Altcoins stir from crypto winter slumber—just as the whales want you to notice.

Signs of Green Shoots (Or Just Another Pump?)

The Altcoin Index creeps upward, sparking whispers of a comeback. Cue the billionaire founder of Binance—never one to miss a hype cycle—declaring 'FOMO season' is nigh. Traders scramble, wallets open, and the usual suspects start dusting off their 'altseason' memes.

Timing Is Everything (For Those Holding the Bags)

Convenient, isn’t it? Just as institutional money starts yawning at Bitcoin’s sideways action, the altcoin casino lights flash back on. History rhymes: retail piles in late, whales cash out early. But hey, maybe this time it’s different—said every crypto degenerate before.

The Bottom Line

Whether this is the start of a legit rally or another ‘buy the rumor, sell the news’ play, one thing’s certain: someone’s getting rich. And it’s probably not you.

Altcoin Season Index Climbs to 51, Up from 16 Last Month

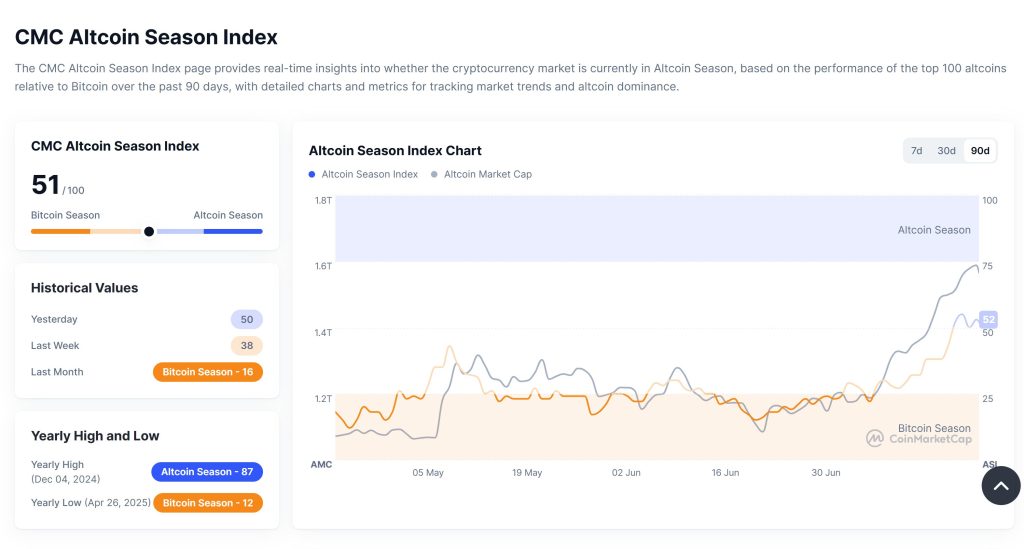

The Altcoin Season Index, maintained by CoinMarketCap, currently sits at 51 out of 100, up from 38 last week and just 16 a month ago.

A reading above 75 indicates an official “Altcoin Season,” where at least 75 of the top 100 altcoins outperform bitcoin over the previous 90 days.

While 51 falls short of that threshold, the momentum reflects growing market rotation into non-Bitcoin assets.

Historically, these phases follow a predictable pattern: Bitcoin rallies first, lifting overall sentiment and liquidity.

Ethereum and other altcoins then pick up, fueled by narrative-driven speculation, new protocol launches, and increased developer activity.

In the 2021 altcoin season, for instance, top altcoins posted gains over 170%, compared to Bitcoin’s 2% during the same period.

Current data supports that pattern. ethereum is up 110% over the past 90 days, while meme coins like BONK (+148.7%) and FLOKI (+119.1%) have surged.

Even lower-cap projects such as PENGU and M have posted gains exceeding 500%, according to CoinMarketCap’s 90-day performance chart.

The methodology behind the index excludes stablecoins and wrapped tokens and instead focuses on price performance among the top 100 coins listed on CoinMarketCap.

The goal is to help investors gauge market sentiment shifts between Bitcoin-dominated periods and broader altcoin rallies.

Bitcoin Dominnace Falls Sharply

Bitcoin’s dominance in the crypto market has fallen sharply, dropping 5.8% in just one week to under 61%, its lowest point since March, and the steepest decline since June 2022.

The metric had peaked NEAR 66% at the end of last month, according to TradingView.

The drop in dominance coincides with a surge in total crypto market capitalization, which has jumped from $3 trillion to around $3.8 trillion over the past three weeks.

Altcoins, particularly Ethereum, have led the rally as investors shift focus away from Bitcoin.

“Everyone is saying ALTSEASON has started but if you look at indicator they say ~ Not yet,” X user Henry said in a recent post.

They added that none of the 30 bull market top indicators have triggered yet, with Bitcoin dominance at 61%, the Altcoin Season Index at 51, and key metrics like Puell, MVRV Z-Score, and Mayer Multiple still in SAFE territory.

Everyone is saying ALTSEASON has started but if you look at indicator they say ~ Not yet.

Out of 30 bull market top indicators, not a single one has triggered.

• Bitcoin dominance is still high at 61%

• Altcoin Season Index is sitting at 51/100 (needs to hit 75+)

• Puell,… pic.twitter.com/NU92VlpWZN