The $550 billion trade agreement between the US and Japan boosts stocks, but Bitcoin drops 0.55%, with the broader cryptocurrency market declining by 1.20%.

President Donald Trump announced what he called "possibly the biggest deal ever" with Japan on Tuesday night, committing to a $550 billion investment in the US economy. This trade agreement created a positive reaction in the traditional stock market but did not generate a similar impact in the cryptocurrency sector, with Bitcoin and altcoins recording slight declines.

According to Trump's announcement on the Truth Social platform, the deal will see Japan invest $550 billion in the United States under his direction, with the goal of achieving 90% profit. The President affirmed that this agreement will create hundreds of thousands of jobs and emphasized that "nothing like this has ever happened before". The deal also includes facilitating automobile and agricultural product trade between the two countries.

The stock market reacted positively to this news, with S&P 500 rising 0.26%, Nasdaq increasing 0.09%, and Dow Jones up 0.42%. However, Bitcoin showed an opposite trend with a 0.55% decline, demonstrating a clear separation between traditional and digital assets in responding to geopolitical and trade news.

Cryptocurrency Market Faces Selling Pressure

The broader cryptocurrency market experienced a worse situation with a 1.20% decline, pushing CoinMarketCap's Altcoin Season Index down to 46 points. The index had reached a peak of 56 points on Monday, leading some analysts to prematurely declare the start of an "altcoin season" – a period where, according to CoinMarketCap, 75% of the top 100 tokens outperform Bitcoin over a three-month period.

With the current index at 46, it seems that even an important trade agreement between the world's two largest economies is not enough to create a positive momentum for Bitcoin. This suggests that the cryptocurrency market has its own unique influencing factors, not entirely dependent on macroeconomic news.

At the time of reporting, Bitcoin was trading at $118,203.22, decreasing 0.77% in 24 hours and 0.88% from the previous week. The asset fluctuated between $117,391.39 and $120,269.97 since yesterday. The 24-hour trading volume dropped 11.52% to $67.28 billion, while BTC's market capitalization also decreased 0.78% to $2.35 trillion.

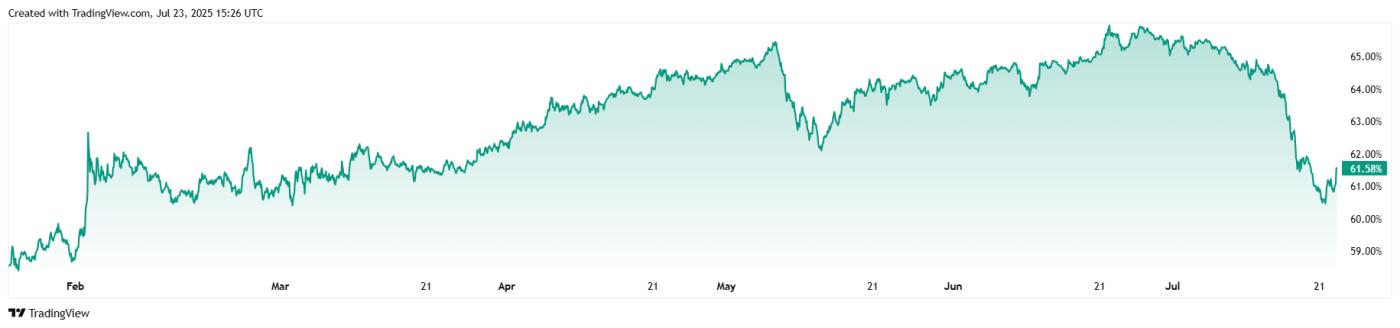

Bitcoin's dominance increased by 1.10% and stood at 61.57%, indicating capital flowing out of altcoins and into Bitcoin. The total open Futures Contract slightly decreased by 0.05% to $85.02 billion according to Coinglass. Liquidation activity recorded $51.23 million in 24 hours, with $34.66 million from long positions and $16.57 million from short positions.