In Washington, seemingly unrelated events are often intricately intertwined, sketching a grand strategic landscape. In early July, while public attention was focused on the "Independence Day gift" for President Trump - a massive fiscal bill dubbed the "One Big Beautiful Bill" (OBBB) - another quieter but equally profound revolution was brewing on Capitol Hill: a series of legislative proposals targeting digital assets were being put on the agenda at an unprecedented speed.

These two seemingly parallel tracks - one of radical fiscal expansion, the other of precise regulatory reshaping - are not coincidental. They together constitute a carefully designed "Washington Yang Mou": by creating a macroeconomic tsunami while constructing a regulatory moat tailored for the United States, thereby establishing an unshakable hegemonic position in the global digital asset race. This is not just about tax cuts or regulation; this is a high-stakes gamble about the future dominance of the financial system.

The Economic Engine and Debt Black Hole of the "Big Beautiful Bill"

Structurally, the OBBB bill is a carefully designed duet. On one hand, it introduces an unprecedented scale of tax cuts. The bill has been criticized by critics as an extreme "rob from the poor to give to the rich": it permanently locks the corporate tax rate at 21% and brings nearly $6,000 in annual tax savings for high-income groups. On the other hand, the cost for all this is brutal cuts to social welfare programs. Food stamps for about 600,000 families will shrink by $100 monthly, and the Medicaid program will be directly slashed by $1.2 trillion over the next decade.

The core controversy of this game lies in its real fiscal cost. The White House Council of Economic Advisers (CEA) uses a "dynamic scoring" model, insisting that tax cuts will stimulate economic growth, with tax revenues sufficient to cover the cost. However, this optimistic prediction is far from the conclusions of almost all non-partisan analysis institutions.

The non-partisan Congressional Budget Office (CBO) predicts that the bill will increase federal debt by $3.3 trillion net over the next decade. Think tanks like the center-left Brookings Institution and the libertarian-leaning Cato Institute have drawn similar conclusions, believing its GDP boost is minimal and completely unable to offset its massive debt cost. Goldman Sachs economists were even more blunt, arguing that any weak growth momentum brought by the bill would be completely offset by the economic drag created by the government's concurrent tariff policies.

The academic debate about scoring models actually masks a more fundamental, unavoidable truth: however calculated, the United States has clearly chosen a path of stimulating the economy through large-scale, unfunded fiscal expansion. This is not an ordinary policy adjustment, but a paradigm shift in fiscal posture. The real economic reality behind this is that a debt-driven super-stimulus cycle has been launched.

An Inevitable Rise

Such a scale of fiscal expansion will inevitably trigger responses in the monetary realm. A new national debt hole of trillions of dollars means an equivalent monetary expansion is needed to finance it. This will inevitably lead to the devaluation of fiat currency, thus creating a powerful and structural long-term positive for hard assets with scarcity and non-sovereignty like Bitcoin.

This logical chain has been elaborated by two thought leaders in the crypto world - Michael Saylor and Arthur Hayes. MicroStrategy's founder Michael Saylor compares currency devaluation to a "leak of economic energy". In his view, Bitcoin is the engineering solution to this problem, the first time in human history where "you can closely bind economic energy to individuals... without living in fear". BitMEX's co-founder Arthur Hayes believes government spending and fiat creation are the most fundamental fuel for crypto bull markets. "Printing money is their only answer," Hayes asserts, predicting that the Trump administration's massive stimulus will be a catalyst for pushing Bitcoin's price to hit a million dollars.

These views are supported by macro data. There is a significant positive correlation between global broad money supply (M2) and Bitcoin price. Historical data shows that when global M2 rises, excess capital flows into "risk assets" like cryptocurrencies. The passage of the OBBB bill essentially announces the arrival of the "Fiscal Dominance" era. The Federal Reserve's monetary policy will have to serve the government's fiscal needs by purchasing newly issued bonds - which is essentially debt monetization, or the "Stealth QE" described by Hayes.

Therefore, the OBBB bill is not just a tax bill; it is a clear signal that the United States has chosen to manage its heavy debt burden through currency devaluation. This transforms the logic of investing in Bitcoin from a cyclical speculative behavior to a long-term, structural inevitability.

Game Rules: A Completely New Regulatory Framework

If the macroeconomic tsunami is the first step of the "Yang Mou", then the regulatory lightning war that follows is the second step. Washington is simultaneously advancing a carefully designed regulatory combination punch, whose purpose is not to strangle, but to build a solid "regulatory moat" for the US digital asset ecosystem, thereby attracting capital and talent globally and shaping the industry landscape according to US intentions and advantages.

The first pillar of this regulatory reshaping is the "GENIUS Bill" designed to tailor a legal framework for stablecoins. The bill establishes a comprehensive federal regulatory framework for "payment stablecoins", strictly limiting the range of issuers and requiring reserves to be backed 1:1 by high-quality liquid assets like cash or short-term US Treasury bonds. This not only provides advantages for the traditional banking-dominated track but, as Arthur Hayes pointed out, cleverly guides trillions in private savings to the US Treasury bond market, creating a massive buyer group for the new debt created by the OBBB bill.

The second pillar is the Digital Asset Market Clarity Act, aimed at resolving the blurred regulatory responsibilities between the SEC and CFTC. The bill creates a clear path for digital assets to be classified as "digital commodities" after their network becomes sufficiently decentralized, thus being regulated by the CFTC. This paves the way for compliance of mainstream crypto assets like Ethereum, greatly reducing the legal risks for institutional entry.

The final pillar of the regulatory framework is the Anti-CBDC Surveillance National Act. Through legislation, the bill explicitly prohibits issuing retail central bank digital currencies (CBDC), declaring to the world that the United States will be committed to a private, permissionless financial future, rather than a "Chinese-style monitoring tool". This strategic choice supports an ecosystem led by the private sector, based on open and free principles, to compete with China's digital yuan, thereby ensuring that the US dollar continues to maintain its global dominance in its new digital proxy form.

Market's Verdict: Capital Flow and Future Trajectory

As Washington's macro and regulatory blueprint gradually unfolds, the market has begun voting with real money. However, as many investors worry, all recent policy benefits seem to have been cashed in. After the short-term boost to US stocks by the OBBB bill, the market may face a volatile adjustment period due to massive deficit pressures.

On-chain Data and Market Sentiment Analysis

The current market is digesting a series of complex signals. While surface-level market sentiment indicators show greed (Fear and Greed Index rising to 73), deeper on-chain data reveals a more mature and solid landscape. According to glassnode's analysis, despite market volatility, the bull market structure remains robust, forming a solid structural support between $93,000 and $100,000.

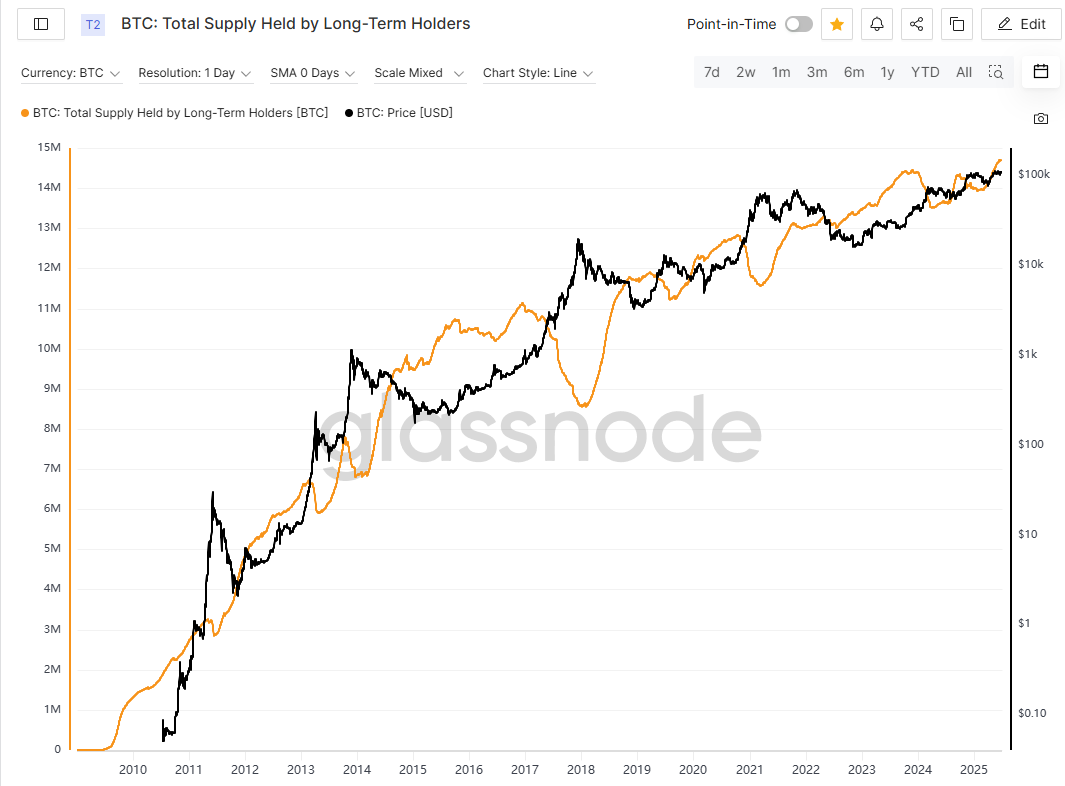

Although price increases have led to profit-taking, data shows selling pressure is weakening, and long-term holders' (LTH) behavior is shifting back to "HODL" (long-term holding). Notably, the Bitcoin supply held by long-term holders has reached a historical high, which is unusual in the later stages of a bull market, indicating their extremely strong belief in the future. This divergence between surface sentiment (greed) and underlying data (calmness) is precisely a sign of a maturing, institution-driven market. The market is building a strong support foundation, patiently absorbing selling pressure, and waiting for comprehensive implementation of macroeconomic and regulatory policies.

Corporate Balance Sheet 2.0

The "corporate playbook" pioneered by MicroStrategy, using publicly listed companies as a tool to gain crypto asset exposure, is entering version 2.0. Under both macroeconomic and regulatory tailwinds, companies are beginning to look beyond Bitcoin to other strategically valuable digital commodities, especially ETH.

Crypto mining company Bitmine Immersion (BMNR) saw its stock price surge over 130% in a single day, catalyzed by the announcement of completing a $250 million private placement, with a clear purpose - purchasing ETH as its core inventory reserve asset. The appointment of Tom Lee, a well-known crypto bull and Fundstrat founder, as the new chairman, further injected massive market credibility into this strategy. Similarly, Canadian fintech company Mogo Inc. (MOGO) announced a $50 million Bitcoin inventory reserve authorization, using Bitcoin as the "corporate hurdle rate" for all capital allocation decisions.

This is a perfect positive feedback loop. The CLARITY Bill de-risks ETH, making BMNR's ETH inventory reserve strategy possible. In turn, BMNR's action serves as a massive proof of concept, demonstrating the importance of the CLARITY Bill. We are witnessing the birth of a new asset class for corporate balance sheets. The market is beginning to distinguish between "Bitcoin as a store of value" and "ETH as a decentralized computing platform/settlement layer". Washington's regulatory strategy provides a framework for these two to coexist and thrive in compliant entities' portfolios.

Conclusion: Navigating the New US Crypto Paradigm

In summary, the inflationary fiscal lightning war, a regulatory framework aimed at legalizing and guiding the industry, and the strategic rejection of national monetary control are not coincidental. This is a well-thought-out "Washington strategy" aimed at consolidating US leadership in the next generation of financial and technological revolution.

The US is choosing to manage its debt through inflation, creating a permanent structural demand for hard assets. Meanwhile, it is building a regulatory moat, bringing digital assets into its dominant trajectory. It provides a clear path to legitimacy for the broader Web3 ecosystem, ensuring the next generation of the internet is built on US soil. More importantly, while doing all this, it explicitly chooses the path of economic freedom and personal privacy, not state surveillance, giving it a powerful advantage in the global ideological competition.

The market has understood this signal and responded with mature consolidation and strategic corporate adoption beyond Bitcoin. For global investors, developers, and builders, Washington's message could not be clearer: the game has begun, and the US is determined to win. A globally most attractive macroeconomic and regulatory environment tailored for digital assets is forming in the US. This high-stakes bet is risky, but its goal is clear - attract global capital, nurture domestic innovation, and ensure the dollar continues to be the undisputed global reserve currency through its new, private, decentralized digital proxy, navigating the 21st century.