Author: Blockworks Research

Translated by: White55, Mars Finance

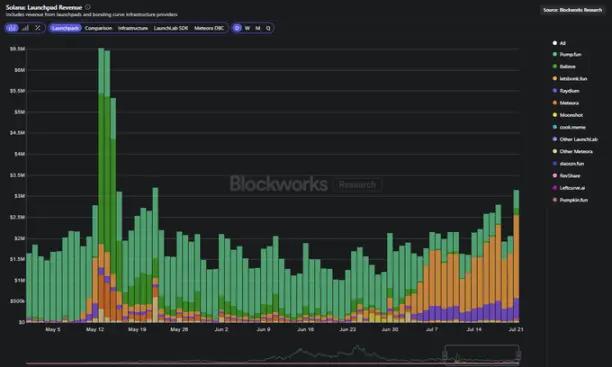

@bonk_fun and @pumpdotfun are competing for Launchpad dominance. Bonk has risen to lead Solana Launchpad revenue over the past month. What else can we discover by analyzing Bonk's growth? Let's dive in.

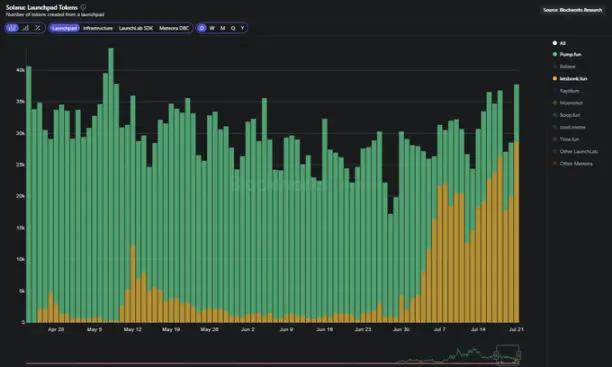

Before Bonkfun, Pumpfun consistently issued 30,000 to 40,000 tokens daily. Since Bonk took over, the total token issuance across platforms has remained relatively stable. However, Bonk now issues over 25,000 tokens daily, while Pump's daily token issuance is below 10,000.

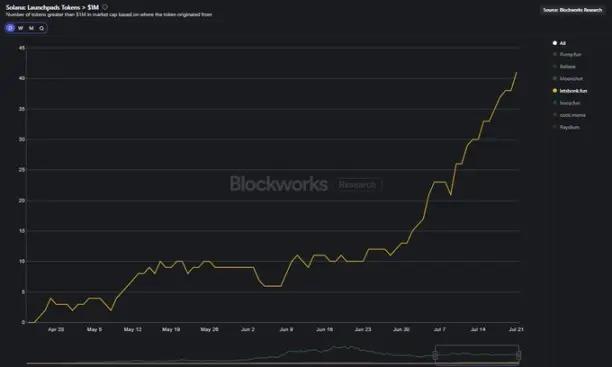

As the number of tokens grows, Bonk's token market cap has also increased. With the platform's expanding market share, the number of tokens with a market cap exceeding $1 million is trending upward.

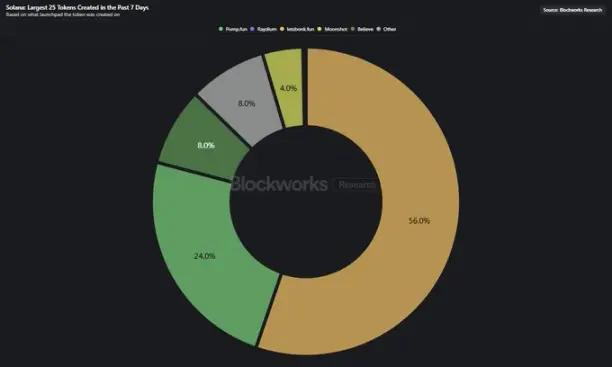

We also found that most of the highest market cap tokens issued in the past 7 days came from Bonkfun. The growth in issuance, trading volume, and market cap may be accelerating a flywheel effect, with traders favoring Bonk-based tokens due to their outstanding performance.

Interestingly, the proportion of high-frequency traders on the Pumpfun platform is higher. This may indicate an increasing presence of professional consumer traders or bots, which is intriguing considering Bonk's overall growth in tokens and trading volume.

We also discovered that over two-thirds of Bonkfun's trading volume comes from third-party trading applications. Meanwhile, Pump's proportion has dropped from over half to around 30%.

A few months ago, Pump firmly controlled the market. But in recent weeks, Raydium and Bonk have swept the token issuance market, challenging Pump's position. With Pump's recent financing and token issuance, we can't help but wonder how the team will respond.