This article is machine translated

Show original

Thoughts on Middle Eastern Trading, First Trading Review, Seeking Guidance from Fellow Traders.

The Middle Eastern conflict seems to have come to a temporary halt. I've always said that analysis is for trading purposes. During this period, I opened some positions, all in small ant positions, mainly to test my views. I plan to share the details whether I lose or gain.

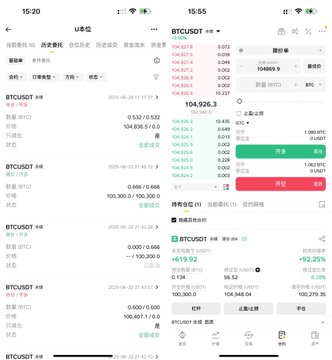

The first geopolitical conflict trade started on June 17th, with a long position of $104,666. Feeling uncertain due to potential war escalation, I closed 85% on the 19th at $104,753, essentially covering funding rates and transaction fees.

The remaining 15% was left to observe. I typically reduce large positions when unsure about future trends and maintain a smaller position for monitoring. That evening, prices began dropping, and my 0.5 $BTC long position at $103,555 was liquidated.

I always start with 0.5 $BTC positions. As the market knew, war escalated, causing market decline. My liquidation price was around $98,800. On June 22nd, with reports of potential US involvement, prices rapidly dropped. After weighing options, I chose to stop loss at $100,567.

The initial loss was $1,800. I placed an order at $100,200 that wasn't filled, then another at $100,700 which was executed. My reasoning was that US involvement would likely end the war quickly, given Trump's limited time.

Prices continued dropping. While accepting the decline, I felt the price was still high, as my liquidation price was around $96,500. I hoped for a lower liquidation price and closed at $100,407, losing another $200.

I continued placing orders, eventually committing my entire contract account worth 0.666 $BTC. Prices dropped to a low of $98,115 on the 22nd while I was on vacation, contemplating whether to stop loss.

However, considering it was Sunday with low liquidity and high panic, especially in crypto markets, I believed the reaction was excessive. I tweeted my thoughts, suggesting the weekend reaction was disproportionate.

I decided to hold rather than stop loss, even considering transferring funds from my spot account. This aligns with my three-month-long discussion with friends that analysis should support trading.

I started with $2,000 in contracts, gradually growing to $5,000 through careful trading. My initial plan was to limit monthly trading to $2,000, treating liquidation as a learning opportunity.

On June 23rd at CME opening, prices returned above $100,000, turning my position profitable. On the 24th, rumors of Hormuz Strait blockade emerged, causing oil price increases and market risks.

After careful analysis, I believed US involvement would be swift. Two key factors supported holding my position: Iran's prior communication with the US and Trump's energy policy responses.

Waking up at 11 AM, I saw prices above $105,000 and peace talks. With subsequent missile launch reports, I closed 80% of my position at $104,836, achieving a net profit of $500.

The remaining 20% reached 100% profit at $105,200. With Israeli ministers discussing potential retaliation, I closed the final position around $105,000.

My current account has grown to nearly $7,500. Future trades will depend on oil prices and war trends, with increased caution.

I emphasize contract trading's high risks, especially with higher leverage. I always prepare for potential total loss, maintaining a calm mindset. My focus remains on market analysis to support spot trading.

Contracts can be a point of no return. While currently profitable, without careful management, gains can quickly disappear.

Sponsored by @ApeXProtocolCN | Dex With ApeX

Continuous trading, continuous summarization, excellent

thanks

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content