Author: XinGPT

For people in the Web3 industry, stablecoins seem to be a familiar term, with buying stablecoins being a standard action since the first day of crypto trading.

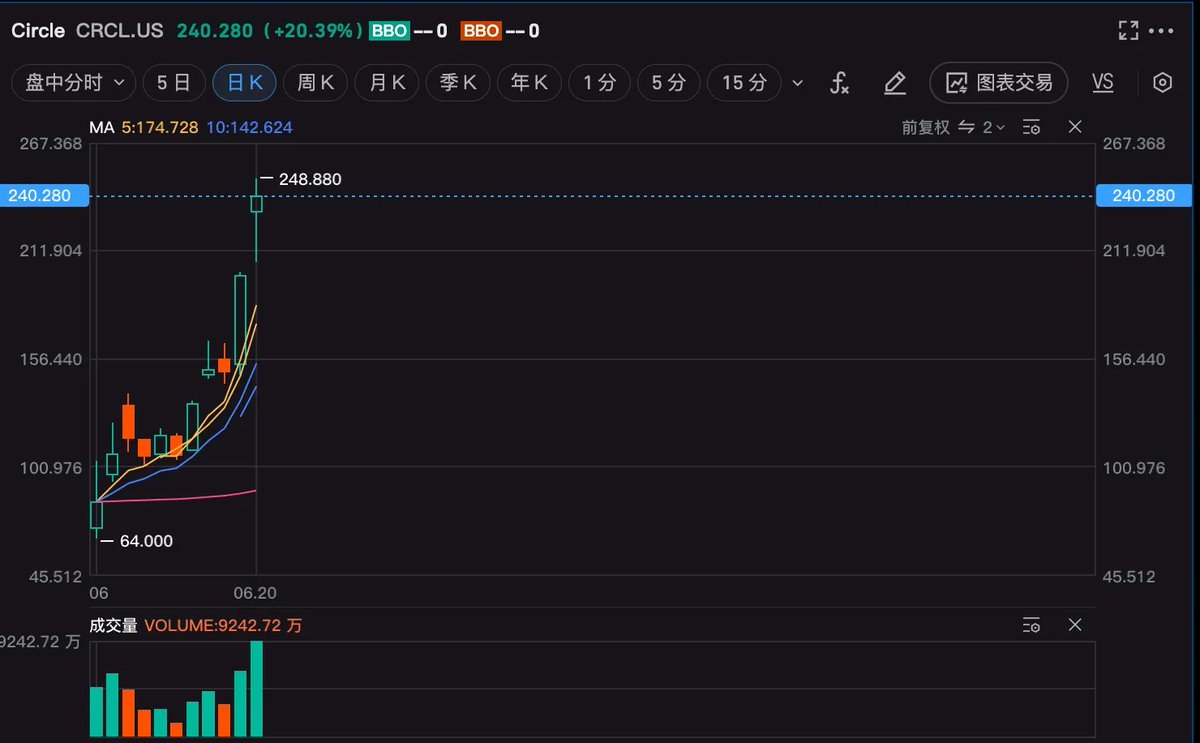

So why has Circle, the first stock of stablecoins, achieved an amazing threefold increase in just two weeks of being listed?

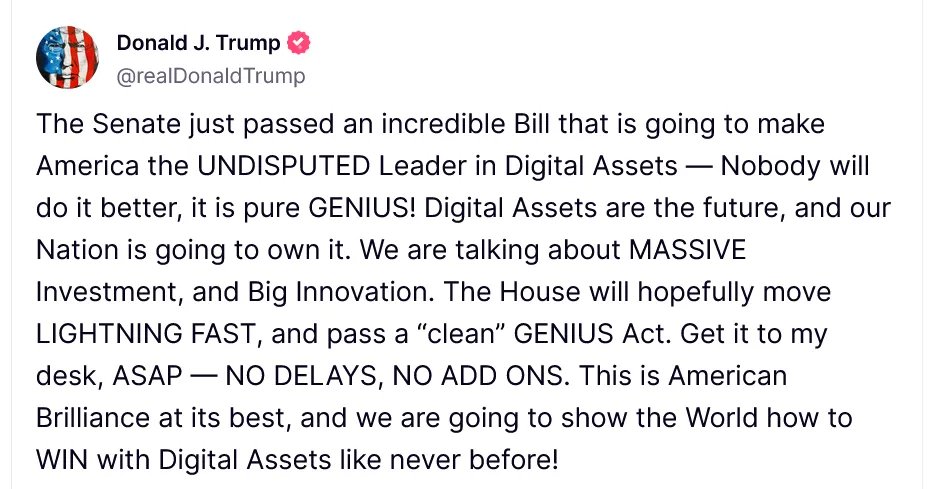

The most important catalyst stems from the US Senate's passage of the GENIUS Stablecoin Act on June 17th. We will now analyze the main content of this act and why it was able to pass the Senate and is likely to be formally implemented.

The key regulatory points of the stablecoin act are as follows:

Dual Regulatory System: The GENIUS Act establishes a federal and state "dual-track" regulatory framework, setting clear operating rules for the stablecoin market. Stablecoin issuers need to choose federal or state-level regulatory paths based on their scale. Large-scale issuers (with an issuance volume over $10 billion) must be subject to federal regulation to ensure compliance and transparency.

1:1 Reserve Requirement: The act requires all stablecoins to maintain a 1:1 reserve ratio, limited to highly liquid and safe assets. The legally permitted reserve assets include: US dollar cash, insured bank demand deposits, US Treasury bills maturing within 93 days, repurchase/reverse repurchase agreements, government money market funds investing only in the above safe assets, and tokenized forms of the above assets that comply with the law. Issuers are prohibited from using high-risk assets like cryptocurrencies as reserves.

Information Disclosure and Audit Mechanism: To enhance market transparency, stablecoin issuers must disclose reserve status monthly and undergo independent audits. This aims to enhance public trust in the stablecoin system and prevent bank run risks.

License and Compliance Requirements: Issuers must apply for a license from regulatory authorities and comply with banking regulatory requirements. There is an 18-month transition period during which existing market stablecoins must complete compliance adjustments.

Anti-Money Laundering and Sanctions Compliance: Stablecoin issuers must comply with the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulations, establishing customer identification (KYC) and monitoring systems to prevent illegal fund flows.

Consumer Protection: The act stipulates that stablecoin holders have priority repayment rights in case of issuer bankruptcy, ensuring their reserve assets are not misappropriated.

The second point reveals a message that is most likely the primary reason the stablecoin act was given attention during Trump's term: debt reduction.

Senator Bill Hagerty's blueprint of "strengthening US dollar hegemony" is being quickly realized by capital: Standard Chartered Bank estimates that if the act passes, the global stablecoin market value could surge to $2 trillion by 2028, equivalent to creating a massive buyer specifically consuming short-term US Treasury bonds. More shockingly, Tether and Circle currently hold $166 billion in US Treasury bonds, and Wall Street analysts predict that stablecoin issuers will soon become the third-largest US bond player after the Federal Reserve and foreign central banks. Treasury Secretary Scott Bessent calculated that if the stablecoin market reaches trillions of dollars by the end of the decade, private sector demand for US bonds could reduce government borrowing costs by several basis points - essentially using crypto hot money to discount the US Treasury's financing costs. More subtly, this demand is essentially "attracting gold" for US bonds globally, with the US dollar's status as a reserve currency being further consolidated through the stablecoin channel, which is why Trump commented, "Send it to my desk as soon as possible, the faster the better."

Although the final act still needs to be reviewed and voted on by the House of Representatives before being submitted to the President, based on market expectations, the passage and implementation of the stablecoin act seems to be a done deal.

What Impact Will the Stablecoin Act Have on Investments?

Let's first look at Circle. With its current market value of around $50 billion, Circle's projected profit is $160 million in 2024 and $490 million in 2025 based on an optimistic Q1 financial report, corresponding to a price-to-earnings ratio of over 100 times. This assumes USDC's issuance volume will nearly triple by the end of 2024, reaching $120 billion, doubling from $60 billion in June 2025, while Tether's USDT issuance is only $150 billion. Such a financial estimate is almost impossible for Circle to achieve.

But the market isn't stupid. Why give Circle such a high premium?

BitMEX founder and Ethena stablecoin investor Arthur Hayes commented:

US Treasury staff believe assets under control of stablecoins could grow to $2 trillion. They also believe US dollar stablecoins could become the spearhead, both advancing/maintaining US dollar hegemony and serving as buyers insensitive to Treasury bond prices. This is an absolutely important macro tailwind.

The market's dream lies in stablecoins being portrayed as Trump's tool to maintain dollar hegemony, enhance US bond attractiveness, and further promote Federal Reserve interest rate cuts. For such a track leader stock, is $50 billion expensive? Not to mention price-to-earnings ratio, even at $100 billion, it wouldn't be considered expensive.

What Other Investment Opportunities Exist in the Stablecoin Track?

If stablecoins are compared to cars, the industrial chain can be divided into car manufacturing (whole vehicle manufacturers), car sales (channel distribution), car parts, car repair, and car maintenance services. Similarly, the stablecoin industrial chain includes stablecoin issuance (stablecoin issuers), stablecoin sales (stablecoin channels), stablecoin application scenarios (services), and stablecoin technical support (parts).

Stablecoin issuance is already a top-tier track. Tether dominates the entire underground dollar (gray market) and is actively working to go legitimate, while Circle currently leads the compliant market. However, they will face significant competition in the future. Payment giants (PayPal, Stripe) have their own channels, and distribution costs will likely be less than half. Payment giants like Trump's background team's USD1 are expected to take a share from Tether and Circle.

For startups, I'm more optimistic about stablecoin service providers in niche scenarios, similar to traditional payment's Square, handling stablecoin settlements in specific areas. If I can tell merchants that our settlement fees are 90% lower than traditional cards, it would be much easier to accept compared to educating them about USDC payment.

For niche scenario selection, I believe small-amount cross-border remittance is a pain point. Remote small remittances via SWIFT cost $10-30 and take 1-3 working days. Compared to stablecoins' seconds-level arrival time and nearly negligible transfer costs, user experience is improved by more than 10 times. Channel providers who can solve such niche scenario needs might become the Paypal of the stablecoin era.

Technical support service providers like custody and Regtech have low input-output ratios. Compliance costs are high, operations are heavy, and profit margins are low, but very stable and counter-cyclical. This is suitable for defensive entrepreneurs seeking stable cash flow or internal incubation by large companies like Ceffu and CB Custody.

Besides Circle, What Other Opportunities Exist for Stablecoin Concepts in the Secondary Market?

Circle's market value increase directly benefits Coinbase. Before the unequal treaty was canceled, Coin could sit back and collect channel fees at 50%.

Other newly listed stablecoins may also be hyped like Coinbase, and some brokers, payment organizations, and card organizations will depend on the progress of accessing the stablecoin network:

For the crypto, the growth of stablecoin scale means a significant increase in the supply of on-chain DeFi assets, which is beneficial to DeFi lending protocols like Aave, Morpho, and of course, it also means that yield layers such as Ondo and Maple Finance, especially enterprises that tokenize U.S. Treasury bonds, have the most direct advantage.