As the global market panics due to fears of a full-scale US-Iran conflict, a message from former US President Trump arrived like a "savior from the sky". On June 23rd local time, Trump claimed that longtime rivals Israel and Iran had reached an agreement on a "comprehensive and complete ceasefire".

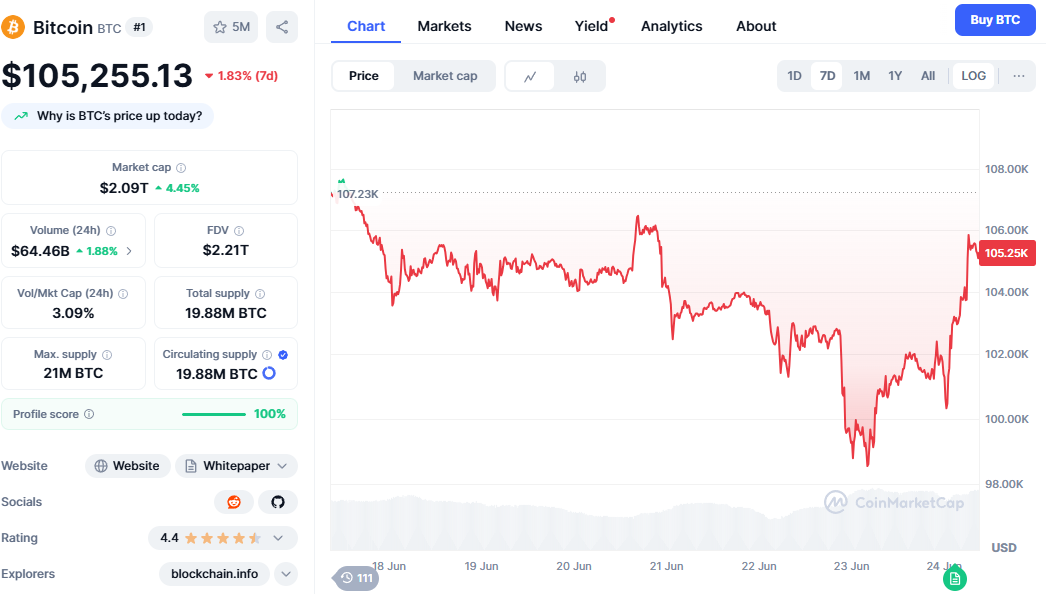

As soon as the news broke, the market reversed. Previously plummeting oil futures instantly erased risk premiums, and Bitcoin, representing risk assets, staged a thrilling V-shaped comeback, leaping from panic-selling depths and strongly breaking through the $106,000 mark. This revelry ignited by "peace expectations" made countless traders believe the worst was over.

However, before the champagne bubbles could dissipate, market euphoria was challenged by cruel reality. Is this fragile peace agreement the end of conflict or the prelude to an even larger storm? After the violent rebound, both the market and investors face a core question: What's next?

An Agreement That Never Existed?

To predict the next steps, one must first analyze the entirely different calculations of the US, Iran, and Israel behind this so-called ceasefire agreement. From its inception, this seemingly clear agreement was filled with discordant tones and mutually contradictory interests.

Iran's "Categorical Denial": While the market was still interpreting rumors of "Iranian senior officials agreeing to the agreement", the Iranian Foreign Minister issued a definitive official statement on June 24th, completely bursting the market's bubble. He explicitly stated that so far, Israel and Iran have not reached any "agreement" on ceasefire or stopping military operations. This official denial means the "ceasefire agreement" lacked Iranian recognition from the start.

America's "Eagerness to Succeed": The Trump administration's high-profile ceasefire announcement stems more from Washington's own predicament. Recent polls show 84% of Americans are worried about escalating conflict, eroding Trump's already declining support. In this context, facilitating even a superficial ceasefire is an urgent need to divert domestic political pressure.

Israel's "Silence and Subtext": In this three-party game, Israel is undoubtedly the most critical and unsettling role. Prime Minister Netanyahu's response after the ceasefire news - neither confirming nor denying, but issuing a strict "gag order" - is an extremely dangerous signal. In Israeli political context, this typically means significant internal cabinet divisions or imminent major military operations.

A Mirage of Peace?

The market's logic is simple and cruel: it trades expectations. Bitcoin's V-shaped comeback was entirely based on a rapidly constructed optimistic narrative chain: Ceasefire → Oil Price Drop → Inflation Pressure Eases → Federal Reserve Gets Rate Cut Space → Liquidity Easing Expectations Reignite.

However, the first link in this chain - the "ceasefire" itself - is built on sand.

Just as the market was immersed in "peace dividend" revelry, two emergency messages from the Middle East, like ice water, awakened all optimistic investors. On the morning of June 24th Beijing time, Israeli Prime Minister Netanyahu suddenly requested his cabinet members not to comment on the ceasefire agreement. Hours later, a more shocking news arrived: Explosions were heard in multiple locations in Tehran, air defense alarms echoed through the night, and Iranian officials confirmed their defense systems were countering Israeli airstrikes. The peace mirage was ruthlessly torn apart by the sound of real artillery.

Strangely, despite the peace expectation being openly broken, Bitcoin's price did not collapse as expected, but tenaciously maintained its post-rebound high. This is the core puzzle of the current market.

The market might believe Israel's "final strike" is a foreseeable tactical action to "save face", not a restart of full-scale war. Traders might be betting that this explosion is the end of the previous conflict, not the beginning of the next. As long as no ground troops enter and no more intense retaliatory cycles occur, the market is willing to believe this is just "going through the motions".

What's Next? Three Possible Scenarios

After this roller coaster from revelry to terror, Bitcoin and global markets stand at a crossroads. The next step will depend on the subtle interaction between geopolitics, macroeconomic factors, and market sentiment. We believe the following three scenarios are possible:

Scenario One: "W"-shaped double-bottom. The most pessimistic possibility. If Tehran's explosions trigger substantial Iranian retaliation, causing conflict to spiral, the market's optimistic narrative will completely collapse.

Scenario Two: "Fragile Balance" at high positions. This is the current scenario. The market acknowledges the ceasefire agreement's fragility but believes conflict intensity will remain "controllable".

Scenario Three: Slowly climbing "New Normal". The most optimistic possibility, but also with the lowest probability. If Israel's strike is truly the "final blow" and Iran chooses patience or only symbolic response, the regional situation will enter a relatively calm period.

To determine where the market will go, investors need to closely monitor several key indicators:

- WTI Oil Price Trend: This is the most direct thermometer for measuring geopolitical risks.

- US Dollar Index (DXY): Reflects changes in market expectations of Federal Reserve policies.

- Official Statements: Any formal statements from the White House, Pentagon, and Israeli Prime Minister's Office.

- Military Dynamics: Any new military deployments or signs of conflict in the Middle East region.

The storm has not yet passed. After experiencing a false revelry, the world is holding its breath. Bitcoin's next move will be jointly written by the dissipating gunpowder smoke over Tehran and the decisions made in Washington's conference rooms.