Welcome to Asia Pacific Morning Brief—a newsletter summarizing overnight cryptocurrency developments affecting regional markets and global sentiment.

Enjoy a cup of green tea and follow this information. BTCD has dropped below 60% in a short time due to altcoin momentum. Changes in Japan's election have promoted discussions about cryptocurrency tax reform, potentially reducing the rate from 55% to 20%. Meanwhile, Jack Dorsey's Block Inc. has joined the S&P 500, confirming the viability of Bitcoin-integrated business models.

Bitcoin Dominance Drops Below 60%

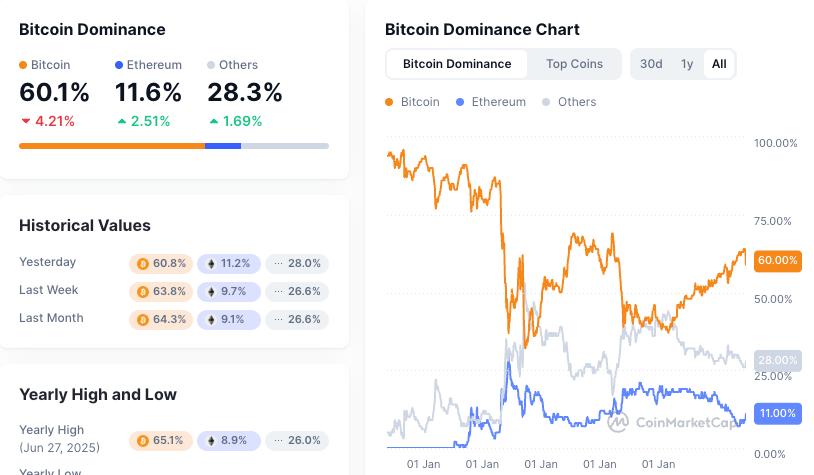

BTCD has dropped below 60% this morning for the first time since March. This index, measuring Bitcoin's market share in total cryptocurrency market capitalization, decreased to 59.8% on Monday morning.

Bitcoin dominance has dropped below 60% this morning. Source: Coinmarketcap

Bitcoin dominance has dropped below 60% this morning. Source: CoinmarketcapThis decline reflects enhanced altcoin performance across major digital assets. Ethereum increased 4% while XRP and Solana rose 2% and 3% respectively. Bitcoin itself dropped 1% during the same period.

Market momentum indicates accelerating portfolio rebalancing towards alternative cryptocurrencies. Thematic tokens have experienced significant surges alongside broader altcoin momentum. The dominance ratio recovered to 60.1% at 01:00 UTC.

Japan Election Promotes Cryptocurrency Tax Reform Momentum

Japan's Liberal Democratic Party suffered its largest electoral defeat in decades. The LDP lost its majority in both parliamentary houses for the first time since 1955. The Komeito alliance partner lacks at least two seats to maintain control in Sunday's upper house election.

This historic change creates unprecedented political instability amid rising living costs and stagnant wages. Prime Minister Shigeru Ishiba faces calls for resignation from within while populist opposition parties gain advantage. Markets anticipate volatility as a weakened government negotiates from a diminished position.

Digital Asset Policy Transition

Election results significantly promote discussions about cryptocurrency tax reform. Opposition parties strongly campaigned on tax reduction platforms, specifically targeting Cryptoassets. The Japan Blockchain Association submitted proposals for separate taxation, replacing the current maximum 55% with a unified 20.315% tax rate.

The current heavy taxation hasn't prevented Japan from ranking fifth globally in cryptocurrency trading volume. Bitcoin-JPY pairs represent the world's third-largest market despite regulatory constraints. Domestic Bitcoin corporate acceptance accelerates, with MetaPlanet becoming the fifth-largest global holder.

Web3 supporter Takahiro Yasuno (right) won his first parliamentary seat. Source: BeInCrypto

Web3 supporter Takahiro Yasuno (right) won his first parliamentary seat. Source: BeInCryptoJapan's household savings of $20 trillion represent a significant untapped investment potential. Substantial tax reduction could stimulate domestic demand, potentially enhancing Bitcoin price momentum. Web3 supporter Takahiro Yasuno won his first parliamentary seat, signaling technology policy priority in the new political landscape.

Block Inc Achieves S&P 500 Milestone

Jack Dorsey's Block Inc will join the S&P 500 on Wednesday, marking institutional recognition of Bitcoin-focused business models. The formerly named Square increased 10% in after-hours trading following the announcement. Block replaces Hess Corporation in the benchmark index.

This milestone follows Coinbase's inclusion two months ago, establishing cryptocurrency-focused enterprises in traditional stock indices. Block operates comprehensive digital asset infrastructure, including self-custody Bitkey wallet and Proto mining services alongside payment platforms.

The company demonstrates strategic Bitcoin commitment through systematic fund allocation. Block invests 10% of monthly Bitcoin profits back into BTC, accumulating 8,584 coins valued around $1 billion. Management has open-sourced their fund allocation plan, allowing businesses to adopt and replicate.

Block's S&P inclusion confirms institutional acceptance of Bitcoin-integrated business models. This achievement represents broader market maturity as traditional indices embrace blockchain-origin companies.

Contributions by Shigeki Mori and Paul Kim.