Author: Titanium Media

A few days ago, Meituan’s core local business CEO Wang Puchong revealed the profit margin of his own food delivery business: about 4%.

This is exactly the "profit margin" of the US dollar stablecoin. Because the business model of stablecoins is to use the money users use to buy stablecoins to buy government bonds and make profits, and the current US government bond interest rate is about 4%.

——It may not seem like much, but this is more than the net profit of many companies.

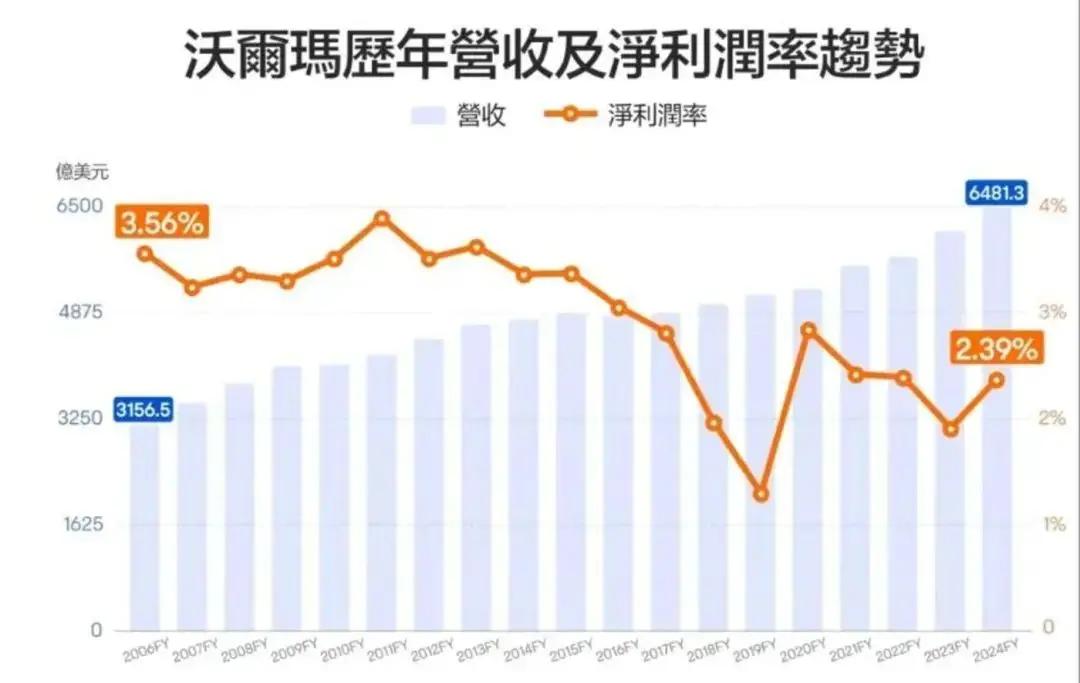

Walmart's net profit margin in fiscal year 2024 is only 2.39%, JD.com's net profit margin in 2024 is 3.6%, and Amazon's retail business profit margin is about 5%.

These companies happen to be the large companies that are currently actively issuing stablecoins.

If stablecoins can really become the mainstream payment method in their ecosystem as the outside world imagines, the interest income alone may reach hundreds of billions of yuan per year - this is not only a financial management method, but also a source of income that can become a pillar. The business model of many low-profit businesses will be permanently changed.

The lower the profit, the more stablecoins are needed

4% is the "natural bottom line" in the world of US dollar stablecoins.

The entire industry’s business model revolves around this number, which is the current U.S. Treasury bond interest rate.

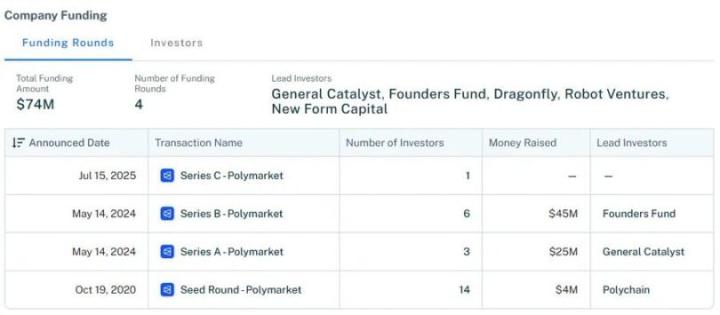

Most of the fees paid by stablecoin users to buy stablecoins are used by the issuer to purchase this risk-free investment product. If $100 million of stablecoins can be issued, the issuer can earn about $4 million in revenue each year. This is the business model of stablecoin manufacturers such as Circle and Tether.

On the one hand, 4% is too low.

It is just a kind of interest. Of course, a company can optimize its financial structure with interest, but how can it rely on bank interest for its livelihood? And it is also volatile. Once the Federal Reserve cuts interest rates significantly, the net profits of all stablecoin manufacturers will plummet. This kind of business has no profit pricing power at all and is a purely cyclical business.

But on the other hand, 4% is high enough, higher than the net profit of many companies.

Wang Puchong, CEO of Meituan's core local business unit, accepted a report a few days ago that Meituan's takeaway profit margin was about 4% in the past year. Internet giants have invested hundreds of billions in the war, and in the end they can only earn a dollar interest rate. The profit margins of Internet platforms are not as good as Pinduoduo's. Didi's profit margin in 2024 is lower than that of Meituan's takeaway business, less than 1%.

Traditional retail companies have long been known for their low profits. Walmart's net profit margin in 2024 was only 2.3%, and its total profit was only about US$15 billion, which is completely unworthy of its status as the number one in the Fortune 500 for many years.

Online retailers are not much better, with JD.com's net profit margin of only 3.6% in 2024. Amazon's net profit margin for the whole year of 2024 is less than 10% - this is the result after the high-profit cloud service is supported. According to external estimates, its retail business is only about 5%.

Not to mention the manufacturing industry, a large number of leading companies are in the red. Let alone 4%, some companies don’t even have a profit margin of 1%.

The 4% interest rate may be just icing on the cake for Apple, but for these companies, it is a core business that is sufficient to support the main profit. ——Financial as the main profit is not without precedent. Ideal Auto suffered an operating loss in the first half of 2024 from selling cars. Of the 1.692 billion yuan in net profit, 1.439 billion yuan was investment income. At its peak, General Electric had low profits in the manufacturing industry, but 40%-50% of its profits came from financial services.

It can be said that the lower the profit margin of a company, the more it needs financial means such as stablecoins to optimize its business model.

Of course, not every company has the ability to issue a large number of stablecoins. The role of stablecoins is trading, and it needs sufficient trading volume to support it. The most suitable companies have emerged: retail. They have almost the largest transaction volume in all industries and have strong ability to issue coins. At the same time, their profit margins are low, and the benefits of entering this field will be more substantial than those of high-profit companies.

As a result, retail enterprises have become the most active group in the field of stablecoins. In June, the media revealed that both Walmart and Amazon planned to launch stablecoins. In addition to these two retail giants, OTA platform Expedia is also gearing up. On the other side of the ocean, Liu Qiangdong personally announced that JD.com hopes to apply for stablecoin licenses in all major currency countries around the world.

Their ultimate goal is obvious: to issue a large number of stablecoins and use them for transactions of their own products. It would be best if all transactions within the ecosystem were issued with their own stablecoins, just like barber shops use membership cards for payment. They then save these "pre-charge" fees to earn interest.

How much can you earn?

How much revenue can stablecoins actually generate?

Take Walmart as an example. Walmart’s revenue last year was as high as $680 billion. In addition, Walmart also has some third-party e-commerce businesses, and the total GMV may exceed $700 billion. If it can issue a stablecoin with one-tenth of its GMV, its stablecoin market value may exceed Circle. If it can issue a stablecoin with the same GMV, Walmart will become a giant in the stablecoin industry.

So can Walmart issue 700 billion stablecoins?

Of course not. After all, money is mobile, and 700 billion GMV does not require 700 billion stablecoins. The amount of stablecoins that Walmart can issue is actually "how much unspent balance can be deposited in the market."

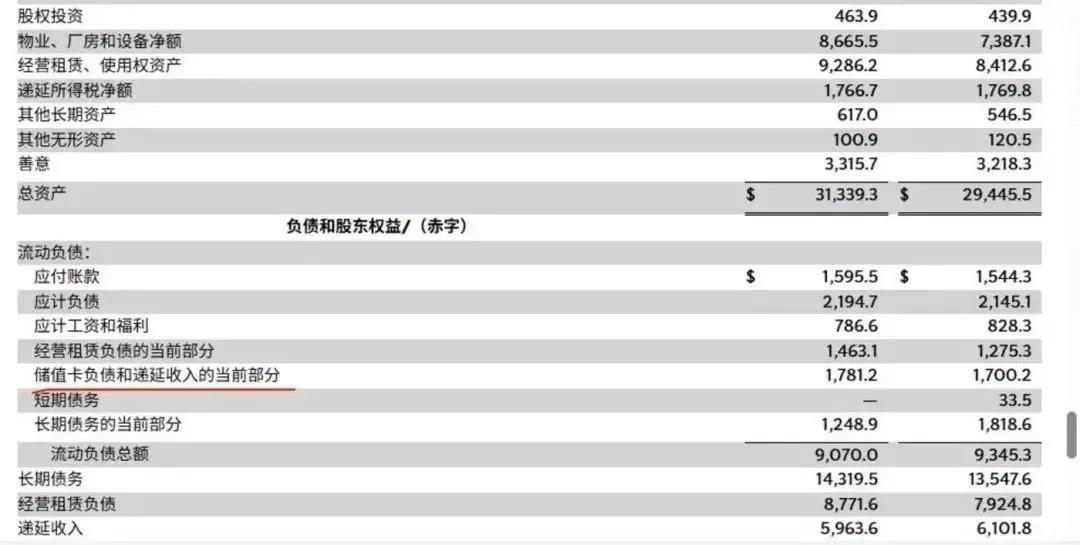

There is a reference for this number: the unspent membership amount of Starbucks. Starbucks' 2024 financial report shows that the amount of stored-value cards deposited in its account is as high as $1.7 billion. You should know that Starbucks' annual net revenue is only $36 billion, and Walmart is about 20 times that. If Walmart can reach Starbucks' pre-charge ratio with stablecoins, that is, nearly 5% of its revenue is deposited in membership card pre-charges, its account will be deposited with nearly $40 billion.

Note: This $1.7 billion is the money that members have topped up but have not spent. Starbucks can use it to buy government bonds and earn a profit of about $70 million per year.

In addition, Starbucks is a high-frequency consumption, while whether it is shopping in Walmart supermarkets or online shopping on JD.com and Amazon, the frequency is much lower than "drinking a cup of coffee". The lower the shopping frequency, the slower the capital circulation, and the more unspent amount will be on the card - more coins can be issued.

The single consumption amount in the retail industry is also much higher than that of Starbucks - Americans spend hundreds of dollars on a trip to the supermarket, and only $5 for a cup of coffee. The high consumption amount means that the balance required on the account is also greater. Retailers can use the method of "recharge 1,000 and get 100 for free" to attract consumers to recharge more - and issue more coins.

In terms of talent, Walmart's ability to accumulate funds is stronger than Starbucks. If the payment ratio of its stablecoin can reach the payment ratio of Starbucks' membership card, its issuance volume is likely to exceed 50 billion US dollars, and the annual interest income will exceed 2 billion US dollars. For Walmart, which has an annual profit of 15 billion US dollars, this is definitely not a small amount of money.

This is not the end. Retailers such as Walmart and Amazon have to pay billions of dollars in fees to card organizations such as VISA, MasterCard, and American Express every year. If the payment system can be largely replaced by stablecoins, it will save a lot of profits.

In addition, if all liquidity is deposited on its own chain, this will give birth to a large number of financial management services.

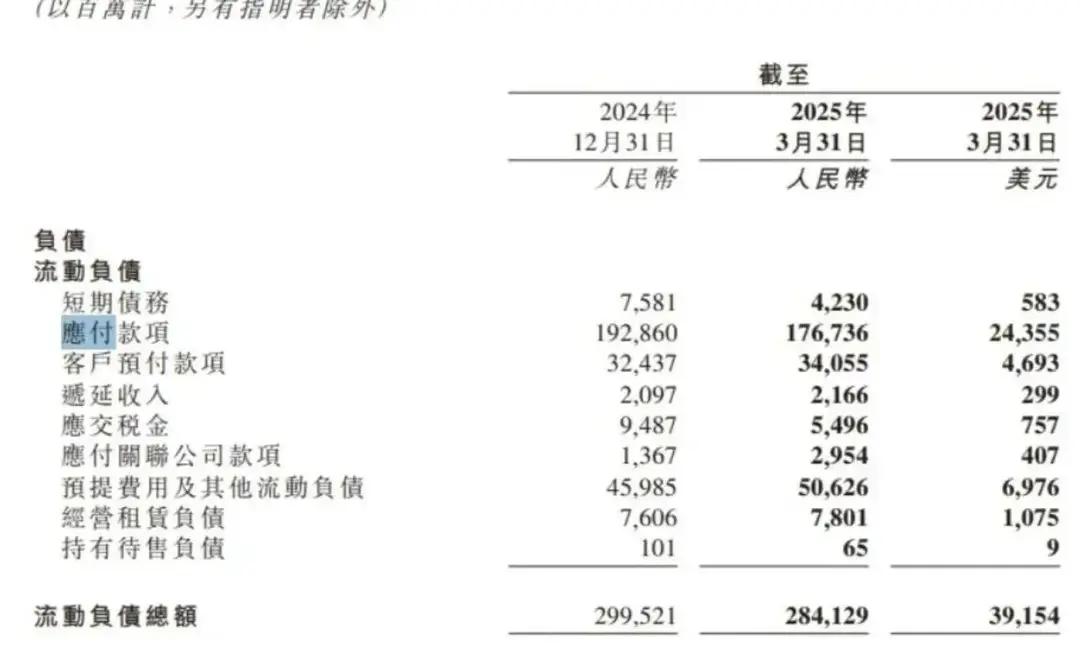

——An even more unrealistic fantasy is that as terminal retailers, Walmart, Amazon, and JD.com can even use stablecoins to pay for upstream goods and employee bonuses. The potential of this part can be directly referenced by the company's accounts payable. Walmart's accounts payable are over US$50 billion all year round, and JD.com's accounts payable in its latest financial report are as high as RMB 176.736 billion. If all these accounts are paid with stablecoins, the issuer can earn interest for a period of time in the time between the upstream manufacturers receiving the stablecoins and the stablecoins being redeemed.

Figure caption: Retailers are at the bottom of the industry chain, accumulating a large amount of upstream funds

As long as the above vision can be partially realized, for these companies with extremely high income but extremely low profit margins, the income from stablecoins may even be higher than the main business. The business model of consumer companies may also change completely. They can be like Costco: if they don’t make money from selling things, they can make friends and then make profits through stablecoins (membership cards).

Everyone is an insurance company

Of course, in the world of finance, earning a lot is not enough; you also have to survive.

In fact, before the emergence of stablecoins, there were many companies that wanted to improve their low profits through finance, but most of them failed in the end.

For example, the manufacturing giant GE (General Electric). Compared with the meager profits of the manufacturing industry, the money in finance seems to be more plentiful and easier to earn. This has become a powerful tool for GE to "improve bad business". At its peak, more than half of its profits came from the financial industry.

But the crisis is also obvious. Because most companies in finance have only one source of funds: borrowing.

For example, GE is one of the companies that has been able to issue bonds the most in history. Before the financial crisis, GE's commercial paper volume had exceeded $100 billion. These short-term loans were reissued by GE to earn the interest difference between the two - this was also the business model of many domestic Internet financial companies.

People today can see the problem at a glance: this is essentially "borrowing to support loans" or "taking money from Peter to pay Paul." It cannot withstand any fluctuations, but as long as there is a little uncertainty in the entire chain, the company may not be able to repay the money. As a result, GE collapsed directly during the financial crisis, and its stock price evaporated by 80%.

It is the extremely high risk of finance that has almost made GE's game disappear. Today's Internet financial companies such as Du Xiaoman also play more of a platform role, with funds coming from banks and other partners. Instead of borrowing money to earn interest differentials, after all, a fluctuation could break the entire chain.

——But stablecoins don’t have this problem.

Compared with traditional finance, the financing model of stablecoins is comparable to playing rogue: companies need to pay high interest to issue bonds, and even banks have to pay interest to depositors. But stablecoin issuers do not have to pay any interest. They even charge a certain fee when withdrawing money. For example, Circle, the first stablecoin stock, raised its redemption fee in October last year, up to 0.1%. Not only do they not pay interest for financing, but they can also charge a sum of money when repaying the money?

Even if there is a fee, not everyone can redeem stablecoins. For example, Tether stipulates that only certain trusted entities that have passed KYC certification can directly mint or redeem USDT. In short, only large institutions can redeem stablecoins. What's even more overbearing is that Tether has reserved the right not to redeem users, truly putting the saying "the one who owes money is the boss" into practice.

This greatly reduces the redemption frequency of stablecoins, so that stablecoin manufacturers do not need too much reserves to meet liquidity needs.

Due to the extremely low financing costs and regulatory requirements, stablecoin manufacturers do not have to look for various high-return but high-risk loans like GE, but only need to purchase risk-free financial products - government bonds. At present, the four major US dollar stablecoin issuers hold a total of about 180 billion US dollars in US government bonds. Of course, stablecoin companies can also invest in other products. For example, Tether, the largest stablecoin issuer, holds some gold and Bitcoin.

If GE, Lehman Brothers, and Goldman Sachs had such financial instruments, they would not have collapsed during the 2008 financial crisis - government bonds are a risk-free investment, and during financial crises, government bonds not only do not fall, but rise instead. Even if users redeem on a large scale and sell stablecoins, they can still repay their debts smoothly.

In a nutshell: Stablecoins have low funding costs and low risks.

In fact, the reason why banks and insurance companies can make money is that they have an extremely low-cost and relatively low-risk source of funds.

However, with the support of stablecoins, companies with large transaction volumes such as Walmart, JD.com, and Amazon are likely to become players with the lowest financing costs in the future. They are not insurance companies, but they can enjoy negative-cost leverage like insurance companies.

Of course, companies are still exploring the possibility of issuing stablecoins. Whether they will be issued on a large scale or only used as a supplement in a few scenarios such as cross-border trade, no one has yet given an answer.

Even if it is issued on a large scale, can it become a universal currency? If not, it is just a "pre-charged shopping card" in a different skin for consumers. If consumers did not accept pre-depositing thousands of dollars at Walmart in the past, they may not accept it after the currency is available.

Whether it is a revolution or just a gimmick, only time will tell.

Related reading: " Stablecoins are breaking out of the circle: in-depth analysis of the stablecoin regulatory policy race in 12 countries "