Written by: Li Xiaoyin, Wall Street Insights

How Divided Are the Fed's Rate Cut Prospects?

The Federal Reserve's latest Summary of Economic Projections (SEP) shows that the median expectation for rate cuts in 2025 is two times, but officials' predictions range from no cuts to 75 basis points of cuts, highlighting significant differences among policymakers.

More critically, Fed governors Waller and Bowman were the first to "switch sides," publicly stating that they do not rule out the possibility of a July rate cut, further fueling market speculation about a policy shift.

According to Chasing Wind Trading Desk, Matthew Luzzet, Chief US Economist at Deutsche Bank, and his team stated in their latest research report that the June SEP report reflects the highest level of official disagreement in a decade, as officials have fundamental differences in balancing inflation control and economic growth.

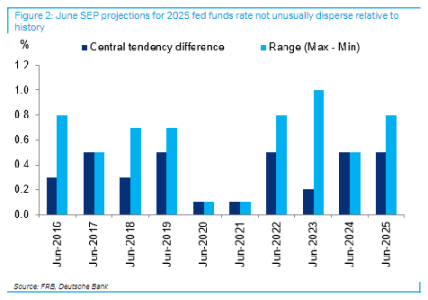

The report also added that despite the current significant differences, the uncertainty of the Federal Reserve officials regarding the 2025 interest rate path is not unprecedented and is even lower than the same period last year. It is expected that as economic data gradually becomes clearer, officials' views may converge, but differences will persist in the short term.

Historic Divergence Within the Fed, But Interest Rate Uncertainty Actually Decreases

Through an in-depth analysis of the Fed's June SEP report, Deutsche Bank believes that the main issue currently facing the Federal Reserve is not "historical uncertainty" but "historical division".

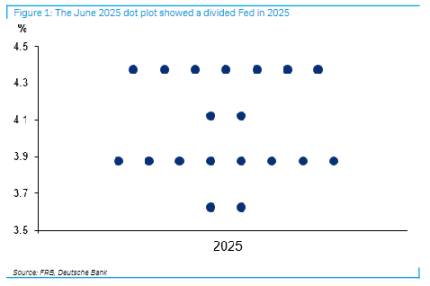

According to Deutsche Bank's research, the June dot plot shows a highly polarized distribution of Federal Reserve officials' predictions for the 2025 federal funds rate, with the gap between the most common and second most common predictions reaching 50 basis points, the highest in the past decade.

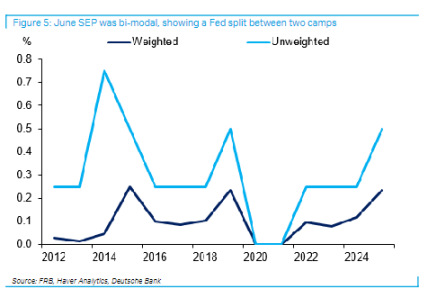

The report further pointed out that when calculated by the number of officials, this bimodal distribution is close to a historical record, indicating that the Federal Reserve has been split into two camps.

The report said that this level of divergence suggests more debates and even dissent within the committee in the coming months.

Although the current differences are significant, the report shows that the Federal Reserve officials' uncertainty about the 2025 interest rate path is not unprecedented.

Measured by the difference between the maximum and minimum values of the dot plot, the dispersion of the June SEP is comparable to many mid-year predictions in the past decade and even lower than the level in June 2023.

In terms of inflation forecasts, although officials' differences in core PCE inflation reached the highest level in the past decade at 1 percentage point, this did not translate into historical differences in federal funds rate expectations. This is partly due to officials' relatively consistent views on unemployment rate prospects, with differences of only 0.3 percentage points.

Economic Prospects and Inflation Risks

The internal division of the Federal Reserve stems from different interpretations of economic fundamentals.

The report noted that despite high inflation uncertainty, officials have a high consensus on unemployment rate prospects, which may suppress further dispersion of interest rate predictions.

However, the bimodal distribution of the June dot plot for the policy path indicates that officials have fundamental differences in balancing inflation control and economic growth. The open attitude of governors Waller and Bowman towards a July rate cut further highlights these differences, possibly reflecting some officials' concerns about current economic slowdown risks, while others are more focused on the persistence of inflation.

Looking ahead, it remains unclear whether the internal differences within the Federal Reserve will evolve into actual policy disagreements. The report expects that as economic data gradually becomes clearer, officials' views may converge, but differences will persist in the short term.