#SOL

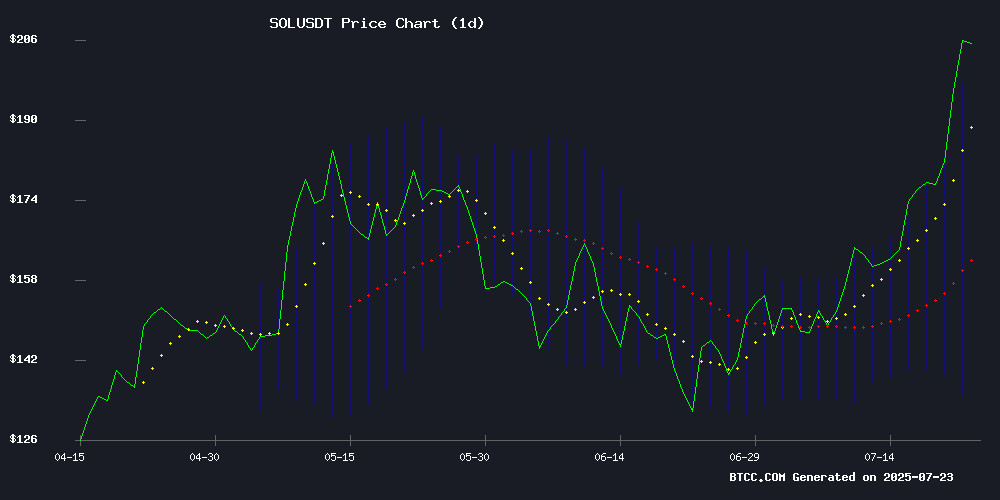

- Technical breakout: Price sustains above 20MA with Bollinger Band expansion

- Fundamental catalyst: $14B DeFi TVL and institutional adoption rumors

- Sentiment shift: Retail FOMO emerges after 5-month high breakout

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

SOL's current price of $200.59 sits comfortably above its 20-day moving average ($168.36), signaling strong bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-5.83), while price trades NEAR the upper Bollinger Band ($202.19) - typically indicating overbought conditions that often precede continuation patterns in strong trends.

Solana Market Sentiment: Social Hype Meets Institutional Interest

Positive sentiment dominates as SOL breaks $200 amid record DeFi TVL ($14B) and corporate treasury speculation. While influencer scams and fake venture deals create noise, the fundamental narrative remains strong with price prediction articles gaining traction and the asset testing 5-month highs.

Factors Influencing SOL's Price

Solana Social Media Buzz Peaks as Price Surpasses $200

Solana (SOL) has breached the $200 threshold for the first time in months, igniting a surge in social media activity. Analytics firm Santiment reports that SOL's Social Dominance—a measure of its share of cryptocurrency-related discussions—has spiked to 8.9%, the highest level since early June.

The rally reflects renewed investor confidence in the ethereum competitor, with its Social Volume (unique mentions across platforms) outpacing most top-100 assets. Market observers note the milestone coincides with broader altcoin strength, though SOL's 2025 price resurgence has particularly captured retail attention.

Solana Price Prediction: SOL Breaks $200 – Could $500 Be Closer Than Anyone Thinks?

Solana's SOL surged past $200 for the first time since February, fueled by altcoin season sentiment and deeper capital rotation. The rally has sparked a resurgence in crowd interest, with social dominance hitting a 7-week high at 8.9% of crypto-related discussions. Developer activity on the network has also reached a two-month peak, signaling growing adoption.

The momentum is partly driven by a 31% spike in Solana-based meme coins since July, as speculative demand returns. With geopolitical and macroeconomic uncertainties fading, pro-crypto regulatory developments are unlocking sidelined capital. The GENIUS Act's recent passage and the anticipated CLARITY Act in October provide further bullish catalysts, extending the rally beyond "Crypto Week."

Technical analysis suggests $200 may only be the beginning, with SOL breaking out of an ascending triangle pattern formed since mid-April. Market watchers now speculate whether $500 could be within reach as bullish sentiment solidifies.

Solana's $210 Breakout Looms as Corporate Treasury Shift Fuels Momentum

Solana's SOL token is exhibiting explosive momentum, with ChatGPT's AI analysis flagging a potential breakout above the $210 resistance level. The rally comes amid a historic corporate treasury Gold rush, with firms like DeFi Development and Bit Mining driving adoption.

Technical indicators reveal extreme conditions, including an overbought RSI that traditionally precedes corrections. Yet this rally differs from retail-driven surges—institutional accumulation and infrastructure expansion may sustain the uptrend despite overheated readings.

The asset's weekly surge mirrors January's all-time high trajectory, with MACD divergence suggesting persistent buying pressure. Market participants now watch whether SOL can maintain its parabolic ascent as it tests psychological resistance levels.

Crypto Influencer Exposed for $11M ALT Token Dump After Promotion

Blockchain investigator ZachXBT has uncovered an alleged $11 million token dump orchestrated by crypto influencer 'Crypto Beast.' The scheme involved 45 connected wallets selling ALT tokens on July 14, 2025, crashing the token's market cap from $190 million to $3 million in minutes.

Funding traces through instant exchanges led to a single Celestia address linked to Crypto Beast's known wallet. The influencer aggressively promoted the Solana-based ALT token before the dump, deleting all promotional posts post-collapse.

Retail investors were wiped out as ALT plummeted from $0.19 to $0.003 during the coordinated sell-off. The incident highlights ongoing concerns about influencer accountability in cryptocurrency markets.

Solana DeFi TVL Surpasses $14 Billion Amid Price Rally

Solana's native token SOL surged to $195.50, pushing its market capitalization above $105 billion for the first time since January. The rally reflects renewed Optimism in the ecosystem, though questions linger about the sustainability of this recovery.

Total value locked in Solana's decentralized finance protocols reached $14.18 billion, matching levels last seen during January's peak. Price appreciation accounts for much of this growth, as existing locked tokens gain value without significant new deposits. The ecosystem appears larger, but organic usage growth may be trailing headline figures.

Decentralized exchange activity shows promising momentum, with $22 billion in weekly volume across platforms like Raydium ($8.4B), Orca ($6B), and Meteora ($5.3B). Trading activity has increased from $19 billion the previous week, signaling returning trader interest despite volumes remaining below historic highs.

Solana Clinches 5-Month High, Where to From Here?

Solana surged to a five-month peak as open interest climbed, signaling renewed investor confidence. The rally comes despite macroeconomic uncertainties and conflicting technical indicators that suggest a choppy path ahead.

Market participants are weighing Solana's strong on-chain activity against broader crypto market headwinds. The network's performance during this period highlights its resilience amid fluctuating sector-wide sentiment.

Solana Traders Grapple with Uncertainty Amid Rally

Solana's recent surge to $198.43—levels last seen in February—has reignited trader interest, but on-chain metrics reveal deepening ambivalence. Glassnode's NUPL data places SOL in the "Optimism-Anxiety" zone, where holders nurse modest profits but lack conviction about sustainability. The altcoin now teeters NEAR the pivotal $206 resistance level, a threshold that could trigger breakout momentum or profit-taking reversals.

Market behavior reflects this tension. While some accumulate positions anticipating upward resolution, others quietly offload holdings—a dynamic visible in diverging on-chain and price action signals. The rally's staying power hinges on whether SOL can convert its 7-day double-digit gains into a decisive technical breakout, or succumb to the gravitational pull of trader skepticism.

Mercurity Fintech's $200M Solana Ventures Deal Debunked by Solana

Nasdaq-listed Mercurity Fintech sparked confusion with its announcement of a $200 million Equity Line of Credit Agreement with solana Ventures. The deal, purportedly aimed at launching a Solana-based treasury strategy, was swiftly denied by Solana Ventures via an X post. "Solana Ventures is not affiliated or involved with any equity line of credit agreements with any publicly listed companies," the firm stated.

Mercurity's claims included SOL accumulation, staking operations, and investments in Solana-based projects. However, industry reports suggest the agreement might involve a similarly named entity, not the legitimate Solana Ventures. The incident highlights the risks of misrepresentation in crypto partnerships.

How High Will SOL Price Go?

Robert from BTCC sees SOL testing $210 resistance imminently, with a potential 150% rally toward $500 if these key levels break:

| Level | Significance |

|---|---|

| $202.19 | Upper Bollinger Band |

| $210.00 | Psychological resistance |

| $250.00 | Fibonacci extension |

| $500.00 | Long-term target |