Written by: Niu Xiaojing

How Much is a Channel Worth?

Let's start with an ancient yet epoch-making story.

In 1859, the Suez Canal construction began, taking a full ten years to dig an artificial waterway connecting the Mediterranean and Red Seas. At the time, the cost was 416 million francs, equivalent to 1.5% of France's GDP. By today's standards, this was an investment comparable to national infrastructure.

Why did they spend so much back then to dig an "artificial river"?

Look at these figures and you'll understand:

Each ship passing through Suez pays about $250,000;

1.8-2.1 thousand ships pass through annually;

Annual revenue exceeds $6 billion;

Average daily revenue over $15 million.

Because it's not an ordinary river, but a "golden channel" connecting Europe and Asia.

Without this canal, all ships would have to circumnavigate Africa's Cape of Good Hope, adding 4-5 days to the journey and increasing costs 2-3.7 times. Each detour could incur additional expenses from tens of thousands to millions of dollars.

So, this isn't about water, but about the "channel". An efficient, safe, and legal channel brings not just time and cost savings, but the key to controlling global trade.

The Channel Value of Stablecoins is Being Rediscovered

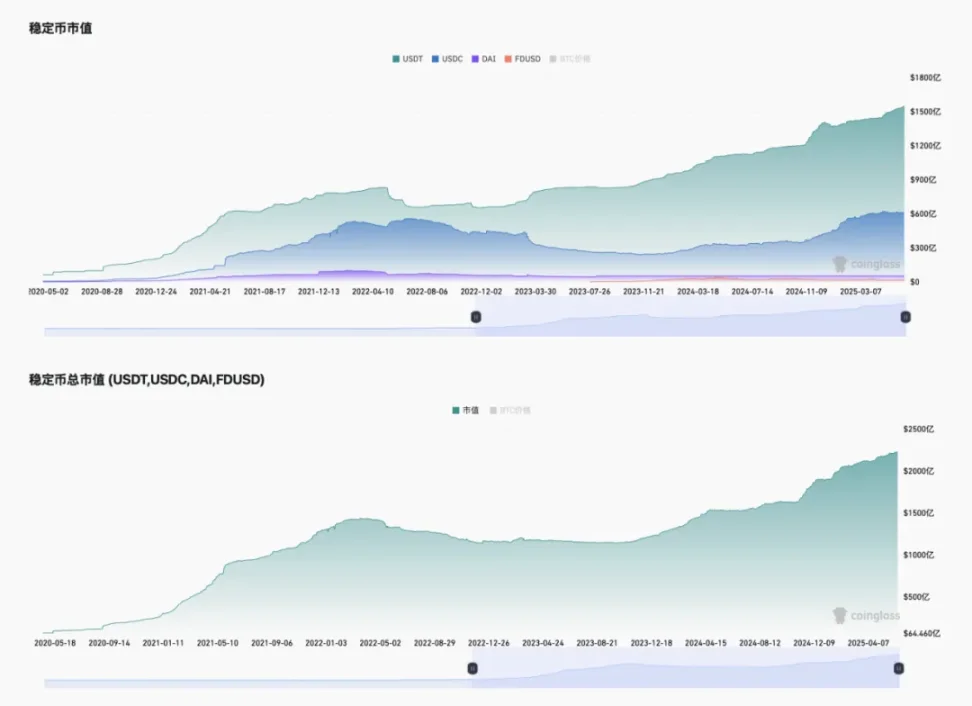

We are standing at a new starting point of a "channel revolution". Multiple countries are promoting stablecoin legislation, creating a main artery connecting the on-chain world to the real financial system. Or, opening a fast channel of on-chain finance for traditional commerce. Predictions suggest global stablecoin market cap will reach $250 billion by 2025; Standard Chartered is even more optimistic, expecting its potential to expand to $2 trillion, thereby leveraging $10 trillion in fund flows.

More importantly: Regulators are beginning to acknowledge the legitimacy of stablecoins.

Just as the Suez Canal was not just about "water flow" but "trade flow", the moment stablecoin legislation passes means capital can finally legally and directly enter the on-chain world. No more relying on intermediary companies or gray channels, reducing costs and increasing efficiency.

This is a landmark moment: the compliant channel is officially open.

Tether's Story: Not Just Issuing a Coin, But Capturing a Structural Position

Before discussing JD, we must first look at the "big brother" Tether - USDT's issuer.

What opportunity did Tether seize? When Bitcoin was born, it was meant for peer-to-peer payments, but due to high volatility, it was difficult to use for daily settlements. USDT perfectly filled this gap. It wasn't "born out of thin air", but emerged from real market demand: providing an anchored asset for on-chain trading, a liquidity hub, and a hedging tool. As someone aptly said: in each burst of market bubble, stablecoins are the "seeds" left in the market, allowing funds to wait for the next wave without completely exiting. Tether's returns are also stunning:

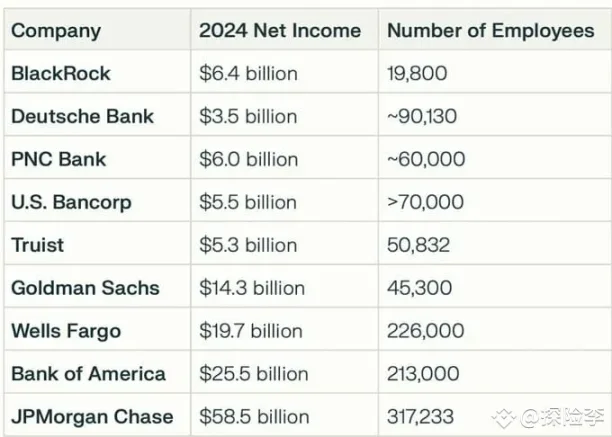

2024 net profit of $13.7 billion, with a team of only hundreds, generating over $68 million per person, far exceeding JPMorgan Chase, American Express, and Berkshire Hathaway.

Was this due to technology? No. It was due to a structural position - standing at the necessary passage of on-chain fund flows. Even when facing investigations and regulatory fines, they didn't evade compliance but continuously improved, ultimately making billions of global users "dare to use" it. This is the structural dividend. And now, a new dividend window has been opened.

Why is JD Doing Stablecoins?

Many say JD has entered Web3. But I don't see it that way.

JD's stablecoin is not about "issuing a coin", but solving long-standing cross-border e-commerce problems:

Long settlement cycles

High costs

Severe capital occupation

Complicated bank procedures

The value of stablecoins lies in being the shortest path between reality and the chain. It can:

Instant arrival

Cross-border payments without intermediaries

Significantly reduced transaction fees

Automatically arrangeable and auditable systems

So, stablecoins are not necessarily Web3 exclusive, but a new tool for Web2 enterprises to build financial infrastructure.

This is not just JD's opportunity, but an opportunity for all Chinese enterprises hoping to go global and connect worldwide.

Stablecoin 2.0 Era: Systemic Solutions

Past stablecoins served crypto trading. Today's stablecoins serve enterprises. It's no longer just a "coin", but a system module, a part of financial settlement systems, user incentives, supply chain closed loops, and cross-border settlement processes. The next stage of stablecoins is systematic, compliant, and structured development. The opportunity behind this is providing "stablecoin infrastructure services" for enterprises.

Web3 Practitioners' Role Transformation: From "Speculators" to "Architects"

The real opportunity is not about whether you can issue a coin, but whether you can:

Design payment systems for stablecoin integration

Build cross-chain settlement bridges

Implement automatic profit-sharing and risk control strategies

Help enterprises achieve compliant landing

If you understand the chain, structure, and enterprises, you're standing at this intersection.

Merely wandering in Web3 is not enough; you must become a service provider, architect, and channel builder for more Web2 enterprises.

We Are Experiencing the "Suez Moment" of Stablecoins

Back to the original question: How much is a channel worth?

No one complained about Suez Canal's tolls because everyone knew: taking a detour is expensive, slow, and dangerous.

The stablecoin channel is the same. You can take gray routes, do arbitrage, use intermediaries, but those risks are "temporary dividends", not long-term moats.

What's truly valuable is the structure, the channel. The next industry breakthrough is not the noisy coin issuance trend, but steady structural building. Those who truly earn long-term value are those who "build channels" for enterprises.

I command this river to be opened, so ships can sail directly to Persia, as I wish. King Darius's oath still applies today. Now is the time for our Web3 generation to dig the next new channel.