Circle's surge to $47 billion is probably the most desolate episode for people in the crypto. I asked several friends in the circle, and most of them miss the pump or sold out. There are a few listeners outside the circle who listened to our podcast but still held on and made money. The worst one also bought $COIN and made money... Compared to losing money in cryptocurrency trading, the saddest thing is probably miss the pump and watching people outside the circle make money.

The second episode of @PodOur2Cents and Di's talk about Circle has also been published. The amount of information is huge. I will try to post some of the essence. For the rest, you can see the link at the end of the article. This article is only a fundamental analysis and does not constitute any investment advice.

【Tether and Circle, two species】

Zheng Di: Although both Tether and Circle are engaged in the stablecoin business, they are actually two different species. This difference mainly stems from two key factors:

1. Compliance differences: Circle has basically achieved 100% reserve compliance, while Tether has about 80% compliance with regulatory requirements, and the remaining 18% does not comply with the provisions of the Genius Act. But it is worth noting that Tether’s main source of profit is precisely this 18% non-compliant part.

2. Funding scale: TEDA’s current overseas investment and lending scale has reached 30 billion US dollars. Although compliance issues are often questioned, when a non-compliant company has already clung to the thigh of the current Minister of Commerce, and SoftBank and Masayoshi Son have already boarded their ship, and there is a 30 billion US dollar check that can be used, can’t it use the money to break a compliant path? It must be able to break it. Having money and political resources is a hard truth. Therefore, in my opinion, Circle will face substantial challenges to achieve the goal of 25 billion or even higher valuations.

Does the crypto-friendly banking narrative still exist?

Zheng Di: What story did ZhongAn tell? ZhongAn basically said that I own 43% of ZhongAn Bank, and I am also one of the early shareholders of Yuanbi in the Hong Kong stablecoin sandbox test. The shareholding ratio is in the single digits, probably not more than 10%. So first, my Yuanbi asset will be valuable in the future. Second, if Yuanbi reaches a stablecoin scale of 500 billion Hong Kong dollars in the future, most of the funds will be deposited in my ZhongAn Bank, and I only need to give him a 2% interest deposit. I just told such a story, and it doubled in a week.

Why do I think this story is not very tenable? First of all, the concept of crypto-friendly banks is actually gone. We first know why the U.S. stocks of Metropolitan Bank, Signature Bank (not listed at the time), Metropolitan Bank and Silvergate were hyped up. Silvergate even became a rare ten-fold stock among U.S. bank stocks, a ten-fold stock in about two or three years. Why? Because at that time, even for a giant like Coinbase, only three banks in the United States were willing to do business with it, and other banks would not open accounts for it. Therefore, the fiat currencies deposited by customers can only be stored in the three banks of Metropolitan Bank, Silvergate and Signature.

These three banks do not need to compete at all. They just accept fiat currency deposits from Web3 enterprise projects and trading platforms, and they do not have to pay interest. They are zero interest. Then they use this zero interest money to buy and sell treasury bonds and MBS to make money. The interest rate spread can be more than 2.5%. However, as more and more banks are willing to serve Web3 enterprises and trading platforms, the era of zero interest savings is gone forever.

Of course, ZhongAn did not tell this story, but just said 2%. But there are several problems here. First, we know that the main bank of the Web3 industry in Hong Kong should be Standard Chartered, not ZhongAn. ZhongAn is actually a virtual bank. Of course, it is more friendly, but after all, it is not a main bank. We also know that Coinbase Singapore actually chose Standard Chartered as its receiving bank. In short, Standard Chartered is more aggressive, has a better appetite, and is willing to take these businesses, so it is more friendly than other banks. So the main bank in Hong Kong actually uses Standard Chartered, and it is unlikely that all or most of the deposit reserves of the Yuan currency are deposited in ZhongAn Bank.

[The story behind the New York State BitLicense]

Zheng Di: For those of us who are deeply involved in the Web3 industry, we should know what is really difficult to obtain, which is the New York State BitLicense. Of course, Circle also has this license, and there are only 20 licenses in the world, but in fact you will find that the transaction volume of the New York State BitLicense is very, very low. The business that can be done with this license is very pitiful. Every quarter, the financial regulatory department of New York State publishes it.

But why do people still tirelessly pursue the New York State license? Because it is a symbol of strength, it is an endorsement . I give it to all other states, including the federal government, including all other countries. For example, I have to deal with the Monetary Authority of Singapore (MAS), I have to deal with the Hong Kong Securities and Futures Commission, or I have to deal with the financial regulators in Dubai and Japan. Let me tell you, I have one of the 20 BitLicenses in New York State. Aren’t these licenses child’s play for me?

The idea of setting up BitLicense actually started in 2013. Didn't New York State hold a hearing at that time? Then they said that New York State was too strict and should relax, otherwise the United States would lose its technological leadership in Web3, right? The idea of BitLicense actually originated from that hearing, the hearing in 2013.

The host of the hearing was the New York State regulator, who invented the BitLicense. But what's particularly funny is that after he invented the BitLicense, he ran away before the first license was issued. He resigned and started his own consulting company. He provides consulting services to all license applicants. I guess Circle may have hired him. I don't know, but I guess it should be him, because he invented it. Who else is more suitable than him to be a consultant to guide you on how to get this license? Because he designed it himself, he also made a lot of money from his consulting company.

So you see, the US has been trading power for money since ancient times, and it has always been such a commercial society, right? So this is why I say that the narrative in the stock market is that USDT is not compliant and will not work in the future, and USDC is compliant and can grab your market share. This narrative is untenable.

The following is the full text of this conversation

Guest: Didier Zheng, a cutting-edge technology investor, who manages the Dots Institutional Investor Community on the Knowledge Planet

Host: Hazel Hu, host of the podcast "Zhi Wu Bu Yan", 6+ years of experience as a financial media reporter, core contributor of the Chinese Public Goods Fund GCC, focusing on the practical application of encryption.

1. Crazy coin stocks

Hazel: Let’s start with the stock price, which is what everyone is most concerned about. I wonder what Mr. Di thinks of Circle’s performance in the first two days of trading?

Zheng Di: Regarding Circle's IPO pricing, I think the initial position is reasonable and there are indeed investment opportunities. But I have always felt that Circle's model still has many hidden concerns in the long run, so I don't quite understand why it can be hyped up to 25 billion (Note: As of the time of this manuscript, Circle has soared to 35 billion US dollars). Some people told me 80 billion, 100 billion, right? In fact, I am not qualified to comment on the stock price these days, because I have been educated by the stock speculation circle for several days, saying that this vision should be long-term. But in fact, I think there is a huge information gap and cognitive asymmetry between the inside and outside of the circle.

In the field of cryptocurrency, we are all used to using USDT and are well aware of Tether’s actual strength. Some people believe that although both Tether and Circle are engaged in the stablecoin business, they are actually two different species. This difference is mainly due to two key factors:

1. Compliance differences: Circle has basically achieved 100% reserve compliance, while Tether has about 80% compliance with regulatory requirements, and the remaining 18% does not comply with the provisions of the Genius Act. But it is worth noting that Tether’s main source of profit is precisely this 18% non-compliant part.

2. Funding scale: TEDA’s current overseas investment and lending scale has reached 30 billion US dollars. Although compliance issues are often questioned, when a non-compliant company has already clung to the thigh of the current Minister of Commerce, and SoftBank and Masayoshi Son have already boarded their ship, and there is a 30 billion US dollar check that can be used, can’t it use the money to break a compliant path? It must be broken. Having money and political resources is a hard truth. Therefore, in my opinion, Circle will face substantial challenges to achieve the goal of 25 billion or even higher valuations.

Hazel: I personally feel that there are still too few high-quality assets in the Web2 and Web3 fields, so when a good target appears, everyone starts to rush in.

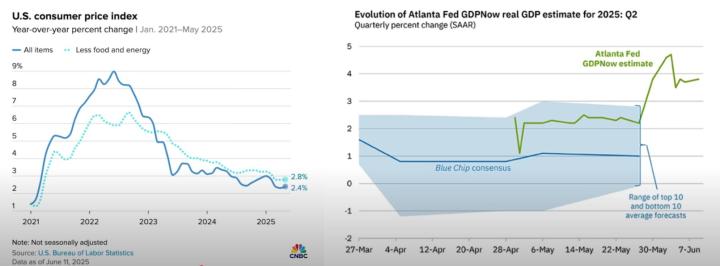

Zheng Di: The Meme craze and the success of Trump Coin in the past year, although great personal achievements, may be a tragedy for the entire Web3 industry. It further reinforced the outside world's label of the industry as "casino-like" and sucked away a lot of liquidity. The alt season usually requires a loose liquidity environment, but the Federal Reserve has not yet cut interest rates. Market expectations have been lowered from the optimistic five rate cuts at the beginning of the year to two (possibly as early as September), and former Dallas Fed Chairman Rob Kaplan (currently Vice Chairman of Goldman Sachs) predicted more than a month ago that there would only be two rate cuts. Some large US buy-side institutions even believe that there will be no rate cuts throughout the year.

In this environment, Bitcoin remains strong, and its market capitalization remains in the range of 60%-65%. The liquidity of the Altcoin market continues to be sluggish, and funds are mainly concentrated in Bitcoin and a few leading projects. This also explains why Ethereum core teams such as ConsenSys want to promote Ethereum's version of "micro-strategy" (such as SBET). During Dubai 2049, everyone was actually discussing that Ethereum could not be short next, and whether it would change dealers. Then I think it refers to Consensys's move to SBET. Because they raised $400 million in the initial stage, they have already bought more than 300 million, right? Then there is another $1 billion ATM. Will they continue? Of course, it also depends on their financing capabilities and their premiums, which are also very important, and it depends on their operations.

I have posted in my planet, and I am also relaying what others say. Currently, there are five main lines in the US stock market: Web3, driverless cars, robots, nuclear power and nuclear fusion, and quantum computing. When liquidity is good, you can basically make money by grasping these five main lines. This year, the wealth of coin stocks is actually much higher than that of Altcoin, so its elasticity is also better than Bitcoin. So what I have observed is that a large number of big players in the crypto, as well as mining bosses, are transferring funds to the coin stock field to speculate on the stocks in this crypto.

I have written about a company called Cangu, which is a US-listed mining company established by an affiliate of Bitmain. Its computing power has reached 32EH. If the next 18EH is injected, it will quickly reach 50EH, entering the ranks of the first camp of listed miners. Many of them are actually the input of miners' computing power. You will also see some miners who also hope to cash out through stocks. For example, there is a company called DFDV that is doing Solana's coin hoarding strategy. In fact, it is doing DeFi, but later it switched to Solana's coin hoarding, and its stock price rose a hundred times. There is also a company in Singapore that originally provided medical services. It also said that it would hoard Bitcoin and its stock price rose a lot. So I think the stock market is indeed extremely hungry for Web3 assets now.

A few days ago, a friend asked me to help him analyze a problem, which was like entrusting me to do a free "research project". He asked me why MetaPlanet and Hong Kong Asia Stocks, both of which were advised by Jason from Solar Ventures, had such a big difference in stock price performance?

I am also thinking about this issue. One possible reason is that Hong Kong lacks local funds. Investors have more other targets to choose from, and they don’t necessarily have to buy Hong Kong Asia. The Japanese market is relatively more closed, and the local funds are huge, so when a "Japanese version of micro-strategy" concept like MetaPlanet appears, the market is willing to pay. It may also be because the chip structure is better and more concentrated, which is easier to be hyped by the market. Of course, I haven’t done in-depth research yet, just some preliminary observations.

But this incident illustrates a phenomenon: the popularity of "coin stocks" is not limited to US stocks. We have seen MetaPlanet in the Japanese market, and we have also seen projects such as Boya and Hongya in the Hong Kong stock market. Although their growth may not be as dazzling as MetaPlanet, they have also achieved several times the growth.

Hazel: It's not just the companies that bought cryptocurrencies. The stocks of some payment companies in Hong Kong that have little to do with cryptocurrencies have also soared.

Zheng Di: Now it is like this, you say you have not explored related businesses, but the market thinks you have. You can't say you don't have them. If I say you have them, then you have them. For example, ZhongAn, LianLian, and Yika, etc., have exploded, basically doubling in a week.

What story did ZhongAn tell? ZhongAn basically said that I own 43% of ZhongAn Bank, and I am one of the early shareholders of Yuanbi in the Hong Kong stablecoin sandbox test. The shareholding ratio is in the single digits, probably not more than 10%. So first, my Yuanbi asset will be valuable in the future. Second, if Yuanbi reaches a stablecoin scale of 500 billion Hong Kong dollars in the future, most of the funds will be deposited in my ZhongAn Bank, and I only need to give him a 2% interest deposit. Just telling such a story, it doubled in a week.

Why do I think this story is not very tenable? First of all, the concept of crypto-friendly banks is actually gone. We first know why the U.S. stocks of Metropolitan Bank, Signature Bank (not listed at the time), Metropolitan Bank and Silvergate were hyped up. Silvergate even became a rare ten-fold stock among U.S. bank stocks, a ten-fold stock in about two or three years. Why? Because at that time, even for a giant like Coinbase, only three banks in the United States were willing to do business with it, and other banks would not open accounts for it. Therefore, the fiat currencies deposited by customers can only be stored in the three banks of Metropolitan Bank, Silvergate and Signature.

These three banks do not need to compete at all. They just accept fiat currency deposits from Web3 enterprise projects and trading platforms, and they do not have to pay interest. They are zero interest. Then they use this zero interest money to buy and sell treasury bonds and MBS to make money. The interest rate spread can be more than 2.5%. However, as more and more banks are willing to serve Web3 enterprises and trading platforms, the era of zero interest savings is gone forever.

Of course, ZhongAn did not tell this story, but just said 2%. But there are several problems here. First, we know that the main bank of the Web3 industry in Hong Kong should be Standard Chartered, not ZhongAn. ZhongAn is actually a virtual bank. Of course, it is more friendly, but after all, it is not a main bank. We also know that Coinbase Singapore actually chose Standard Chartered as its receiving bank. In short, Standard Chartered is more aggressive, has a better appetite, and is willing to take these businesses, so it is more friendly than other banks. So the main bank in Hong Kong actually uses Standard Chartered, and it is unlikely that all or most of the deposit reserves of the Yuan currency are deposited in ZhongAn Bank.

In addition, we should know that both the relevant U.S. bills and the Hong Kong Securities and Futures Commission's draft for stablecoins last July prohibit the issuers of stablecoins from paying interest directly to users. We need to think about why. The reason is probably because everyone is afraid of such competition, and the competition is too fierce, because later competitors will definitely say that I pay interest, and you don't pay interest before, so I will promote it. After such competition, the financial capacity of the stablecoin issuers will be weakened, and it may be easy to go bankrupt. Bankruptcy will cause serious social events and have a bad impact, so they prohibit paying interest directly to users. Of course, there are ways to circumvent it, such as using promotion fees to circumvent it, but in short, on the surface, you are not allowed to pay interest directly.

We also need to consider a question. What is your biggest disadvantage when you make a Hong Kong dollar stablecoin or a US stablecoin? Your interest rate is low. Whether you buy CNH treasury bonds, panda bonds, or Hong Kong dollars, I don’t know if there are treasury bonds for Hong Kong dollars, and I haven’t studied it carefully, but no matter what you buy, your interest rate is low. In the United States, any purchase is 4%, so this is a disadvantage.

So many people didn't notice that it was allowed in the draft for comments in July last year, that is, the SFC actually allows Hong Kong stablecoin issuers to mismatch. That is to say, although you issue Hong Kong dollar stablecoins, you can actually buy, for example, RMB government bonds, that is, CNH government bonds and panda bonds, which are now issued at a scale of 300 billion. For example, you can buy US Treasury bonds and enjoy high interest rates, but you must obtain special approval from the Hong Kong Securities and Futures Commission. Secondly, you must have excess reserves, and excess reserves must hedge the exchange rate risk of currency mismatch. If these two conditions are met, you can buy high-rated sovereign bonds in other currencies, and they do not have to be kept in Hong Kong dollar deposits.

So I think you will find that there is a huge information gap between the stock market and the stablecoin research community. So people are more willing to believe in such narratives, so the price doubled in a week.

2. The licensing landscape of payment companies

Zheng Di: LianLian and Yeahka both said that I got the US Money Transmitter Service license. In fact, in 2018, the crypto was very keen on obtaining the US Money Transmitter Service and payment licenses. We all know that these licenses are not very difficult to obtain. In particular, the Money Service Provider (MSP) license is very easy to obtain. You may only need to pay $1 million for this license. I don’t know what the price is now, but it was this price at the time.

At that time, we all felt that the Web3 industry was just a useless thing that didn’t really help the business. How come it has now become a story for these stock companies and listed companies? The stock speculators don’t understand this either, and they think it’s hard to get a license, but we who are deeply involved in the Web3 industry should know what’s really hard to get, which is the New York State BitLicense. Of course, Circle also has this license, and there are only 20 licenses in the world, but in fact you will find that the transaction volume of the New York State BitLicense is very, very low. The business that can be done with this license is very pitiful. Every quarter, the financial regulatory department of New York State publishes it.

But why do people still tirelessly pursue the New York State license? Because it is a symbol of strength, it is an endorsement. I give it to all other states, including the federal government, including all other countries. For example, I have to deal with the Monetary Authority of Singapore (MAS), I have to deal with the Hong Kong Securities and Futures Commission, or I have to deal with the financial regulatory authorities in Dubai and Japan. Let me tell you, I have one of the 20 BitLicenses in New York State. Aren’t these licenses child’s play for me? Because the regulators of other countries will think that the regulatory threshold of your New York State is the highest and strictest in the world. There are only 20 licenses in the world, and it is very difficult to get them. The licenses of other countries and other states will give you a green light. So this is why everyone is willing to get this license.

You include the Intercontinental Trading Platform, which is run by the owner of the New York Stock Exchange (NYSE). It has a market value of about $200 million. After Webull stopped cooperating with it, its market value plummeted. But why has it been rising recently? I think the market is still speculating whether someone will acquire it. What is its value? It actually has very little business now. The fee income in the first quarter was only 12 million, and this was before Webull stopped cooperating. So we expect that it will definitely fall sharply in the second quarter. But its only valuable asset is that it has one of the 20 New York State licenses. It has these licenses, so everyone is speculating whether it is possible for someone to acquire it for these licenses.

So I think when we look at these payment institutions, some of them have payment licenses in the United States, or money service provider licenses, and the stock market will use them to tell various narratives. I feel that the current way of speaking in the stock market is very similar to the ICO model in 2017, that is, I tell a narrative, and everyone believes it, and everyone thinks this is great, that is great. But everyone never thinks about what is behind it. But now in the Web3 industry, I think these users have been trained to be smart, and I don’t believe anything you say. Unless you really use it to buy back dividends, I won’t believe it even if you have cash flow. I will only believe it if you really buy back dividends. It’s like this now, and it’s also a manifestation of lack of liquidity. I think the liquidity in the stock market is still sufficient. For various narratives and stories, it tends to believe first and then say, believe first to make money, and believe later to take over. So this is the logic now.

But I still want to say that if payment companies introduce stablecoin payments, such as Lianlian, I have also written an analysis of Lianlian. Yika has not yet studied it. Lianlian cooperates with BVNK, a British stablecoin payment company. I think it will help it turn losses around in the optimistic case. In the optimistic case, I think it can increase profits, increase net profit by about 180 million. Its current pre-tax loss is about 500 million, so it can still partially turn losses around, which is meaningful. That is to say, it can increase the total payment amount by 0.2% to 0.3% as part of the profit increase. This part can indeed bring some revenue growth from stablecoin payments. So I think it makes sense for the market to speculate on some Web2 payment companies.

Hazel: You just mentioned the financial license in New York State. I actually remember that in 2018, Circle was the first to get the BitLicense, right? Because I was just covering the industry news at that time, I seem to have some impression of this.

Zheng Di: Yes, this is actually very interesting and funny, so I think it particularly reflects the combination of power and money in the United States. This is why I always say that you should not look at USDT as non-compliant, but now it has embraced the thigh of the Secretary of Commerce. The son of the Secretary of Commerce used to be an intern at Tether, and now he is on board with Tether. I say that it is USDC that has not embraced any obvious thigh. The power-money transaction in the United States has actually started a long time ago. Look at when New York State had such an idea to establish BitLicense, it actually started in 2013. Didn't New York State hold a hearing at that time? Then they said that you New York State is too strict, you should relax, otherwise the United States will lose the technological leadership of Web3, right? The idea of BitLicense actually originated from that hearing, the hearing in 2013.

The host of the hearing was the New York State regulator, who invented the BitLicense. But what's particularly funny is that after he invented the BitLicense, he ran away before the first license was issued. He resigned and started his own consulting company. He provides consulting services to all license applicants. I guess Circle may have hired him. I don't know, but I guess it should be him, because he invented it. Who else is more suitable than him to be a consultant to guide you on how to get this license? Because he designed it himself, he also made a lot of money from his consulting company.

So you see, the US has been trading power for money since ancient times, and it has always been such a commercial society, right? So this is why I say that the narrative in the stock market is that USDT is not compliant and will not work in the future, and USDC is compliant and can grab your market share. This narrative is untenable.

3. Circle and Coinbase, a tangled mess

Hazel: You just mentioned that the most obvious partner of USDC is Coinbase. This is also one of the topics we will talk about next. In Circle's prospectus, its relationship with Coinbase has been very clearly stated. This partnership has actually affected Circle's net profit to a great extent. Although its revenue is about 1.6 billion US dollars, after deducting various expenses, the net profit is only more than 100 million US dollars.

Zheng Di: This agreement is actually quite disadvantageous to Circle. The basic structure of the profit-sharing agreement is this: all of Circle’s income comes from the interest on its reserve funds. And these reserve funds can only be invested in US Treasury bonds maturing within 93 days, repurchase agreements maturing within 7 days, bank deposits that can be withdrawn at any time, and money market funds that invest in the above three types of assets.

But many people don’t actually understand the details of the Genius Act, and mistakenly believe that stablecoins can be invested in money market funds similar to those before the Lehman crisis in 2008. In fact, ordinary money market funds usually allocate longer-term bonds, such as ten-year Treasury bonds, and even assets such as CDO. When a run occurs, the mismatch between asset duration and liabilities may trigger a liquidity crisis. However, the Genius Act clearly stipulates that the money market funds invested by the funds must only contain three types of short-term assets. As long as you hold even a little ten-year Treasury bond, it cannot be counted as a compliant reserve.

Many traditional researchers may not have read the bill carefully, and only analyze stablecoin risks based on experience and assumptions, which is prone to misjudgment. 85% of Circle's reserves are managed by BlackRock, which has established a Circle Reserve Fund, which mainly invests in the above three types of short-term assets with an average duration of only twelve days; the remaining 15% is kept in the bank's current account. Although this is conservative, it can obtain an annualized return of more than 4%.

Circle's entire revenue comes from these interest incomes, rather than charging user fees. The problem is that it does not return this part of the interest to the coin holders, but pays it to promoters, such as Coinbase. This is actually a disguised profit distribution mechanism.

The profit-sharing agreement between Circle and Coinbase is a "three-step" structure. Many people think that Coinbase took 50%, but this is not accurate. Circle actually took out 60% of its revenue as promotion fees, of which about $900 million was distributed to Coinbase, and another $60.2 million was given to other platforms such as Binance. In other words, out of Circle's $1.6 billion in revenue, in addition to promotion fees, it only had more than $600 million left. More than $500 million of this was its own management and operating expenses. After deducting taxes and other expenses, the final net profit was only about $161 million.

Coinbase takes more than 56% of Circle's revenue, but it only holds an average of 22% of USDC reserves on its platform. This income is much higher than its actual market share because the profit-sharing mechanism is set in a way that is extremely favorable to it. Specifically, the first step of this profit-sharing agreement is to determine the "payment basis", which is basically equivalent to Circle's interest income. Circle will first take 0.1% to 1% of it to pay for operating costs, and the rest will enter the "product revenue sharing" stage.

In this phase, Circle and Coinbase will share the profits based on the average daily percentage of USDC held on each platform. If Coinbase holds 22% of USDC, it will take this portion of the profits; if Circle holds 6%, it will take 6%. The second phase is "ecological profit sharing". Coinbase takes 50% of the remaining profits, and Circle takes the other half. Circle may also need to continue to pay other partners. Overall, Coinbase actually took 56% of Circle's total revenue.

Why did Circle accept such an unfavorable agreement? The reason dates back to 2018. At that time, USDC was jointly launched by Circle and Coinbase, and a joint venture company, Center Consortium, was established, with each party holding 50% of the shares. But in 2023, in order to facilitate Circle's independent IPO, Coinbase's equity binding must be released. So Circle used its own 8.4 million shares, worth about more than 200 million US dollars, to buy back Center's 50% equity from Coinbase. The transaction was calculated at US$25 per share, and the market value has now doubled several times.

In exchange, Circle signed two partnership agreements:

· Master Cooperation Agreement: Signed in August 2023 for a period of three years. If Coinbase achieves the KPIs of "product revenue sharing" and "ecological revenue sharing" after the expiration of the agreement, it will have the right to automatically renew for three years and indefinitely.

Ecosystem Cooperation Agreement: This stipulates that if Circle and Coinbase want to introduce new ecosystem partners, both parties must agree in writing. This means that Circle is actually deeply bound to the Coinbase ecosystem and cannot independently expand its ecosystem resources.

There is also a "legal barrier exit clause" in the agreement: if the law prohibits Circle from paying promotion fees to Coinbase in the future, the two parties need to negotiate to modify the terms. If the negotiation fails, Coinbase has the right to require Circle to transfer all trademarks and intellectual property rights including USDC and EURC to Coinbase.

This clause is obviously set up to prevent the possibility of future regulatory prohibition of "disguised interest payments" to promoters. For example, users holding USDC on Coinbase can earn 4% interest, which is actually paid by Circle to Coinbase, and then transferred by Coinbase to users. If this indirect rebate mechanism is prohibited by law in the future, Circle must stop paying promotion fees.

It can be said that Coinbase and Circle are very "smart" in the design of the agreement, taking almost all potential legal risks into consideration and completely locking Circle into their own system through the terms of the agreement. Circle is no longer just a partner, but more like a "sub-ecosystem unit" of Coinbase.

Hazel: This is basically a body-selling agreement, right?

Zheng Di: Yes, I have also studied the structure of this agreement. What if Circle has no legal obstacles but refuses to pay the share? In fact, there is no arbitration mechanism in the agreement. However, because the agreement is subject to New York State law, Coinbase can file a lawsuit in New York. If Circle refuses to perform the agreement, I think it will lose the case in most cases. The court will most likely support the continuation of the agreement, and even if Coinbase is strong enough, it may directly require Circle to hand over its trademarks and intellectual property rights. In this case, Circle basically cannot get rid of this agreement.

4. Insight into the dangers and opportunities of Coinbase

Hazel: The 4% interest rate you just mentioned, in fact, the USDC deposit interest rate that Coinbase gives to users is not just 4%, but subsidized to 12% annualized. This level is already "too good to be true". When Chinese users see more than 10% principal guaranteed returns, many people's first reaction is "Is this a scam?" But in fact, this is to meet the renewal conditions in the cooperation agreement with Circle, and to attract users by increasing the USDC yield?

Zheng Di: You asked a very good question. Although many people thought that these two cooperation agreements were not public, they were actually attached to Circle's prospectus. It's just that the specific data details were not disclosed. According to US securities regulations, major cooperation agreements and employment contracts of key personnel of listed companies must be made public. Back to the agreement itself, Coinbase must meet two prerequisites to obtain the "unlimited automatic renewal right" of the agreement:

1. Product revenue sharing KPI meets the target;

2. The ecological revenue sharing KPI has been met.

The threshold of ecological benefits is relatively simple to understand. For example, Coinbase must continue to support USDC trading pairs, main chain deployment of USDC, and compatibility with official wallets. Whether there are platform exclusivity requirements is not clearly disclosed in the current agreement. The KPI of the product revenue sharing part may set a minimum threshold, such as a certain proportion of USDC must be held on the platform, but the specific amount has not been publicly disclosed.

According to public information, Coinbase received about $300 million in revenue sharing from Circle this year, but at the same time invested about $100 million in "deposit incentives" - that is, encouraging users to deposit USDC on the Coinbase platform. Why is Coinbase willing to spend this $100 million? I think there are two possible explanations:

First, the agreement stipulates a KPI threshold that increases year by year. In order to meet the standard, Coinbase must spend money to attract more USDC deposits;

Second, even if there is no mandatory threshold, Coinbase knows that the more USDC on its platform, the more commissions it will get. Anyway, these subsidies are paid by Circle, and it has no cost pressure, so it is naturally willing to promote it.

As for why Coinbase offers a 12% USDC deposit rate, I think their strategy has changed. In the past, they focused more on attracting spot users and directing funds to US trading platforms. But now that ETFs have been launched, US retail investors can invest in BTC and ETH through ETFs instead of buying them on Coinbase, and the handling fees are much lower.

Coinbase's market maker transaction fee rate is usually only 120,000 to 160,000 yuan, and the ETF fee rate is estimated to be similar, so Coinbase's spot fee income is facing downward pressure. Currently, more than 64% of Coinbase's revenue comes from "Altcoin", of which XRP and Solana are the largest contributors: XRP accounts for about 18%, Solana accounts for 10%, and the two together account for about 28%. If XRP or Solana launches an ETF in the future, these transaction fees will also be affected.

Therefore, the market may not realize a realistic problem: the more ETFs there are, the harder it is for Coinbase to do spot business. If the United States really launches more than 40 crypto ETFs in the future, Coinbase's local spot business will have almost no competitiveness. So where is Coinbase's way out? I think there are two directions:

1. Offshore market (Coinbase Global): currently only accounts for 20% of its total revenue, but has huge growth potential;

2. Derivatives business: ETFs are not covered, so the competition is not that fierce. Coinbase’s recent acquisition of Deribit is a key step in this layout.

From a strategic perspective, it is not cost-effective to acquire Circle. Because Circle can no longer get rid of the constraints of the agreement, Coinbase has already gained great benefits from the agreement, and there is no need to buy the entire company at a high price. They just need to continue to suck the profits of Circle. Therefore, Coinbase no longer focuses on how to "take advantage of spot wool" from local users, but turns its attention to offshore exchanges and derivatives trading. For example, this 12% interest rate subsidy is not given to all users, but concentrated on Deribit accounts or Global users. The subsidy threshold was relatively low in the early stage, such as no limit on the deposit amount. Later, due to the influx of a large number of Chinese users, it was quickly lowered to 1 million USDC per account. Now there are only 100,000 left.

However, some “wool-hunting parties” will use multiple KYC and multiple accounts to operate. For example, 10 accounts can achieve a limit of 1 million and enjoy an annualized interest rate of 12%. However, the core of Coinbase lies in the “conversion rate”: you may not trade immediately after you deposit money, but there will always be some people who will trade. As long as this part is converted, it is worth the cost.

5. The Genius Act and the Future of Stablecoins

Hazel: I read Artemis' report a few days ago. They did an analysis of $240 billion in stablecoins. The report pointed out a trend at the beginning: the stablecoin industry is shifting from "issuance-oriented" to "distribution-oriented". Issuers' profits are becoming increasingly difficult to maintain, and channel capabilities are beginning to become core competitiveness. This also leads to the issues of USDT and USDC that we talked about earlier. Especially after the introduction of the Stablecoin Act, everyone is thinking: After compliance, what impact will various stablecoins have? For example, with a large number of compliant institutions entering the market, can Tether still maintain its leading position?

Zheng Di: I think the answer depends on the final version of the "Genius Act". Many people mistakenly believe that the Democrats are against stablecoins and the Republicans support them, but this is not the case. When the FIT21 bill was passed in the House of Representatives this year, the Democrats also voted in favor of it with 71 votes. This shows that promoting the development of stablecoins has become a cross-party consensus. Even Elizabeth Warren, who is considered the most anti-crypto, has publicly stated that stablecoins may develop to 2 trillion US dollars in the next three years and will strongly support the global hegemony of the US dollar. She opposes the genius bill mainly in two aspects:

First, the corruption problem has not been eradicated. She criticized the bill amendment for prohibiting senior government officials from participating in the stablecoin business, but not prohibiting personnel at the presidential or vice presidential level, such as concerns about the Trump family issuing USD-1 stablecoins.

Second, the bill lacks effective supervision of offshore stablecoins (especially Tether).

I have mentioned before that the main source of profit for USDT (Tether) is actually from the 18% of "non-compliant assets". This includes about 100,000 bitcoins, 50 tons of gold, and investment in Bitdeer - many people may not know that Tether is already the second largest shareholder of Bitdeer, holding 25.5% of the shares.

In addition, it also holds a 70% stake in Adecoagro, a sugar company in Argentina. Many people don’t know that Tether is currently one of the largest lenders in the entire Web3 industry, with a total debt of about $8.8 billion. In addition, it has other forms of investment and income channels.

If the final genius bill does not impose strict long-arm jurisdiction on offshore stablecoins, Tether's offshore model can continue to exist and enjoy arbitrage space. It can even launch a compliant version of the stablecoin in the United States as a "face project", while the main business continues to make money from the offshore model.

So we may see that the offshore market is still USDT's "comfort zone", while in the onshore market, it has no advantages in terms of compliance and licenses. For example, in Europe, Tether did not obtain the relevant license of MiCA (Markets in Crypto-Assets Act), so it has been delisted. In contrast, USDC can still be used in the European market, including some stablecoins that have obtained MiCA licenses, and can continue to participate in traditional payment scenarios.

But then again, the European trading scene itself does not have much profit margin. We can see this from the case of Bistamp: this old European trading platform, founded in 2011, was sold to Robinhood for only $200 million, which was really unexpected. This also shows that the European trading business is "not very profitable", and even if it is compliant, it is of limited significance.

Although payment scenarios still have some potential in Europe, overall, the competition in the onshore market is already very fierce. USDC has to face USD1, Stripe's USDB, and even various stablecoins issued by the banking system. These participants all have a compliance basis and also have traffic or payment network resources, so the competition will only become more and more intense.

Just look at the limitations of other stablecoins on the market:

· PayPal's PYUSD, when it was launched, everyone thought it was "crying wolf". But now there is only $800 million or $900 million in circulation. I guess a big reason is that they are unwilling to pay for promotion;

USDC has $61 billion in circulation, but at the cost of spending about 60% of its revenue on marketing, which is essentially an extremely capital-intensive growth model;

USDT does the exact opposite. Not only does it not pay for promotion, but it also charges its partners 10 basis points. Tether's logic is: I open the API to you, allow you to mint and redeem, and support you to make markets. I am already "giving money", so you have to pay me. But another situation cannot be ruled out: if Warren's insistence and the calls of some Democratic lawmakers eventually lead to the addition of strict clauses for offshore stablecoins in the bill, completely blocking the space for "regulatory arbitrage", then Tether's current model will be difficult to sustain. Therefore, the final key still depends on the attitude of supervision. Will supervision really impose penetrating restrictions on offshore stablecoins? This is the fundamental factor that determines the future pattern.

6. The two-stage rocket of stablecoin development

Zheng Di: I have always believed that the future development of the stablecoin market can be described as a "two-stage rocket". In the first stage, it will be driven by traditional financial institutions, mainly including major banks, card organizations (such as Visa, Mastercard) and payment companies (such as Stripe, PayPal). The application scenarios of this stage will be concentrated in the payment field, especially cross-border receipts and payments, cross-border payments, import and export trade, commodity settlement and other directions.

In fact, Tether (USDT) has entered the field of trade financing for commodities, using stablecoins as a financing payment tool. This type of application is expanding very fast and is an important breakthrough in the development of stablecoins. Many people ask me: "How can we reach a stablecoin scale of 2 trillion US dollars in 2028?" I think the main path to this goal is not to rely on "transaction scenarios" but to achieve it through payment scenarios. The "promotion fee" model we are talking about now is actually more used in trading platform scenarios. In other words, the stablecoin project pays fees to platforms, wallets and other channels to promote user use, but this is a transaction-oriented distribution strategy.

However, in the future, similar promotion logic may also appear in payment scenarios - such as the issuer subsidizing payment institutions, banks or corporate customers. The promotion method of this scenario is not yet fully mature, but I believe it will be established quickly because the competition will be very fierce. This is the first stage of the "two-stage rocket": payment-driven growth led by traditional financial institutions drives the rapid expansion of the scale of stablecoins.

In the second stage, it depends on when the US SEC (Securities and Exchange Commission) will officially relax the issuance threshold of security tokens (STO) and greatly simplify the compliance process. In fact, the new chairman of the SEC, Gary Atkins, has publicly stated about a month ago that he will promote this direction. I think this is likely to be implemented in the next two years. Once the compliance of STO is liberalized on a large scale, the era of everything on the chain will come. By then, not only crypto assets, but all financial assets such as traditional securities, bonds, funds, etc. may be circulated and traded on the chain in a tokenized form.

In this process, the transaction demand on the chain will rise again significantly, and stablecoins, as an important tool for on-chain payment and settlement, will also usher in a second wave of explosion. Even further, as Michael Saylor mentioned in February this year, the total market value of stablecoins is expected to hit 10 trillion US dollars in the future, which is not a fantasy.

Hazel: But I want to know, are user habits and network effects really that easy to break? For example, Binance spent a lot of money to promote BUSD, but it was not particularly successful in the end. Circle has been connecting with countless partners for many years, promoting regulatory communication, and opening up channels. Can these accumulations really be easily surpassed by latecomers?

Zheng Di: What you said makes sense, but it also depends on the perspective from which you look at the main use cases of stablecoins. If you think that stablecoins are mainly 2C (for consumers), then it is indeed as you said that it is difficult to occupy the minds of users, and the threshold for latecomers will be very high.

But the problem is that we are now entering a new stage: stablecoins are becoming legalized, transparent, and gradually entering payment scenarios. Looking at the current stablecoin circulation, most of them are still used in transaction-related transfer scenarios, and the proportion of real "pure payment" is still relatively small. Although we will hear some offshore payment cases, such as Russia selling oil in a certain way, the scale of this gray path is ultimately difficult to compare with the global compliant financial system.

What is growing rapidly now is the transparent cross-border payment scenario. The demand for this is real, and there are more and more participants. More importantly, the payment scenario is mainly 2B (institutions, platforms, and enterprises), not 2C. You can understand stablecoin payment as a "bottom-level payment technology". It changes the background, not the front-end that users see.

For example, when you swipe your card, you may still see VISA, MasterCard, Apple Pay, etc., but the underlying clearing and settlement technology can already be replaced by stablecoins. Bridge, a company that builds on-chain payment infrastructure, can sell for $1.1 billion and 100 times PS because of its "unnoticeable technology replacement" potential.

LianLian’s cooperation with BVNK follows a similar logic. Ordinary consumers do not need to know the name Bridge or BVNK. Under this architecture, the biggest advantage is that users are not aware of it. If you change the underlying layer, users do not need to be re-educated. It is precisely because it is a 2B scenario that the replacement and competition of stablecoins in these fields are not so difficult. Corporate cooperation often depends more on the exchange of interests, such as how much promotion fee you are willing to share.

Suppose I am Meta, I have a huge ecological scenario, you want me to integrate your stablecoin system into the platform, or "Zucker has the final say". Most of Meta's users have no clear understanding of "stablecoins". They only know that they receive rewards, payments, or settlements on Facebook or Instagram, but they don't know what assets are used at the bottom. For this reason, I believe that in the next 1~2 years, payment scenarios will be the most important incremental breakthrough for stablecoins. In contrast, the substantial expansion of trading scenarios will have to wait until the STO (Securities Token Offering) process is truly simplified and everything on the chain begins to land, and then the demand for the on-chain financial ecosystem will become active again.

7. Big Tech and Stablecoins

Hazel: We just talked about Meta. Actually, I have always had a question. According to the idea of the Genius Act, the issuer of stablecoins should be regarded as a "financial institution", right? But Meta is a technology company. So can it not issue it itself, but let other institutions with financial licenses issue it, and it will be responsible for its own use and distribution? Or can Meta set up a financial subsidiary to issue coins, thereby "bypassing" the entity identity restrictions?

I just discussed this question with my friends this morning. They asked: Meta is so big, why doesn't it just acquire a bank and then let the bank issue stablecoins? On the surface, it sounds reasonable, but I want to say: If it were that simple, Meta would have done it a long time ago. Why didn't it issue it itself, but went to Instagram to do a pilot and cooperate with external stablecoin projects? This shows that the problem is not that simple. The core reason is probably that the genius bill is a "penetrating supervision" of the participation of "large platform technology companies." In other words, whether you hold a controlling stake in a bank, set up a subsidiary, or find a concerted action person, as long as the regulator believes that this is Meta's actual holding or participation, it will still be restricted.

In other words, even if you use a shell company to make stablecoins, even if you have a financial license, if Meta is actually behind the scenes, you may be restricted. The Genius Act may be to clearly draw a red line: technology platforms cannot directly control the issuance of stablecoins. Of course, there is also a possibility that the regulatory framework has not yet been fully implemented, and even Meta itself is waiting and watching. They don’t know whether the final enforcement of the new regulations will really penetrate into operations such as subsidiaries and indirect shareholders. But from the current point of view, "not personally participating and collecting promotion fees" is actually a safer choice for Meta.

So I think it’s not that Meta can’t do it, but that it doesn’t need to do it. If you really want to issue stablecoins, you have to accept the supervision of financial institutions. For a technology platform, this means complicated processes, heavy responsibilities, and extremely high compliance pressure. On the other hand, if Meta insists on being a "scene entrance", it can completely embed stablecoins as a means of payment or interaction into its own platform, and let others bear the compliance, supervision and liquidation risks.

I have always said that Web3 is becoming more and more like the Internet. In the end, "scenario and traffic are king", not who controls the infrastructure. You see so many public chains, stablecoins, and clearing systems. Technically, anyone can do it, but the ones that really have scenarios and users are the core of value. If your Ethereum is too expensive, I will find a cheap chain like Aptos that few people use; if your Tron is too slow, I will change a chain. Platforms like Meta have huge distribution capabilities and user bases, so there is no need for them to "dive" into regulatory areas.

8. Financial Stablecoin or Tokenized Market Fund

Hazel: Regarding some non-mainstream types of stablecoins, such as Ethena-USDe, which has attracted much attention from last year to this year, that is, stablecoins with "interest payment attributes", what will be their future direction after compliance?

Zheng Di: My judgment is that this type of stablecoin may always be just a niche market. According to the current relevant legislation in the United States and Hong Kong, it will be very difficult for this type of interest-paying stablecoin to become "sunshine" in the future. Although BitMEX founder Arthur Hayes and others have publicly supported this model, in reality, regulators are highly cautious about this type of product. In other words, the future space for this type of stablecoin is likely to be limited to certain "non-compliant gray areas" or small-scale experimental environments, and it is difficult to enter the mainstream financial system.

The direction that really has the opportunity to be "sunshine" is actually TMMF (Tokenized Money Market Funds). This is why Circle announced the acquisition of Hashnote in January this year. The company is positioned to make compliant TMMF products on the chain. Circle also clearly stated in the prospectus that they have observed a trend: large registrars on the chain have increasingly tended to use TMMF to replace traditional stablecoins as collateral.

Why? It's very simple. In the on-chain financial environment, especially in scenarios such as market makers, leveraged trading, and liquidation, stablecoins themselves are interest-free assets. If you use stablecoins as collateral, there will be no interest income during this period. TMMF is different. It is essentially a money market fund. As long as it is pledged, there will be annualized returns. For on-chain market makers with huge amounts of funds and active leverage, these interests constitute a very important source of income. Therefore, many on-chain market making platforms and liquidity pools have gradually begun to accept TMMF instead of stablecoins as pledged assets.

This actually means that stablecoins are no longer the only "base currency" option in on-chain financial scenarios. Moreover, if TMMF products can achieve high-frequency settlement in the future, such as daily settlement, or even further open up the exchange channel with stablecoins, then it may also have payment functions in some 2B payment scenarios, especially in the fields of large-scale cross-border, corporate settlement, and supply chain finance. These are not scenarios where C-end consumers use to buy coffee, but enterprise-level bulk settlements. In such applications, interest income and settlement efficiency are more important than "payment experience", so TMMF may occupy a place in these scenarios in the future.

9. Changes and Consistencies of the Old System

Hazel: We just mentioned Visa and Mastercard. As global card organizations, they have a strong voice in the field of cross-border payments. And Circle itself has a network called CPN. I am curious about the relationship between this CPN network and Visa and Mastercard in the future? In particular, if, as you said, Visa and Mastercard go out to promote changes in the future, is it possible to directly "eat up" part of the stablecoin market?

In fact, Visa has already started testing the waters of stablecoins. They invested in the British stablecoin payment service company BVNK through Visa Ventures. This company was led by Horn Ventures, which you should be familiar with. The founder of Horn was the former head of legal affairs of the SEC, and later founded VC, and a16z became its largest LP. Horn Ventures is now also a well-known investment institution in the United States. This round of financing also included Coinbase and Tiger Fund.

BVNK mainly provides stablecoin solutions for the European branch of LianLian Pay. In Visa’s recent quarterly earnings call, it was specifically mentioned that they have processed approximately $300 million in stablecoin payments. Of course, this number is insignificant compared to Visa’s overall transaction volume, but it shows that they are testing the waters.

In fact, stablecoins have an impact on Visa and Mastercard. I have done a rough quantitative analysis before. The main income structure of Visa and Mastercard is roughly: 60-65% comes from card processing fees, and 35-40% comes from value-added services. The core competitiveness is its KYC (real-name authentication) and AML (anti-money laundering) system, as well as the entire payment network.

We have to ask a question: If stablecoins are widely adopted in the future, can KYC and AML be avoided? I think it is impossible. So Visa and Mastercard may still rely on KYC/AML interfaces to charge service fees in the future. They can serve as KYC/AML API providers recognized by global regulators, and even if they are not the leaders of transactions, they can still collect "tolls".

In other words, whether it is Circle, Tether or other stablecoin companies, they will eventually need to access a large, trusted compliance interface. Visa and Mastercard are likely to play this role. In scenarios with high KYC/AML requirements, their service value still exists. In scenarios with low KYC requirements, they may be impacted to a certain extent.

My judgment is that Visa and Mastercard's gross margins may drop by 5 to 7 percentage points, and their total revenue may be impacted by 20 to 30%. But the core business should not be affected too much. At the same time, they must embrace this trend, otherwise they will be squeezed by new players. They also need to actively participate in rule-making, especially around the opening of compliance interfaces.

But so far, we have not seen any substantial action from Visa and Mastercard in the construction of the underlying stablecoin. Banks and local payment networks such as Zelle and Singapore's PayNow are more active now, and they hope to issue stablecoins themselves.

Circle's CPN network is indeed very advanced in terms of technology, such as cross-chain zero-confirmation payment and other capabilities, which are user-friendly. But from an investment perspective, what is more important is whether it can bring actual income. Investors pay more attention to the scene promotion and monetization capabilities. The two core scenarios of stablecoins are transactions and payments. I think that at least in the "sunshine" scenario of payment, the "integration" path is still the main one, rather than a complete revolution.

In other words, the current route is how to embed into the existing financial system and replace some intermediaries and channels. This is why cross-border payment has become a key breakthrough direction. Card organizations, payment institutions, and banks actually have opinions on SWIFT. Now many participants hope to skip SWIFT and build a link by themselves. The US government is also willing to participate in supervision as long as KYC/AML can be controlled. So SWIFT has become a relatively weak link. The promotion of stablecoin payments now is to try to cut a piece out of the traditional financial system and embed it, rather than overthrow and rebuild it. I think this path is feasible and can develop quickly.

Once the US "Genius Act" is passed, the biggest promoters may be banks and payment institutions, and even card organizations may join. But currently the most active are Stripe and several large banks. On the contrary, small and medium-sized banks may face a big impact, especially those small banks that rely heavily on savings lending and card issuance for profit.

TBAC, an advisory body to the U.S. Treasury Department, has put forward a view: if the genius bill is passed, up to $6.6 trillion in deposits may be "moved". However, large banks are not worried about this because they can issue stablecoins themselves and have diversified businesses for hedging. What they are most afraid of are small and medium-sized banks. Once they lose their savings, they lose their credit derivative ability. In addition, many small banks rely on card issuance rebates. Once this is also replaced by stablecoins, they may find it difficult to continue. This means that after the bill is passed, it may cause a large-scale bankruptcy of small and medium-sized banks in the United States.

Hazel: This reminds me of the hotly debated discussion on central bank digital currency (CBDC) a few years ago. People were worried that the central bank's issuance of currency would lead to the "disintermediation" of commercial banks. In fact, the logic is similar. However, the central bank's issuance of currency is not feasible, and stablecoins may really lead to similar results, especially for small and medium-sized banks.

Zheng Di: That’s right, but I think there will definitely be on-chain banks. In the future, big banks may find that stablecoins can be used not only for payments but also for lending. Once stablecoin payments are widely accepted, people will be willing to stay in stablecoins instead of immediately exchanging them for fiat currency, and the circulation scale of stablecoins will expand.

At present, most of the lending agreements on the chain are pawn-style mortgage loans, with the mainstream being Bitcoin mortgages, an LTV ratio of 64%, and an interest rate of 8.5%. This business is essentially a "loan to the rich". Why does no one dare to lend credit? Because there is a lack of a scoring system like FICO. But if traditional importers and exporters are willing to accept stablecoin settlement and have a complete credit rating, credit loans on the chain can be realized. Banks will also find that issuing and collecting stablecoin deposits and then lending can be profitable, which may give rise to "stablecoin banks."

So small and medium-sized banks will indeed be "disintermediated", but credit derivatives will not disappear, but will take a different form and a new group of players will appear. Traditional research often says that financial disintermediation will weaken the ability of credit derivatives, but I don't completely agree. The path of credit derivatives may change, and the participants will change.

10 Circle founder Jeremy Allaire's story with China

Hazel: We just talked about some investor information disclosed in Circle's prospectus, including investment institutions from China, such as IDG Capital and China Renaissance Capital. This actually surprised many people - because many people don't know that Chinese capital once invested in Circle in its early days, and this investment now seems to have extremely rich returns. In less than ten years, the return may be as high as more than a billion US dollars, which is a classic case in the venture capital field. So the question is: How did these Chinese capitals enter Circle?

Zheng Di: Actually, it is not complicated. The crypto industry ten years ago was a period when Chinese capital was very active. From USDT (Tether) originating in Hong Kong to Ethereum and other early public chain projects, there are a large number of Chinese people behind them. Chinese investors themselves are the main force in the early trading market of Web3. At the same time, the mining circle has accumulated a lot of funds, and many mining bosses have also participated in early equity financing. Moreover, Chinese VCs at that time were also at the peak of the mobile Internet dividend. They had sufficient funds and were willing to try the new direction of Web3.

Circle CEO Jeremy Allaire actually attached great importance to the Chinese market at that stage. He not only set up a local team, but also visited Chinese regulatory agencies many times and communicated with the central bank, research institutes, etc. At that time, he obviously hoped to introduce USDC or the concept of stablecoins to China and promote local cooperation.

Hazel: I have had some personal experience with Jeremy myself, so I can provide some personal perspective:

The first time I met him was in 2018, during a brief interview in the lobby of a hotel in Beijing. At that time, stablecoins were far from being as widely valued as they are today.

The second time I met him was at a closed-door seminar. That was after the Libra incident, when stablecoins became the focus of policy discussions. At the time, Caixin, where I was still working, organized a weekend meeting. The director of the Central Bank Digital Currency Research Institute and Jihan Wu of Bitmain all came. I happened to facilitate Jeremy's participation in this small closed-door meeting. He must have come from overseas and appeared in the office on the weekend. He still had expectations for China's participation and regulatory acceptance.

The third time was in Davos in 2022. Due to the pandemic, the winter meeting was moved to May, which was the only Davos without snow. Circle was one of the main sponsors that year, and I could see their large advertisements as soon as I arrived at the station. We met again, and this time he didn't talk about China at all, but focused on the compliance policies and stablecoin legislation in the United States. At that time, the draft of the Stablecoin Act was being discussed in the U.S. Congress.

The biggest feeling I got from these exchanges is that he really sticks to a very steady and solid route. In an industry full of "pirate culture", he insists on being a "navy", insists on taking the compliance path, and really makes Circle the size it is today. I thought it was a fantasy at the time.

Speaking of Jeremy himself, he is actually a very typical Silicon Valley serial entrepreneur:

· He first co-founded Allaire with his brother in 1995. It went public in 1999 and had revenue of over 100 million US dollars in 2001. It was eventually sold to Macromedia, which was later acquired by Adobe. He also became the CTO of Macromedia and made important contributions to core products such as Flash Player. Some of the products they first made at Allaire are still in Adobe's suite library.

In 2004, he founded Brightcove, an online video platform, which went public in 2012 and was just privatized earlier this year (2025).

· Founded Circle in 2013, and has explored businesses such as trading platforms, payments, and stablecoins, ultimately focusing on USDC and officially IPOing in 2025.

In my opinion, he is a steady and long-term entrepreneur. Although Circle has also explored diversification in the early years, such as acquiring trading platforms and developing wallet services, he has been determined to move forward after he determined that USDC is the main channel for the future. I admire his ability to maintain a sense of direction in a highly volatile and uncertain industry.

11 Circle What the Future Can and Cannot Do

Hazel: Does Circle have any new stories to tell? In addition to the current main line of USDC and the content mentioned in the prospectus, can it expand some new businesses? For example, the direction you just mentioned is of course subject to regulatory restrictions. For example, Tether has already been involved in commodity payments. Can Circle also expand similar scenarios? Can it even be combined with emerging fields such as AI, or promote new currency products such as the euro stablecoin? What do you think of the future of stablecoin companies?

Zheng Di: I think it can certainly be expanded, but the biggest problem is whether there is enough money. Why can Tether enter the bulk scenario? Because it is really lending. We must understand that although there is demand for stablecoins in payment scenarios, compared with financing scenarios, its rigid demand is not as strong. Especially for buyer or seller credit - if you can lend me money, that is hard power.

Tether's strategy is to leverage the use of funds. Its total loans amount to $8.8 billion, its own capital investment is about $14 billion, plus some other investments, the overall scale of foreign investment and loans is about $30 billion. In an offshore state, if it continues to be "non-compliant", this $30 billion "checkbook" can easily promote the use of stablecoins, especially in commodity scenarios. It is essentially not just a stablecoin company, but a stablecoin + bank model.

In this case, it is much easier for it to use loans to promote stablecoin payments. Circle cannot do this because it does not have the ability to lend. If you can only convince others to use USDC through business development (BD), it will be difficult. This is only possible if there are big buyers like the Trump family who are willing to use USDC in full. But in essence, they are looking for resource relationships, such as being able to establish connections with the Trump family.

Similarly, Ant Group is promoting the RWA project in Hong Kong. Buyers are willing to participate, in a way, to establish a cooperative relationship with Ant. This shows that the scenario is not driven by payment itself, but by credit capacity. Tether binds loans and payment scenarios: USDT is used for lending and USDT is also used for collection. You have to accept it because the financiers have the final say.

The biggest problem for Circle is that it does not have this "checkbook", cannot strongly control the scene, and has limited resources. Most of its money has to be invested in promotion costs, and it must comply with regulations and cannot make excess profits. Therefore, from a business perspective, its story seems relatively mediocre, and it can only rely on industry dividends to accumulate slowly.

In contrast, Tether has already started acquiring listed companies. For example, the Argentine company Abaco Agro it acquired not only has business in commodities and agricultural imports and exports, but also participated in an agricultural blockchain project as early as 2017, holding a 10% stake. This shows that it has a high degree of acceptance of blockchain and encryption, so Tether can integrate these resources. Behind this is the dividends brought by capital strength, freedom from regulatory restrictions, and first-mover advantage.

After further research, we will find that Tether and Circle are not the same species at all. If Circle does not have the ability to control the situation, it must "cling to the thighs". The scenarios that Coinbase can provide are also limited. We can even ask this question: In three to five years, Robinhood and Coinbase will have similar profits and market capitalizations. Who will win? Most people will probably choose Robinhood because it has a wider user base and more scenarios. Robinhood also acquired Bitstamp to expand into the European market.

So the biggest problem of Coinbase is that it does not have enough scenarios and users, and it may even be losing users, especially its spot business. So I said that Circle did not hold on to the thigh, not only because of political resources, but also because of business resources. For example, Stripe is an important partner of Bridge after launching USDB, and it also exchanged equity. There are also banks, card organizations, payment companies, and China's bulk traders, all of which are important partners.

All of these may bring about large-scale use of stablecoins. What Circle needs to focus on now is how to enter these scenarios and whether it can introduce a strategic major shareholder.

In addition, China should now also realize that the competition between the digital RMB (CBDC) and private stablecoins has already had a clear outcome. In fact, a more effective path is to allow private companies to issue stablecoins, the government to conduct strong supervision, KYC and anti-money laundering control, and then promote these stablecoins overseas. This "soft control" model is actually better than the official-led CBDC model. This is why more and more people are calling for the issuance of offshore RMB stablecoins. For example, Dr. Jianguang Shen of JD.com wrote an article specifically pointing out that China cannot be absent from this track.

In the international trade and commodity payment scenarios we envision in the future, the competition of stablecoins will not only be between the US dollar, but also involve the euro and RMB stablecoins. You have to consider a question: Who is the most important player in the global commodity and goods trade? It is not the United States, but China. The United States is strong in service trade, but in the field of physical goods, China is definitely the main force.

If China promotes offshore RMB stablecoins in the future, Chinese companies will no longer use USDT or USDC, but RMB stablecoins, which will be a huge competition for existing USD stablecoins. So I think this track has broad prospects, but the competition will be very fierce.

On the contrary, the space for innovation in technology is limited. For example, the threshold for AI access is not high, and it is not easy to break through in the direction of AI Agent. Big model companies have begun to make their own agents, and no longer just provide basic models. Those who were excited to start a business as agents last year now find that their advantages are no longer obvious after the big model companies personally get involved. So technically speaking, the threshold is not that high, and what is really valuable is the scenario and the user. If Circle abandons its main business and pursues a fancy direction, there may be problems. It should focus on its main business.

As for the possibility of non-US dollar stablecoins in the future, I think the most promising ones are the Euro stablecoin and the offshore RMB stablecoin. Many countries in the world have already been dollarized. For example, the US dollar stablecoin is widely used by the people in Latin America, Africa, and Turkey. If China and Europe do not promote their own stablecoins, they will fall behind in the new generation of financial order. So I don’t think they will let a stablecoin company controlled by the United States take on the task of issuing non-US dollar stablecoins.

Hazel: Let’s give another example. What would happen if Meta used USDC?

Zheng Di: If Circle can successfully bind Meta and make Meta its strategic shareholder, it will be a key breakthrough. You know, there is already a similar agreement between Circle and BlackRock. During the validity period of the agreement, BlackRock is the sole manager of the Circle Reserve Fund, and the scale of funds under management may reach tens of billions of dollars. In exchange, BlackRock cannot issue stablecoins on its own, nor can it support other stablecoins, but can only support USDC. In this way, Circle is essentially "bound" to BlackRock.

Can Circle bind Meta in a similar way? Bind a large technology company and fully integrate into its ecosystem, rather than simply cooperating and discussing. For example, Meta may use USDC today and USDP or USD1 tomorrow. Or it is not impossible to "kneel down" and ask for cooperation with Trump. But if an exclusive agreement can be signed, such as making Meta a strategic shareholder and exclusively promoting USDC, then Circle's prospects will be limitless. The question is whether it has the ability to facilitate such a binding.

12. With institutions entering the market in droves, what investment opportunities are there for ordinary people?

Hazel: It’s almost time for today, so let’s talk about the last question. Circle is rushing to go public so aggressively, has this wave of market momentum come to an end? From the perspective of ordinary investors, with so many institutions entering the market, what opportunities are there?

Zheng Di: I think there are definitely still many investment opportunities. At the current stage, opportunities are mainly concentrated in coin stocks, that is, Web3-related stocks. Now many Web3 companies that are doing well will eventually