Author: Grayscale Research; Compiled by: ALMan@Jinse Finance

The cryptocurrency sector is a proprietary framework developed in collaboration with FTSE Russell to organize the digital asset market and measure returns. In the second quarter of 2025, price returns and fundamental indicators for various cryptocurrency sectors showed mixed performance.

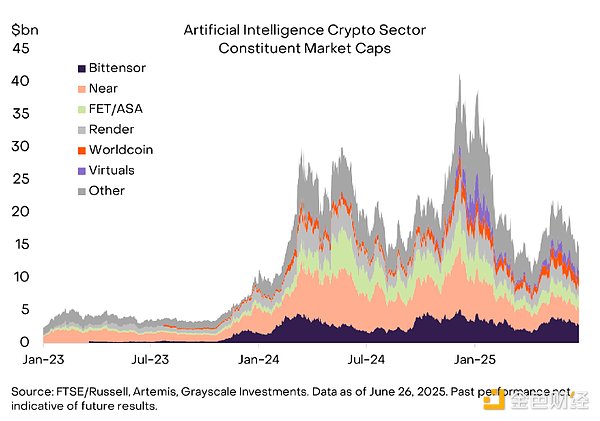

We recently launched an AI cryptocurrency sector containing 24 assets with a total market capitalization of $15 billion. According to the index methodology, this sector increased by 10% in the second quarter.

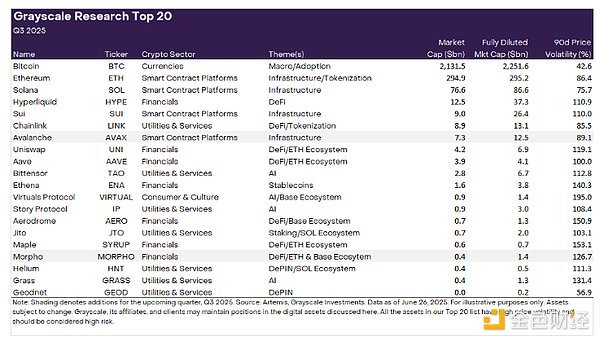

We updated Grayscale Research's Top 20 token list. The Top 20 list covers diverse assets in the cryptocurrency field that we believe have tremendous potential in future quarters. New assets added this quarter include Avalanche (AVAX) and Morpho (MORPHO). All assets in our Top 20 token list have high price volatility and should be viewed as high-risk assets.

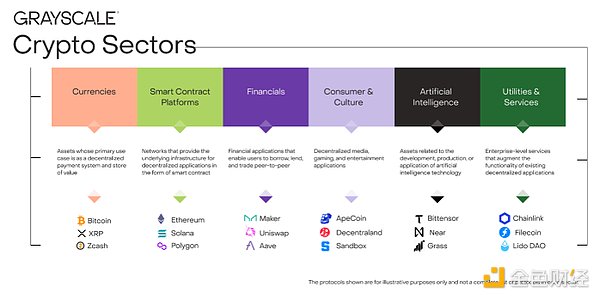

Each asset in cryptocurrencies is associated with blockchain technology and shares the same basic market structure - but the commonalities end there. This asset class covers a wide variety of software technologies applied in consumer finance, artificial intelligence (AI), media, and entertainment. To make the data clear, Grayscale Research uses a proprietary classification and index series developed in collaboration with FTSE Russell, called "Crypto Sectors" (see Figure 1). As of the latest adjustment, the Crypto Sectors framework now covers six different submarkets, including the AI cryptocurrency sector to be discussed below. They collectively contain 261 tokens with a total market capitalization of $3 trillion.

Figure 1: Crypto Sectors Framework Helps Organize the Digital Asset Market

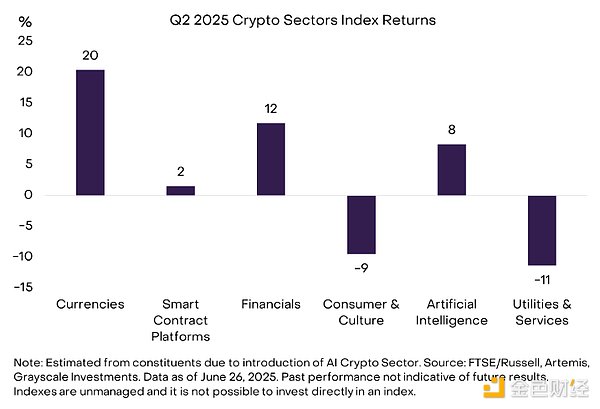

Returns in the second quarter of 2025 were mixed, with the "Liberation Day" tariff announcement and US military actions in the Middle East. Our market-cap-weighted comprehensive FTSE/Grayscale Cryptocurrency Industry Total Market Index remained essentially unchanged this quarter (Chart 2). With Bitcoin's price rising 30% during this period, the cryptocurrency monetary industry index performed well. The FTSE/Grayscale Financial Cryptocurrency Industry Index and FTSE/Grayscale AI Cryptocurrency Industry Index also saw slight increases. In contrast, the FTSE/Grayscale Consumer & Culture Cryptocurrency Industry Index declined due to weakness in certain meme coins and game-related tokens. The FTSE/Grayscale Utilities & Services Cryptocurrency Industry Index also fell, reflecting widespread weakness in its constituents.

Figure 2: Crypto Sector Returns Varied in Q2 2025

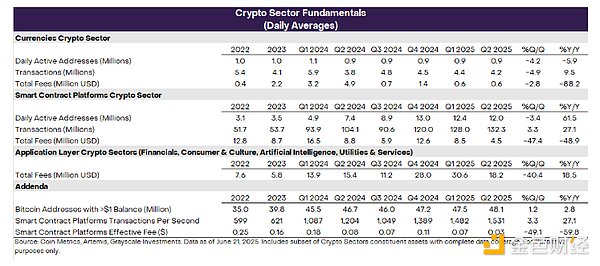

Blockchain is not a company, but its economic activity and financial health can be measured similarly. The three most important on-chain activity indicators are users, transactions, and transaction fees. Since blockchains are anonymous, analysts typically use "active addresses" (blockchain addresses with at least one transaction) as an imperfect proxy for user numbers.

Similar to token price returns, blockchain financial health indicators in the second quarter of 2025 were mixed. On one hand, smart contract platforms processed an average of 130 million transactions, about 1,500 transactions per second; transaction volume grew nearly 30% year-on-year (Chart 3). On the other hand, transaction fees paid by users comprehensively declined. This partly reflects further cooling of memecoin trading activity on Solana, which was the primary source of transaction fees in previous quarters. According to the blockchains analyzed in this report, smart contract platforms' actual transaction fees are around $0.03 per transaction. Despite the quarter-on-quarter decline in application layer fees, the annualized growth rate over the past four quarters still reached $5-10 billion.

Figure 3: Cryptocurrency Industry Transaction Fees Decline

Last month, we launched the AI cryptocurrency sector, which was formally incorporated into the FTSE/Grayscale Cryptocurrency Sector Index series in the latest index adjustment. The AI cryptocurrency sector currently contains 24 tokens with a total market capitalization of approximately $15 billion, up from about $5 billion in 2023, but still less than 1% of Bitcoin's market cap (Chart 4). The highest market cap asset in the AI cryptocurrency sector is Bittensor, a platform aimed at incentivizing decentralized AI development.

Figure 4: AI Crypto Sector Has 24 Assets and $15 Billion Market Cap

Grayscale Research Top 20 Tokens

The Grayscale Research team analyzes hundreds of digital assets each quarter to inform the rebalancing process for the FTSE/Grayscale Cryptocurrency Industry Index series. Based on this process, the Grayscale Research team generates a list of the top 20 assets in the cryptocurrency industry. This list covers a diverse portfolio of assets in the cryptocurrency industry that we believe have tremendous potential in the next quarter (Chart 5). Our methodology covers a range of factors, including network growth/adoption, upcoming catalysts, fundamental sustainability, token valuation, token supply inflation, and potential tail risks.

Over the past quarter, cryptocurrency market focus has included stagflation and other macroeconomic risks (which could benefit Bitcoin), as well as US progress in stablecoin and market structure regulation (which seems to support Ethereum and DeFi-related assets). These themes, along with advances in decentralized AI, are fully reflected in the Top 20 list.

Therefore, we made only two changes this quarter, which are more related to specific protocol fundamentals than new themes. Specifically, we added:

1. Avalanche (AVAX): Avalanche is a prominent smart contract platform blockchain - currently ranked sixth by market cap in its crypto domain. This is a competitive subsector with many high-quality projects striving to create the best platform for users and developers. In fact, it's difficult to determine which platform will achieve the most enduring network effects based on technology alone. Therefore, Grayscale Research places great importance on de facto adoption trends. Recently, Avalanche has seen increased transaction volume (with growth in users and fees), which seems incongruous with its ecosystem (possibly related to the MapleStory video game and associated stablecoin trading volume). While we're uncertain if this activity growth will persist, such organic adoption is a good omen for Avalanche's competitive position in the smart contract platform crypto domain and may support its native AVAX token.

2. Morpho (MORPHO): Morpho is an over-collateralized decentralized lending protocol characterized by independent lending pools that pair a collateral asset with a loan asset. Primarily built on Ethereum and Base, Morpho has a simple structure allowing users to lock assets in customizable vaults. Morpho has grown rapidly over the past year, with annual fee income rising to around $100 million and total locked value (TVL) more than doubling to over $4 billion, making it the second-largest lending application by this metric. Last month, Morpho announced the launch of Morpho V2, aimed at bringing DeFi to traditional financial institutions. Grayscale Research is optimistic about the future of on-chain lending activity, and Morpho seems well-positioned to capture a share of this growth (along with other lending-related protocols in the top 20 list like Aave and Maple Finance).

Figure 5: AVAX and MORPHO Join Q3 2025 Top 20 Tokens

To make room for Avalanche and Morpho, we will remove Lido DAO (LDO) and Optimism (OP) this quarter. Both projects are leaders in their respective domains (staking and Layer 2) and are core to the Ethereum ecosystem. However, if US regulatory changes allow broader use of staking services (such as in ETPs), Lido may face fee competition from centralized staking providers. Optimism's technology is widely used by Ethereum Layer 2 networks, including Coinbase's Base chain, Uniswap's Unichain, and the OP mainnet itself. But the fee revenue generated by OP tokens is limited. Additionally, we are uncertain how Optimism's "superchain" vision will align with the Ethereum Foundation's own efforts to improve interoperability, possibly through alternative rollup designs (i.e., "based" and "native" rollups). The long-term investment themes for LDO and OP remain unchanged: Lido provides core liquidity staking services, while Optimism leads Ethereum's scaling path. However, we are less certain about near-term prospects, so we will remove these two assets in the next quarter.

Investing in crypto asset categories involves risks, some of which are unique to the crypto asset category, including smart contract vulnerabilities and regulatory uncertainty. Moreover, our top 20 assets are highly volatile and should be viewed as high-risk, and therefore not suitable for all investors. Given the risks of this asset category, any digital asset investment should be considered in the context of a portfolio and the investor's financial goals.