Author: Li Zhongzhen

"......The stablecoin market is developing exponentially, showing a trend of integration with the global economy. In the future, global regulatory standards for international cooperation may be established, achieving mutual recognition of global stablecoin regulation. Currently, Visa and Mastercard both support stablecoin settlement, and online payment processing company Stripe has announced the acquisition of stablecoin payment platform Bridge. Central banks of various countries are also studying how to incorporate stablecoins into their payment systems. These signs indicate that stablecoins are evolving towards global compliance and mutual recognition. We just need to go with the flow and seize the opportunity."

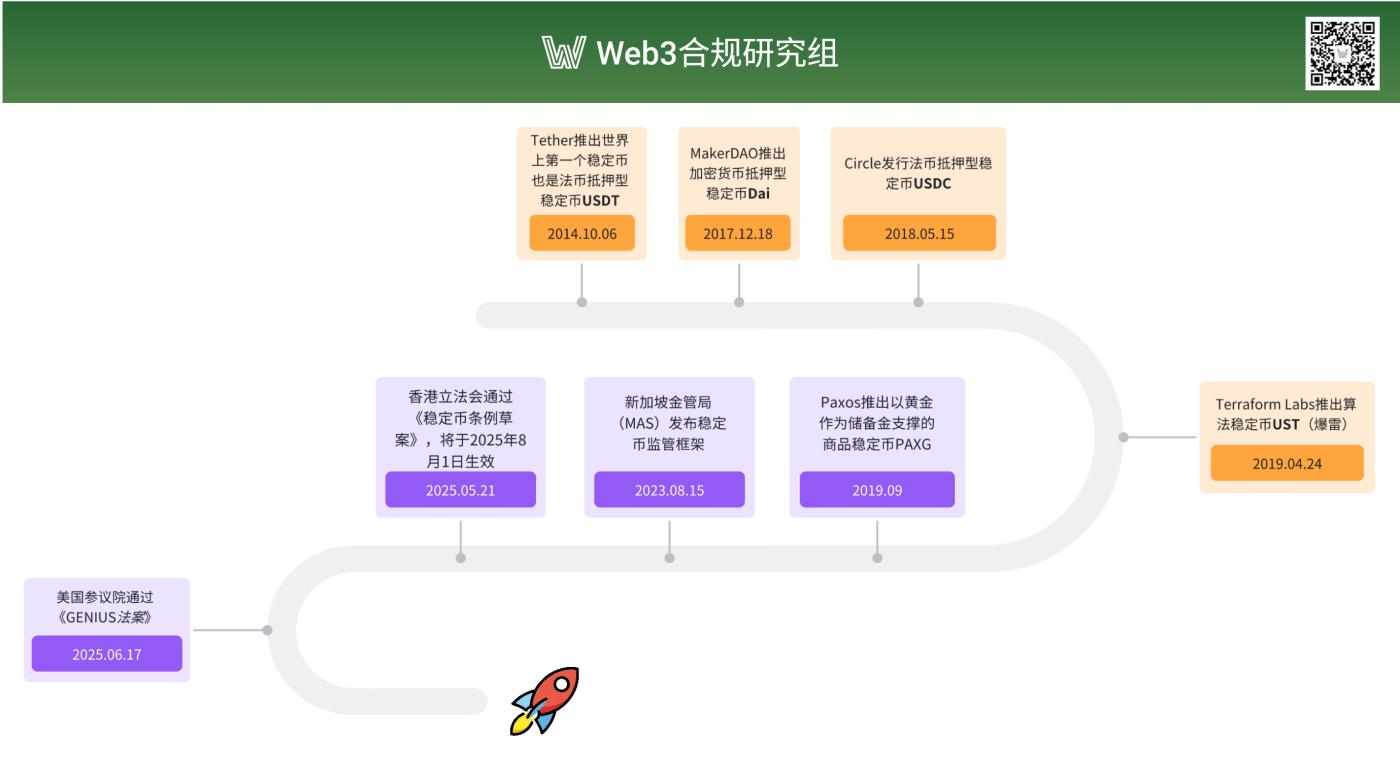

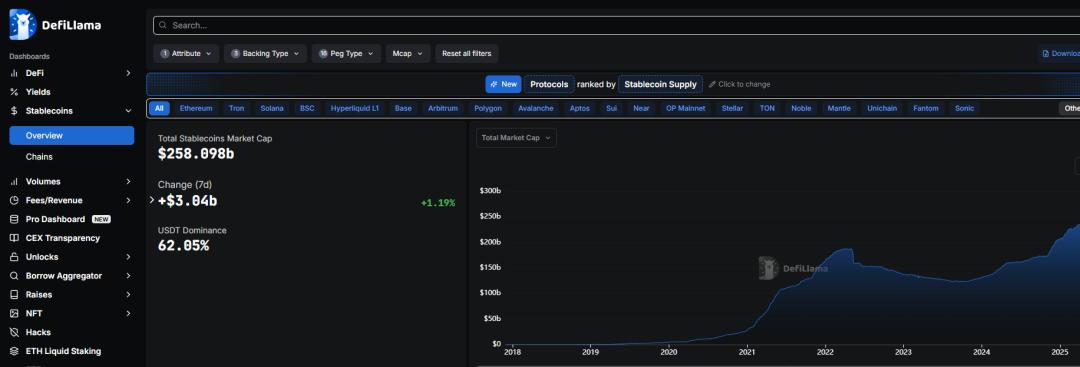

The above image briefly records major historical events in the evolution of stablecoins. Since Tether launched USDT nearly 11 years ago, according to defillama, the global stablecoin market size has approached $260 billion. With the implementation of Hong Kong's Stablecoin Regulation and the expected passage of the US GENIUS Act, the author believes that stablecoin application scenarios will continue to expand, with growth potential in crypto assets, cross-border payments, daily consumer payments, and traditional capital markets. According to calculations by Guotai Haotong Securities, the future scale of stablecoins is expected to reach $3.5 trillion.

I. Background and Evolution of Stablecoins

(I) Birth of Stablecoins

On October 31, 2008, Satoshi Nakamoto first proposed the concept of Bitcoin (BTC) in "Bitcoin: A Peer-to-Peer Electronic Cash System". On January 3, 2009, Satoshi Nakamoto mined the first Bitcoin block, marking the official birth of Bitcoin. Since then, the cryptocurrency market began to develop, with various cryptocurrencies emerging such as XRP, LTC, and Doge. In Satoshi Nakamoto's vision, Bitcoin would replace existing currencies and become a universal electronic currency, with all goods priced and settled in BTC.

The ideal is beautiful, but reality is cruel. Although BTC has a fixed total supply of 21 million, it is not pegged to gold or national credit, but rather priced based on global cryptocurrency user consensus, global monetary supply, and mining costs. This inherently means BTC cannot be a 1:1 electronic currency pegged to any fiat currency. Pricing directly in BTC would contradict people's long-established pricing habits and be difficult to accept. Moreover, cryptocurrencies like BTC have no price limit and frequently experience significant volatility, with daily fluctuations often exceeding 10%. During bear markets, investors want to exchange cryptocurrencies for fiat, but many cryptocurrencies lack direct fiat exchange channels, requiring conversion to BTC or other major cryptocurrencies first, then to fiat. During bear markets, BTC market trading is also sluggish, so successful conversion is risky.

In this context, to address cryptocurrency volatility, provide a stable value measure, facilitate a bridge between cryptocurrencies and fiat currencies, and meet decentralized finance and cross-border payment needs, Tether launched the world's first stablecoin—a fiat-backed stablecoin USDT on October 6, 2014. Subsequently, various stablecoins emerged like mushrooms after rain. According to defillama, there are currently 273 stablecoins globally.

A reminder: Although the stablecoin market is booming, it has inherent fatal problems—current stablecoins are issued by private enterprises or organizations without any sovereign national credit endorsement. They were not subject to specific regulation by any sovereign nation before issuance. As the United States, Hong Kong, Singapore, and the European Union accelerate establishing compliance regulatory systems for stablecoin businesses, many stablecoins will be classified as illegal and their issuers may face litigation or even criminal risks.

(II) Stablecoin Evolution Path

Stablecoins aim to ensure 1:1 exchange with fiat currencies, but existing projects have chosen different implementation paths. After years of development, current stablecoins can be divided into four types:

- Fiat-backed Stablecoins

- Crypto-backed Stablecoins

- Algorithmic Stablecoins

- Commodity Stablecoins

1. Fiat-backed Stablecoins

This is currently the most common and largest market share stablecoin type, with representative projects including USDT and USDC. These stablecoins are pegged to fiat currencies (such as USD, GBP) at a 1:1 ratio. Their issuers promise to hold an equivalent amount of fiat currency as reserve assets to support the issued stablecoins. These reserves typically exist as US dollar cash, bank deposits, or short-term US Treasury bonds. Fiat-backed stablecoins are usually issued and managed by centralized institutions. Due to their fiat collateral, they have low value fluctuation risk and strong price stability.

Its working principle can be detailed in the article by Sun Wei and Aiying, "Thousand-Word Description of Stablecoin Track: Models, Operating Principles, Trends, and Thoughts on Hong Kong Stablecoins", briefly summarized as:

- Step 1: User deposits US dollars into Tether's bank account

- Step 2: Tether creates a corresponding Tether account for the user and mints USDT of corresponding value

- Step 3: Transaction circulation between users

- Step 4: Redemption stage, where users need to return USDT to Tether when redeeming US dollars

- Step 5: Tether destroys the corresponding value of USDT and returns US dollars to the user's bank account