Original Author | @0x Artikal

Compiled by | Odaily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

This content is compiled from two tweets by @0x Artikal and compiled by Odaily. As the current market continues to heat up, this article attempts to provide market participants' observations and judgments from the perspective of capital flow and cycle evolution, listening to the market's voice. The views in this article are for reference only and do not constitute any investment advice.

Bitcoin broke through its historical high, with prices reaching as high as $123,000. This trend has sparked market divergence: some investors are bullish to $200,000, believing there is still room for growth, while others believe it is close to the cycle top and recommend taking profits.

However, compared to these market sentiments, the data itself is more worth paying attention to. Analysis of trading behavior and capital flows shows that the current market is far more complex than it appears on the surface.

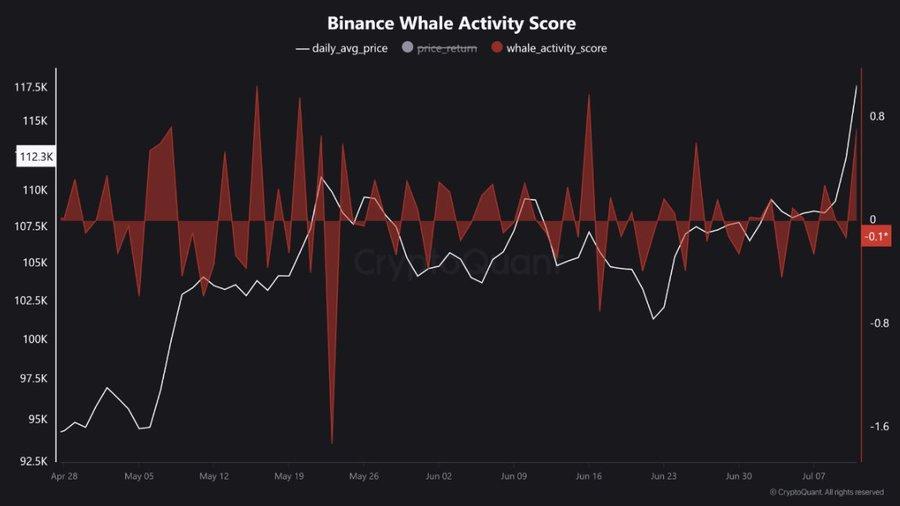

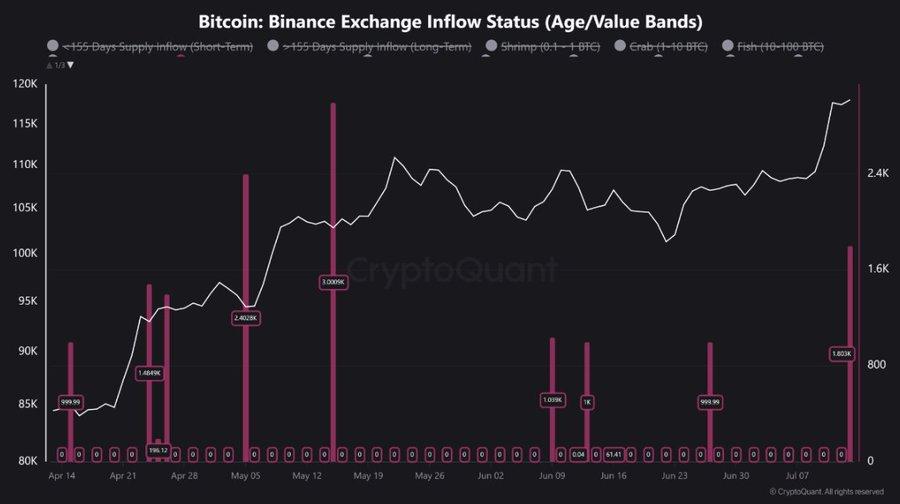

While BTC surged to a new high, significant changes occurred in whale behavior on Binance. The whale activity indicator suddenly rose, indicating that market sentiment might be turning. In just one day, over 1,800 BTC were net inflows to Binance, meaning large amounts of funds are flowing to more liquid trading platforms.

Further observation reveals that over 35% of these inflows came from single transactions exceeding $1 million, clearly not from retail investors. Extensive data indicates this is a collective response from several large investors, with extremely high coordination.

Additionally, data shows most of these transferred coins have been held for less than three months, indicating strong speculative intent. However, some long-term holders who have held tokens for over a year are also transferring tokens to exchanges, casting uncertainty on the market's future direction.

The first scenario is a typical profit-taking. Immediately transferring BTC to the exchange after reaching a new high likely means investors intend to cash out profits. This operation is not uncommon, as they tend to lock in profits at high points and wait for an opportunity to re-enter the market. If this trend continues, the market may experience a mild callback in the next few days.

The second possibility is more strategic. These large fund movements might be for risk hedging or establishing leveraged positions using Binance's deep liquidity. This means these large investors may expect further market volatility and are preparing for the next market phase. If so, even if a short-term adjustment occurs, its magnitude might be small, and the market is likely to quickly rebalance.

More notably, this capital flow involves both short-term speculators and long-term holders, indicating that multiple large participants are likely synchronously executing a strategy. In just one day, over 1,800 BTC were transferred to Binance, which cannot be underestimated in terms of short-term platform liquidity and significantly enhances market sensitivity to large orders.

These whale operations are likely strategically aimed at capturing trend turning points. At such critical psychological nodes, collective actions by large investors often create pressure on retail investor sentiment. As prices reach new highs, market sentiment oscillates dramatically between excitement and tension, further catalyzing speculative atmosphere and increasing short-term volatility probability.

Simultaneously, Binance's overall liquidity is also rising, attracting more institutional traders. For these professional players, the ability to quickly establish and flexibly close positions is crucial. At the current stage, whale behavior almost determines the overall market sentiment and price direction. Therefore, for all investors, closely tracking capital flows, especially real-time large transfer movements, becomes particularly important.

Whether the market chooses to callback or continue oscillating upward, one thing is certain: current volatility is increasing, and risks are escalating. Any subtle changes in sentiment and liquidity are almost instantly reflected in prices. The entire market is in an extremely sensitive period where even minor events could become a fuse for market movement.

We have previously witnessed a single whale's operation on Binance triggering a new round of Bitcoin breakthrough. This fully demonstrates that large capital behavior has a decisive impact on market structure.

For long-term investors, this might not be a "sell-off" signal, but more like a test of trend resilience. Large amounts of BTC transferred to exchanges are likely strategic position adjustments rather than massive withdrawal. Of course, short-term violent fluctuations are almost unavoidable and might be a window for asset reallocation and position optimization.

Currently, the market is in a delicate balance: profit realization and strategic deployment coexist. In the coming days, the movements of large investors on Binance and changes in overall liquidity environment will continue to dominate market rhythm. Investors need to remain highly alert and always be prepared to adjust strategies based on market dynamics.

After all, Bitcoin remains in the spotlight, and its every move still affects the entire crypto market's nerves.

Note: This tweet was published on July 17, 2025

Cyclical Market Structure Evolution Path

If we look at the typical evolution path of past crypto market cycle structures, how do we define our current position?

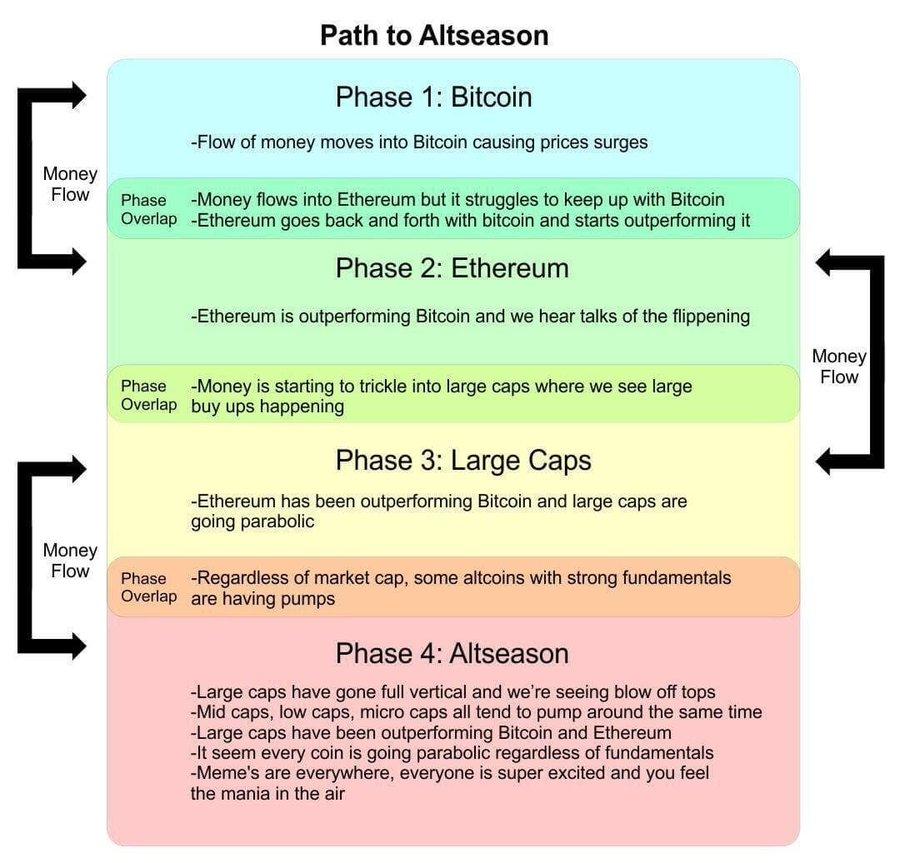

While BTC leads the price breakthrough, ETH begins to show relatively strong signs. From the ETH/BTC trend, the exchange rate has broken through the oscillation range of several months, which is the first signal of the rotation structure officially unfolding.

Typically, market rotation always unfolds along this path: BTC leads → ETH follows → High market cap coins catch up → Eventually bringing a comprehensive altcoin season. ETH outperforming BTC indicates that market liquidity is flowing from the BTC-dominated structure to the next stage represented by ETH.

BTC usually initiates the offensive first, and when ETH starts to catch up or even perform stronger, it represents broader funds' willingness to bear higher risks. ETH is not just ETH, but also a "bridge" to DeFi and other altcoins. Its strength means the market's confidence is recovering.

After ETH gains momentum, high market cap projects like SOL, XRP, and ADA have successively shown strong buying pressure, typically serving as "index-type" alternative bets after ETH. Once these coins start, funds will continue flowing to mid-cap projects under $1 billion, with retail attention soaring and market narratives changing daily. Traders will accelerate fund rotation to seek higher Beta returns.

Mining coins (such as DCR) typically follow after mid-cap coins start, at which point the market enters a highly reflexive state: the faster the price rises, the more inflows, and the more inflows, the faster the price rises. This stage is the breeding ground for Memecoin to potentially create short-term parabolic trends.

This entire rhythm is essentially a natural chain of "liquidity sinking". Starting from BTC's lead, funds gradually migrate: from BTC to ETH, mainstream altcoins, mid-cap coins, and then to Meme and small-cap tokens. In this process, volatility and market acceleration continuously increase.

From a structural perspective, we are standing at the starting point of the "ETH phase": rotation is emerging, not yet overheated, with the opportunity window still open. ETH's strength will further drive liquidity to continue migrating downward, while retail FOMO sentiment has not yet been fully ignited. The fear and greed index remains at 60-65, with room still available before reaching extreme emotions. This also means that this cycle still has sufficient upward potential.

The market direction has become very clear: BTC has lit the fuse, ETH is taking over and accelerating, and high-market-cap tokens will quickly catch up. After this, the true comprehensive altcoin season will arrive as scheduled, with mid-cap coins, Memecoin, and various concept coins taking turns, until all liquidity is exhausted.

ETH's leading performance is not only a confirmation of the trend but also the starting point of the next stage.