Stablecoins are dominating the market, gradually penetrating traditional financial sectors and retail markets. For example, some supermarkets in South America have started directly pricing goods in US dollar stablecoins (USDT). Its application scenarios are real, and supporting this expansion trend may require seeking new infrastructure support.

Recently, we have seen news about stablecoin-related chains, such as Plasma and Stable.

- What are these projects?

- What are their differences?

- Are they indispensable?

The Rise of Stablecoin-Specific Chains

The design goals of Plasma and Stable are to achieve faster, cheaper, and more scalable stablecoin transfer functions. Their core concept is to attract liquidity by absorbing funds from old networks that are less efficient but still hold a large amount of stablecoins.

Although these two networks have some fundamental differences, their similarities may be more significant. Notably, their strongest common point is USDT, which serves as the core hub for both.

More specifically, both have integrated USDT0. This is an anti-fragmentation version of USDT that can be natively exchanged across different blockchain networks through LayerZero, currently mainly based on the Arbitrum network and continuously expanding to emerging public chains. For end-users, its usage experience is no different from regular USDT.

Plasma

Plasma is built as a Bitcoin sidechain, which means it inherits Bitcoin's security through an anchoring mechanism while maintaining its own independent consensus mechanism. In short, malicious attackers would need to breach Bitcoin to tamper with Plasma's historical records, but Bitcoin itself does not verify Plasma's blocks.

This system is designed for thousands of transactions per second and approximately 1-second final confirmation, making it very suitable for quickly transferring US dollar stablecoin USDT. However, its most outstanding feature compared to ordinary blockchains is that basic USDT transfers are completely gas-free. So what is its profit model? The answer is: charging gas fees for all other operations in the network, attracting users through free transfers to create a scale effect, and subsequently increasing paid on-chain operations as user numbers surge - this is its strategy of creating revenue through second-order effects.

Another special feature is that when it comes to transaction fees, users can choose to pay using USDT or Bitcoin. The platform is fully EVM-compatible, allowing developers to easily deploy Ethereum applications. Given the dual support from Bitfinex exchange and Tether company, its focus on supporting USDT and Bitcoin is understandable.

Stable

Stable adopts a different implementation approach. It is an independent Layer 1 network, not a sidechain, and uses a self-developed Proof of Stake consensus mechanism. Similar to Plasma, Stable is also EVM-compatible. USDT stablecoin transfers have zero gas fees, while all other on-chain operations still require payment. The key characteristic of gas fees is that only USDT is accepted as payment.

Stable is supported by Bitfinex and USDT0. The company has hired Tether's CEO Paolo Ardoino as an advisor from the beginning, which fully demonstrates its focus on the primary circulating stablecoin, USDT.

Moreover, they seem to be more focused on enterprise and institutional clients, with details to be discussed later.

Privacy Policies

Both networks are very concerned about privacy protection. Although the specifics are not yet clear, the Shielded transaction concept mentioned by Plasma and the confidential transfer technology adopted by Stable are both designed to protect transaction privacy while maintaining compliance.

Overall, there is currently limited precise information about these two types of infrastructure. Besides the technical differences already explained, it is reported that the Stable platform will add more institution-friendly features, such as:

Enterprise-exclusive block space service: Providing dedicated block space for enterprises. This means ensuring stable transaction speed and preventing fee spikes, regardless of network congestion.

USDT transfer aggregator: Integrating multiple USDT0 transfers to improve processing speed and reduce transaction costs.

Do they have real use cases so far?

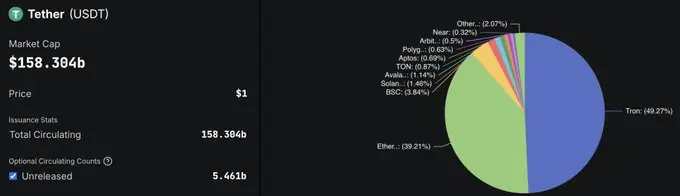

In the $158.304 billion market cap of USDT, 49.27% circulates through the TRON network. Is this chain still in use? New public chains' ecosystems are much more developed.

However, it was initially the cheapest and most efficient option. Therefore, Tether has always used this chain to mint and transfer funds. But the TRON public chain was not originally designed for this. More critically, Tether is merely a user and has not deeply participated in the chain's ecosystem. Losing its dominance over USDT would be the last straw that breaks TRON. Considering the chain's lack of a sustainable ecosystem, this outcome is inevitable.

The core strategy of chains like Plasma and Stable is to target DeFi-weak ecosystems for liquidity absorption. Their purpose is not to eliminate competitors but to build a hub centered on USDT payment and commercial settlement. Especially with the advantage of free transfers, surpassing inefficient chain ecosystems is not difficult. The attracted liquidity will naturally drive users and capital inflow, thereby spawning new DeFi protocols and ultimately constructing a truly viable ecosystem.

This might give rise to a new SWIFT-like system specifically serving stablecoins, where Tether will not only issue stablecoins but also become a dual cornerstone supporting monetary value and underlying infrastructure. Leveraging USDT's scale advantage, Tether will benefit, while Plasma and Stable can fully enjoy the dividends of high-speed fund circulation on their networks.

Undeniably, other blockchain ecosystems will not be forgotten. Solana, focusing on debit card payments and fiat conversion channels, Ethereum and its Layer 2 solutions focusing on DeFi, and emerging chains with specific application scenarios may continue to thrive.

Plasma's Recent Progress

Although this does not represent long-term sustainability, short-term enthusiasm has been fully verified through Plasma's public token sale, with total deposits within the allocation limit reaching $1 billion. This means that when the chain goes online, it will rank 12th in stablecoin circulation.

Additionally, Plasma has advanced multiple collaborations, such as:

- Yellow Card: Focusing on USDT transfer services in Africa.

- BiLira Kripto: Connecting Turkish Lira with stablecoins for cross-border payments.

- Uranium Digital: Bringing commodity trading on-chain.

- Axis: Launching yield-generating synthetic USD (xyUSD).

- Curve and Ethena, etc.

We will also await Stable's subsequent development.

Conclusion

It's not to say these projects will definitely achieve product-market fit. In fact, the "stablecoin chain" concept might just be a clever marketing strategy: creating a spotlight effect for USDT while generating hype with zero gas fees. Essentially, this is paving the stage for vampire attacks, but instead of creating token incentives out of thin air (like the SushiSwap model), it achieves this by eliminating user transaction costs. In a sense, it's a freemium model in the trading domain.

Both chains are ready. But what will be more interesting going forward is observing how they will differentiate and compete, choose the best market channels, with the key focus being whether they can build a sustainable business ecosystem.