Since the end of June, the Crypto industry has sparked a wave of "US stocks on-chain," with Robinhood, Kraken, and others successively launching tokenized versions of US stocks and ETF trading services, even introducing high-leverage contract products for these tokens.

From MyStonks to Backed Finance (xStocks) to Robinhood Europe, they all allow users to trade US stock assets on-chain through "actual stock custody + token mapping" - theoretically, users only need a crypto wallet to trade Tesla or Apple stocks at 3 AM without opening a brokerage account or meeting capital thresholds.

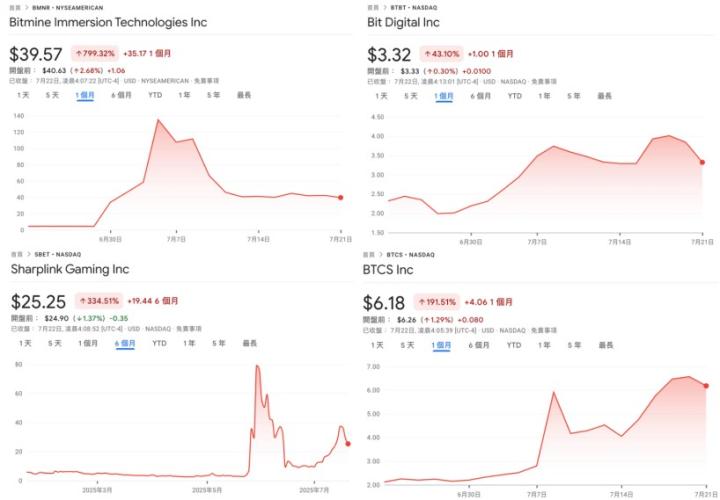

However, with the proliferation of related products, issues like price spikes, premiums, and de-pegging have frequently appeared, quickly exposing underlying liquidity problems: while users can buy these tokens, they can almost never efficiently short, hedge risks, or construct complex trading strategies.

US stock tokenization essentially remains at the initial stage of "only being able to go long".

I. The Liquidity Dilemma of "US Stocks ≠ Tradable Assets"

To understand the liquidity dilemma of this "US stock tokenization" wave, one must first penetrate the underlying design logic of the current "actual stock custody + mapping issuance" model.

This model currently mainly consists of two paths, with the core difference being whether compliance issuance qualifications are possessed:

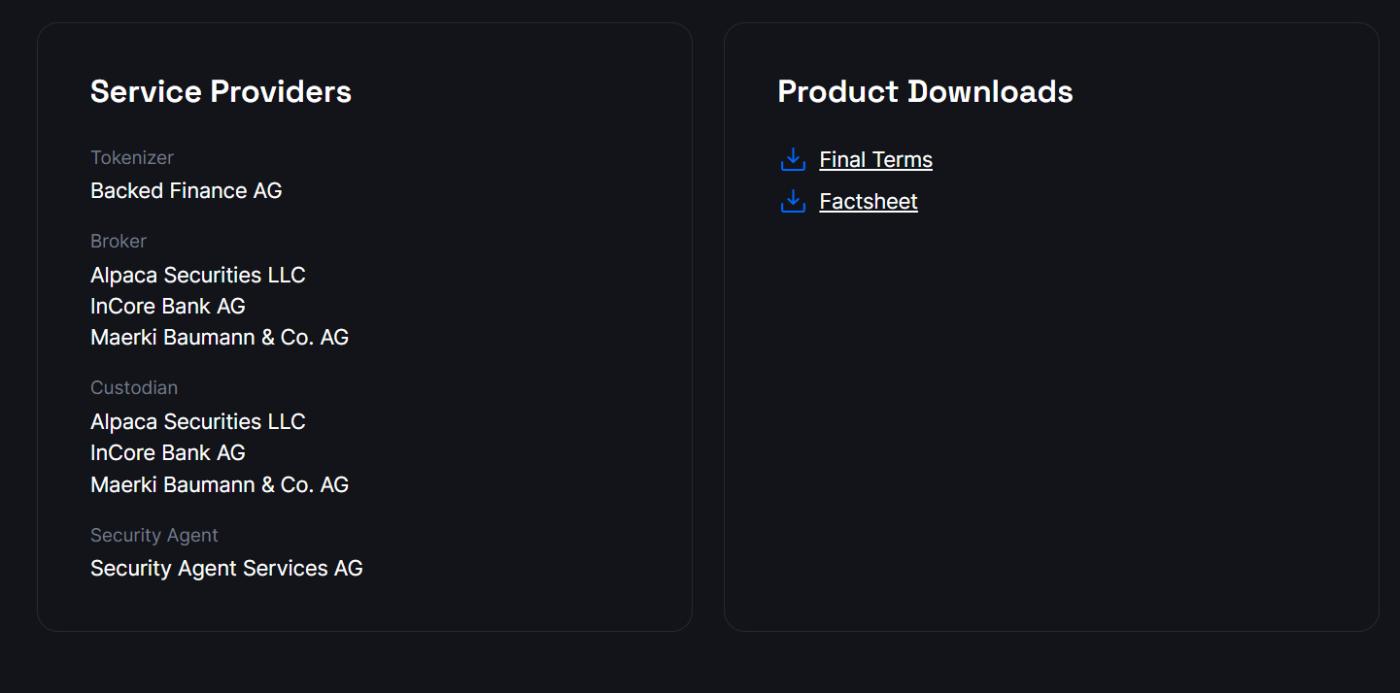

One type is the "third-party compliant issuance + multi-platform access" model represented by Backed Finance (xStocks) and MyStonks, where MyStonks collaborates with Fidelity to achieve 1:1 anchoring of real stocks, and xStocks purchases and custodies stocks through Alpaca Securities LLC;

The other type is the Robinhood-style licensed broker's closed loop, relying on its broker's license to complete the entire process from stock purchase to on-chain token issuance;

The common point of both paths is that they view US stock tokens as pure spot holding assets, with users only able to buy and hold while waiting for appreciation, thus making them "dormant assets" lacking an expandable financial function layer and unable to support an active on-chain trading ecosystem.

Moreover, since each token requires actual stock custody, on-chain trading is merely token ownership transfer without affecting the spot stock price, naturally causing an on-chain/off-chain "two-skin" problem where even small trading volumes can trigger significant price deviations.

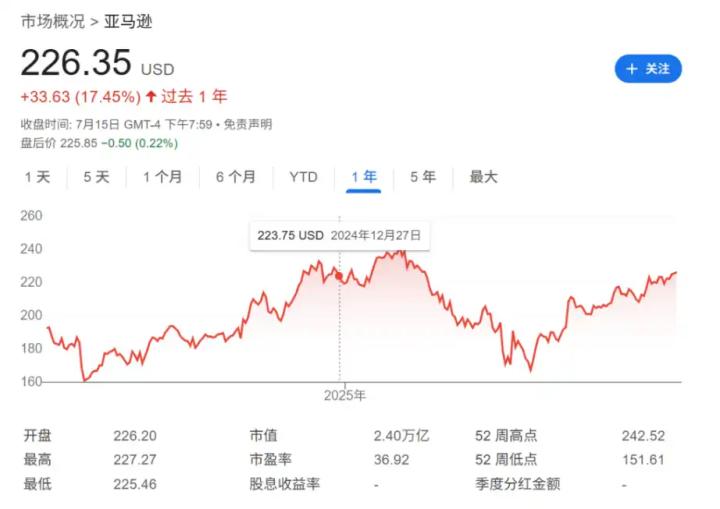

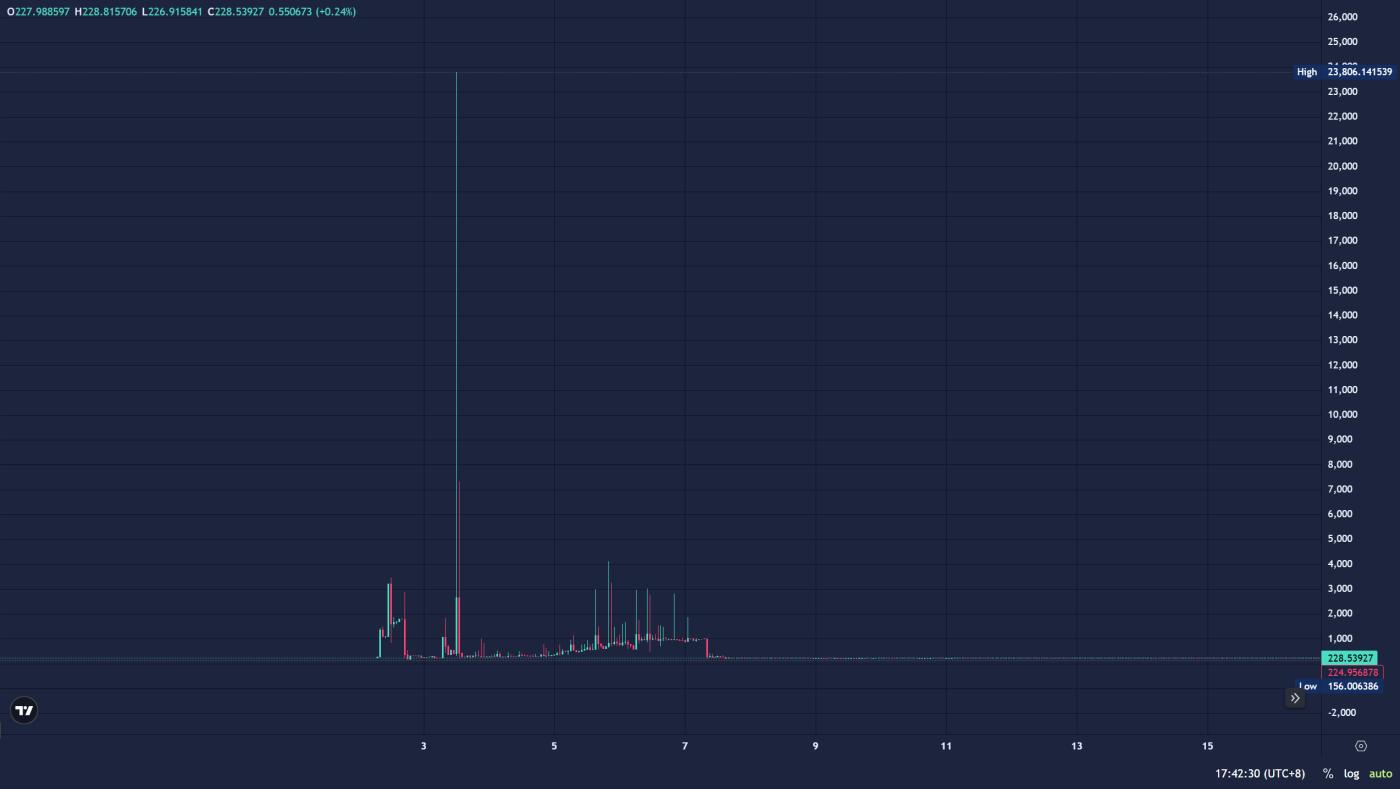

For instance, on July 3rd, a $500 buy order pushed the on-chain AMZNX (Amazon stock token) to $23,781, over 100 times its actual stock price. In non-extreme scenarios, most tokens (like AAPLX) frequently experience quote deviations and price spikes, creating ideal scenarios for arbitrageurs and liquidity market makers.

Secondly, the asset functions of current US stock assets are severely castrated. Even platforms like MyStonks attempting to distribute dividends through airdrops mostly do not open voting rights or re-pledge channels, essentially being merely "on-chain holding certificates" rather than true trading assets, lacking "margin attributes".

For example, after purchasing AAPLX, AMZNX, TSLA.M, or CRCL.M, users cannot use them for collateral lending or as margin to trade other assets, and it's even more difficult to access other DeFi protocols (such as using US stock tokens as collateral for lending) to further obtain liquidity, resulting in near-zero asset utilization.

Objectively, the failure of projects like Mirror and Synthetix in the previous cycle has confirmed that price mapping alone is insufficient. When US stock tokens cannot be activated as margin in liquidity scenarios or integrated into the crypto trading network, no matter how compliant the issuance or perfect the custody, they are merely token shells with extremely limited practical value in the context of liquidity scarcity.

From this perspective, the current "US stock tokenization" has only moved prices on-chain, remaining at the initial stage of digital certificates, and has not yet become a truly "tradable financial asset" to release liquidity, thus struggling to attract broader professional traders and high-frequency capital.

They not only improved capital efficiency but also created long and short game, non-linear pricing, and diversified strategies, attracting market makers, high-frequency funds, and institutional investors to continuously enter the market, ultimately forming a positive cycle of "trading activity → deeper market → more users".

However, the current tokenized US stock market precisely lacks this structure. After all, tokens like TSLA.M and AMZNX can be held but cannot be "used" - they cannot be used for collateral lending or margin trading other assets, let alone constructing cross-market strategies.

This is extremely similar to ETH before DeFi Summer, when it could not be lent, used as collateral, or participate in DeFi, until protocols like Aave granted it "collateral lending" functions, releasing billions in liquidity. For US stock tokens to break through their predicament, they must replicate this logic and transform deposited tokens into "pledgeable, tradable, and combinable active assets".

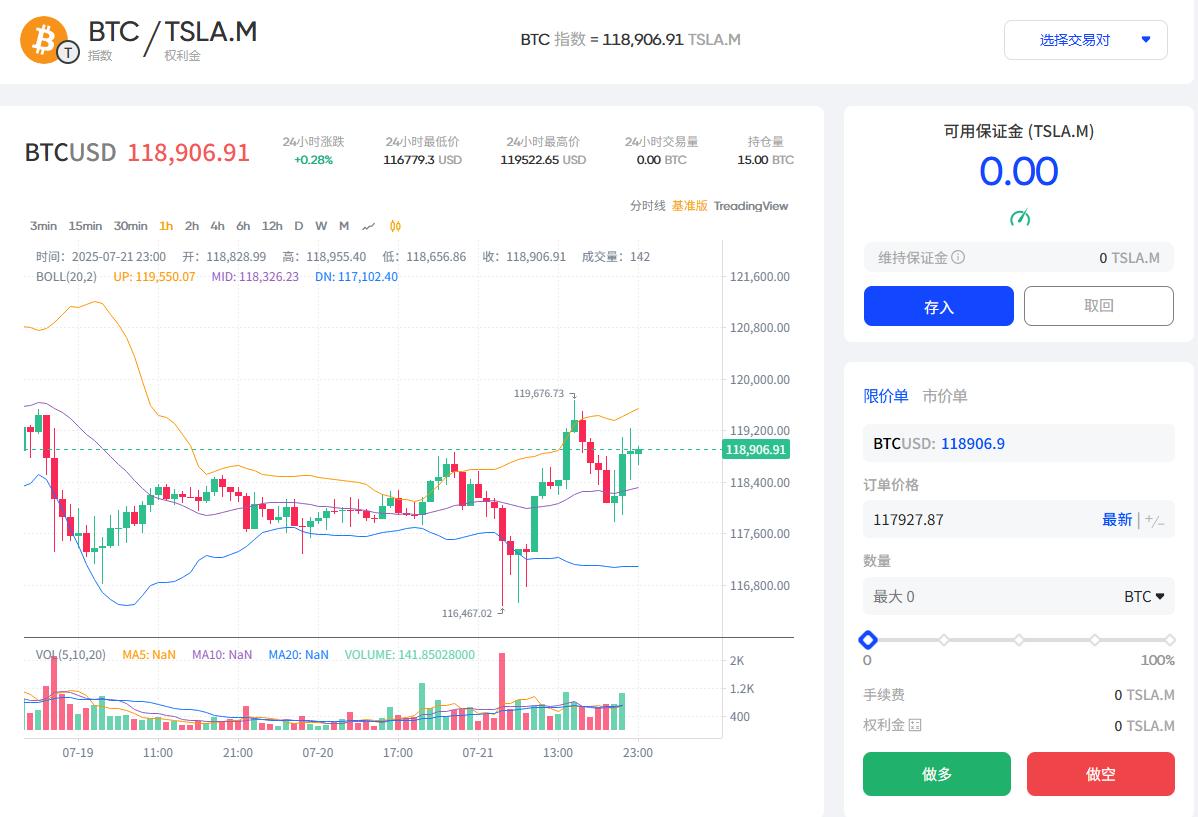

If users can short BTC with TSLA.M or bet on ETH's trend with AMZNX, these deposited assets will no longer be mere "token shells" but margin assets in use, with liquidity naturally growing from these genuine trading demands.

US stock tokenization product service providers are indeed exploring this path. MyStonks has this month launched a TSLA.M/BTC index trading pair with Fufuture on the Base chain, with the core mechanism being "coin-based perpetual options" to truly make US stock tokens "margin assets usable for trading".

For instance, allowing users to use TSLA.M as margin for BTC/ETH perpetual option trading. It is understood that Fufuture plans to expand support for over 200 tokenized US stocks as margin assets, enabling small-cap US stock token holders to bet on BTC/ETH trends (such as using CRCL.M as collateral to long BTC), thereby injecting genuine trading demand.

Compared to CEX's centralized contract restrictions, on-chain options can more freely combine asset pair strategies like "TSLA × BTC" and "NVDA × ETH".

When users can use TSLA.M and NVDA.M as margin for BTC and ETH perpetual option strategies, trading demand will naturally attract market makers, high-frequency traders, and arbitrageurs, forming a positive cycle of "trading activity → increased depth → more users".

Interestingly, Fufuture's "coin-based perpetual options" mechanism is not just a trading structure but also naturally possesses market-making capabilities to activate US stock token value, especially in the early stage where a deep market has not yet formed, and can be directly used as an over-the-counter market-making and liquidity guidance tool.

Project parties can inject tokenized US stocks like TSLA.M and NVDA.M as initial seed assets into liquidity pools, establishing a "main pool + insurance pool". On this basis, holders can deposit their US stock tokens into liquidity pools, bear part of the seller's risk, and earn transaction users' option premiums, essentially constructing a new "coin-based value-added path".

For example, suppose a user is long-term bullish on Tesla stock and has bought TSLA.M on-chain. In the traditional path, his choices would only be:

Continue holding and wait for appreciation;

Trade and exchange on CEX/DEX;

But now he can have more options:

Be a seller to earn option premiums: Deposit TSLA.M into the liquidity pool, waiting for appreciation while earning option premium income;

As a buyer to release liquidity: Use TSLA.M as margin to participate in cross-asset options trading for BTC and ETH, betting on crypto market fluctuations;

Combination strategy: Market-make with part of the holdings, trade with another part, achieving two-way income paths and improving asset usage efficiency;

Under this mechanism, US stock tokens are no longer isolated assets but truly integrated into the on-chain trading ecosystem, being reused and completing the full path of "asset issuance → liquidity construction → derivative trading loop".

Of course, different paths are still in the exploration stage, and this article only discusses one possible approach.

In Conclusion

This round from MyStonks, Backed Finance (xStocks) to Robinhood Europe's actual stock custody model means that US stock tokenization has thoroughly solved the initial problem of "whether it can be issued".

But it also indicates that the new cycle's competition has actually arrived at the stage of "whether it can be used" - how to form genuine trading demand? How to attract strategy construction and capital reuse? How to truly activate US stock assets on-chain?

This no longer depends on more brokers entering, but on the improvement of on-chain product structures - only when users can freely long and short, build risk portfolios, and combine cross-asset positions can "tokenized US stocks" have a complete financial vitality.

Objectively speaking, the essence of liquidity is not capital accumulation but demand matching. When on-chain can freely achieve "hedging BTC volatility with TSLA options", the liquidity dilemma of US stock tokenization might finally be resolved.