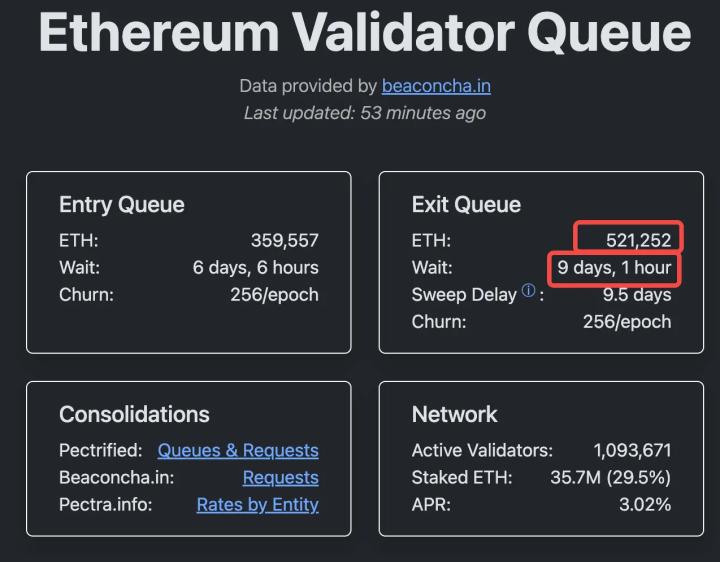

1. Data: Ethereum Validator Exit Queue Scale Currently Around 519,000 ETH, Reaching a New High Since January 2024

As Ethereum's price has risen over 160% year-to-date, ETH validator exit queue has surged. Data from validatorqueue shows that as of July 23, the number of ETH queued for exit has reached 519,000, valued at approximately $1.92 billion at current prices, with an exit waiting time exceeding 9 days, a new high since January 2024. Analysts believe this round of exits is mainly due to some early stakers choosing to take profits after the price increase. Meanwhile, with ETH treasury-like enterprises such as SharpLink Gaming and Bitmine continuing to enter the market, strong staking demand remains, with 35,700 ETH currently waiting to enter the network, with a queue time over 6 days.

2. Arthur Hayes: Year-End Target is $250,000 for Bitcoin and $10,000 for Ethereum

Arthur Hayes predicted in his latest blog post that his year-end target is $250,000 for Bitcoin and $10,000 for Ethereum. He stated that the upcoming Ethereum bull market will completely ignite the market, and Maelstrom (his personal family office) is doing everything related to Ethereum, DeFi, and ERC-20 shit coins.

3. Korea Financial Supervisory Service: Restricts Enterprises' ETF Crypto Asset Related Investment Proportion

The Korean financial regulator, Financial Supervisory Service, recently provided verbal guidance to local asset management companies, requiring them to control the investment proportion of crypto asset-related enterprises like CoinBase and MicroStrategy in ETF portfolios, and reiterated that the 2017 "Virtual Currency Emergency Measures" remains effective, prohibiting financial institutions from holding, purchasing, or investing in virtual asset-related enterprise shares. This move is seen as a response to the rapid increase in "crypto theme" enterprise weights in Korean ETFs, with multiple ETFs currently having related component stock proportions exceeding 10%.

4. Goldman Sachs Collaborates with Bank of New York Mellon to Launch Tokenized Money Market Fund Investment Service

Goldman Sachs and Bank of New York Mellon jointly launched a new service for institutional investors, allowing them to invest in tokenized money market funds through Goldman Sachs' blockchain platform. The project has been joined by multiple asset management institutions including BlackRock and Fidelity. The two banks stated that the project will lay the foundation for money market funds in a "24/7 real-time trading" digital financial system and is expected to expand to collateral use in financial transactions in the future.