Centralized exchanges (CEX) are simultaneously developing on-chain trading tools, wallets, and Perp DEX, while ironically reviewing CEX users for compliance, which is inherently contradictory.

In our era, everyone is being driven crazy, without exception.

Artificially Creating Crisis, Crypto Roma

Compared to Roma, which is struggling due to 3C, OKX's problem is the lack of internal checks and balances, completely driven by the founder's self-will.

Artificially creating a public opinion crisis cannot accelerate the compliance process.

Star Xu's "commanding" statement rejecting "online loan" users shocked the entire crypto community, which is different from the responsible Star Xu people were familiar with.

In public memory, early OK was a very responsible entity:

- In 2020, when OK faced regulation, the "private key management" explanation gave the public a profound understanding of crypto: Not your Keys, Not your Money;

- In 2025, when OK faced regulation and needed MiCA license for compliance, they proactively suspended the DEX aggregator in OKX wallet, leading to being overtaken by Binance and losing market share.

Of course, this can be interpreted differently. If suspending services for regulation means OK doesn't earn money and other service providers can, this special regulatory action against users is puzzling.

For going public, this is untenable. From DiDi's emergency IPO being ordered to rectify, to Binance's compliance costs of CZ's imprisonment + fines + exit + rectification, even stopping BUSD issuance, these were all stopped after being discovered.

But OK is different, directly telling everyone "I'm going to take action against you". The core issue is not compliance, but the attitude towards users.

Image caption: OK admits compliance misjudgment, image source: @star_okx

Ultimately, it will ferment in the public opinion arena. OK's global 600-person compliance team must also adjust dynamically based on market conditions. If OK doesn't exist, no matter how good the compliance is, it's meaningless.

At its core, this is not a compliance issue, nor a debate about whether online loan users should trade. The best response to the latter is no response.

This is a public relations crisis with extremely distinctive characteristics, most absurdly initiated by the founder himself.

Unlike Binance's dual-core drive, OK's true controller is Star Xu alone. Regarding circulating rumors, as enterprises grow, they become less controllable. It's hard to say who is cleaner, which is not the core factor affecting business competition.

Star Xu's will is OKX's will. OKX has no independent will. In the founder's strong corporate culture, no executive can raise objections, let alone opposing views.

- JD's Liu Qiangdong can make executives line up to report and directly dismantle the brand department, reassigning it to a more market-oriented marketing department;

- After CZ's release, he cannot directly manage Binance but can "influence" it, with Binance accepting market influence and lawyers ensuring compliance.

Which approach is more sophisticated is self-evident. OK's current problem is that the founder is unsuitable for public relations but insists on interacting with the market and triggering repeated public opinion crises.

A prediction can be made: if OK does not isolate its founder, future public opinion storms will continue. It would be better to hand it over to professional managers.

Professional managers seek to avoid mistakes, while founders seeking to achieve merit are truly frightening.

Binance Continues to Win Effortlessly, Crypto Liu Xiu

Liu Xiu is different from Liu Bang, he is lucky. Liu Xiu is different from Liu Bei, he is lucky.

If luck could be a person's synonym, it would be because opponents contributed their misfortune.

Current exchanges are not doing well. Bybit struggled after being hacked, Bitget faced retail investor criticism, Gate/Matcha are doing small-scale business, Huobi belongs to Sun, Coinbase and Kraken are rooted in the US.

Not to mention Deribit has been sold to Coinbase. A new round of exchange integration has begun. With trading enthusiasm already low, the competition is about making fewer mistakes, stabilizing customer base, not embarking on new journeys.

The only ones capable of competing with Binance were centralized OKX and "decentralized" Hyperliquid, but now only the latter remains.

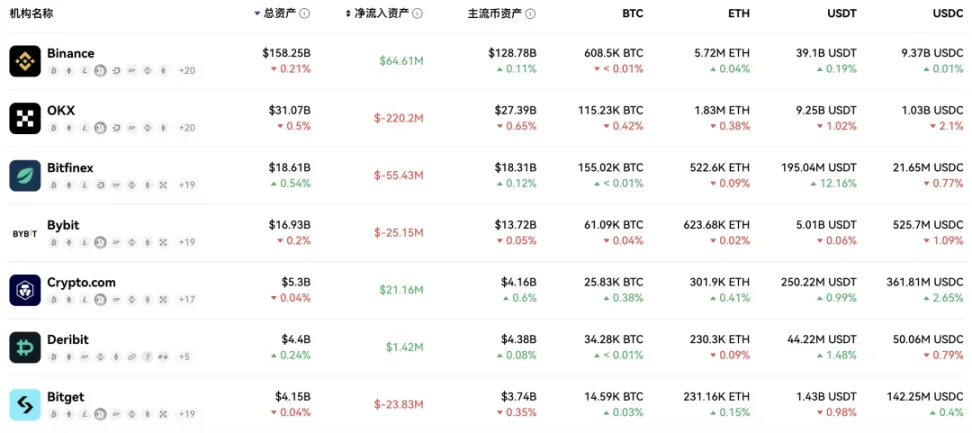

Image caption: Exchange 24H capital flow, image source: @OKLink_CN

Not using defillama data, OKLINK's own data shows OKX is experiencing asset outflows. While withdrawal movements have only "killed" FTX before, that was the once-famous FTX.

The market criticizes Binance, and other competitors are working hard. For example, Bybit actively participates in the Solana ecosystem, with its Perp DEX Byreal using Solana technology stack, first supporting xStocks stock trading.

All exchanges must consider how to operate under compliance, which is not an easy task.

Compliance issues since 2022 involved high leverage for BitMEX, FTX, and Binance - a moral issue, money laundering a legal issue, offshore a operational issue.

Now, only Binance maintains the composure of an old artist. FTX has vanished, BitMEX is nominal. If you think compliance is just talk, you clearly underestimate its dangers.

Previously, Binance withdrew its Hong Kong exchange license application because it couldn't include mainland customers. Hong Kong is serious about compliance. Many offshore exchanges chose to "preserve market, abandon license", and OKX HK also withdrew its license application at the time.

In this era, exchanges are anxious - wanting to comply and get licensed while facing the real impact of DEX.

The latter's pain, regulators won't understand. It can be predicted that licensed CEX will next attack unlicensed DEX. Believe me, Coinbase, which can launch Stand With Crypto and target congressional members, can also target Hyperliquid.

Binance is working on Alpha, stabilizing the wallet market stolen from OK, expanding BSC, occasionally ambushing Hyperliquid, and thus outrunning everyone.

OK's wallet and product tactical success ultimately facilitated Binance's strategic effortless win. Who can judge its merits and faults?

Conclusion

Surviving in the crypto world, the difficulty of avoiding fate, metaphysics, and political topics decreases successively. With a scientific and rational attitude, we can explain cosmic motion and tidal changes, but it's hard to explain why a certain cryptocurrency rises or why OKX fights with users.

We can only sigh: it's not that the opponent is too strong, but that peers are too stupid.