Yesterday, due to the holiday, the US stock market was closed. Except for the Taiwan Weighted Index, major global stock markets experienced significant declines. Although the US stock market was closed, futures markets also saw nearly a 1% drop. If a reason for the decline must be found, the traditional explanation is that due to the US market closure, the market lacked direction, causing investors to withdraw liquidity and trigger sell-offs. However, the market consensus is that there is a high chance of escalation in the Middle East situation over the weekend, so investors consistently retreated and are now observing.

VX: TZ7971

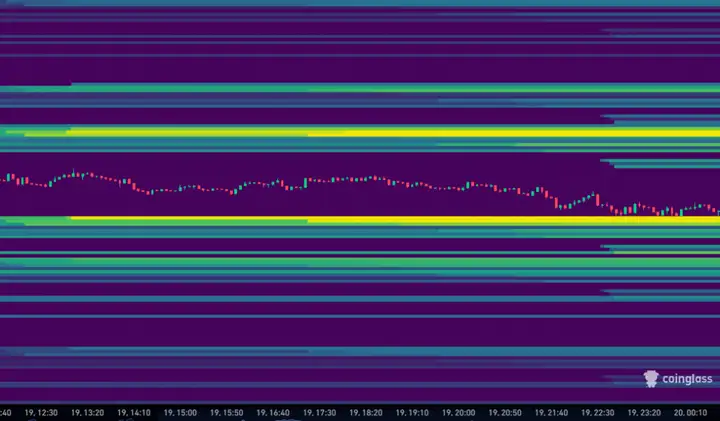

The cryptocurrency market is no different. Bitcoin has been hovering around $104,000, and Ethereum has been oscillating around $2,500 for six consecutive weeks. Looking at glassnode's Bitcoin liquidation map, short-term high-leverage contracts are betting on the range between $103,000 and $106,000. If there are no major news events guiding the market before the weekend, market makers will likely focus on liquidating contracts at these two price levels and create up and down oscillations. If the Middle East situation worsens, Bitcoin may test $100,000 again.

Currently, both Iran and Israel continue to maintain a state of mutual air strikes, and everyone is waiting for the US to clarify its stance. According to White House news last night, Trump will decide within the next two weeks whether to personally intervene in the war. After meetings with the National Security Council in the past few days, Trump has not publicly stated his position. The market speculates that the US is inclined to participate in the war, so the announcement will likely be made after the US stock market closes on Friday to avoid a stock market crash and provide the market with sufficient time to calm down and prepare for risk aversion. Therefore, during the weekend when traditional stocks and foreign exchange markets are closed, the cryptocurrency market requires extra caution.

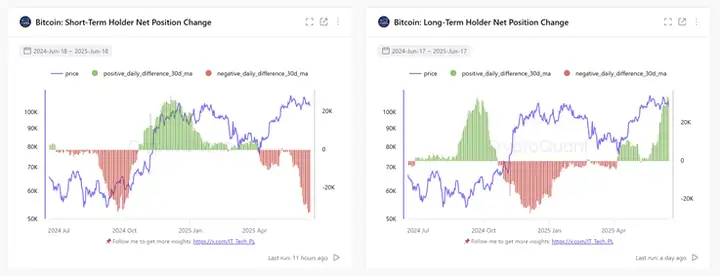

According to glassnode, on Monday, 959 BTC were transferred to exchanges at a loss. By Wednesday, this number had surged to 16,700 BTC. Simultaneously, BTC price dropped from $106,500 to $103,500. This series of activities reflects a common behavior pattern: STH (often referred to as "weak hands") tend to panic sell during price declines, usually to cut losses.

This selling behavior indicates increased activity among the STH group during market adjustments. When "weak hands" exit their positions, these tokens are typically transferred to long-term holders (LTH) - also known as "strong hands" - which helps stabilize the market and create a more sustainable price foundation.

It is worth noting that the total supply held by the STH group is declining, especially after significant price drops. The selling pressure from weak positions is gradually weakening, bringing opportunities for accumulation, which might signal that a price bottom is forming.

The net position change chart between STH and LTH provides further insight, showing strong selling activities by STH over the past month. Notably, most of the selling was absorbed by LTH - which might be a key factor in helping BTC maintain above $100,000.

Bitcoin is in a "blind zone" and needs new buying power

Bitcoin is currently trading in a market "blind zone". Data shows that spot trading volume increment has been negative since June, indicating that despite a slight price recovery due to weak buying power, selling pressure still exists. Although the bearish pressure is gradually easing, this still suggests that the current pullback may continue for some time before a significant breakthrough - which depends on the return of demand.

Considering a potential short-term pullback before recovery, the on-chain price fundamentals for short-term holders support a range between $97,000 and $94,000.

Everyone is now waiting for the US stance. If the US truly enters the war, it will definitely test levels below $100,000 again. Those trading futures should be prepared for risk, and for spot traders, the advice remains: sharp drops are opportunities, and the continuous buying from major companies is the best example.