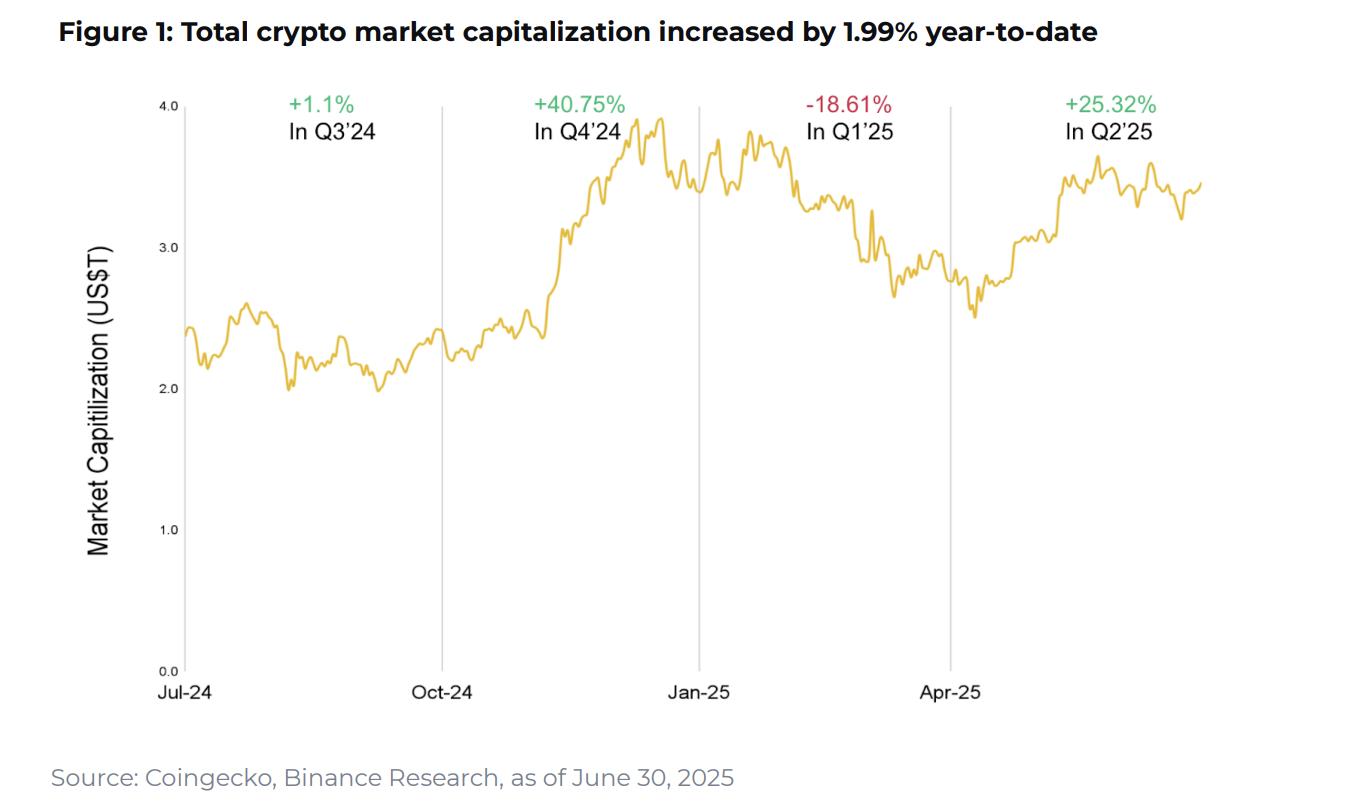

According to the report from Binance Research, the total cryptocurrency market capital has slightly increased by 1.99% since the beginning of the year. This figure may not be impressive compared to previous price increases.

However, it reflects the cautious optimism of investors. Experts consider this a positive signal in the context of macroeconomic uncertainty and the prolonged impact of strong corrections from 2022 to 2023.

Modest Growth with Hidden Variables

A notable highlight from the report is the clear differentiation between the two quarters this year.

In the first quarter of 2025, the market dropped significantly by 18.61%, affected by multiple factors. These include negative sentiment after a prolonged correction, tightened venture capital, and concerns about global macroeconomic recovery.

However, entering the second quarter, the market quickly recovered with a growth rate of 25.32%. This growth completely offset the previous decline and also brought new optimism to the entire industry.

Total cryptocurrency market capital. Source: Binance

Total cryptocurrency market capital. Source: BinanceThe strong recovery in the second quarter can be attributed to several key factors.

First, the US monetary policy has stabilized after a series of interest rate increases in previous years. This stability has helped improve investor sentiment and paved the way for capital to return to high-risk assets like cryptocurrencies.

Second, many large blockchain infrastructure projects, such as Second-Layer Solutions, have made significant progress in technology and user adoption. Additionally, tokenizing real assets (RWA) and AI-integrated DeFi applications have also made notable advances in these areas.

These advances have laid the foundation for unlocking new capital flows into the market.

However, the modest growth of 1.99% in the first half of 2025 also reflects a clear reality: the cryptocurrency market is no longer driven by FOMO as in previous price cycles.

Instead, investors are becoming more cautious, carefully evaluating the sustainability, business models, and actual cash flow potential of each project. As a result, the market is becoming "higher quality", where only projects with genuine capabilities and clear strategies can attract attention.

Recovery in Q2 Brings Hope for the Second Half of the Year

In this context, long-term investment trends are focusing on infrastructure, stablecoins, and projects generating revenue.

Traditional financial institutions continue to experiment with cryptocurrency products through ETFs and RWA. They are also exploring blockchain applications for cross-border payments, driving a wave of integration between traditional finance and digital assets.

Looking at the second half of 2025, the cryptocurrency market faces both opportunities and challenges.

If macroeconomic conditions continue to stabilize and policies supporting blockchain technology are maintained, we can expect a stronger growth phase. However, the potential for market differentiation remains high.

Projects following trends but lacking fundamental value may be quickly eliminated, paving the way for projects capable of delivering real value and long-term impact.