Written by: Zuo Ye

From underground businesses in Asia, Africa and Latin America to the Indian diaspora on the Arabian Sea, an iron curtain has been drawn across the Third World continent.

Behind this iron curtain lie all the banks and FinTech barriers - Bank of America, Morgan Stanley, non-bank institutions, Wall Street, K Street, the Big Four state-owned enterprises, as well as Washington and Silicon Valley.

These notable bastions and capital flows all fall within the TradFi sphere of influence, and all, in one way or another, have not only fallen under the influence of stablecoins, but have come under the increasing control of USDT and Sundar Pichai.

Tether’s unfocused strategy

Messari has just released the 2025 Stablecoin Report. In addition to the logos flying all over the place and unlimited business orders, it can also serve as the opening speech of the stablecoin war. Whether it is payment stablecoins, cross-border settlements, or C2C remittances, they are all built on the alliance between USDT and TRON. Only USDC and CPN (Circle Payment Network) can barely compete with it.

However, USDT's stablecoin kingdom is not stable. Sun Ge's Tron chain is the only dominant one, and Tether is too active. First, USDC "profit-sharing" Coinbase and Binance devoured the market, and then Ethena relied on the "bribery mechanism" to bind CEX to capture hedging returns.

Image caption: Tether's non-stablecoin business, Image source: @MessariCrypto

Gold dollar —–> Petrodollar —–> Stablecoin dollar

After surpassing BlackRock with a net profit of US$14 billion in 2024, stablecoins officially swept away the shadow of UST's collapse and were brought back into the mainstream vision of various countries. This is the direct motivation for the GENIUS Act to specifically regulate stablecoins. Not only can stablecoins make money, but also that stablecoins have surpassed national entities such as Germany and become the new contractors of US debt.

The golden combination of the U.S. dollar and U.S. bonds appears to be the petrodollar on the surface, with military hegemony behind it. However, stablecoins are becoming the new dollar by changing the sales pattern of short-term bonds. They are either a supplement to the dollar or a new form of the dollar.

However, Tether’s focus is not on challenges or peacemaking, but on BTC mining, password managers, African solar nodes, and entering the institutional settlement market through Plasma. It also has the same hobby as Jack, the former co-founder of Twitter - to make Bitcoin bigger and stronger.

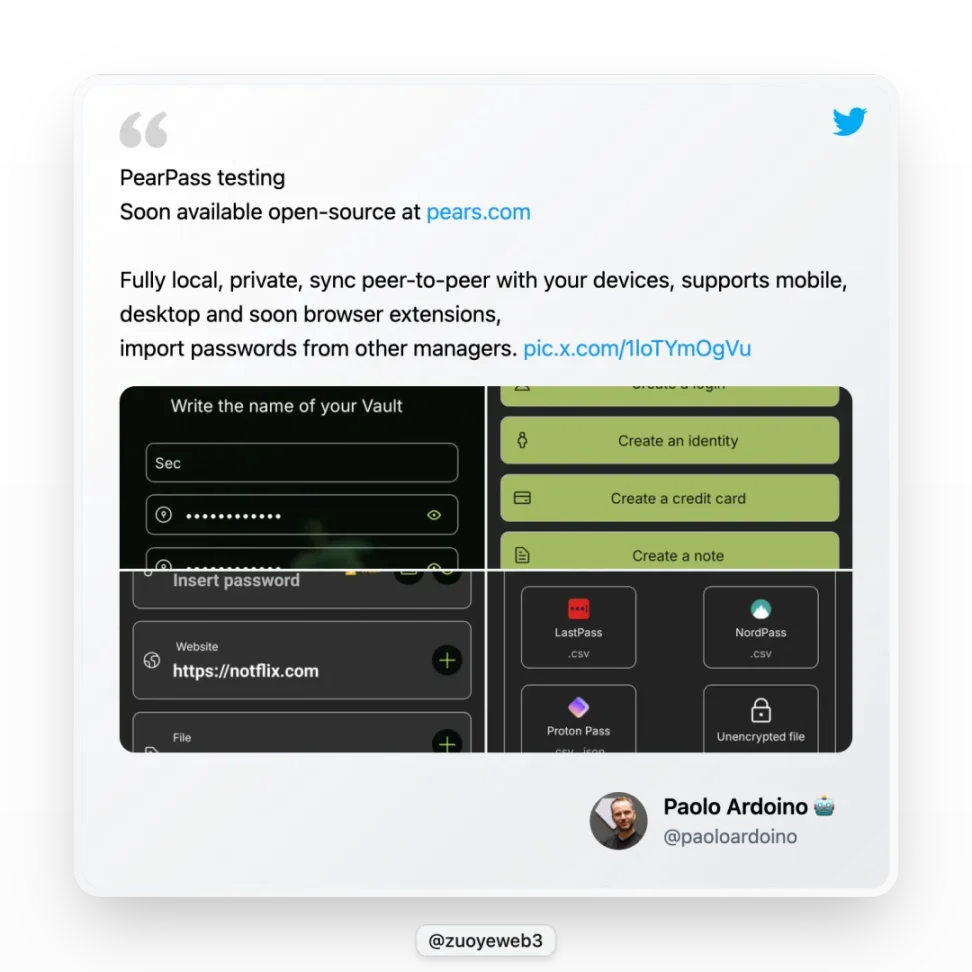

Image caption: Tether releases password manager Pears, Image source: @paoloardoino

On June 29, Tether CEO Paolo released the open source free password manager Pears. This does not directly enhance Tether's business, but you can believe in Tether's technology and original intention. They do this just for passion, not for money.

Tether is different from Bitcoin

Of course, this is just a daily pastime for rich people. In Tether's decentralized investment, the construction of the Bitcoin ecosystem and payment network is the key. The former values the value of Bitcoin in the long term, and the latter is a daily escape from Sun Ge.

By the way, Sun Ge and Tether are also alienated. Sun Ge tried TUSD, USDD and FDUSD to get rid of the strong dependence on USDT. Tether frequently tried emerging networks, but the two were tied together by fate. Bitcoin is true love, and Sun Ge was just an accident, but the two cannot be separated.

Tether has been consistent in its investment and construction in Bitcoin. The earliest USDT was issued on the Bitcoin Omni chain, which ultimately came to nothing. It was recently deployed on the Bitcoin sidechain network Rootstock, and the Plasma it supports also treats BTC and USDT as first-class citizens.

It is hard to say that this enthusiasm is a pure "indication" of orthodoxy, but more like a real passion. Anyway, I am not optimistic about the future of Omni and Rootstock. It is good for Bitcoin to be the digital gold of mankind. Plasma has market prospects, but the competition it faces is too intense, and it is far from being the only one in the payment field like USDT in the past.

The Battle of Legitimacy: Scar and the Hyena Alliance

All great empires have perished in internal struggles, and USDT’s alliance of interests is not solid.

Plasma and Stablechain, who is the successor of Tether? On the surface, it seems to be Plasma, but the relationship between USDT and USDT0 is ambiguous. USDT0 is more like a hidden branch of Tether outside of Plasma. The battle for the crown prince will be very exciting in the future.

Of course, this is an internal dispute within the ecosystem. Externally, USDC is leading the way towards compliance. The GENIUS Act clarifies the compliance details. Circle has previously communicated on the chain through CCTP and accepted the ISO 20022 standard to enter the SWIFT network, making it compatible and inclusive on and off the chain.

If Circle is Scar, then USDG is the Hyena Alliance. Paxos, the predecessor of BUSD, is its issuer. The Global Dollar Network (GDN) is the counterpart to CPN, Stablechain, Plasma and other clearing networks/chains. Its ecological alliance includes exchanges such as Kraken, Bullish (evolved from the parent company of EOS, holding 164,000 BTC), BTC ecological giant Galaxy, and the hottest brokerage Robinhood.

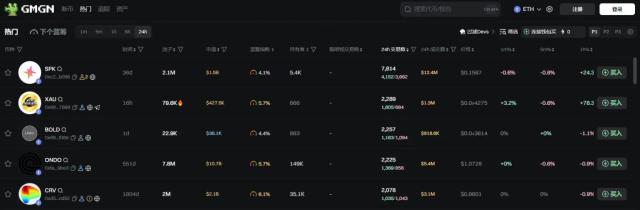

Image caption: GDN members, Image source: @global_dollar

Overall, the current stablecoin alliance consists of four teams:

USDT: Binance-Tron-Tether-Bitfinex

USDC: Coinbase-Circle-Binance

USDG: Paxos-Bullish-Galaxy Digital-Kraken-Robinhood

USDe: Ethena-Arthur Hayes-Bybit

It basically covers all aspects of payment, settlement and pricing, but what keeps it running is not glorious, mainly the "bribery" mechanism. Convex, which originated in the Curve War, and Penpie and Equilibria, which shined in the Pendle War LST/LRT era, all belong to this category.

They do not lobby stakeholders directly, but attract more funds to be managed by them through mechanism design, gain scale advantages over other competitors, and take more profits from Curve or Pendle to distribute to their own users.

Even simpler and more straightforward is Lido’s gameplay. With no threshold, more retail investors can avoid investing in building their own nodes. They only need to pay the handling fee to Lido. In this sense, Lido is Ethereum’s largest vote-buying platform.

The same is true for USDC. By distributing 60% of its profits to Coinbase and Binance, it has successfully achieved a market position second only to USDT. Whether it makes a profit or a little, it is still a profit. However, a strong binding relationship also has its advantages. When Silicon Valley Bank (SVB) collapsed, USDC was unpegged to 0.87 and was not abandoned by Coinbase.

Ethena's USDe also belongs to this category. USDe's investors include almost all CEXs, including Binance (YZi Labs), OKX, Bybit, Deribit, Bybit (Mirana), Gemini, and MEXC. They basically accept all CEXs, which is also its most subtle feature. These CEXs get ENA in exchange for USDe's hedging arbitrage and coin price stability.

Now there is a crack in the USDT alliance. In the trend of institutional settlement, it not only lags behind the entry of USDC, but even Ethena has cooperated with BlackRock to issue USDtb and, and cooperated with Securitize to issue the institutional chain Converge.

Following suit, USDG even promised that ecological participants can obtain 97% of the issuance income. It is determined to take the third place after USDT/USDC even if it loses money to gain publicity. The takeaway Red Yellow Blue is fighting against Mixue Bingcheng. Who will be the final loser in the stablecoin war?

Conclusion

The long stablecoin war has entered its 11th year since the issuance of USDT in 2014. Among them, the RMB (offshore) stablecoin appeared no later than USDT, and its operating scale is also equally large. For example, Huobi once directly supported RMB denominated currency, just as Kraken now denominated in USD.

Hopefully, this time, the market can change the situation where one company dominates the market, and prevent the situation where the pricing power of Bitcoin computing power is handed over to others from happening again.

After all, water can come back once it flows away, but money can never come back once it is gone.