Original Title: 'Wall Street Chases Crypto, Ethereum's Moment of Glory'

Original Author: MONK

Original Translation: TechFlow

Trading code is $ETH.

Wall Street is experiencing a moment of glory in cryptocurrency.

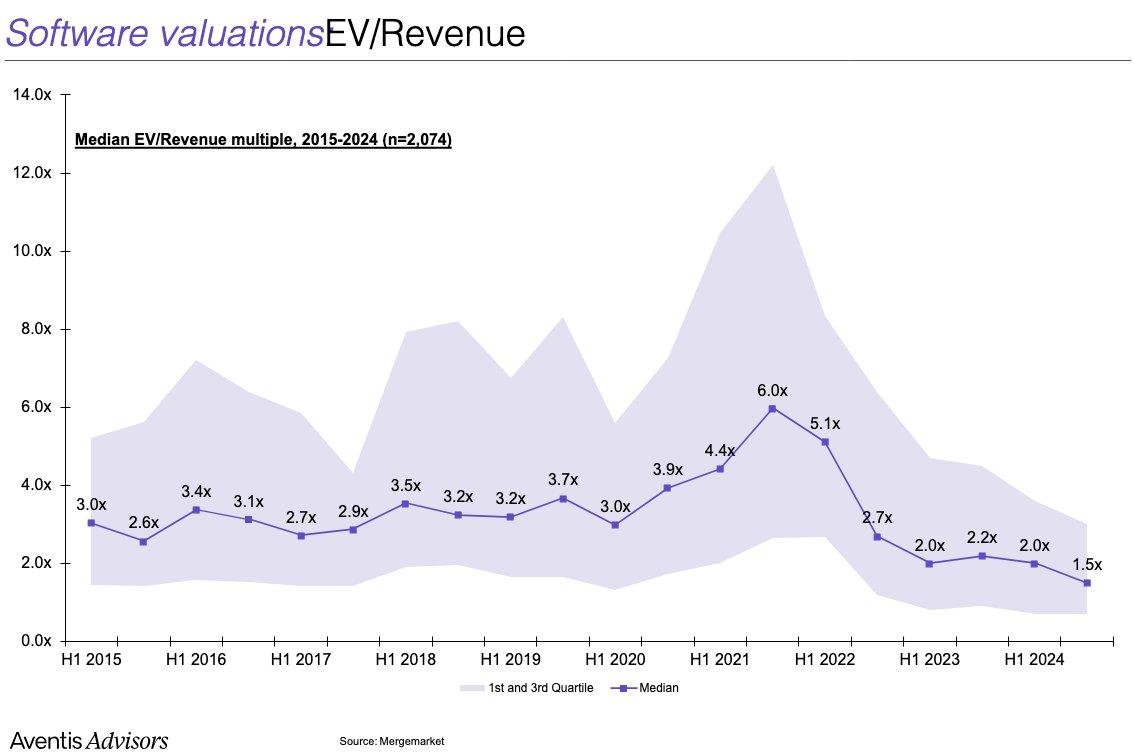

Traditional Finance (TradFi) is running out of growth narrative resources. Artificial intelligence has become the market's hot spot, but its attention has been excessive, and software companies are no longer as attractive as they were in the 2000s and 2010s.

Deep down, growth investors who raise capital for innovative stories and large serviceable markets (TAM) know that most AI-related companies are valued at ridiculous premiums, and other so-called "growth" narratives are no longer easy to find. The once-revered FAANG stocks are gradually transforming into "high-quality, profit-maximizing, medium-growth" composite assets.

For example, the median enterprise value to revenue (EV/Rev) multiple for software companies has dropped below 2.0 times.

At this moment, cryptocurrency enters the stage.

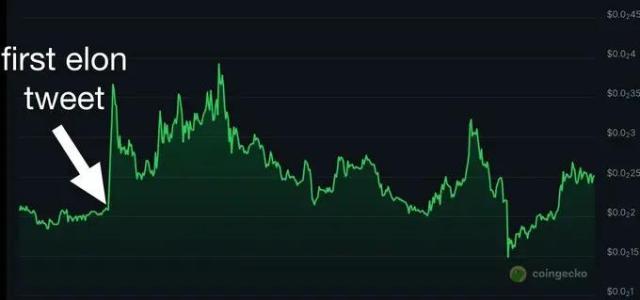

Bitcoin ($BTC) breaks historical highs, the US President strongly promotes our assets at a press conference, and a wave of regulatory benefits brings cryptocurrency assets back into the spotlight for the first time since 2021.

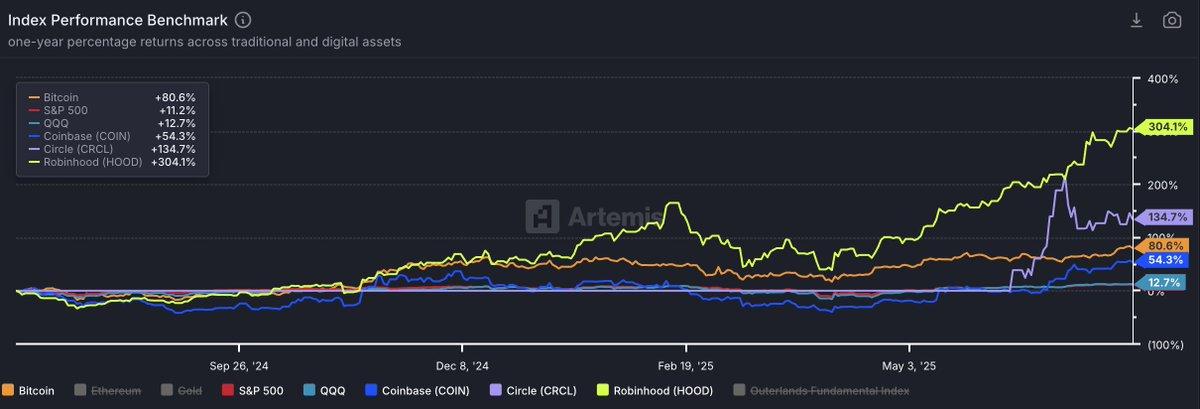

BTC, COIN, HOOD, Circle vs. SPY and QQQ (Source: Artemis)

This time, the protagonists are not Non-Fungible Tokens and Doge. This is the era of digital gold, stablecoins, "tokenization," and payment reform. Stripe and Robinhood are claiming that cryptocurrency will be their next core growth focus; $COIN (Coinbase) has successfully joined the S&P 500 index; Circle shows the world that cryptocurrency is attractive enough to make growth stocks ignore earnings multiples again.

But how is this related to $ETH?

For us crypto natives, the smart contract platform domain looks very fragmented. There's Solana, Hyperliquid, and dozens of emerging high-performance blockchains and Rollups (on-chain scaling solutions).

We know that Ethereum's leading position has been truly challenged, and it faces an existential threat. We also know it has not yet solved the value capture problem.

But I highly doubt Wall Street understands these nuances. In fact, I can boldly say that most Wall Street investors know almost nothing about Solana. If we're honest, XRP, Litecoin, Chainlink, Cardano, and Dogecoin probably have higher external market recognition than $SOL. After all, these people have been indifferent to the entire cryptocurrency asset class for years.

What Wall Street knows is that $ETH represents the "Lindy effect" (indicating that things that have long existed are more likely to continue existing), has been battle-tested, and has been the primary "beta investment choice" for $BTC for years. Wall Street sees that $ETH is the only other cryptocurrency asset with a liquidity ETF. Wall Street is keen on upcoming catalysts and classic relative value investing.

Those suit-wearing investors may not know much about cryptocurrency, but they know that Coinbase, Kraken, and now Robinhood have all decided to "build on Ethereum". With minimal due diligence, they can discover that the largest stablecoin pool is on the Ethereum chain. They will start calculating "moon math" and quickly realize that while $BTC has reached historical highs, $ETH is still more than 30% below its 2021 peak.

You might think the relatively poor performance looks pessimistic, but these people have different investment approaches. They are more willing to buy assets with lower prices and clear objectives rather than chase high assets that make them question whether they've "missed the opportunity".

I believe they have arrived. Investment authorization is not an issue; any fund can drive cryptocurrency exposure through appropriate incentives. Although Crypto Twitter (CT) has claimed for over a year that they won't touch $ETH, the trading code has performed consistently well over the past month.

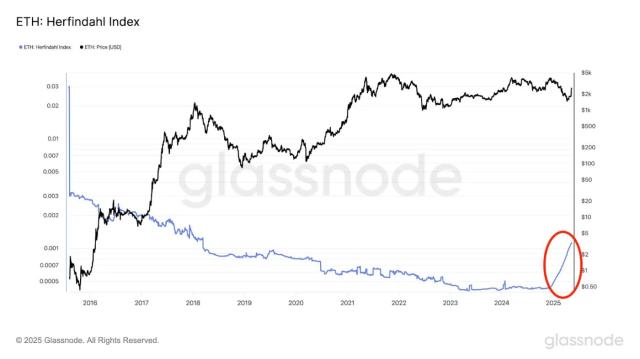

As of this year, $SOLETH has dropped nearly 9%. Ethereum's market dominance bottomed in May and has since created the longest upward trend since mid-2023.

If the entire Crypto Twitter (CT) has marked $ETH as a "cursed coin", why is it still performing excellently?

The answer is: it's attracting new buyers.

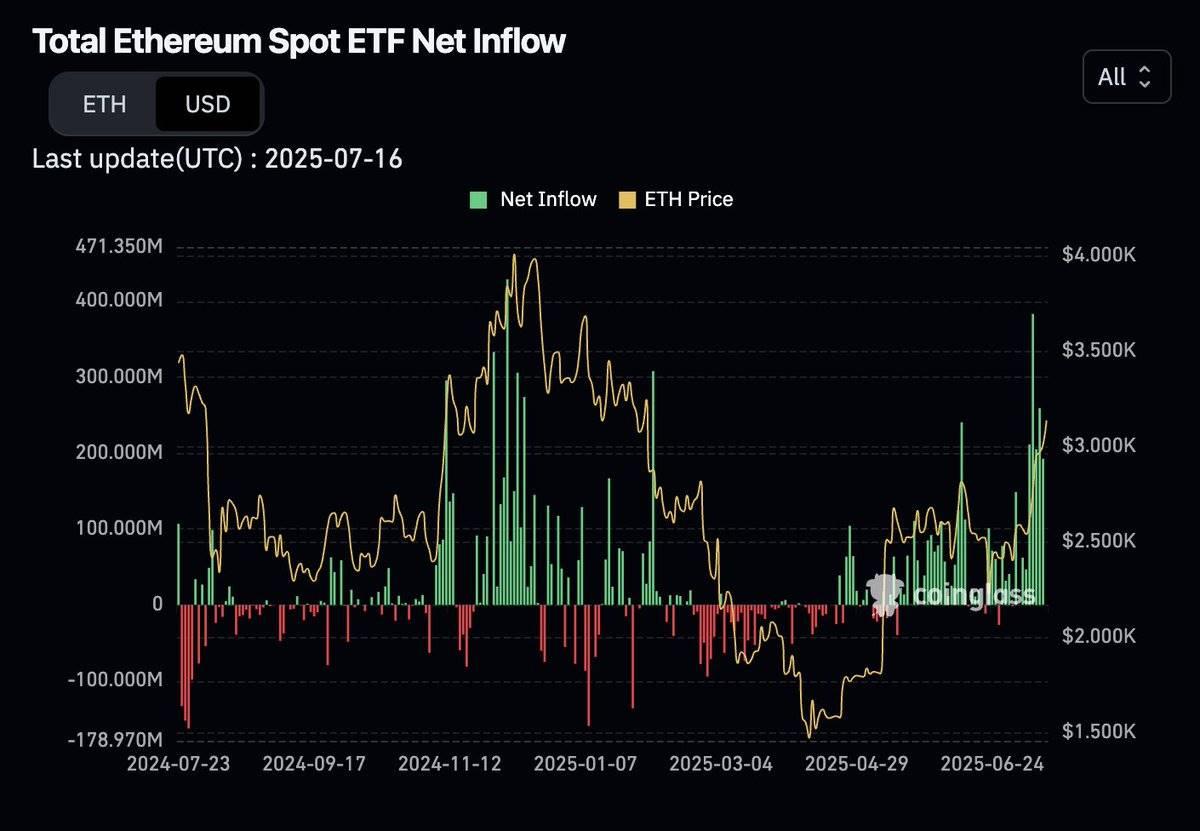

Since March this year, spot ETF capital inflows have been consistently unidirectional.

Source: Coinglass

Similar to $ETH's MicroStrategy clones are heavily adding positions, introducing early structural leverage to the market.

Perhaps some cryptocurrency natives realize their insufficient $ETH exposure and are starting to rebalance positions, possibly exiting $BTC and $SOL, which have performed outstandingly in the past two years, and instead positioning in Ethereum.

I'm not saying Ethereum has solved its existing problems. I think what might happen at this stage is that $ETH as an asset begins to decouple from the Ethereum network itself.

External buyers are driving a paradigm shift in the $ETH asset, challenging our inherent perception that it "will only decline". Shorts will eventually be forced to close. Then, native crypto capital will start chasing the trend until a comprehensive speculative frenzy about $ETH emerges in the market, ending with a spectacular top.

If all this really happens, then the all-time high (ATH) won't be too far away.