Mitigating Negative MEV is the First Step in Solana's New Roadmap.

Written by: Alex Liu, Foresight News

On July 21, Jito Labs released BAM (Block Assembly Marketplace), attempting to address the long-standing issues of transaction ordering unfairness and negative MEV (Maximum Extractable Value) in the blockchain ecosystem, bringing a new transaction processing paradigm to Solana. BAM seeks to build a more transparent and controllable transaction execution chain for Solana, introducing privacy protection, order verifiability, and application-layer programmability while maintaining high performance, achieving an efficient and fair on-chain execution market.

This article will analyze the technical mechanism, application scenarios, ecosystem impact, and development roadmap of BAM to help readers understand the significance of this new infrastructure.

Background: MEV Issues and Block Construction Reform

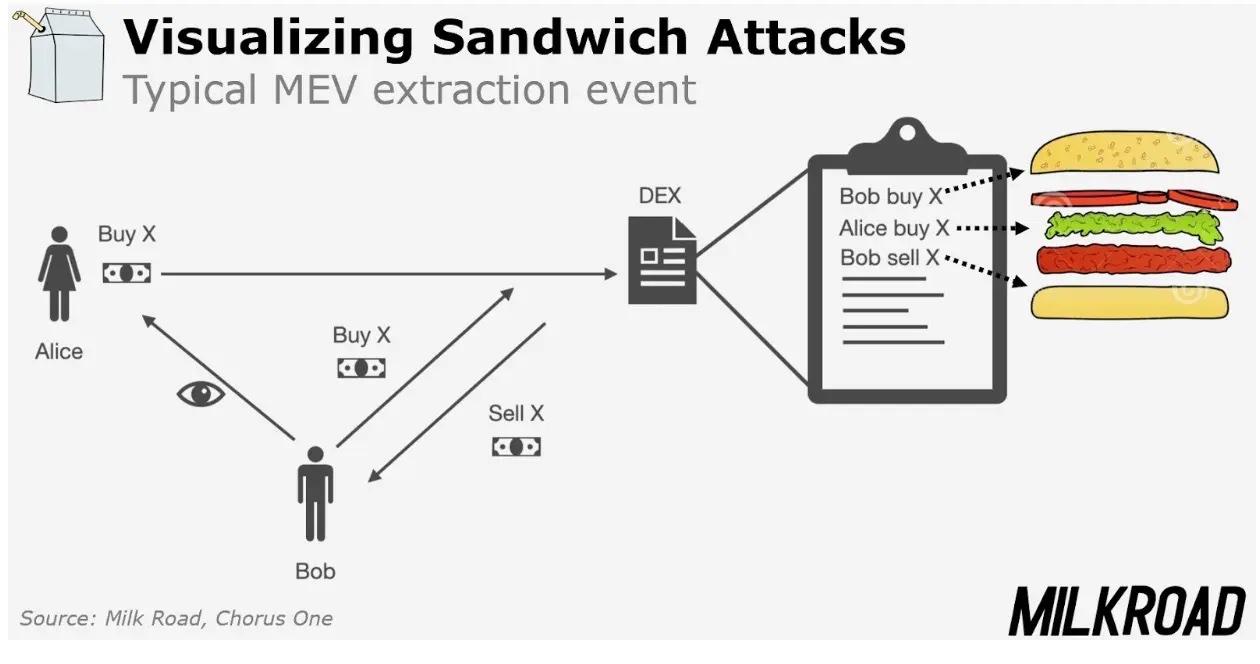

In traditional blockchains, transaction ordering is typically decided by block producers (such as Solana's Leader nodes), allowing certain nodes to gain benefits by prioritizing, reordering, or even sandwich trading transactions (so-called "front-running" and "front-running"), which is MEV. Although this mechanism is called "value extraction," it often harms users and applications, reducing execution fairness and user experience.

Especially in on-chain trades based on CLOB (Central Limit Order Book), the ordering mechanism directly affects transaction results, and the lack of a transparent, controllable ordering model not only hurts users but also affects the protocol's revenue generation capability.

Illustration: User Sandwich Attack

The Ethereum ecosystem has introduced a block construction market through PBS (Proposer-Builder Separation) to separate ordering rights from block proposers and alleviate MEV problems. On performance-oriented Solana, BAM proposes a more aggressive and native ordering market architecture compatible with hardware and underlying protocols.

Architecture + Plugin Mechanism

The BAM system consists of several core components:

- BAM Nodes (Scheduling Nodes): A TEE (Trusted Execution Environment) dedicated hardware network run by Jito to receive and encrypt transaction processing. They can filter and order transactions in a sealed state while generating cryptographic proofs, ensuring transaction ordering remains private before execution while being externally verifiable.

- BAM Validators (Execution Validators): Validators running the updated Jito-Solana client who execute transactions according to BAM Nodes' ordering and generate execution proofs. The execution process follows ordering requirements, preventing transaction order changes.

- Plugins: Developers can build plugins to access BAM Node's scheduling process, adding custom ordering logic. For example, prioritizing oracle updates, order cancellations, or transactions from specific user addresses to create an ordering method more aligned with actual business logic.

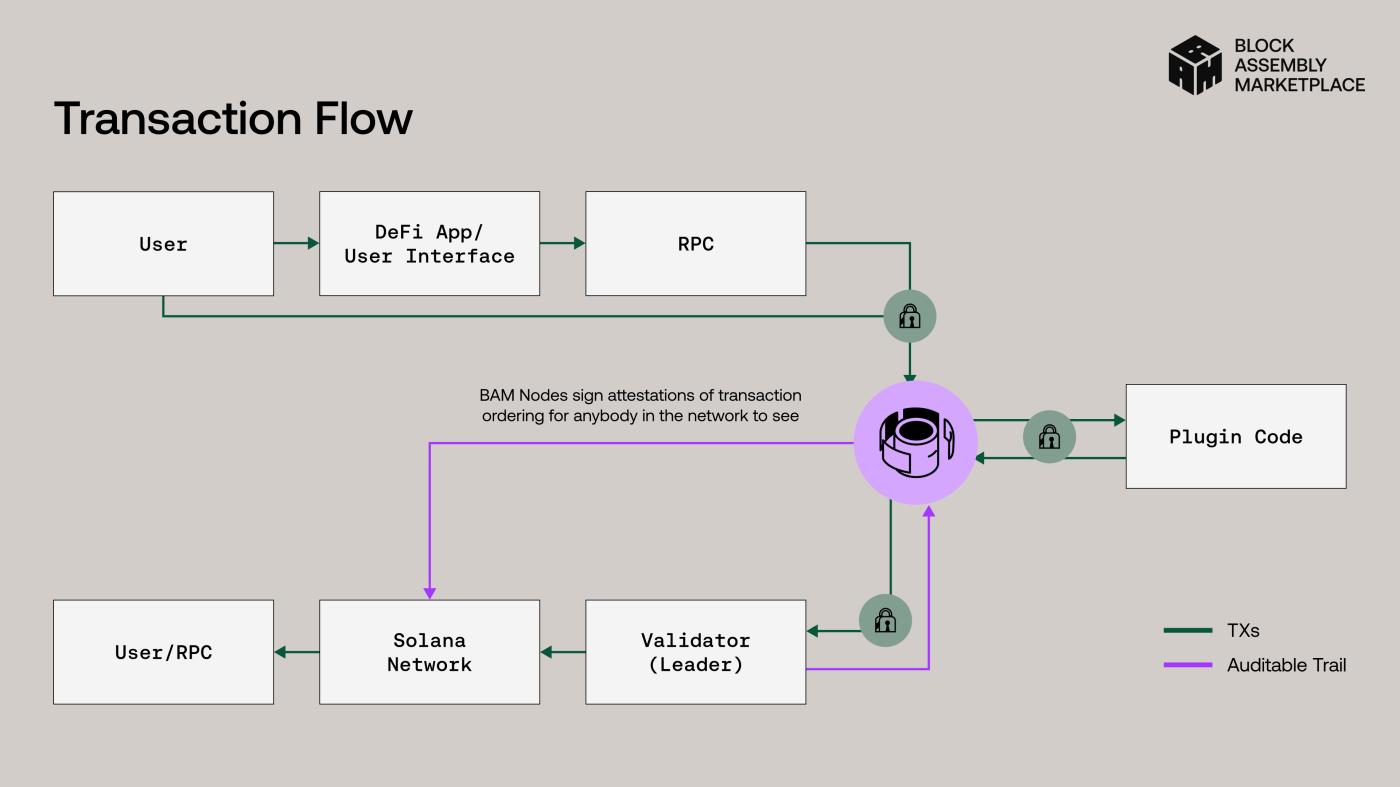

The entire transaction process is as follows:

- Users or applications send transactions to BAM Node;

- BAM Node orders transactions in TEE and generates an ordering proof, potentially inserting additional transactions through plugin mechanisms, such as Just-In-Time oracle data updates. After ordering, BAM Node generates a cryptographic proof and submits the ordered transaction package to the current Leader;

- The current Leader node executes transactions in the specified order, returning the execution process to BAM Node to confirm execution consistency, while generating an execution proof.

- All proofs generated by BAM Node and Validator will be published on-chain, creating a complete auditable trail that any third party can verify for potential tampering or skipping, thus achieving transaction execution accountability.

The highlight of this complete process is introducing an ordering market, privacy processing, and on-chain verification without changing Solana's core consensus mechanism, enhancing network fairness and programmability.

Functions and Applications

BAM is not just a transaction ordering optimization but opens up an entirely new set of use cases:

- Oracle Just-In-Time Updates: Like Pyth maintaining thousands of price sources. Through plugins, Pyth can insert price updates in the same block as user transactions, avoiding stale data and improving transaction accuracy while reducing liquidation risks.

- High-Frequency Cancellation Support: Similar to high-frequency market makers in traditional finance, BAM supports prioritizing order cancellation transactions, effectively improving DEX order book execution efficiency and liquidity without worrying about network "spam" from cancellations.

- Custom Ordering Logic: DEXs, Non-Fungible Token platforms, perpetual contract protocols, and others can define their transaction priorities, building execution models more tailored to business needs.

These functions not only optimize user experience but also provide a trading environment that meets compliance and execution guarantee requirements for institutional traders, potentially becoming a key lever for Solana to further attract institutional capital.

Jito's Role and Economic Model

BAM's launch also solidifies Jito DAO's role in Solana's MEV infrastructure. According to Jito's announcement, all protocol fees generated by BAM and Jito Block Engine will flow into the Jito DAO treasury.

Additionally, plugin usage and deployment will bring a new value capture model: developers can charge Plugin Fees from users, while BAM Nodes and Validators can receive profit shares from ordering services and execution.

Jito Labs will continue to maintain BAM's technology, with governance rights gradually transitioning to the DAO community to ensure technical neutrality and decentralized development.

Roadmap and Ecosystem Partners

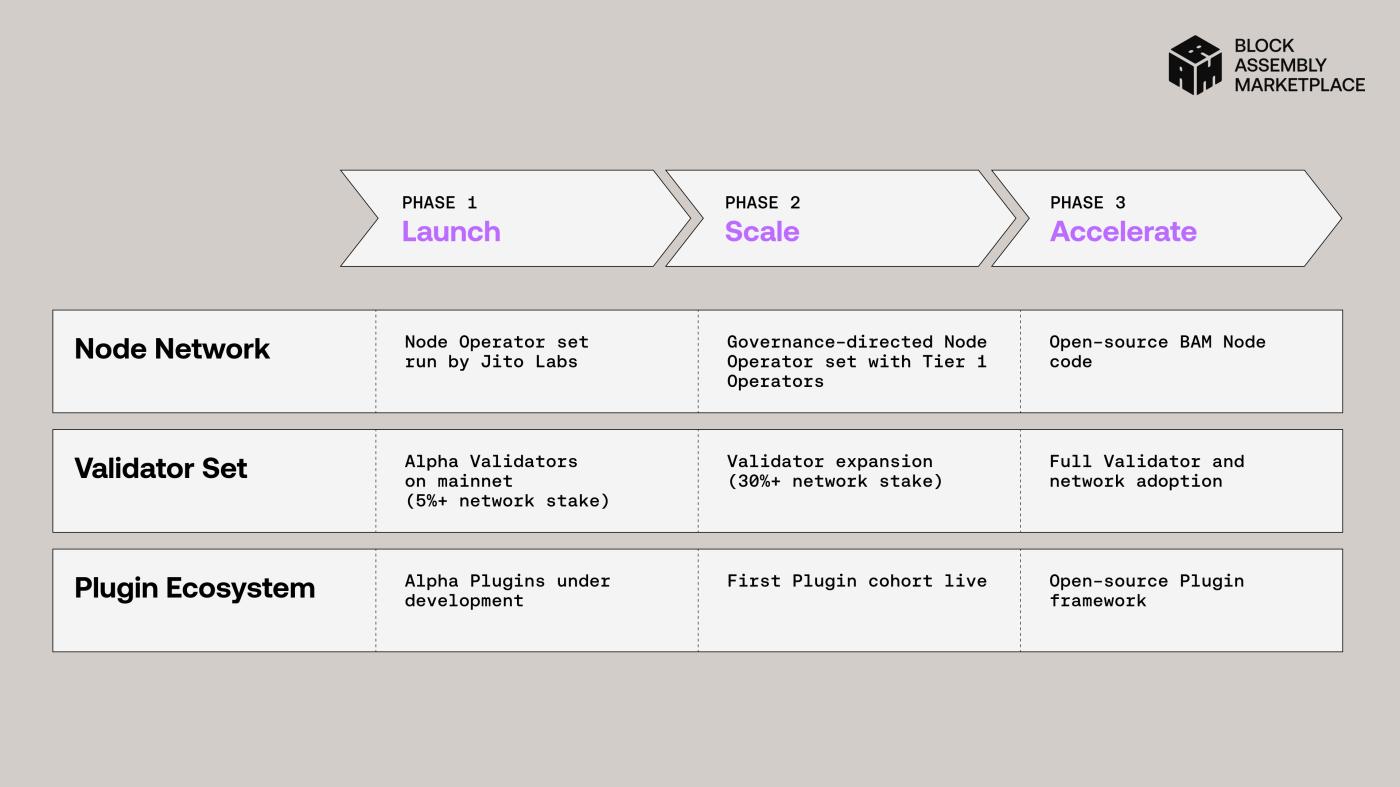

BAM's promotion will be rolled out in stages:

- Launch Phase: Jito Labs self-operates BAM Nodes, with early partner validators including Triton One, SOL Strategies, Figment, Helius, etc.;

- Expansion Phase: Open third-party BAM Node Operator access, targeting coverage of over 30% of Solana network staked assets;

- Open Source and Acceleration Phase: Open-source code to empower more developers to quickly deploy plugins and fully implement decentralized transaction construction.

Current initial partner applications include Drift, Pyth, DFlow, and other core Solana ecosystem protocols, with more DeFi, oracle, and trading infrastructure projects expected to join.

BAM's Potential and Challenges

BAM brings to Solana not just performance improvement or fairness enhancement, but a transformation of "ordering rights" from the protocol layer to developers and users. It makes the on-chain trading environment closer to the determinism, privacy, and accountability required in traditional financial markets, providing infrastructure support for building DeFi 2.0.

Of course, BAM's implementation is accompanied by certain challenges, such as dependence on TEE security, plugin design complexity, and balancing network decentralization, which will need continuous verification in subsequent development. In the future, whether BAM can truly "make Solana win" remains to be seen.