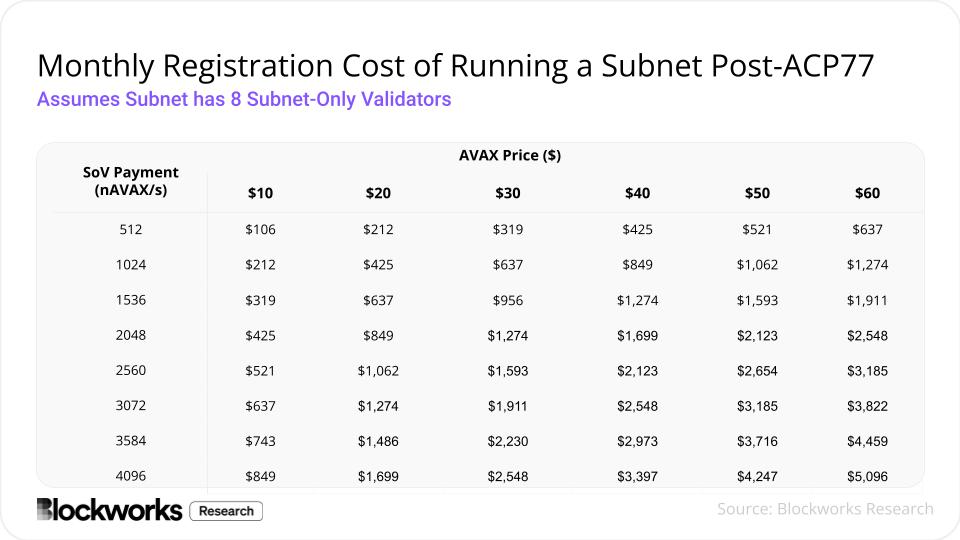

In the ACP-77 proposal, the high fixed staking cost requirement for Avalanche validator nodes (2000 AVAX) was replaced with a low-threshold pay-as-you-go model.

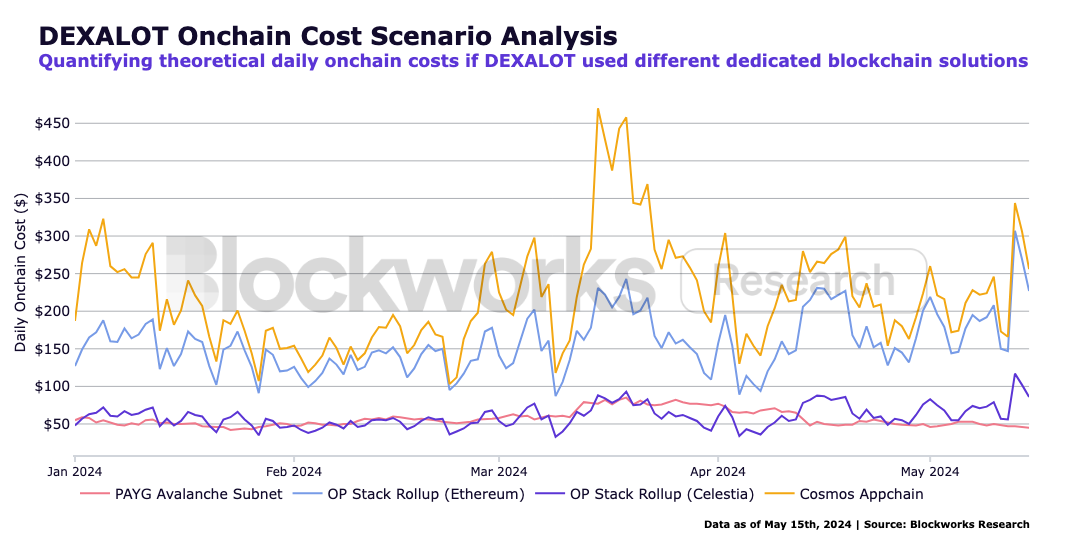

Assessment data from Blockworks Research analyst Effort Capital shows that the reduced upfront costs make launching a sovereign Avalanche L1 chain highly attractive, with costs potentially even lower than the Celestia rollup solution or Cosmos application chain.

Further cost savings.

Teams creating Avalanche first-layer chains can leverage the infrastructure already built on the C-Chain (Avalanche's liquidity hub).

For example, Avalanche's first-layer network can provide users with centralized exchange deposit channels through the C-Chain without paying high token proportions as direct integration fees.

"This is one of Avalanche's core value propositions," Luigi D'Onorio DeMeo, Chief Strategy Officer of Ava Labs, told me in an interview, "From a market entry perspective, this can save development teams a lot of time and millions of dollars in integration costs."

For most standard on-chain infrastructures, including oracles, RPC services, indexers, block explorers, Non-Fungible Token markets, etc. (which are already available on the C-Chain), if an independent L1 were to build from scratch, the launch costs could be as high as $13 million.

All of this depends on Avalanche's inter-chain communication protocol, through which Avalanche's layer-one network can easily transfer assets between the C-Chain and other chains, thus fully utilizing the aforementioned functional advantages.

The connection between the C-Chain and Henesys (MapleStory's dedicated chain) is now the most active two-way communication route in international chat systems, carrying thousands of messages daily.

Source: L1beat.io

Value capture mechanism is another major reason for launching an Avalanche layer-one network.

Avalanche's first-layer blockchains can build clear value accumulation channels for their native tokens by guiding their own validator sets, issuing Block rewards (or using native tokens as gas fees).

Ethereum layer-two networks cannot utilize the same mechanism, so project tokens have extremely limited or even completely absent value capture channels beyond governance functions (with a few exceptions).

Finally, AvaCloud's HyperSDK supports highly customizable L1 chains, which stands in stark contrast to the constraints faced by current rollup technology stack L2 solutions, demonstrating significant advantages.

AVAX Value Accumulation

Given the value accumulation issues faced by ETH and ATOM, it is necessary to study how AVAX achieves value accumulation.

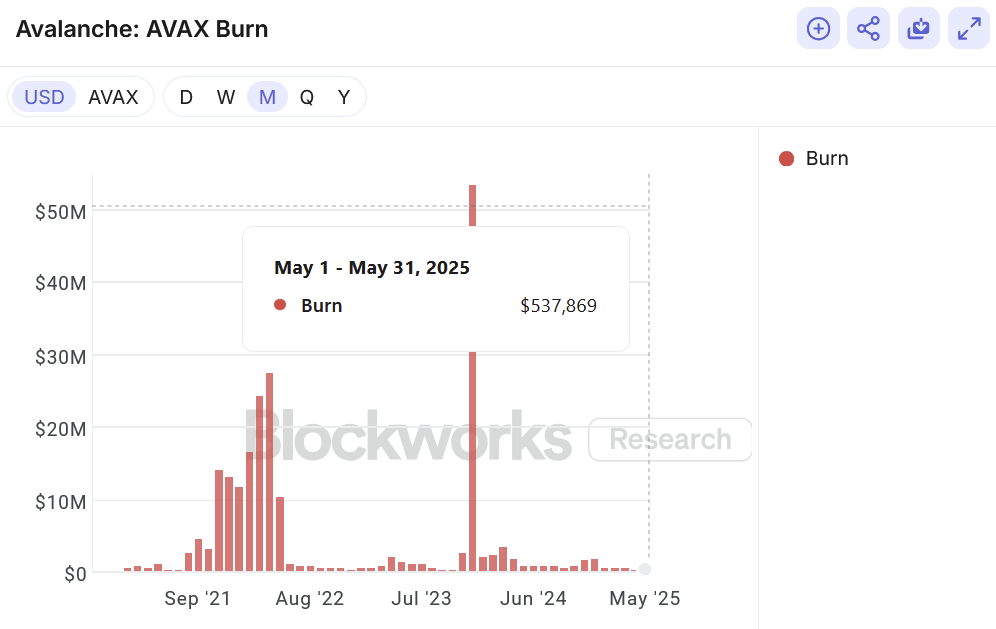

First, unlike Solana or Ethereum's partial token burning mechanisms, all fees on Avalanche's C-Chain are 100% burned. In 2025, the average monthly AVAX token burn value is approximately $453,000.

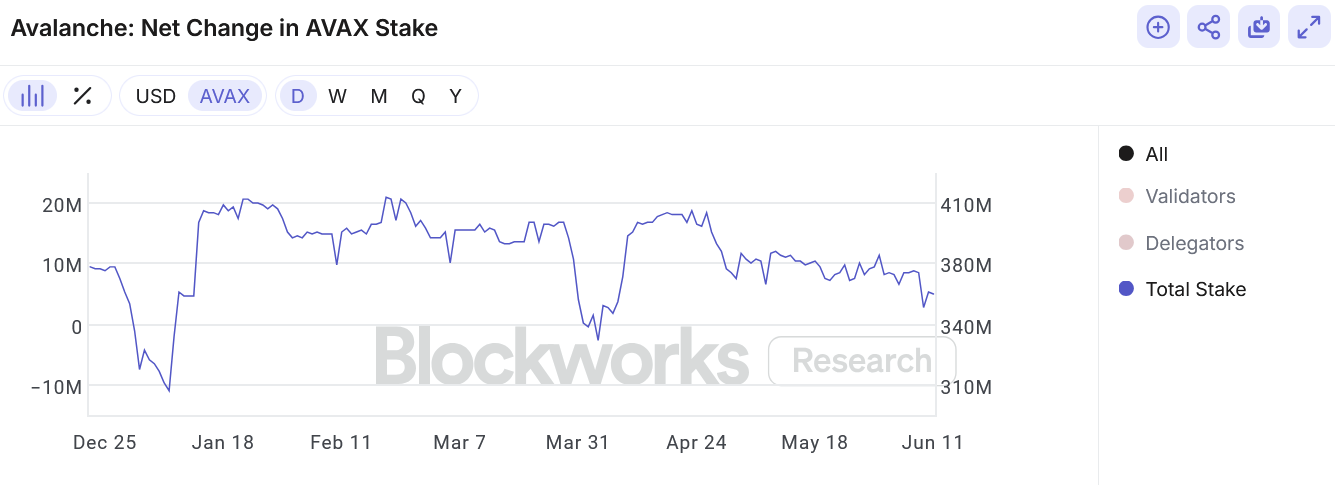

Validator nodes continue to stake AVAX to maintain the mainnet, with the current staking amount around $8 billion (360.2 million AVAX).

Third, according to the ACP-77 proposal, each Avalanche L1 validator node must pay a small amount of AVAX as a fee each month. Depending on the number of validator nodes, this fee fluctuates between hundreds to thousands of AVAX. Blockworks Research analyst Boccaccio made a detailed calculation for the Gunzilla chain (detailed calculation report shown in the link image).

Whenever a transaction involves the C-Chain, a small amount of indirectly generated ICM (inter-chain communication) fees are burned.

Avalanche's Development Path

Ultimately, Avalanche's business strategy is quite familiar: reducing upfront investment to subsidize long-term growth.

Ethereum is also adopting the same strategy, actively giving up short-term execution fee income to pursue long-term data availability fees. To pursue long-term growth, Celestia is currently actually providing data availability services for free.

"One common misconception about Avalanche is that it is not interested in pursuing a high-speed chain," DeMeo told me, claiming this is not true.

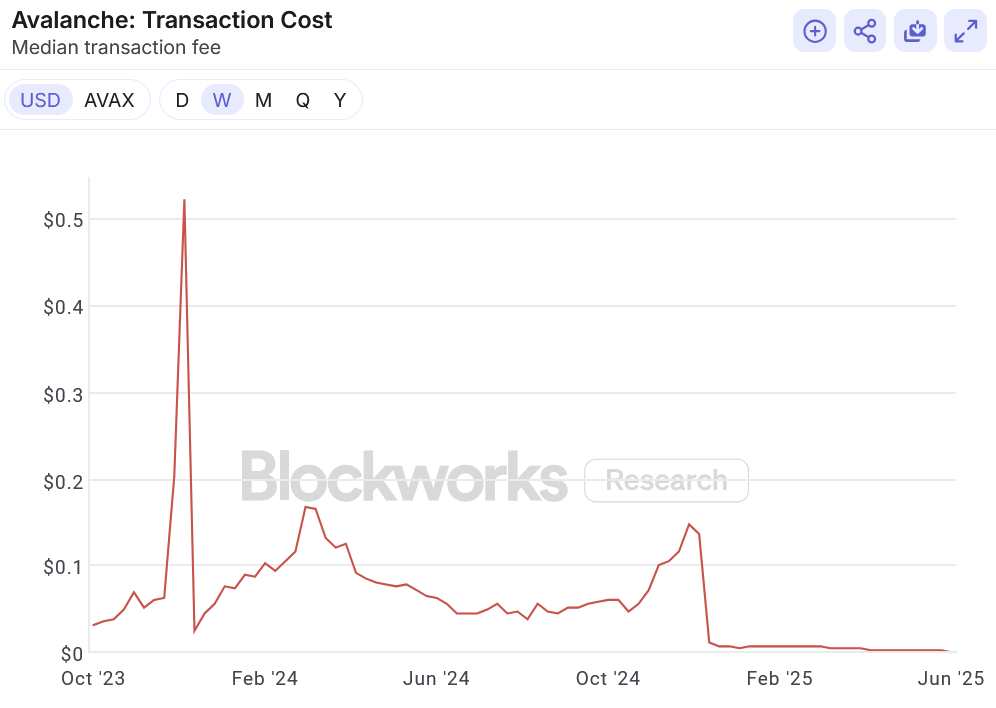

The two major upgrade proposals, ACP-125 and ACP-176 (Octane), implemented a reduction in the minimum base fee on the C-Chain and introduced a dynamic fee mechanism to optimize gas fees, with these two improvements causing an overall 96% decrease in C-Chain fees from early 2025 to now.

DeMeo continued, "As part of the network's subsequent implementation of 'asynchronous execution (ACP-194)' plan this year, fees will continue to decrease. Currently, Avalanche's value capture has not reached a significant scale, but the development path is clear. With 66 active L1 chains in the ecosystem continuing to operate and more chains being added, Avalanche is fully capable of creating its own network effects."