Author: Marco Manoppo

Translated by: TechFlow

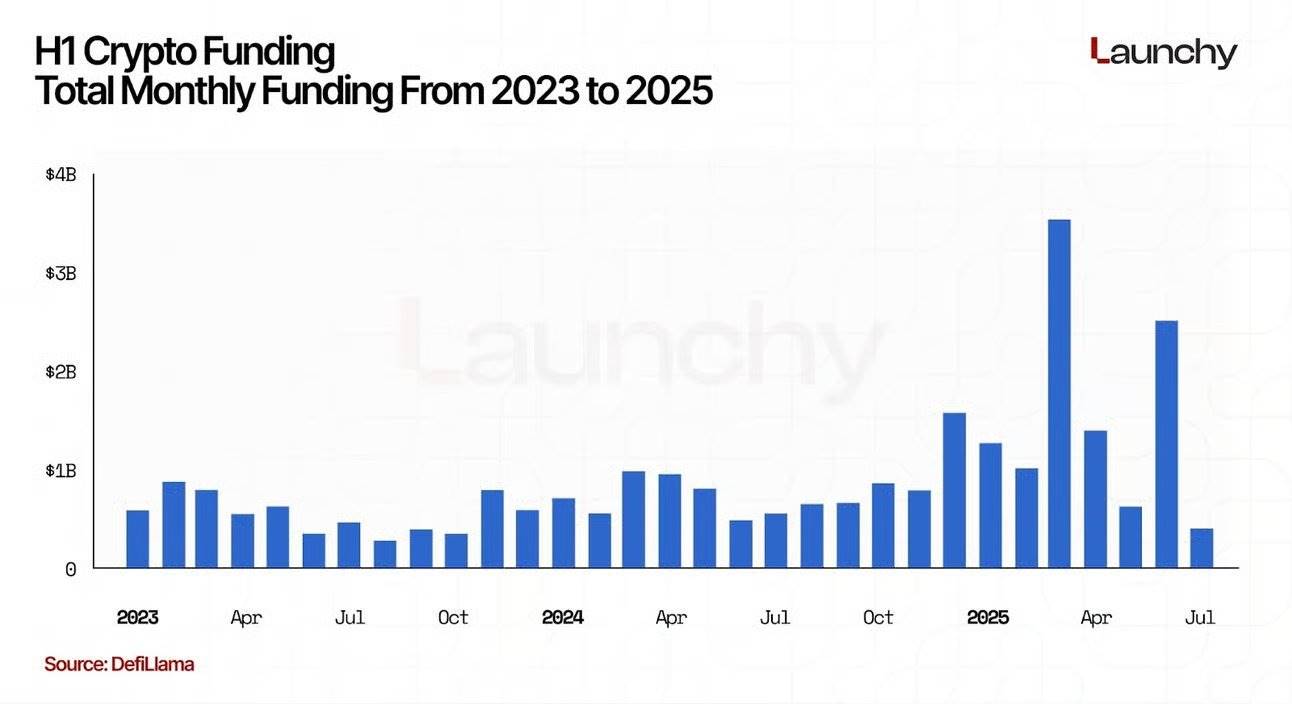

The first half of 2025 marks a turning point for cryptocurrency venture capital. After two years of capital tightening and investor caution, funds have surged. As of June 30, disclosed cryptocurrency financing has exceeded $37 billion, with over 150 tracked transactions covering seed, A-C rounds, strategic rounds, and IPOs. Despite regulatory uncertainty and ongoing token price volatility, institutional and venture capital confidence in the industry has strongly returned.

Key Points:

• Disclosed cryptocurrency financing in the first half of 2025 exceeded $37 billion, making it one of the most active periods since the 2021 bull market, with over 150 tracked transactions.

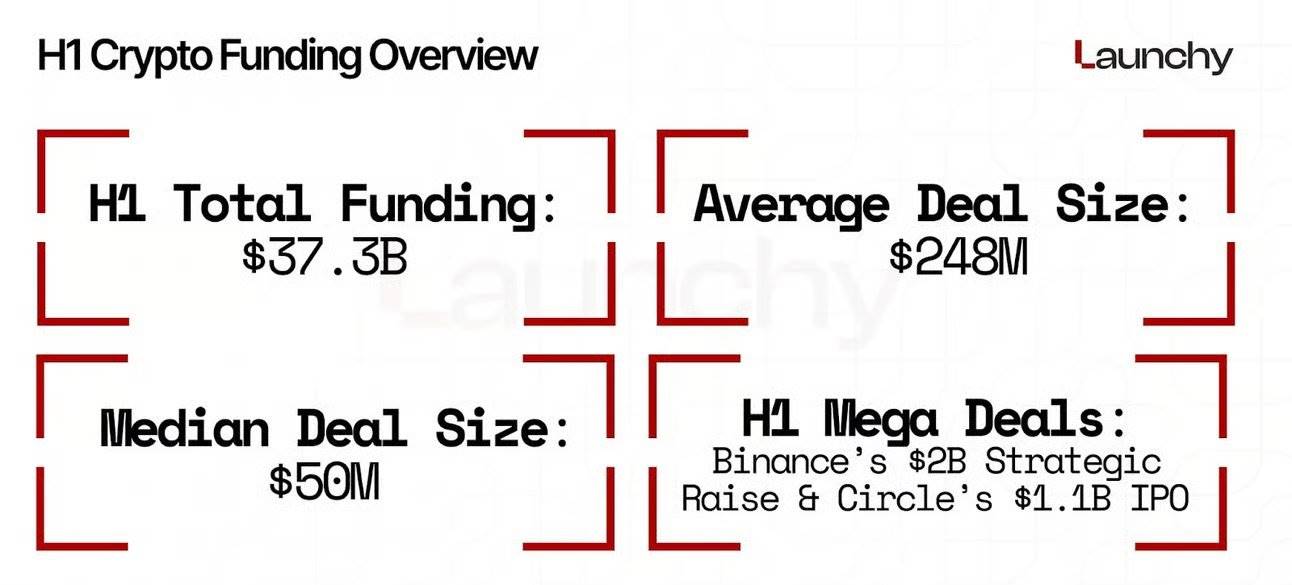

• Large-scale financings like Binance's $2 billion strategic funding and Circle's $1.1 billion IPO pushed the average transaction size to $248 million, demonstrating renewed market confidence in mature platforms.

• Most funds have shifted from consumer applications and speculative projects to scaling solutions, compliance infrastructure, and cross-chain protocols.

• Approximately $700 million flowed into crypto projects related to AI, indicating investors view this as the next critical innovation frontier.

• Top investors like a16z crypto, Paradigm, Pantera, Galaxy Digital, and Sequoia occupied about 40% of the highest valuation rounds, currently wielding significant influence over the crypto industry's development direction.

Total Financing Overview

Between January and June 2025, crypto and blockchain startups raised approximately $37.3 billion in disclosed funding.

The average transaction size was around $248 million, significantly higher than previous years. This average was influenced by several large funding rounds and IPOs, such as Binance's $2 billion strategic financing and Circle's $1.1 billion IPO. The median transaction size was close to $50 million, reflecting that most funding rounds remain within the mid-market range.

This total financing makes the first half of 2025 one of the most active periods since the 2021 bull market. Notably, a substantial amount of funds flowed into infrastructure and scaling solutions, rather than just consumer application sectors.

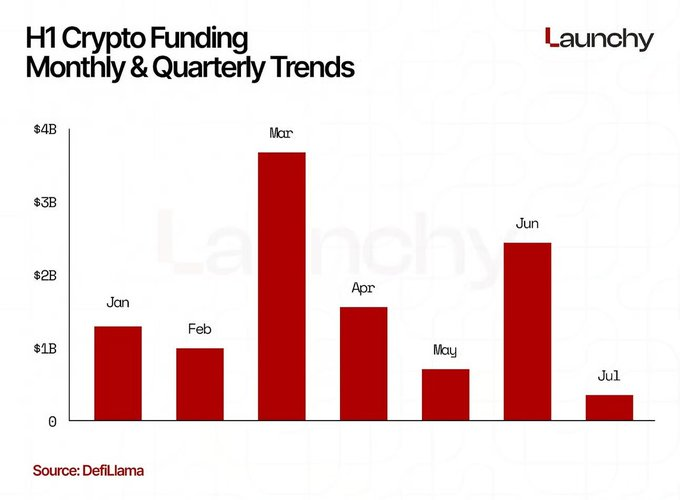

Monthly and Quarterly Trends

Financing amounts varied monthly, with March being the strongest. In March alone, driven by large strategic rounds and pre-IPO financing, companies raised an estimated $8 billion.

January and February combined saw financing of around $9.4 billion, while April slightly slowed down to about $4.5 billion.

In May and June, financing activities rebounded, each exceeding $5 billion, primarily from late-stage transactions and Circle's IPO.

Quarterly, the first quarter saw financing near $17.4 billion, with the second quarter adding another $15.9 billion. While the first quarter was driven by early-year momentum and Binance's financing, the second quarter's financing was more broadly distributed across scaling infrastructure, custody solutions, and DeFi.

This pace suggests investors made financing decisions early in the year, possibly to lock in valuations before further token price increases.

Industry Segments and Analysis

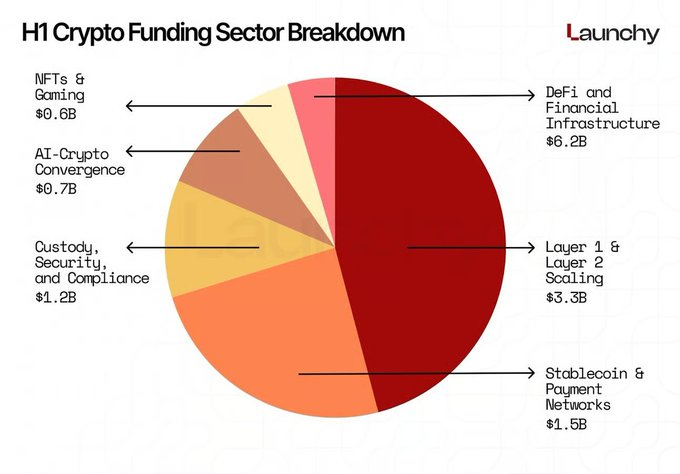

Analyzing fund allocation across industries reveals investor perspectives on long-term value:

• DeFi and financial infrastructure attracted the largest share, over $6.2 billion. Institutional DeFi protocols focusing on compliant lending, derivatives, and liquidity provision were particularly popular.

• Layer 1 and Layer 2 scaling solutions received around $3.3 billion. EigenLayer, LayerZero, and other protocol-focused projects were the biggest beneficiaries, reflecting investor belief that Ethereum scaling and cross-chain interoperability remain unresolved opportunities.

• Custody, security, and compliance solutions attracted over $1.2 billion, highlighting the importance of trusted infrastructure amid tightening regulatory requirements.

• Stablecoins and payment networks received about $1.5 billion, indicating continued capital support for projects linking fiat and on-chain liquidity.

• AI-Crypto convergence emerged as a rapidly growing theme, with approximately $700 million invested in projects combining large language models, decentralized computing, and token incentives.

• Compared to 2021-2022, NFT and gaming sector financing remained subdued, totaling around $600 million, underscoring the market's shift from speculative collectibles to more utility-focused applications. In short, capital has decisively moved from pure consumer hype cycles to infrastructure, compliance tracks, and expanded ecosystems.

Notable Financing Rounds

Several major financing rounds dominated headlines and capital flows. Binance's $2 billion strategic financing in January immediately set the tone for this year's financing market, indicating that even mature exchanges still command significant investor confidence. Circle's $1.1 billion IPO became the largest public exit in the first half of the year, confirming the stablecoin model as viable and revenue-generating. Simultaneously, Binance and Circle's funding rounds were the second and third largest in cryptocurrency history.

Other notable financing rounds include TON's $400 million strategic financing, Phantom's $150 million C-round, and LayerZero's $150 million investment. These financings alone accounted for a quarter of the first half's total funding.

A significant dynamic: Almost all major financing rounds attracted top investment firms like a16z crypto, Paradigm, Sequoia Capital, and Pantera Capital, signaling that mainstream venture capital funds continue to concentrate equity in industry-leading companies.