Compiled by Wu Blockchain Blockchain Aki_Chen

The content of this article does not represent Wu Blockchain views and does not provide any investment advice. Readers are advised to strictly abide by local laws and regulations and not participate in illegal financial activities.

The article content is excerpted as follows:

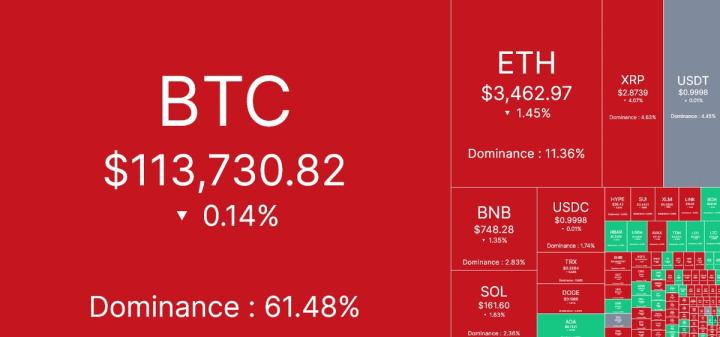

Although Circle CEO Jeremy Allaire “had to” take office at the behest of “Coinbase boss” Brian Armstrong, Circle’s initial public offering (IPO) was still an unexpected success. Many retail and institutional investors entered the market at this point, heralding the arrival of a new round of stablecoin craze. This article reviews the past, present and future of stablecoins to analyze why it is almost impossible for latecomers to replicate their success path. And for readers who participate in stablecoin-related transactions in the open market, it clarifies a key issue: Are the current valuation system, network effects and profit models of stablecoins sustainable? Or has another round of bubbles that are “over-packaged” by financial engineering begun?

From marginal arbitrage to systemic revolution: the starting point of stablecoins

Buying Bitcoin is not easy — there is no clear standard for which channel is safe and reliable. For most people, when they first got involved in crypto trading in 2013, they could only buy from individuals through cash transfers or bank wires, and then gradually transitioned to centralized exchanges. However, since exchanges often lack stable banking partnerships, the path to fiat currency deposits is extremely fragile, and fraud and runaway incidents are frequent. Or they are in a regulatory gray area in their country, making it impossible for users to remit money directly to them. As a result, exchanges will design various alternatives, such as asking users to remit fiat currency to local agents, who will issue cash coupons in the exchange system, or setting up a "shadow company" that seems to have nothing to do with crypto business to open a bank account, and then let users transfer funds to the account to complete the fiat currency deposit process.

This is not a distant history. To this day, there are still many crypto exchage around the world that cannot obtain bank accounts. USDT was born in this context: people need to bypass banks and create a "trustless" dollar clearing tool.

Understanding how money flows in China gives me insight into how major Chinese and international crypto exchage(such as Bitfinex) conduct business. This is crucial because almost all real innovation in the crypto capital market was born in China, especially in the field of stablecoins. This experience made me realize the fact that stablecoins are not the product of technological innovation, but the natural evolution of real structural pressures.

The combination of Bitfinex, Tether and Chinese capital

In the early stages, crypto trading was not widely noticed. For example, Bitfinex has been the world's largest non-Chinese crypto exchage since 2014. At that time, Bitfinex was affiliated with an operating company based in Hong Kong and had multiple local bank accounts. It was very friendly to local users who lived in Hong Kong at the time and focused on arbitrage trading. At the same time, the three major exchanges in mainland China - OKCoin, Huobi and Bitcoin China (BTC China) - all had multiple accounts in several large state-owned banks. It only takes 45 minutes to take a bus from Hong Kong to Shenzhen, and with a passport and basic Chinese skills, you can open various local bank accounts.

However, as the crypto industry continues to gain attention, banks have begun to close accounts. Every day, it is necessary to check whether the partnerships between banks and exchanges are still operating. This has a huge impact on the profits of arbitrage traders - the slower the flow of funds, the fewer opportunities to capture price differences and the lower the profit. A question has surfaced: Is there a way to build an on-chain "digital asset" that is separated from the banking system but still represents the US dollar? That would mean that the blood of the crypto capital market - the US dollar can be freely circulated between exchanges at almost zero cost and around the clock (24/7).

Tether was born out of this structural gap. In 2015, Bitfinex launched Tether USD (USDT), using the Bitcoin chain's Omni protocol to transfer Tether USD (USDT) between addresses. This is equivalent to a "primitive smart contract layer" built on top of Bitcoin. Users remit US dollars to Tether's bank account, and then Tether will mint USDT in the equivalent amount. These USDT can then be sent to Bitfinex to purchase cryptocurrencies.

At first, this was just a small tool designed by Bitfinex to solve the problem of depositing funds. But at that time, market participants throughout China and Asia were facing the same situation - in the context of the overall tightening of bank accounts in China and Asian markets and the continued strong demand for US dollars, on the one hand, the local currency was prone to exchange rate shock depreciation and high inflation, and on the other hand, the local bank deposit interest rate was too low. And for most Chinese users, it is extremely difficult, or even almost impossible, to obtain US dollar assets and enter the US financial market. For this reason, Tether provides a form of digital US dollars that can be held by any user with an Internet connection - USDT unexpectedly became the "holdable digital dollar" in the eyes of Chinese traders. More importantly, the Bitfinex/Tether team went with the trend. Jean-Louis van der Velde, who has served as CEO of Bitfinex since 2013, worked in a Chinese automobile manufacturer and has extensive experience in the Chinese market. He is well versed in the Chinese market environment and is committed to making USDT the preferred tool for "US dollar bank accounts" for crypto users. This has enabled Tether to establish a high degree of trust in the Chinese-speaking world. During this period, it was extremely difficult for the Chinese-speaking world to withdraw funds. USDT bypassed all obstacles such as capital controls, bank blockades, and policy ambiguity in a technologically neutral way. In southern countries, especially in Asia and Africa, the Chinese community generally uses USDT as a standard tool for cross-border payments and fund storage.

How USDT becomes the pricing anchor for on-chain exchanges

Even if Tether had a large exchange as its primary initial distribution channel, this in itself would not have been enough to ensure its success. What was really critical was that the market structure subsequently changed: if you wanted to trade Altcoin denominated in US dollars, it was almost only possible through USDT. The real explosion of stablecoins began in 2017. This was the peak of the ICO craze - it was during this stage that Tether really solidified its product-market fit.

As long as money keeps getting created, the macro environment is always favorable. At the time, Chinese traders were the marginal buyers of almost all crypto assets — when “crypto assets” were basically equivalent to Bitcoin. Once they became uneasy about the trend of the RMB, Bitcoin surged. At least, that was the mainstream market narrative at the time. The sudden devaluation of the RMB by the People’s Bank of China further exacerbated capital outflows. By August 2015, the price of Bitcoin had fallen from an all-time high of $1,300 before the bankruptcy of Mt. Gox (February 2014) to a low of $135 recorded by Bitfinex earlier that month. It was at that time that Zhao Dong, China’s largest over-the-counter Bitcoin trader, suffered a forced liquidation of up to 6,000 BTC on Bitfinex.

This round of “capital flight” narrative started the upward trend of Bitcoin: the BTC/USD exchange rate rose more than three times between August and October 2015 alone. The truly exciting things always happen at the “micro level”. That is, the explosive growth of Altcoin actually began after the Ethereum mainnet and its native token Ether were officially launched on July 30, 2015. Poloniex was the first exchange to support Ether trading, and it was this forward-looking vision that made it one of the “market protagonists” in 2017.

Poloniex and other Chinese exchanges quickly seized on the nascent Altcoin market by launching crypto-only trading platforms. Unlike Bitfinex, these platforms do not require access to the fiat banking system, and users can only deposit and withdraw crypto assets and use them to trade cryptocurrencies. However, this model is not ideal because traders instinctively prefer to trade " Altcoin/USD" trading pairs. If the platform cannot accept fiat deposits and withdrawals, how can it provide these trading pairs? Poloniex and Yunbi (once one of the largest platforms in China until it was shut down by the People's Bank of China in the fall of 2017) faced this problem.

At this time, USDT came on the scene. After USDT switched to the Ethereum ERC-20 format, almost all Ethereum-supported platforms can seamlessly support USDT. This change directly promoted the explosive expansion of its circulation network. This also means that digital dollars can be efficiently transferred and seamlessly connected between capital entry exchanges such as Bitfinex, OKCoin, Huobi, and Bitcoin China and more speculative and entertaining platforms such as Poloniex and Yunbi.com. The former is responsible for the capital injection of the ecosystem, while the latter is an active paradise for "Degen (highly active speculators)".

Between 2015 and 2017, Tether successfully solidified its product-market fit and built a moat that was difficult for subsequent competitors to cross. Thanks to the high level of trust in Tether by the Chinese trading community, USDT was widely accepted by major trading platforms. At that time, although USDT had not yet been used for daily payments, it had become the underlying settlement network for on-chain crypto finance. At this time, crypto exchage also generally faced great difficulties in maintaining bank accounts. Taiwan gradually became the "de facto crypto banking center" for large non-Western crypto exchage, which control a major share of global crypto trading liquidity. The reason is that some Taiwanese banks allow exchanges to open US dollar accounts and can maintain correspondent banking relationships with large US settlement banks (such as Wells Fargo) to a certain extent. But this arrangement eventually began to collapse: US correspondent banks pressured Taiwanese banks to fully clear all crypto industry customers, otherwise they would be cut off from access to the US dollar global clearing network.

Therefore, USDT has become the only solution that can achieve large-scale US dollar flows in the crypto capital market, thus thoroughly establishing its market position as the dominant stablecoin.

Conflict of interests between social giants, banks and stablecoins

In 2019, Facebook (now renamed Meta) announced the Libra project, intending to use WhatsApp and Instagram to issue its own stablecoin and build a dollar alternative network that completely bypasses banks. This plan directly threatens the foundation of traditional finance and has triggered a strong backlash from regulators. In the end, the US political circles quickly took action to prevent Facebook from obtaining global clearing rights in order to protect the traditional banking industry from real competition in the payment and foreign exchange fields. The Libra project died aborted and became a "cautionary tale" in the history of digital finance. This conflict reveals the nature of stablecoins: it is not a payment tool, but a contender for global financial sovereignty. Whoever controls the right to issue stablecoins holds the digital scepter of the "offshore dollar".

But that was the past. Now, the Trump administration will allow real competition in the financial markets. During Biden’s term, the entire Trump family was “deactivated” by the banking system — so the Trump 2.0 regime has no good feelings towards traditional banking. Against this backdrop, major social media companies are restarting projects to try to embed stablecoin technology natively into their platforms. This is undoubtedly good news for shareholders of social media companies. These companies have the ability to eat up the traditional banking system’s revenue sources in the payment and foreign exchange fields. But at the same time, it is bad news for stablecoin entrepreneurs. Because social platforms will build a complete stablecoin infrastructure in-house, achieving closed-loop control of all core functions. For those who plan to create new stablecoins, this will greatly reduce their living space. Therefore, any investor who hears the initiator of a new stablecoin project touting that it will “partner with social media companies” or “distribute through the platform” should be highly vigilant. Other technology companies are also following this wave of stablecoins. Social media platform X, Airbnb and Google have all begun to explore the feasibility of integrating stablecoins into their own business systems.

Whether banks like it or not, they will no longer be able to earn billions of dollars a year from holding and transferring digital fiat currencies, nor will they be able to charge the same level of fees through traditional foreign exchange transactions. When discussing the topic of stablecoins, a board member of a large bank said frankly: "We are done." They believe that the development of stablecoins is unstoppable and use the situation in Nigeria as an example. Although the Central Bank of Nigeria has strongly suppressed crypto assets, about one-third of the country's GDP is currently denominated and settled in USDT. He further pointed out that due to the "bottom-up" popularization path of stablecoins, regulators are simply unable to stop it. When regulators really realize and try to take action, it is often too late - because the use of stablecoins is already deeply rooted in the general public and difficult to reverse.

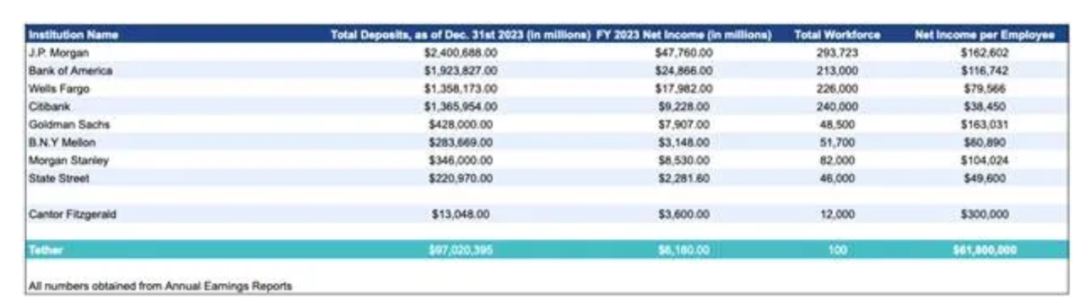

Although there are forward-thinking people like them at the top of every large traditional bank, the entire banking system is not willing to undergo fundamental changes because it means threatening the survival of its many "cells" (that is, employees). With a team of no more than 100 people, Tether can complete the key functions of the global banking system through blockchain technology and achieve high scalability. In contrast, JP Morgan, the world's most recognized commercial bank with the highest operational efficiency, currently has a total of more than 300,000 employees.

The problem worldwide is that banking regulation has largely evolved into a "job program for an overeducated population." And this "overeducated" does not mean trained in really important areas, but rather has obtained a high degree in a lot of content that has no real value. These people, in the final analysis, are just highly paid mechanical compliance personnel responsible for completing formalistic compliance processes. Although bank executives may very much like to cut the number of employees by 99% and significantly improve efficiency, as regulated financial institutions, they simply cannot do so. Stablecoins will eventually be adopted in a restricted form in the traditional banking system. These banks will run two systems at the same time: one is the traditional, slow and costly old system, and the other is the fast and low-cost new system. And the extent to which they can truly embrace stablecoins will be determined by the prudential regulators of each country.

It is important to note that JPMorgan Chase is not a unified organism, and its branches in different countries are independently regulated by local regulators. Therefore, data and personnel are often not freely shared between legal entities in different countries, which makes it difficult for banks to achieve unified optimization and integration based on technology on a global scale. These banks will almost certainly not cooperate with third parties in the technical development or issuance and distribution of stablecoins. They will do it all in-house. In fact, regulators may even explicitly prohibit such cooperation. Therefore, for entrepreneurs trying to build their own stablecoin technology, the path has been basically closed. No matter how many "Proof of Concept" experiments an issuer claims to have conducted for traditional banks, it is unlikely to translate into real adoption within the banking system.

Distribution monopoly, profit model and the dilemma of new issuers

Stablecoins are one of the most profitable business models in the crypto market, with net interest income as the core profit source. The cost side is mainly the fees paid to holders, while the income side comes from cash investment income, such as investment in US Treasury bonds (such as Tether and Circle's model), or through some crypto market arbitrage methods (such as the "positive basis arbitrage" strategy adopted by Ethena).

Take Tether as an example. It does not pay interest to users. All the US dollars "deposited" by users are actually used to purchase short-term US Treasury bonds, and all interest income belongs to Tether.

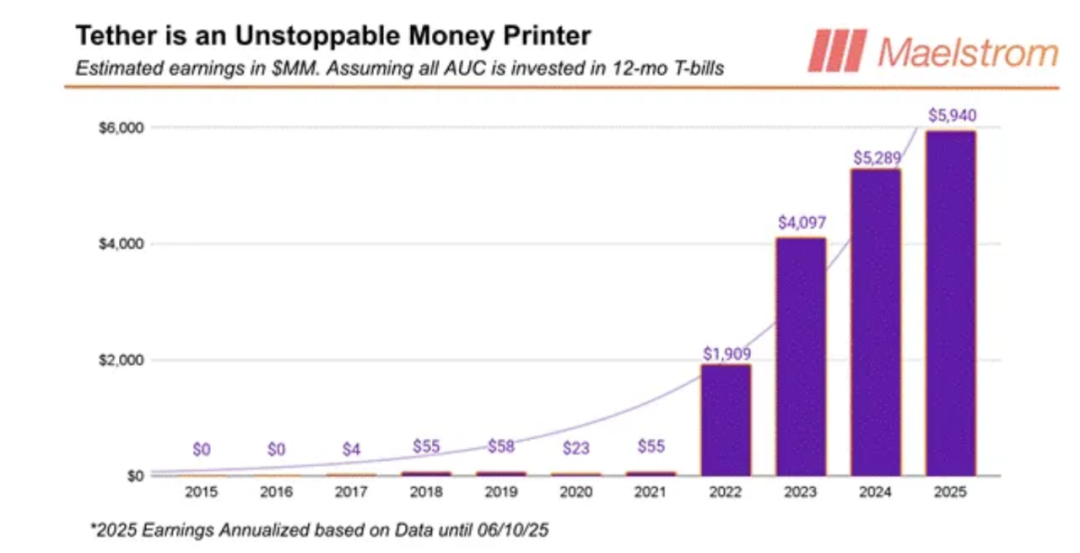

Tether’s annual profit is actually higher than the estimate shown in the figure.

The chart assumes that all assets under custody (AUC) are invested in 12-month U.S. Treasury bills (T-bills).

The core purpose of the chart is to illustrate that Tether’s profitability is highly correlated with US interest rates.

It can be clearly seen that Tether's profits jumped significantly between 2021 and 2022 as the Federal Reserve raised interest rates at the fastest pace since the early 1980s.

More importantly, Tether does not need to pay extra fees for user acquisition or distribution. It has a high degree of overlap with the Bitfinex founding team, naturally has millions of user distribution entrances, and builds network effects at almost no cost. Tether's high profit margin is itself the best advertisement for social media companies and banks to issue their own stablecoins. These two types of institutions naturally have strong distribution capabilities, so they do not need to pay costs to absorb "deposits", which means they can also fully obtain net interest income (NIM). Therefore, the stablecoin business is entirely likely to become their super profit center.

This is why Circle chose to strengthen its binding relationship with Coinbase. Coinbase is one of the few large exchanges that is not in the influence of Tether, and its users are mainly from the United States and Western Europe. Before U.S. Secretary of Commerce Howard Lutnik provided banking services for Tether with the help of his Cantor Fitzgerald banking business, Tether had long been regarded by Western media as a "potential scam issued by a foreign country." Coinbase's business model is highly dependent on gaining the trust and endorsement of the American political system, so it has to seek a "compliant alternative." It is in this context that Circle CEO Jeremy Allaire chose to "accept the arrangement" and reached a close cooperative relationship with Coinbase CEO Brian Armstrong. According to the agreement between the two parties, Circle will pay 50% of its net interest income to Coinbase in exchange for distribution channel support within the Coinbase network.

This means that if any emerging stablecoin project wants to gain market share, the only viable strategy is to transfer most of the NIM to users, that is, "high interest rate deposit absorption". Although this aggressive subsidy strategy can attract users in the short term, the platform without a distribution foundation will sooner or later run out of profitability - this is the fate of almost all late-developing stablecoin projects in this cycle. And there is an even more serious problem: the distribution channel has been completely occupied by leading platforms such as Tether, Circle, and Ethena. If the new issuer does not have an exchange background or social media support, it is almost impossible to break through. It has become a trend for social platforms to build their own stablecoins. Meta, X, and Airbnb have all begun to integrate digital payment systems. For ordinary entrepreneurs, it is almost impossible to impress traditional banks by relying on "technology + proof of concept".

The carnival and hidden dangers of the stablecoin narrative

In addition to long-term holding of Bitcoin and other Altcoin, the three major business models that truly create wealth in the crypto industry are: mining, operating exchanges, and issuing stablecoins. Ethena started almost from scratch in 2024, and in less than a year it became the world's third largest stablecoin issuer. And with the successful listing of Circle, this round of "stablecoin narrative" has been completely ignited. Next, more "Circle replicas" will flood into the market. They will use the banners of traditional financial resumes, regulatory compliance, and bank cooperation to tell the grand narrative of stablecoins replacing bank accounts and reshaping the payment system.

The uniqueness of the stablecoin narrative is that it has the most clear and large total serviceable market (TAM) for traditional finance (TradFi) people. Tether has proved that an "on-chain bank" that is only responsible for keeping user funds and realizing on-chain transfer functions can become the financial institution with the highest per capita profit. However, we must look at it calmly - the reason why the stablecoin narrative attracts investors is not because its financial model is advanced enough, but because its profit model is too "rough": high interest, no expenses, and little supervision.

Tether has achieved this against the backdrop of ongoing “lawfare” at multiple levels of the U.S. government. If U.S. regulators were to stop being hostile and give stablecoins a degree of freedom to operate so that they could compete fairly with traditional banks for deposits, the result would be explosive profit growth. Treasury staff believe that stablecoin assets under management (AUC) could grow to $2 trillion. They also believe that dollar stablecoins could become a “vanguard weapon” to maintain or even expand the dollar’s dominance and act as long-term buyers that are insensitive to U.S. Treasury prices. This undoubtedly constitutes a strong macro tailwind. Even more “exciting” is that Trump has always been dissatisfied with large banks — because these banks “de-platformed” him and his family after his first presidential term. Today, Trump clearly has no intention of preventing the free market from providing a faster, safer, and more efficient way to hold and transfer digital dollars. Even his sons have begun to get involved in the stablecoin business.

Therefore, after the first wave of listings, the scale of the “cutting leeks” in the entire stablecoin market will depend entirely on the stablecoin regulatory framework that the United States is about to introduce. In this scenario, if the United States adopts a “light regulation” or even “no regulation” model, it is very likely that we will see a reappearance of the algorithmic stablecoin Ponzi scheme similar to Terra/Luna. In this model, issuers can pay high returns to coin holders, and the source of these returns is the excess returns obtained by leveraging some of the underlying assets. The so-called “future” does not exist at all, and for new entrants, the distribution channels have been completely blocked. But it is worth mentioning that for investors, these newly listed stablecoin stocks may also hit short short hard in the short term.

At present, both the macro environment and the micro structure are in a state of resonance. As Chuck Prince, former CEO of Citigroup, said when asked whether he was involved in the subprime mortgage market: "When the music stops, that is, when market liquidity dries up, things will become complicated. But as long as the music is still playing, we have to get up and dance. We are still dancing."

In other words, the market's capital carnival is still going on, and before the heat subsides, both risks and returns are at their limit. Ultimately, this bubble will depend on how regulation is implemented. If stablecoins are allowed to provide interest income, financial engineering and leverage structures will once again give birth to the "Ponzi model of the digital age." If regulation strictly defines the underlying assets and limits the use, the bubble will quickly recede. But before the regulatory boots land, capital will still chase this singularity industry that is jointly catalyzed by high interest rate spreads, Fed rate hikes, distribution barriers, and the globalization of the US dollar.