Source: Wall Street News

Author: Zhao Ying

With an unexpected official release, Labubu is experiencing a dramatic shift from being sold at dozens of times its original price to a sudden 50% drop in secondary market prices, with market sentiment rapidly changing from frenzied pursuit to selling.

Just a week ago, Labubu was "hard to obtain", with scalpers using booking software to monopolize supply and reselling at 10 to 30 times the original price, still finding buyers. However, a dramatic reversal occurred on June 18-19.

On the evening of June 18, Bubble Mart's official mini-program restocked the Labubu "High Energy" series with unprecedented intensity, and for the first time opened an online pre-sale channel.

The official's "generosity" instantly triggered a collapse in the secondary market, with data showing Labubu series prices generally plummeting by about 50%.

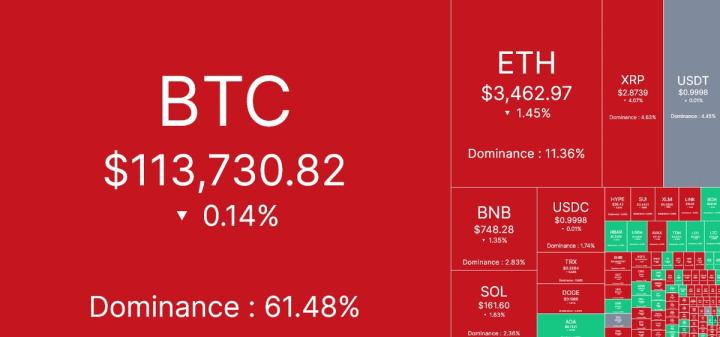

The market has begun to question the sustainability of this IP's popularity, with some investors believing Labubu might follow the same path as Violent Bear. Affected by this news, Bubble Mart's stock price dropped over 5% today!

A "Routine Restock" Turns Scalpers from Massive Profits to Losses

On June 18, Bubble Mart's "routine restock" triggered an earthquake in the secondary market.

Data shows this restock caused a price avalanche: Labubu series prices generally plummeted about 50%. Previously sold at 1,500 to 2,800 yuan per box (6 blind boxes), the recovery price dramatically dropped to the 650-800 yuan range. Even rare hidden editions like "Id" fell from 4,600 yuan to around 2,800 yuan, a drop of over 38%.

On social platforms, consumers who previously struggled to purchase now share screenshots of successful orders, with some noting that this restock's quantity and frequency far exceeded previous attempts, suggesting the company truly wants fans to buy.

In previously bustling scalper groups, the atmosphere has turned ice-cold. Sellers' 1,200 yuan pre-sale listings remain untouched, replaced by low-price calls of "will buy at 700 yuan".

Some scalpers suffered daily losses of tens of thousands of yuan, a dramatic reversal that made netizens gleeful: seeing scalpers lose money is more satisfying than earning money themselves.

This "ugly-cute" spirit that once drove global superstars like Rihanna and Beckham crazy is experiencing its first price collapse - and this may just be the beginning of a test for Bubble Mart's 350 billion Hong Kong dollar market value myth.

Market Debate: "Peak" or "Fake Fall"?

Labubu's challenges come not just from price fluctuations, but from fundamental doubts about its IP's sustained popularity. Investors are comparing it to historically phenomenal IPs, searching for signs of decline.

Previous articles have pointed out that from internet popularity data, these concerns are not unfounded. Violent Bear maintained its popularity for 2 years from 2020 to 2022; last year's "Black Myth: Wukong" maintained popularity for less than 3 months; Nezha similarly maintained its peak for only about 3 months during the Spring Festival.

Some analyses suggest that four common signals indicate young people's speculative assets have peaked: first, media and search heat first plateau; second, producers release large quantities at high prices; third, widening price gap between high-end and mid-range; fourth, liquidity stagnation. LABUBU is highly likely to repeat the paths of AJ and Violent Bear in the next 6-12 months, potentially experiencing over 50% pullback after being emotionally overvalued, with an objective probability of about 95% (±10 percentage points).

Supporters, however, offer a different perspective, comparing Bubble Mart to another company relying on core fans and IP ecosystem - Nintendo.

Analysis comparing Bubble Mart to gaming giant Nintendo: Nintendo has 106 million annual active users, a market value of about 85 billion yuan, revenue of 78 billion yuan, with a P/E ratio of 61; Bubble Mart has 46.08 million registered members, a member repurchase rate of 49.4%, with a projected 2025 P/E ratio of 56 and expected profit growth over 100%.

The analysis argues that Labubu, like games, doesn't need to be "loved by everyone". Its commercial foundation lies in a massive fan base with high loyalty and repurchase rates. Bubble Mart's nearly 50% member repurchase rate is the "moat" of its business model.

From this perspective, Bubble Mart's valuation doesn't seem outrageous. The key is whether Labubu can become a classic IP spanning generations, rather than a fleeting internet sensation.