Ahead of the upcoming Federal Open Market Committee (FOMC) meeting and the next interest rate decision to be announced on Wednesday, the market began to reduce risk, with BTC falling to $103,300.

VX:TZ7971

This adjustment came after a bearish weekly chart, indicating a trend reversal, and geopolitical tensions, especially the conflict between Israel and Iran, intensified risk-averse sentiment.

The decline in Bitcoin's price was not entirely driven by the macro environment. This drop synchronized with seasonal weakness and slowing on-chain network growth, suggesting that spot demand has cooled down.

On that day, over $434 million in BTC futures were liquidated, highlighting that the current trend is primarily driven by leverage, with cautious traders choosing to reduce positions rather than open new ones.

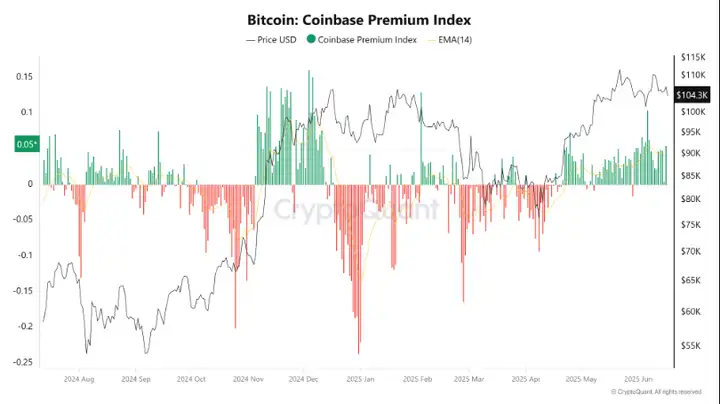

Nevertheless, the Coinbase Premium Index (a metric used to compare BTC prices on Coinbase and Binance platforms) remained positive for most of June, indicating stable spot demand from U.S. investors. However, due to the generally cautious market, this demand has limited impact on price.

Further pressure came from "mid-cycle holders" (6 to 12 months) who realized profits of $904 million on Monday.

This group accounts for 83% of all realized profits, a significant change compared to the long-term holders who previously led profit-taking or those holding assets for over 12 months.

This change indicates a shift in market dynamics, with more passive participants gaining profits as BTC reached recent highs.

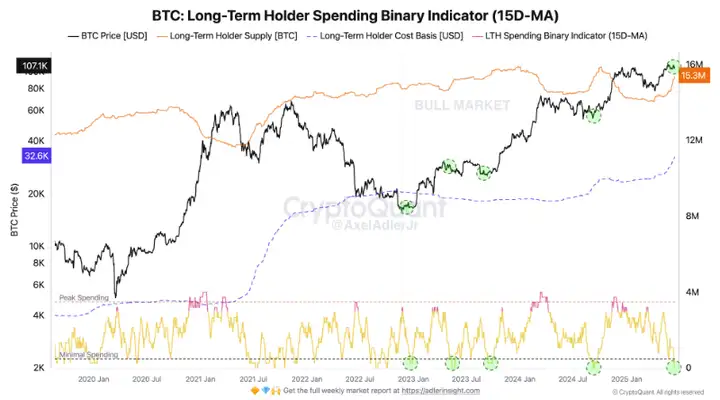

However, the behavior of long-term investors suggests an optimistic outlook. Long-term holders (LTH) continue to avoid large-scale spending, which has historically been a bullish signal.

A healthy MVRV Z ratio indicates that BTC remains undervalued, while a positive Coin Days Destroyed (CDD) suggests selective profit-taking rather than panic.

Similar setups in previous cycles generated 18-25% increases within 6-8 weeks, implying a potential price target of $130,000 by the end of the third quarter.

Bitcoin May Bottom Out Around $102,000

From a technical perspective, Bitcoin may be approaching a short-term bottom between $102,000 and $104,000, where significant liquidity and large orders converge.

The Bollinger Bands are another reason for a potential reversal near $102,000. As shown, due to the dynamic resistance around $106,000 at the Bollinger Bands' midline and the consolidation in early June, a technical pullback may occur around $102,000.

The Bollinger Bands are also contracting, suggesting an imminent change, with the middle band (near $106,000) acting as a dynamic resistance level.

A successful rebound and closing above $106,748 could confirm a bullish reversal, with a target price of $112,000. Conversely, falling below $100,000 might invalidate the above setup, with a target price of $98,000.

The key support level at $98,300 is where short-term holders (STH) can profit. Breaking below this level could lead to a deeper pullback.

As long as Bitcoin remains above the support level, we can still consider the market bullish. Only when Bitcoin falls below $98,000 would the situation change, potentially triggering a deeper decline.

Today's fear index is 52, shifting to a neutral state.

Initially, the Israel-Iran situation was not affecting the market, so it was gradually recovering. However, before stabilizing for a day, it was brought down by a Trump statement. Whether the U.S. participates directly affects the rise and fall, and Trump's statement of "actively considering participation" caused Bitcoin to fall below $104,000. If the U.S. gets involved, the nature would be different, and Bitcoin is estimated to fall below $100,000.

Tonight also has the Federal Reserve meeting results. If Powell's speech leans hawkish and continues to insist on maintaining short-term interest rates, it will inevitably accelerate this decline. Currently, the conflict may again push oil prices higher, raising inflation risks. Powell has more reasons to maintain an observant stance, so short-term market negative factors have not been eliminated.

However, spot is a rare opportunity to pick up chips, 618 discount coins, with priority given to DeFi altcoins.