Private domain information is becoming the most signal-to-noise ratio data source in quantitative investment.Cryptoracle is attempting to build a comprehensive system for collecting, modeling, and indexing "unstructured community behavior data", and using this as a foundation to provide high-frequency, verifiable data signals for Altcoin market strategy construction and institutional investment. This article will briefly introduce Cryptoracle's data system, application logic, and market positioning, and analyze how it can fill key gaps in the current quantitative market.

Team and Company Structure

Cryptoracle is built by the AIVIX team, with its main entity AIVIX SDN.BHD registered in Malaysia in 2025, incubated and led by Bitrise. The overall governance structure is clear: establishing a holding platform Aivix Horizon Holdings Ltd through Cayman BVI structure, with shares held by Bitrise, Skyslor Fund, and founding team individuals, and designing a long-term incentive plan covering technical backbone and data supply side.

As one of the few companies in the crypto market with fintech qualifications, AIVIX chooses to advance development through a "data + equity" path, aiming to build a stable and differentiated value barrier under compliance premises.

Logical Starting Point: Private Domain Communities are the Closest Data Source to "Market Consensus"

In the Altcoin field, mainstream data platforms mostly focus on on-chain data and public market trading behaviors, however, what truly drives price fluctuations often lies hidden in hard-to-quantify private domains:

Project community sentiment fluctuations

KOL group chat shills and discussions

VIP group and core position holders' behavior synchronization

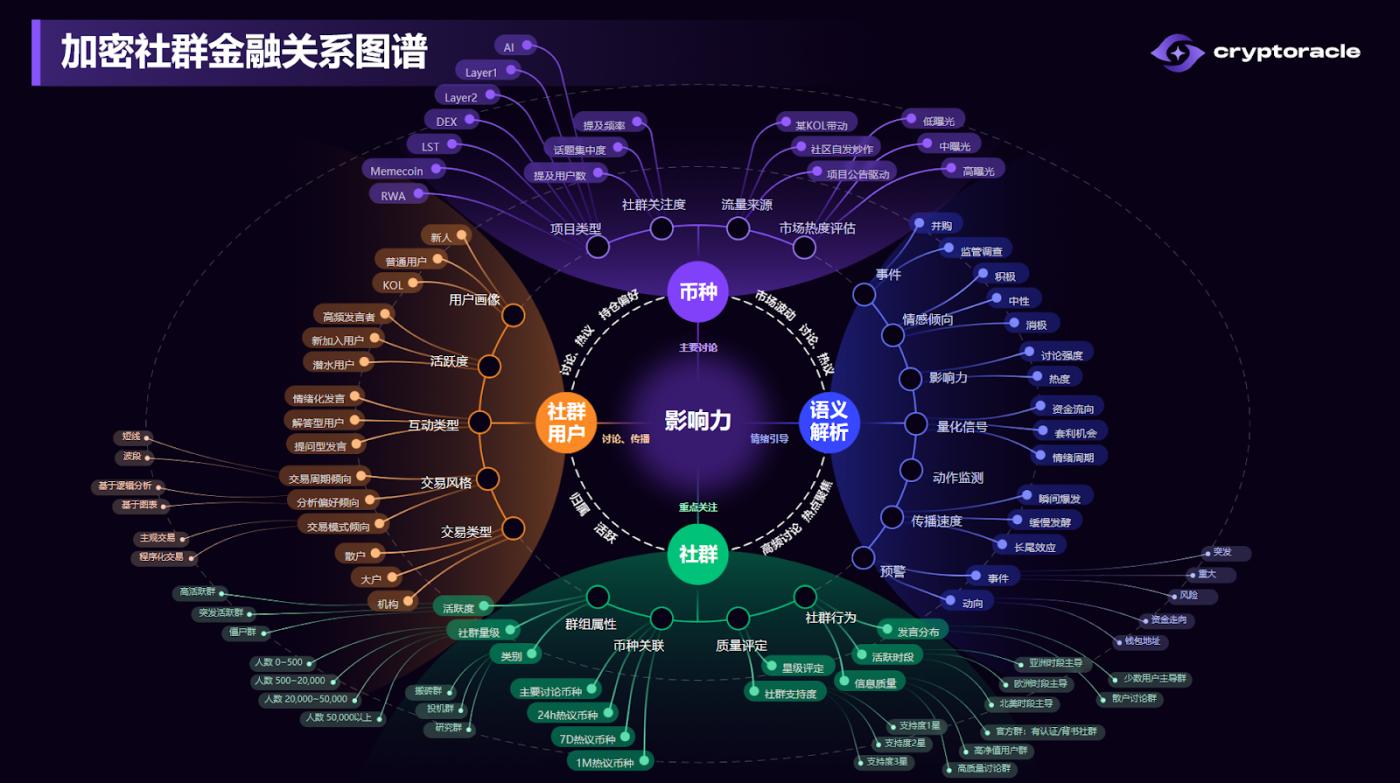

These non-public channels not only reflect market expectations but are also the starting point of consensus formation. Cryptoracle's task is tostructure, trace, and quantify these behavioral data, transforming them into tradable signals for institutions.

Product System: An Integrated Data Chain from Community to Signal

Cryptoracle's data engine consists of three major systems:

1) Private Domain Data Collection System

Through a multi-terminal crawler matrix of cloud hosts, physical terminals, and mobile devices, running over a thousand accounts long-term, real-time coverage of 3200+ crypto communities (including 380 VIP groups). Community sources include Telegram, Discord, WeChat, Feishu, Snackshort, Reddit, Binance Square, etc.

2) Quality Evaluation and Structuring Engine

The team scores community scale, activity, density, and governance indicators based on a self-developed "community quality evaluation system", and builds a tagged field library. Currently accumulated over 50G of backtest data, with over 100 fields and more than 30 indicator systems.

3) Indicator Service Generation

Based on daily semantic extraction results of over 220,000 entries, providing quantitative strategy providers with standardized or customized indicator services such as "KOL Sentiment Index", "Coin Hotness Trend", "Community Inflow and Outflow Monitoring", while supporting exclusive model training, API calls, and local deployment to meet compliance needs of different scale customers.

Market Gap: Why Altcoin Strategies Cannot Do Without Private Domain Data

The Altcoin market currently faces the following structural challenges:

On-chain data difficult to map actual game structure: Real buyer and seller expectations are often hidden in closed communities, with on-chain performance being a lagging reflection;

Frequent price volatility, but lacking predictable signals: Most strategies rely on historical trends, unable to make forward-looking layouts;

Lack of liquidity modeling foundation, compressed arbitrage space: Project distribution is scattered, market sentiment hard to capture.

The private domain data provided by Cryptoracle precisely fills these gaps. By structurally analyzing massive crypto community behaviors, it helps institutions predict sentiment trends, monitor project hotness, capture early fund movements, and provide practical basis for strategy design and factor optimization.

Core Data Capabilities and Achievements

As of now, Cryptoracle has completed:

Daily behavioral data processing:600,000+ entries

Private domain community coverage:30% (targeting increase to 50%)

Total user interaction coverage:2.6 billion times (1.2 billion users after deduplication)

Active speaking users:1.2 million+ daily

Supported strategy coin pool:TOP 50+, soon to expand to 200

Related data has been successfully backtested in multiple strategy systems, with an average strategy enhancement of 3%-5%.

Typical Strategy Research: How Data Becomes Trading Advantage

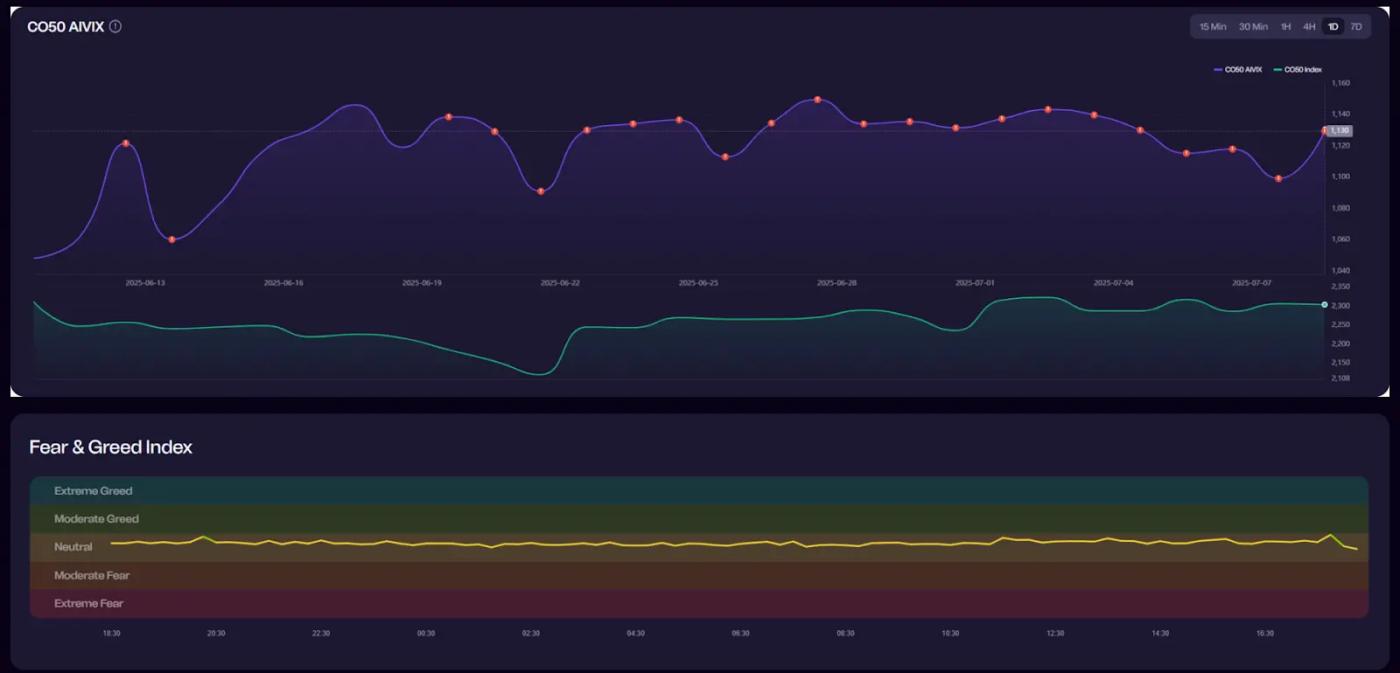

▍Multi-Coin Rotation Strategy

Signal source: Coin mentions in communities and their rate of change

Execution logic: Rebalance every 1 hour, selecting top five coins with rising heat

Backtest results: Approximately 5% increase over original baseline returns

▍Grid Trading Enhancement Strategy

Key signals: Community sentiment momentum, KOL sentiment direction, public opinion trend changes

Enhancement method: Combining volatility prediction module, dynamically adjusting grid boundaries to avoid entering during high-risk phases

Strategy models developed by Cryptoracle are currently in live trading trial phase.

Commercialization Path and Customer Structure

Currently, Cryptoracle has formed a parallel commercial service model of standardization and customization:

Standard indicator subscription: Suitable for small and medium strategy institutions, monthly payment

Custom model training: Training signal generation models for specific strategy needs

API and local deployment: Targeting high-frequency trading institutions and quantitative funds

Joint plans: Collaborating with Matrixport, Meta Alpha, BitonEx, etc.

Summary: Building "Consensus-Driven Strategies" with Private Domain Data

Traditional markets focus on assets, Cryptoracle focuses on behavior; traditional indicators track trends, Cryptoracle captures "expectation structures" in advance.

By structuring and quantifying private domain communities as "market consensus generators", Cryptoracle is constructing a new paradigm of data infrastructure. As Altcoin strategies continue to evolve, requirements for "information source uniqueness" and "data interpretation capabilities" are rising, andCryptoracle is not just a data provider, but a consensus cognitive generation engine.

From KOL groups to indicators, from community tags to trading strategies, this mechanism is gradually becoming the underlying driving logic of the next-generation crypto quantitative strategies.