On local time June 25th, the Director of the Federal Housing Finance Agency (FHFA), Pulte (Bill Pulte), suddenly posted that he has requested Fannie Mae and Freddie Mac - these two "hidden giants" controlling over half of US mortgages, to study incorporating Bit and other cryptocurrencies into mortgage assessment systems!

What do Fannie Mae and Freddie Mac do?

Although FHFA's review of crypto assets in mortgage underwriting is still in early and exploratory stages, the consideration itself reflects a shift in crypto asset relevance and leadership priorities.

How might crypto assets be evaluated?

In the US, borrowers currently wanting to use digital assets in the mortgage process must first convert them to USD and deposit funds into a regulated US bank account. To meet Fannie Mae and Freddie Mac's down payment or reserve guidelines, these funds must also be "seasoned", meaning they must be held in the account for at least 60 days.

FHFA's review is expected to study whether these regulations need updating. One potential focus area is asset valuation. Due to the volatility of crypto assets like Bit, lenders may be reluctant to accept their full market value when assessing borrower assets. A method commonly used in traditional finance is applying a "haircut", which deducts a portion from the declared value to address potential price fluctuations. It remains uncertain whether cryptocurrencies will adopt similar adjustments.

Holding history might also be scrutinized. Lenders typically prefer long-term held assets over short-term ones. Assets with clear documentation, consistent custody, and minimal transaction activity might carry more weight than those recently acquired or frequently transferred.

Stablecoins might be considered separately. Tokens like USD Coin (USDC) and Tether (USDT), designed to maintain stable value relative to USD, might make them more suitable for underwriting purposes. Nevertheless, stablecoin handling will depend on regulatory acceptance of their structure, custody arrangements, and transparency standards.

Private markets have already tested the waters

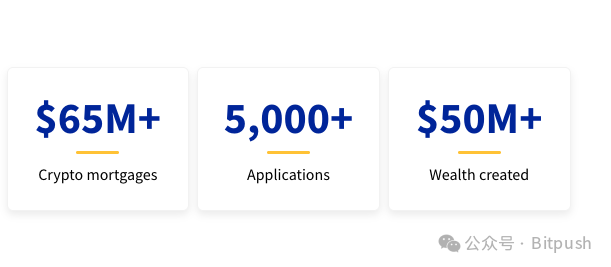

Florida-based lender Milo Credit launched one of the first US crypto mortgage products in 2022. It allows borrowers to pledge digital assets (like Bit, ETH, or certain stablecoins) as collateral without selling cryptocurrencies or paying cash down payments. This setup enables clients to obtain financing up to 100% of home value without liquidating their crypto assets. By early 2025, Milo reported issuing over $65 million in crypto-backed residential mortgages.

Similarly, fintech company Figure Technologies, led by former SoFi CEO Mike Cagney, has explored large-scale crypto-backed mortgage programs, offering loans up to $20 million using digital assets as collateral.

Additionally, Ledn's "Bit Savings Account" can be seen as a mortgage product, allowing users to obtain USD loans at a 50% LTV ratio.

However, these private products operate outside the federal mortgage system. Their loans do not qualify for resale to Fannie Mae or Freddie Mac, meaning they cannot benefit from the same level of liquidity and risk sharing as traditional loans. Therefore, interest rates are often higher, with lenders typically retaining loans or collaborating with alternative investors for financing.

Another limitation is risk. Crypto mortgages often require over-collateralization - borrowers must pledge crypto asset values exceeding the loan amount to offset volatility. But even with such a buffer, price fluctuations can pose challenges.

In summary, if FHFA chooses to advance this policy, it signals cryptocurrency's transition from an investment vehicle to a utility financial tool. While specific implementation will take time, it already sends a strong market signal: the mainstream financial system is opening its doors to crypto assets.

Twitter: https://twitter.com/BitpushNewsCN

Bitpush TG Community: https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush