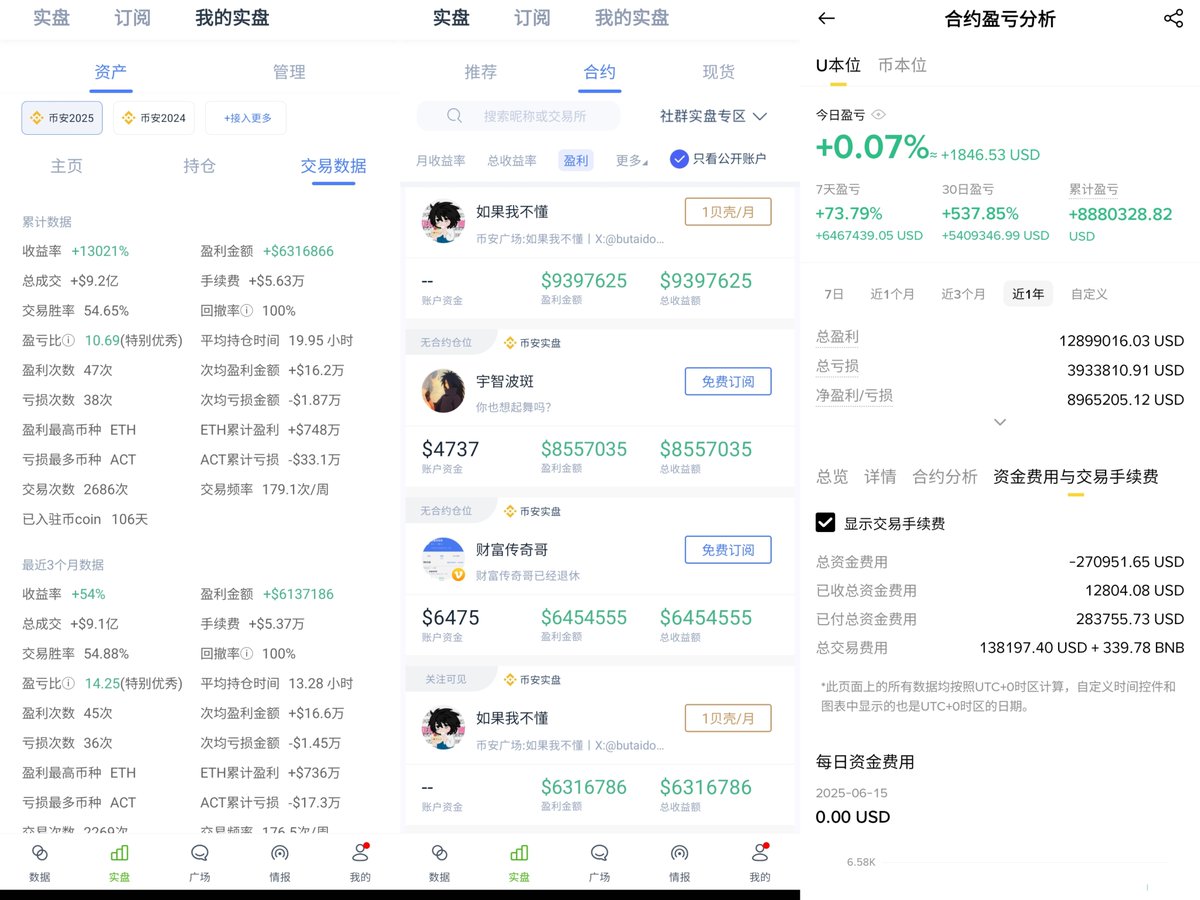

Source: If I don't understand

@butaidongjiaoyi

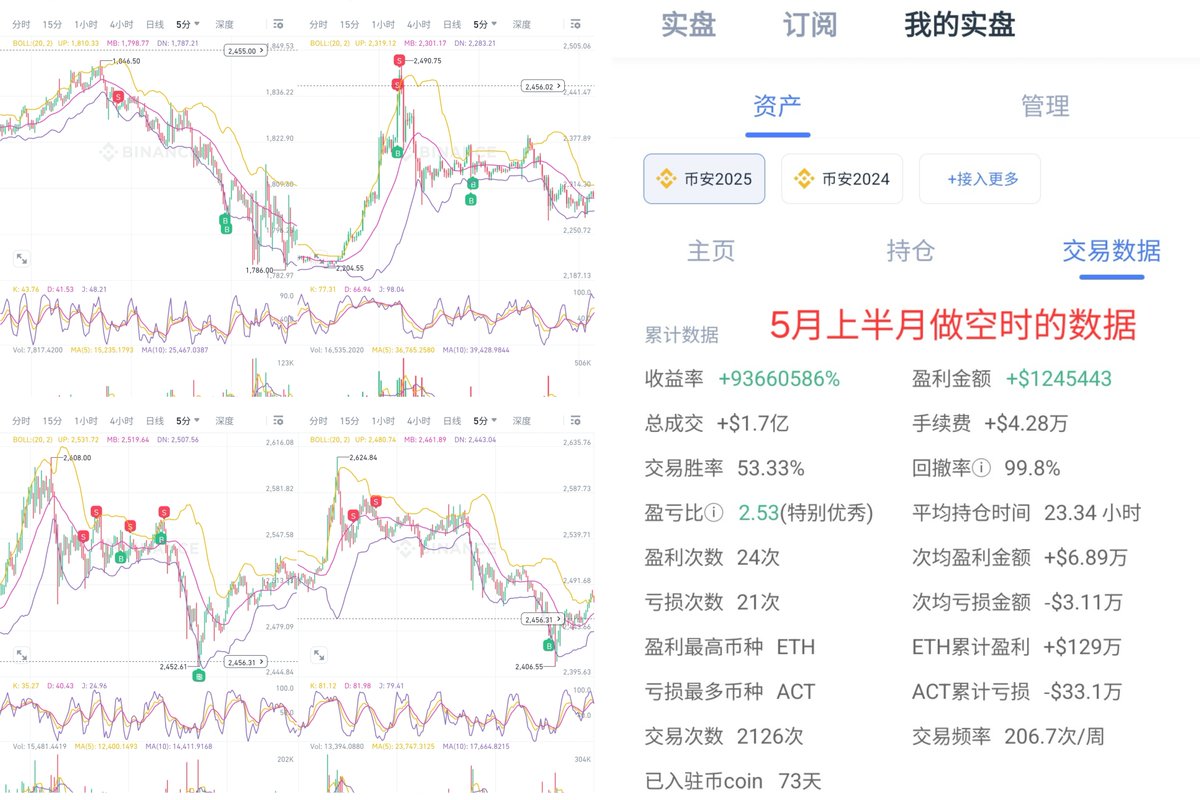

ETH's on-chain fundamentals Gwei are currently at zero, which is one of the main reasons for ETH's weak overall performance. But I am still enthusiastic about the future of the chain. If there are interesting DEFI paradigms and gameplay in the future, you are welcome to recommend them to me. I will do research and share my views.

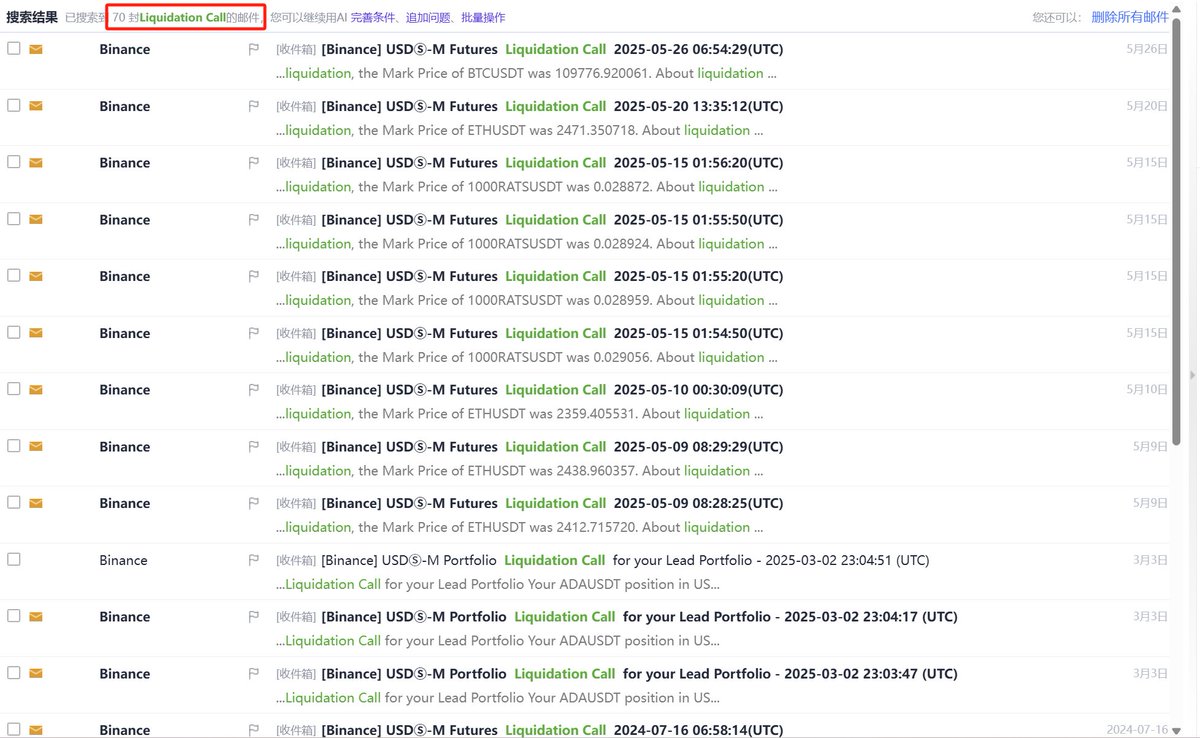

Enter the topic: Principles/experiences/lessons of contract trading

1. Position control, never lose chips, keep them on the table

The details are to observe the volatility of token prices and the bottoming area. For example, if BTC fluctuates only 10% in a month, it is okay to play 30 times short-term. If the price on the gain list fluctuates by 2% in one minute and exceeds 5x, it is dangerous.

Develop the habit of managing your positions by entering the market in stages;

Make a habit of placing a stop-loss order before going to bed to prevent black swans;

Full-time trading with debt is strongly not recommended;

At this time, your psychological pressure will make it more difficult for you to overcome human weaknesses, which is a minus card in trading. It is recommended that you first repay the loan with a down-to-earth regular job and career, improve your cognition during this period, invest with spare money, learn to make friends with time, don't rush, if you are not successful at 30, then wait until you are 35, if you are not successful at 35, then wait until you are 40, and be bold to plan your life.

2. Know yourself and know your enemy, and you will never be defeated in a hundred battles.

My habit is to make multi-factor judgments and have sufficient understanding of all the macro news/trends/underlying fundamentals of the currency.

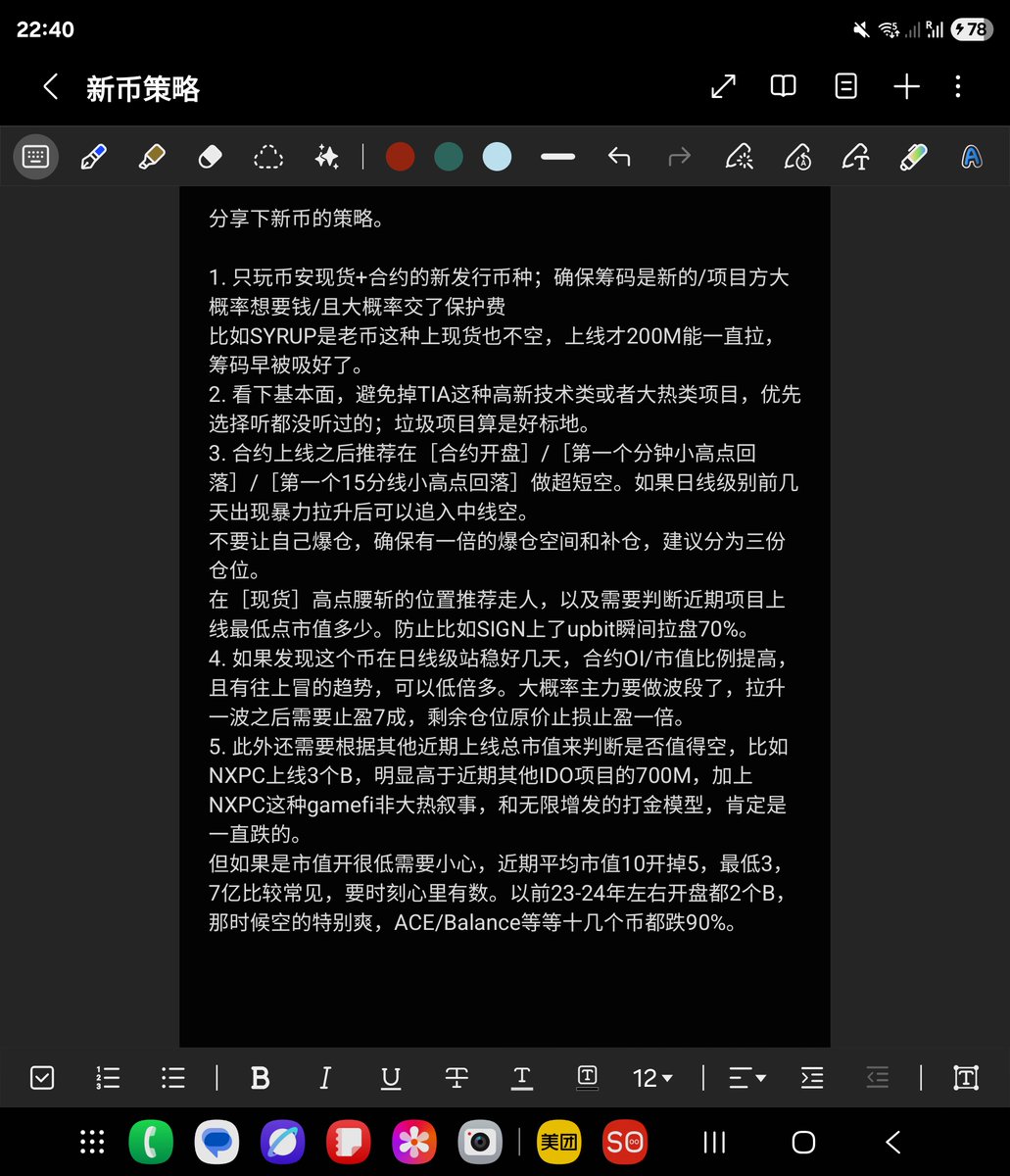

For example, I posted an open shorting strategy for $NXPC on Coin on June 13. I disclosed all my research-based insights and various market changes, as well as my segmented strategy. Even though I said that the momentum was strong due to the Tencent acquisition expectation, I also disclosed the underlying logic and shorted the stock in batches. I wanted to set an example. Under normal circumstances, you need to wait until the buying power of the acquisition expectation weakens before entering the market.