Author: Jesse

Translated by: TechFlow

I wrote an article about crypto asset management companies earlier this month. If you are not familiar with this topic, I recommend reading that article first, as it builds on most of the same concepts.

The trend of crypto asset management companies represents a shift in how capital flows on-chain (or how value created on-chain flows to investors).

The more these companies invest in other Altcoins (just last week, we acquired TAO and Litecoin), the more market bubble seems to emerge. However, listed companies participating in the ecosystem or other on-chain applications might bring some value, at least for some of the most premium assets in the crypto field.

This article covers the following points:

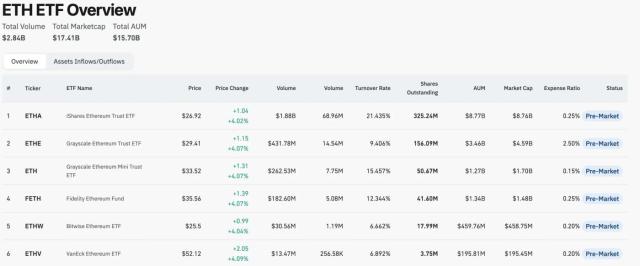

The flexibility and marketization of crypto asset management companies make them superior to ETFs

Crypto asset management companies are the ultimate form of institutional crypto, aligning investors' sales with technological adoption

In many cases, the treasury reserve model alone is insufficient, and teams must balance the ability to build asset financing and extract asset value through DeFi or other infrastructure

Hyperliquid is particularly suitable for this trend, and its ecosystem might be more attractive compared to ETH or Solana

This is in contrast to: $SBET and DeFi protocols: Although they hold more ETH than the Ethereum Foundation, the underlying DeFi they use may have become ossified or managed by a DAO. For example, Lido's staking has been expanded for institutional users. New fund management agencies are unlikely to become design partners of the new Lido. ETH staking remains profitable, but its agency mechanism is lower compared to co-building with the next Lido, which is closer to the reality of super-liquid fund management.

In any case, the further a company is from the underlying DeFi protocol it uses, the fewer opportunities it has to capture value. This also explains why DFDV is promoting a franchise model, where they own the underlying infrastructure of other companies in various regions to build a brand and raise funds to buy SOL.

Summary

Most token asset management companies will not obtain a premium in a bear market, and those companies that do have competitive shared assets will need to delve deeper into the ecosystem to demonstrate that they truly provide unique value.

From this perspective, power law (TechFlow note: In a power law distribution, most events have a very low probability of occurrence, while extremely few events have a very high probability) may benefit some companies focused on specific assets. Companies that cannot fully grasp non-cryptocurrency native demand will need to turn to other assets or on-chain activities. If they cannot do this, their failure modes may vary greatly depending on the company and assets, which may be worth exploring in another article.