As war conflicts escalate, is Bitcoin the calmest? In June, the Iran-Israel conflict intensified, with US President Trump launching an airstrike on Iran for the first time in nearly half a century. While the Dow and Nasdaq indexes experienced severe fluctuations, Bitcoin (BTC), traditionally known for high volatility, unexpectedly remained calm, sparking market discussions about its potential maturation as an asset.

Latest Update》Iran's Foreign Minister: No Ceasefire Agreement Reached Yet, Israel Has One Condition to Negotiate

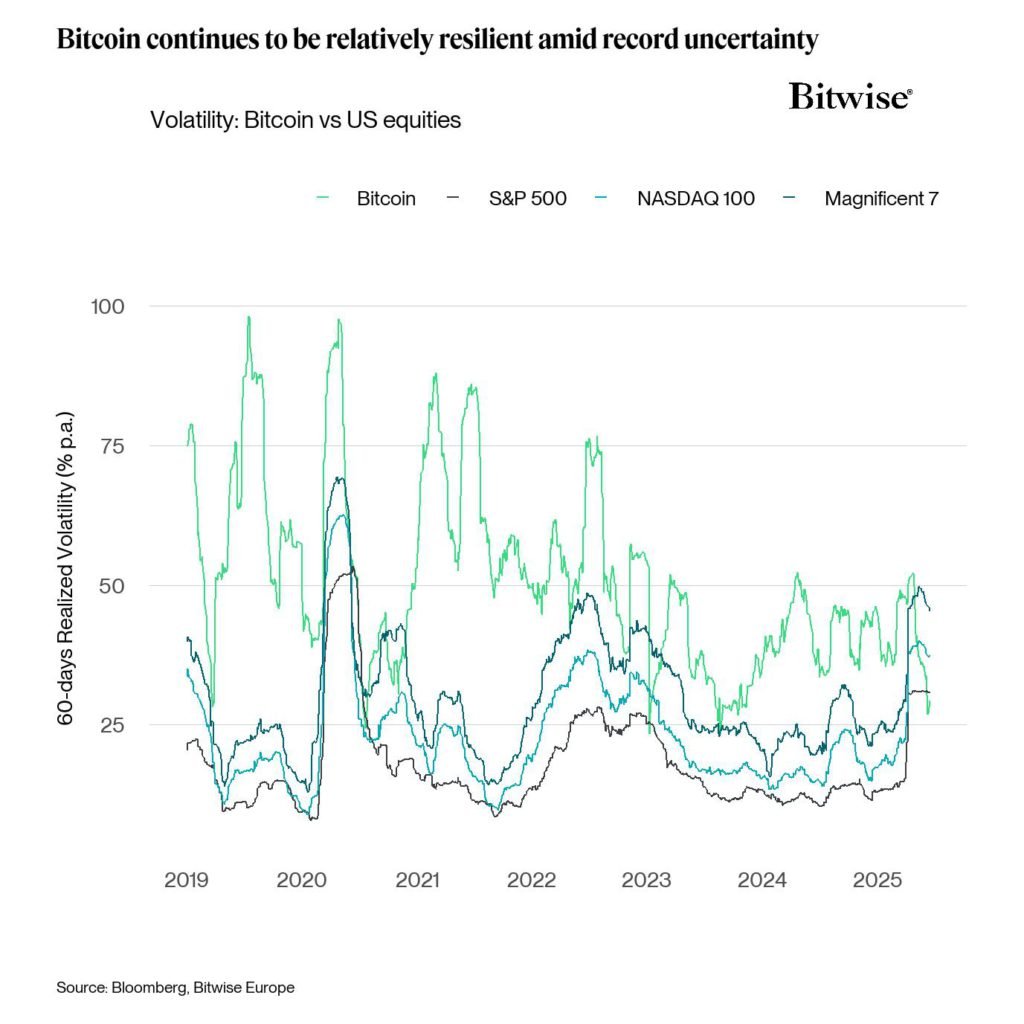

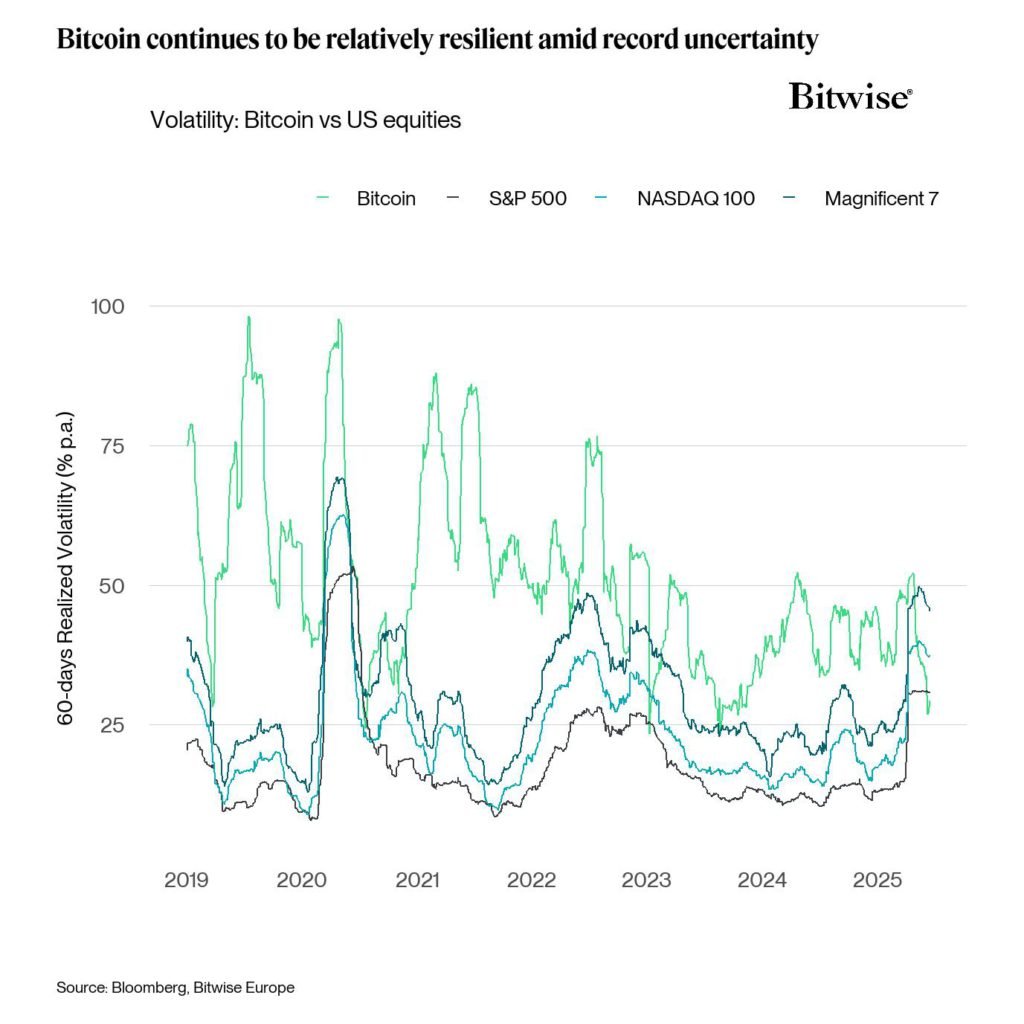

60-Day Volatility First Falls Below US Stocks

According to Bitwise data, Bitcoin's 60-day realized volatility has dropped to 27%~28%, lower than S&P 500's 30%, Nasdaq 100's 35%, and significantly below the US stock market leaders' 40%. Even when it briefly fell below $100,000 over the weekend, Bitcoin quickly recovered.

TradingView data similarly shows that Bitcoin's volatility has fallen below major stock indices for the first time.

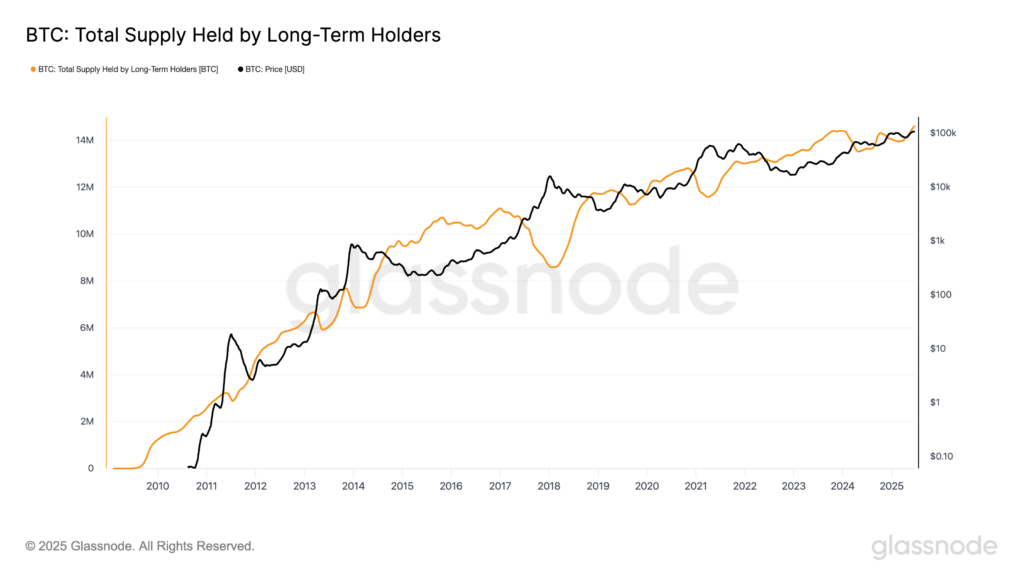

Supply and Demand Changes: Long-Term Holders and Institutionalization

The volatility contraction is closely related to market structure changes. Approximately 145,300 Bitcoins have been long-term settled, continuously tightening circulation.

According to the Glassnode report, long-term holding behavior is strengthening market resilience. Meanwhile, 216 institutions, including spot ETFs, exchanges, custodians, and corporate treasuries, collectively control over 30% of circulating supply, creating a "supply squeeze" that further reduces volatility.

Outlook of $150,000, Risks Still Exist

Multiple research institutions expect that after the 2024 halving reduces supply, combined with potential global central bank easing and continuing scarcity narratives, Bitcoin may challenge $150,000 by the end of 2025. However, the high concentration of holdings could amplify price volatility if large holders sell, and changes in the macroeconomic environment remain an important variable.

Although the Iran-Israel conflict again tests the market, Bitcoin has delivered a "coming of age" with low volatility. Whether its hedging narrative can be further strengthened remains to be seen.