Story's Token IP has emerged as the best-performing asset today. This occurs in a context of decreased trading activity in today's session. This Altcoin has increased by 3% and is extending its price increase chain starting from 07/11.

IP's price has increased by over 20% in the past week, continuing to outperform even as the broader market faces downward pressure.

IP is rising, and 5 million USD spot flow indicates this is just the beginning

Story's native Token, IP, is currently trading at 5.11 USD, holding steady above an important technical support that has supported its price increase.

An analysis of the IP/USD chart over a day shows the token has consistently traded above an upward trend line since 07/11. This trend line is a price surge formation that appears when higher dips are formed over time, signaling strong and sustained buying interest.

IP's ascending trend line. Source: TradingView

IP's ascending trend line. Source: TradingViewThis trend line has played a role as a dynamic support. It continues to drive IP's price up despite the slight market weakness observed in recent trading sessions.

Moreover, IP's spot inflow remains stable in recent days, indicating sustained investor interest and confidence. According to Coinglass, despite the market-wide profit-taking trend, IP has recorded continuous net spot inflow over the past four days, exceeding 5 million USD.

IP's spot inflow/outflow. Source: Coinglass

IP's spot inflow/outflow. Source: CoinglassWhen an asset has such a net spot inflow, it means more capital is flowing into the asset through spot market purchases than being withdrawn. This signals increasing investor demand and confidence in IP's short-term prospects.

Although there was a net outflow of 157,000 USD from IP's spot market today as some traders take profits, the overall sentiment around the token remains very positive.

Futures Contract traders place large bets on IP's price increase

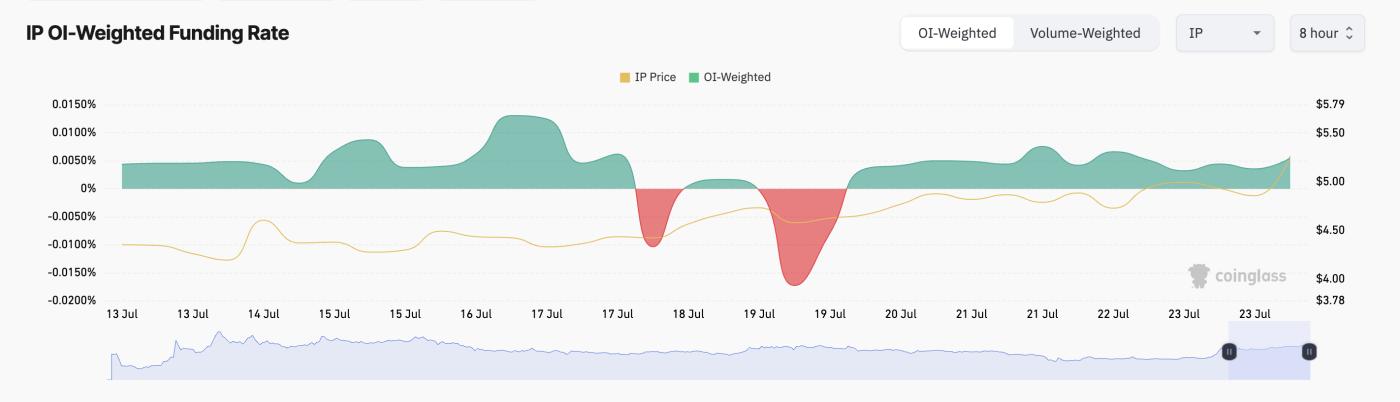

Positive on-chain activity reinforces expectations of continued short-term price increase, and this sentiment is also shared among IP's Futures Contract traders. This is reflected in IP's funding rate, which has remained positive since 07/20.

At the time of writing, this index is 0.0055%

IP's funding rate. Source: Coinglass

IP's funding rate. Source: CoinglassThe funding rate is a periodic fee exchanged between long-term and short-term traders in perpetual futures markets. It keeps the contract price aligned with the spot price.

A positive funding rate means traders are paying a fee to maintain long-term positions, indicating an optimistic market sentiment.

IP's positive funding rate shows that its Futures Contract traders are strongly leaning towards long-term positions. This reinforces the altcoin's price increase and signals confidence in a continued price surge.

IP surpasses 4.92 USD threshold; momentum could drive towards March's peak

IP's ongoing price increase has pushed it above a long-term resistance level at 4.92 USD, a price level it had struggled with for months. If this level becomes a solid support floor, the token could build on recent gains and rise to 5.59 USD, a peak seen in March.

IP price analysis. Source: TradingView

IP price analysis. Source: TradingViewHowever, weakening demand could cause IP to turn back. The token might test the 4.92 USD level, and if it fails to maintain that floor, it could open the opportunity for a deeper correction to 3.83 USD.