- Whales have accumulated around $2.5 billion in ETH over the last weekend, recording the largest single-day purchase since 2018.

- ETH capital flow has exploded alongside the acceleration of financial and fintech services developing on Ethereum blockchain.

Massive ETH Whale Purchases: Signs of Preparing for a New Wave?

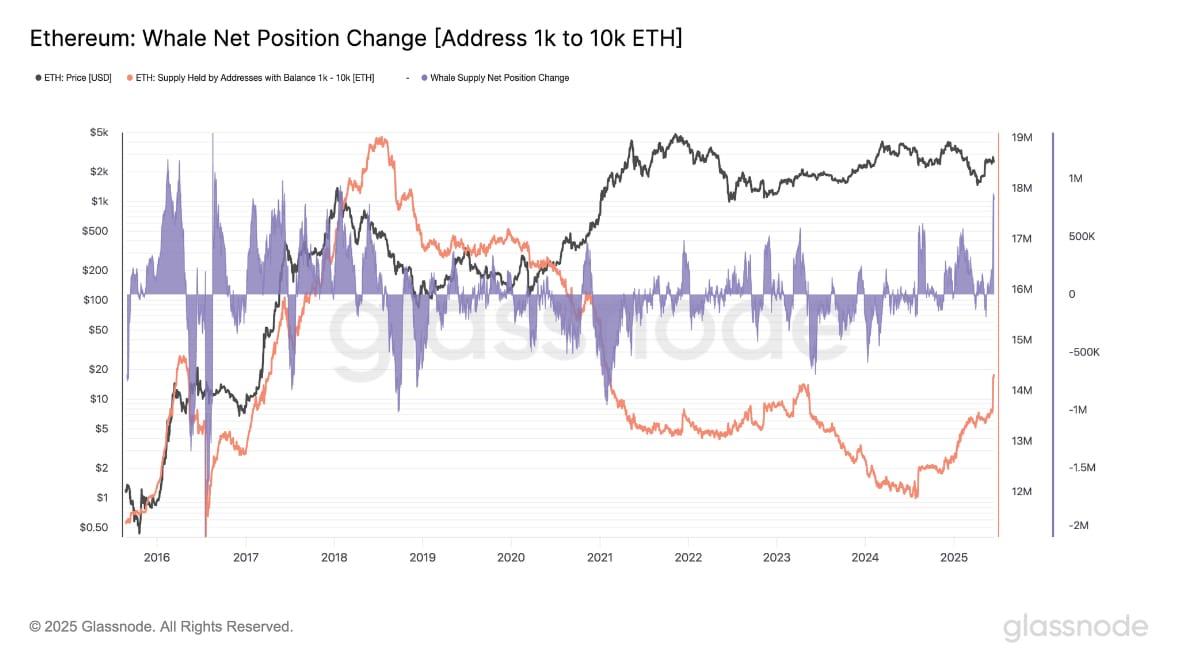

Large-scale ETH holders (holding 1K-10K ETH), known as whales, have just completed a record accumulation phase with a total value of $2.5 billion ETH in just one day—according to statistical data from Glassnode.

The sharp increase on the histogram confirms the peak of whales' net position change. This lightning-fast move casts a shadow exactly like the "heavy accumulation before a big wave" that occurred in 2017, right before Ethereum's rapid price surge.

The total ETH supply held by whales has continuously increased again to over 14 million ETH, reversing the long-term decline process before that.

Meanwhile, ETH price has declined, indicating that whales are moving ahead—quietly accumulating while small investors hesitate.

Source: Merlijn The Trader/X

Previous whale accumulation cycles have paved the way for ETH's major bull run. If history repeats like in 2017, a price explosion is likely very close.

The graph continues to confirm the strong increase in whale trading confidence. This quiet accumulation phase is likely a "harbinger" of a historic ETH movement.

ETH Capital Flow Explodes, Institutions Invest, New Market Signal

In just the past week, net capital flow into Ethereum spot ETF funds has exceeded $450 million—ranking in the top 3 strongest cash inflow weeks since August 2024.

This reflects an extremely strong buying wave from institutional investors, reinforcing the view that market calm is always an opportunity for strategic investors and large banks to accumulate.

Notably, this surge in interest occurred when ETH price retreated close to an important support level—a typical bullish divergence indicator in technical analysis.

A dump phase from ETF funds in March and April 2025 has ended, replaced by two consecutive weeks of strong capital flow in May and June.

This shift marks market confidence recovery and could be a turning point for Ethereum's price momentum.

Source: Crypto Rover/X

Clear price increase signals emerge through sharply declining exchange supply and surging capital inflow.

Instead of creating a peak, these developments suggest the possibility of forming an accumulation phase before ETH price accelerates.

Ethereum Becomes Digital Financial Center, RWAs Inject New Vitality

From the beginning of 2025, Token Terminal data shows parabolic explosion of tokenized assets managed on Ethereum.

BlackRock, PayPal, and Franklin Templeton are the "leaders", confirming large institutions' trust in Ethereum infrastructure.

Ethereum increasingly affirms its position as a digital financial center, with total tokenized real-world asset (RWAs) value pegged at over $4 billion.

History has witnessed that strong capital flow and RWAs expansion always signal a new pricing period—creating a premise for ETH to be ready to explode if the current trend continues.