Get the best data-driven crypto insights and analysis every week:

Breaking Down the Rise in Transaction Activity on Avalanche

Thanks for reading Coin Metrics' State of the Network! Subscribe for free to receive new posts and support my work.

Key Takeaways

Transactions on the Avalanche C-Chain have risen from ~250K to nearly 1.2M in June, driven in part by USDC and a surge in low-value transfers under $10.

Protocol infrastructure like DEX routers and new Avalanche L1s, such as MapleStory Universe, have contributed to this growth by enabling high-frequency swaps, bridging, and application-specific transactions.

The Etna upgrade lowered average transaction fees on the C-Chain by over 90% and reduced validator costs, helping boost on-chain activity and making it easier to launch purpose-built Layer-1s across gaming, social, and enterprise use cases.

Introduction

Built around a network of independent Layer-1s (subnets), Avalanche offers a modular approach to blockchain scaling that sets it apart from other Layer-1s. Its architecture allows for the creation of sovereign, application-specific blockchains with their own validator set, consensus rules and tokenomics, tailored to diverse use-cases such as consumer, DeFi, gaming or enterprise applications. Since we last introduced Avalanche, the network and its ecosystem have undergone significant changes, including a recent protocol upgrade (Avalanche9000 or Etna) that reduced transaction costs and lowered the barriers to launching Layer-1s on Avalanche (subnets).

Recently, we noticed a sustained increase in transaction activity on the Avalanche C-Chain, prompting a deeper look into what’s driving it. In this issue of Coin Metrics’ State of the Network, we explore what's fueling the increase, from low-value USDC activity to new L1 launches like MapleStory Universe, and what this reveals about emerging user behaviour on Avalanche.

Surge in USDC-Driven Activity

In June, daily transaction counts on the Avalanche C-Chain have ballooned from a baseline of around 250,000 to nearly 1.2M, a sharp deviation from previous levels of activity. The C-Chain is one of three blockchains in Avalanche’s Primary Network and serves as the hub for smart contract execution and liquidity, operating within an Ethereum Virtual Machine (EVM) environment.

Source: Coin Metrics Network Data Pro

A majority of this increase in transactions appears to stem from USDC, reaching up to 70% of total transaction activity on multiple occasions. To better understand the nature of these spikes, we broke down USDC transfers by size and timing, leveraging the ATLAS blockchain explorer.

What's Behind the Growth: Low Value Transfers

Most of the growth stems from low-value transfers under $10, with the majority clustered in the $5–10 range. Despite the rise in transaction count, C-Chain transfer volume in USD remains relatively low, suggesting a shift in user behaviour and transaction type.

Hourly heatmaps of USDC activity on Avalanche confirm this, showing an increase in transactions with dense clusters of activity sustained over multiple days. The pattern supports the idea of a structural change in transaction patterns.

Source: Coin Metrics Stablecoin Dashboard, ATLAS

A similar pattern appears on Ethereum as well. Low-value USDC transfers in the $5–10 range also spiked during the same period, and heatmaps show a parallel increase in activity density. While it’s unclear if the two events are directly connected, the overlap in timing, value bands, and behavior raises the possibility of a shared activity spanning both chains, such as a cross-chain bridge or swaps being routed across chains or DEXs involving USDC.

What's Behind the Growth: Accounts & Applications

DEXs & Bridges

Diving deeper into the most active contracts reveals that some of the growth in Avalanche C-Chain activity appears to stem from decentralized exchange aggregators (DEXs). This involves router contracts managing multi-hop swaps across DEX pools (Uniswap, Trader Joe etc…), often using USDC and wrapped AVAX. These routers optimize execution paths, enabling high-frequency, low-value trades, likely contributing to spikes in small USDC transfers.

Source: Coin Metrics ATLAS, (Note: Based on transfer activity from this router contract)

Additionally, bridges that facilitate cross-chain transfers, like Relay.link, may also be playing a role as they are recorded as transactions on the C-Chain. While it's difficult to attribute the entire increase to a single source, the presence of numerous active router and bridge contracts suggests an uptick in protocol-level infrastructure usage.

Source: Coin Metrics ATLAS, (Note: Based on transfer activity from Relay.link contract)

Avalanche L1s & Applications

One likely driver of sustained growth is the May launch of MapleStory Universe, a custom Layer-1 blockchain (Henesys) on Avalanche developed by Korean game studio Nexon. The subnet uses NXPC as the primary in-game currency of the ecosystem. As users onboard into the ecosystem, NXPC is increasingly being bridged from the C-Chain to the Henesys L1, contributing to C-Chain transaction volume.

The timing of MapleStory’s launch closely aligns with the rise in Avalanche C-Chain transactions and active addresses. While not definitively linked, the parallel increase in USDC transfer counts may reflect users onboarding into the ecosystem, swapping into NXPC or related assets, and bridging them to the subnet from the C-Chain.

Source: Coin Metrics ATLAS, (Note: Based on transfer activity from this Arena DEX contract)

Activity has also risen from applications like Arena, a socialFi platform built directly on Avalanche’s C-Chain. Through its DEX, Arena allows creators to monetize via “tickets”, which are tradable social tokens that grant access to gated content or chats. Actions such as minting, tipping, or trading tickets are executed via smart-contracts on the C-Chain, directly adding to base layer activity on Avalanche with over 2.2M balance updates.

The Etna Upgrade: Boosting L1 Growth

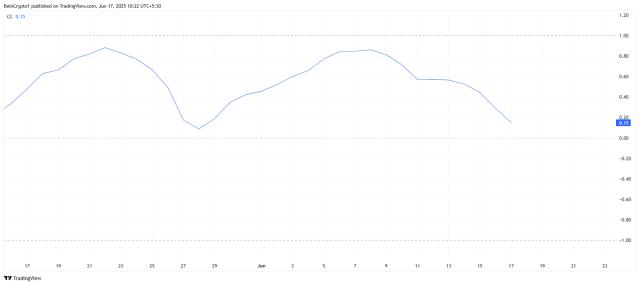

In December 2024 the network underwent the largest update since its launch, known as the Avalanche9000 upgrade. This increased the flexibility and economic feasibility of launching purpose-built L1s on Avalanche, while also influencing user behavior. This upgrade included Etna, which activated various Avalanche Community Proposals (ACPs) with a major one being a reduction in base fees on the C-chain.

Source: Coin Metrics Network Data Pro

Etna reduced transaction fees on the C-Chain by over 90%, providing a boost to network activity. This makes use-cases like DeFi, high-frequency trading and micro-transactions (such as those featured in gaming or social apps), more feasible. Additionally, Etna also allows developers to spin up L1s with significantly lower validation costs, dropping from a minimum stake of 2000 AVAX to a lower, monthly fee model. L1 validator requirements were also decoupled from the primary network’s P-Chain, unlocking customizable validator and staking parameters.

These changes have lowered technical and economic barriers, opening the door to a growing ecosystem of L1s powered by Avalanche. This spans consumer L1s like Henesys (MapleStory Universe), the FIFA Blockchain and SocialFi apps like Arena, to enterprise blockchains like Balcony tokenizing $240B in real-estate value.

Conclusion

Our investigation into the rise in Avalanche C-Chain transactions uncovered a combination of contributing sources. Growth appears to be driven by protocol-level infrastructure like DEX routers and bridges, alongside application activity from new Avalanche L1s like MapleStory Universe. The Etna upgrade played a key enabling role, lowering transaction costs and reducing the barriers to launching new chains. Taken together, these trends highlight how Avalanche’s modular, multi-chain architecture is beginning to support more diverse forms of on-chain activity.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.