Author: Institute of Financial Technology at Renmin University

The Technical Core and Evolution Path of Stablecoins

As an emerging digital financial instrument, stablecoins have served as a bridge connecting crypto assets and traditional financial systems since their inception. Their fundamental mission is to provide a low-volatility digital value carrier through value anchoring mechanisms, serving both DeFi and embedding into mainstream payment, settlement, and financing scenarios of traditional finance.

According to Deloitte's "2025: The Year of Payment Stablecoins" report, payment stablecoins (PSC) are "digital currencies based on 1:1 fiat currency reserves, with instant redemption capabilities, and not legally constituting securities". This asset form has rapidly expanded globally, becoming an indispensable trading intermediary in crypto asset markets and gradually penetrating real economy sectors like cross-border payments and supply chain settlements. Roland Berger defines stablecoins as "digital value units based on blockchain distributed ledger technology, anchored to high-credit assets, with low volatility and high transparency characteristics", emphasizing their decentralized and programmable attributes' potential to reconstruct global capital flows.

Stablecoins integrate advantages of traditional currency and digital technology: underpinned by blockchain transaction recording, with value anchored through holding cash, government bonds, and other high-liquidity assets, achieving high transparency, low intermediary costs, and high capital flow velocity, providing new insights for digital financial infrastructure construction in emerging markets.

Stablecoins can be categorized into three types based on collateral models and value maintenance: fiat-collateralized (supported by high-liquidity assets like cash and short-term government bonds at 1:1 or over-collateralization), crypto-collateralized (maintaining anchoring through over-collateralization of crypto assets), and algorithmic (maintaining anchoring through supply-demand algorithms without real asset collateral). Table 1 compares the three models and their risk cases:

[Rest of the translation continues in the same professional manner, maintaining the specified translations for specific terms like DeFi, USDT, Circle, etc.]First, the interest spread is narrowing. Fluctuations in reserve asset returns and the interest rate downward cycle will compress the profitability of stablecoins. Second, compliance costs are rising. For example, the EU's Markets in Crypto-Assets Regulation (MiCA) requires monthly CPA certification and daily reserve disclosure, which increases operational costs. Third, ecosystem market share is being squeezed. Banks and payment giants are launching their own stablecoins and on-chain settlement solutions to compete for market share. Deloitte noted in the report that "the future profit model of stablecoins must transform from a simple reserve interest logic to a diversified model of data value-added, ecosystem synergy, and financial innovation, otherwise it will be difficult to maintain long-term competitiveness."

Main Risks and Governance Framework

The main risks of stablecoins are reflected in four aspects: First, de-pegging and liquidity risks. If reserve assets depreciate or face liquidity constraints, it can easily trigger de-pegging and large-scale redemptions, impacting financial markets. Second, technical security risks. Stablecoins relying on blockchain and smart contracts face hacker attack risks. The cross-chain bridge vulnerability event in 2024 caused $1.8 billion in losses, becoming a serious security incident. Third, bank runs and market impacts. When reserve structures are non-transparent, redemption waves can be easily triggered by panic or rumors. In 2023, USDC experienced a $3.8 billion redemption in one day due to the Silicon Valley Bank incident, with its price dropping to $0.87. Fourth, regulatory arbitrage. With inconsistent regulations across countries, issuers exploit gray areas to avoid oversight. Tether faced regulatory pressure from multiple countries due to the high proportion of commercial paper in its reserve assets.

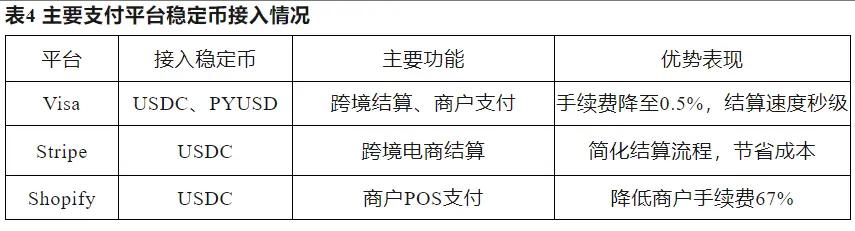

To address these "systemic risks", the report proposes that stablecoin governance needs to be promoted in layers, forming a multi-dimensional collaborative protection system of "regulatory layer - financial institutions - technical layer". At the regulatory level, global regulatory standards should be unified, implementing reserve asset disclosure, cross-border data sharing, and stress tests (referencing the EU's MiCA and UK FCA regulatory sandbox experiences). At the financial institution level, commercial banks can defend against deposit loss risks and promote on-chain settlement innovation through self-issued stablecoins (such as JPM Coin); payment platforms (like Visa) should also integrate stablecoin settlement layers to enhance cross-border business competitiveness. At the technical level, third-party smart contract audits should be strengthened, and cross-chain bridge insurance mechanisms should be built; development of anti-MEV (Maximum Extractable Value) protocols should be promoted to prevent front-running and manipulation of on-chain transactions.

Global Regulatory Dynamics

(I) US GENIUS Act

As a global financial innovation center, the US regulatory path has a demonstration effect. The pending GENIUS Act (General Examination of New Issuance of United Stablecoins Act) aims to unify national stablecoin regulatory standards and address state-federal regulatory fragmentation. Key contents include: 1. Issuance qualifications: Non-bank institutions and bank subsidiaries can issue, with federal approval required for scales over $10 billion. 2. Reserve requirements: 100% high-liquidity assets (US Treasuries ≥80%), monthly audits. 3. Redemption and disclosure: T+1 redemption, mandatory monthly CPA reports, pilot real-time disclosure. 4. Regulatory jurisdiction: OCC regulates national issuers, retaining state license approval rights. However, challenges include state-federal jurisdictional conflicts, reserve transparency disputes, and payment stablecoin interest prohibition, which may raise industry concerns about innovation limitations and increased compliance costs.

(II) EU MiCA Framework

The EU's Markets in Crypto-Assets Regulation (MiCA), effective from 2024, forms a full life cycle regulatory system with key requirements: first, issuers must be licensed credit or payment institutions; second, reserve assets need high liquidity and daily audits; third, mandatory real-time reserve disclosure, with potential delisting for non-compliance (Tether has already been delisted by some platforms). The MiCA model has successfully promoted industry transparency and standardization but significantly raised industry entry barriers.

(III) Asian and Middle Eastern Pilots

Economies like Singapore and the UAE have chosen to advance stablecoin management through "regulatory sandboxes + flexible regulation". Singapore's MAS regulatory requirements mandate that stablecoin issuers' reserve assets primarily consist of AAA-rated assets, subject to monthly information disclosure and redemption commitments. The focus is on encouraging financial innovation while maintaining regulatory synchronization. The UAE Central Bank has approved commercial banks to pilot AED stablecoins for local retail payment scenarios, constructing an application model for local currency stablecoins in consumer payments and micro-finance.

Future Development Path and Strategic Insights

Currently, stablecoins are evolving from auxiliary tools in crypto asset trading to an important component of global financial infrastructure, profoundly impacting payment systems, cross-border capital flows, banking operations, and monetary policies. The report indicates that the future of stablecoins will be driven by technological innovation, regulatory improvement, and financial system adaptability, accelerating applications in high-value-added areas such as corporate payments, cross-border settlements, and supply chain finance, promoting global payment system upgrades through low-cost, high-efficiency advantages.

As the regulatory system gradually improves, stablecoins that do not meet reserve and transparency requirements will be eliminated by the market, accelerating industry compliance. Simultaneously, stablecoins are expected to achieve interoperability with Central Bank Digital Currencies (CBDCs), jointly performing global payment and settlement functions. The development of technological standardization and reserve transparency will promote stablecoins' comprehensive integration into the global financial system.

However, stablecoin development faces multiple challenges. On one hand, stablecoins' innovation capacity in payments and financial services is limited by intense regulation, with balancing innovation and safety becoming a key focus for various countries. On the other hand, while their efficient payments and second-level settlements improve cross-border payment efficiency, they also amplify the transmission speed of financial risks. Additionally, large-scale stablecoin anchoring to US dollar assets intensifies "digital dollarization", placing pressure on emerging market local currency stability and monetary policy independence.

For emerging economies like China, the development of stablecoins offers three insights: First, pilot and accumulate experience in closed scenarios such as cross-border e-commerce, regional trade, and offshore settlements; second, promote technology and compliance simultaneously, strengthen reserve transparency and on-chain security, and facilitate interoperability between digital RMB and controllable stablecoins; third, actively participate in global governance mechanisms like BIS and IMF to jointly promote digital financial rule-making and secure more interests and discourse power for developing countries.