XRP has become one of the prominent cryptocurrencies in the market over the past month. Its price has increased by 72% amid a broader altcoin surge driven by Bitcoin reaching a new All-Time-High.

However, two important on-chain indicators currently suggest that this upward trend may be losing momentum, increasing the risk of a short-term reversal.

XRP Traders Prepare for Correction as On-Chain Signals Flash Red

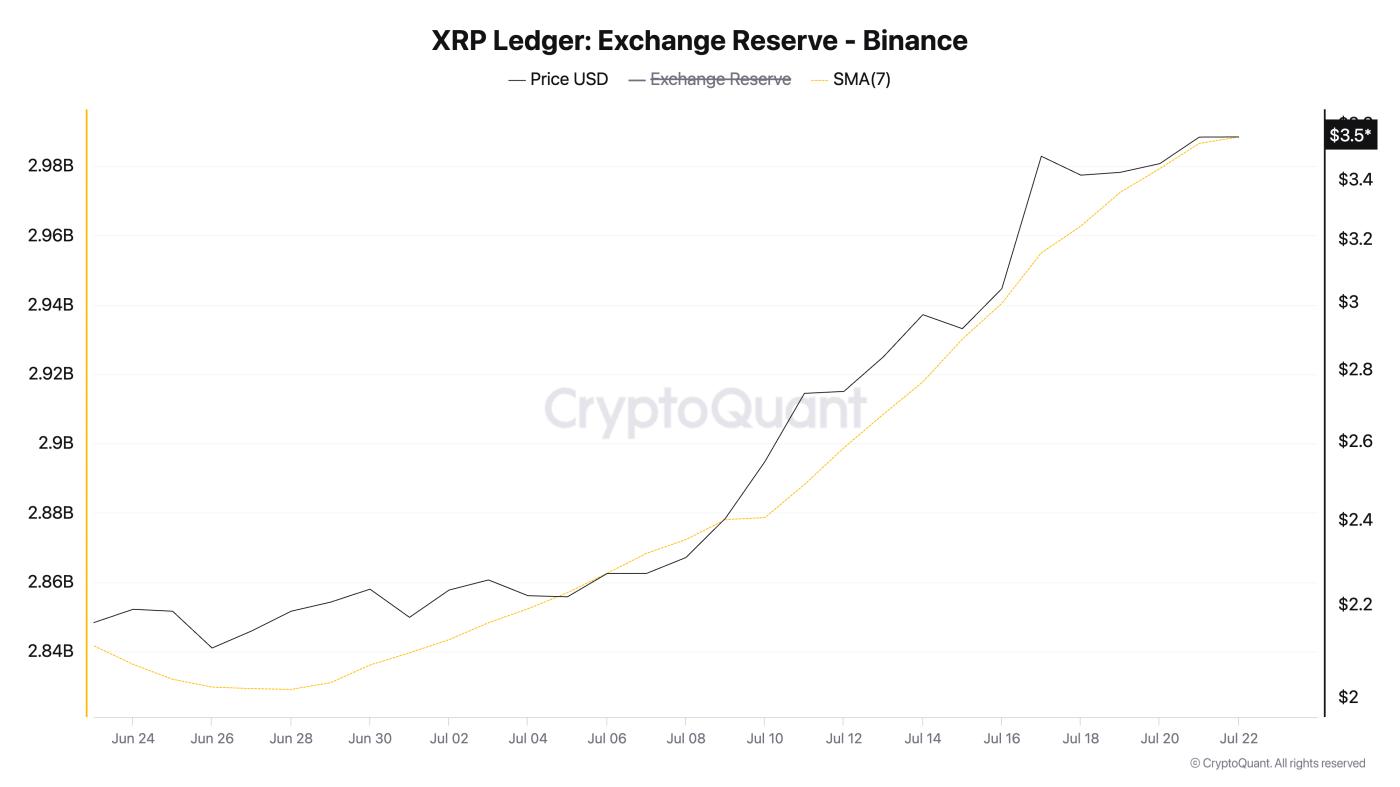

First, XRP reserves on the leading exchange Binance have surged, reaching a year-high. According to CryptoQuant, XRP reserves on the exchange—measured by a seven-day moving average—reached a year-high of 2.98 million tokens on 22/07/2025, valued at over 10 million USD at current market prices.

For TA and token market updates: Want more detailed information about tokens like this? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

XRP reserves on Binance. Source: CryptoQuant

XRP reserves on Binance. Source: CryptoQuantA sudden increase in an asset's reserves on an exchange indicates that many tokens are being transferred to centralized exchanges, often to prepare for selling. When investors move a large number of coins to an exchange, they may be preparing to take profits or exit their position.

In the case of XRP, the increase to 2.98 million token reserves implies a high selling intention. If this supply is not met with equivalent or greater demand from buyers, downward price pressure on XRP could quickly increase.

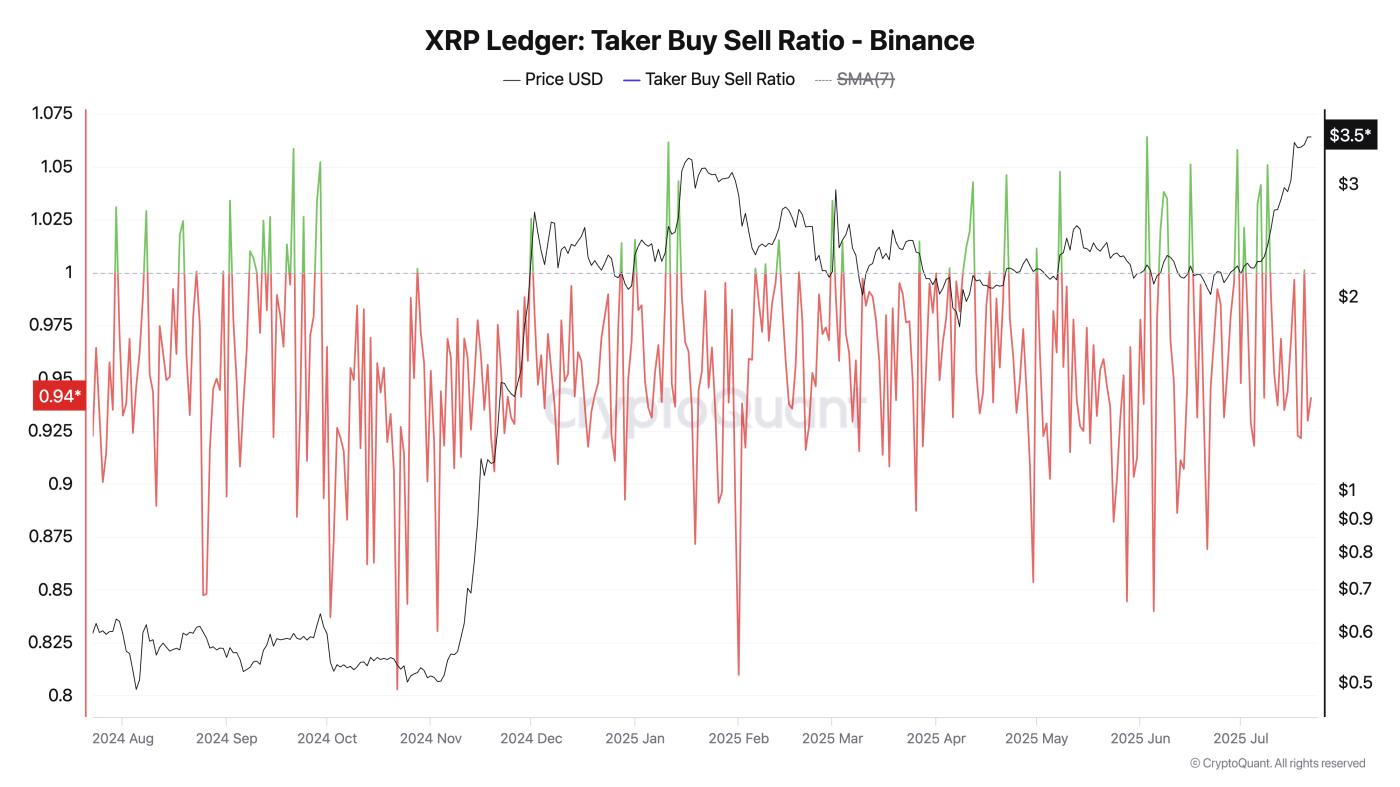

Moreover, data from CryptoQuant shows that the buy/sell ratio of XRP buyers has consistently remained below one since 10/07/2025. At the time of writing, this indicator stands at 0.94.

XRP buyers' buy/sell ratio. Source: CryptoQuant

XRP buyers' buy/sell ratio. Source: CryptoQuantAn asset's buyer buy-sell ratio measures the ratio between buy and sell volumes in its futures market. A value above one indicates buy volume is higher than sell volume, while a value below one suggests that many futures traders are selling their assets.

The fluctuation in XRP buyers' buy/sell ratio below one over the past two weeks indicates a selling trend among futures traders as its price increases. This increasing selling pressure confirms weak sentiment and could trigger a price decline in subsequent sessions if it continues.

XRP Investors Face Crucial Challenge at $3.22

At the time of writing, XRP is trading at $3.47, just below its All-Time-High of $3.66. However, increasing selling pressure raises the likelihood of a short-term correction to the $3.22 support level.

If this support level is broken, XRP could continue to drop to around $2.87.

XRP price analysis. Source: TradingView

XRP price analysis. Source: TradingViewHowever, if selling pressure decreases and new demand emerges in the market, the altcoin could reclaim its price peak and potentially see new growth beyond $3.66.