Spark (SPK) price has corrected by over 17% in the past 24 hours, but some metrics suggest the sell-off may be easing.

While weekly gains still stand at 200%, several technical and on-chain indicators hint at a possible second leg of the rally if one key resistance is breached.

Exchange Outflows Suggest Selling Might be Slowing Down

One of the first signs that sellers might be backing off is the recent drop in exchange balances. In the last 24 hours, SPK exchange holdings fell by 5.33%, or nearly 21 million tokens. That suggests fewer tokens are available for immediate sale.

Spark (SPK) price and increasing exchange outflows: Nansen

Spark (SPK) price and increasing exchange outflows: NansenAt the same time, the top 100 wallets increased their holdings by 0.3%, pushing their combined balance to 9.97 billion SPK. Whales have also entered the mix, courtesy of a small 0.08% uptick in buying interest.

This shift implies that most whales may have already completed their profit-taking, creating a setup where fresh selling could dry up unless the price drops further.

Metrics Signal a Potential Short Squeeze Above $0.13

Spark (SPK) price is hovering around $0.11, but a breakout above $0.13 could trigger a powerful short squeeze. The reason lies in how traders are positioned across leveraged products and what the liquidation map reveals.

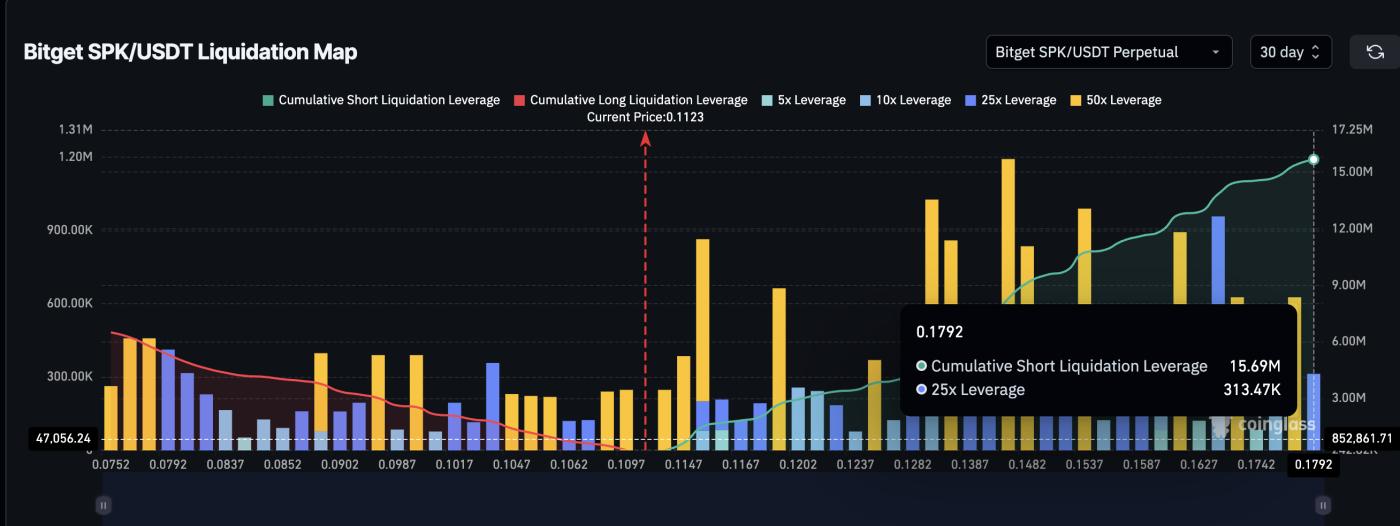

Spark (SPK) liquidation map (30-day): Coinglass

Spark (SPK) liquidation map (30-day): CoinglassThe map shows dense clusters of short liquidation levels beginning at $0.11, thickening between $0.13 and $0.17. These clusters are where high-leverage short positions (25x to 50x) are most likely to get liquidated. If SPK climbs into this range, these liquidations can create a chain reaction of forced buying, pushing the price even higher.

Open interest supports this possibility. It has dropped from $190 million to $83.6 million in recent days, a 60% decline, but remains elevated. This suggests many traders are still active in the market, and a large portion are likely holding shorts (per the liquidation map). That sets the stage for a liquidation-driven rally if key resistances break.

SPK open interest: Coinglass

SPK open interest: CoinglassTogether, these indicators, liquidation clusters above $0.13 and still-high open interest, point toward the possibility of a breakout that traps late bears. If $0.13 gives way, Spark (SPK) could ignite another leg higher, driven not just by fresh demand but by shorts forced to buy back.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Spark (SPK) Eyes The Key Breakout Zone

On the 4-hour chart, the 0.236 Fibonacci extension level lies at $0.13, the same level where intense liquidation triggers begin. Above that, resistance sits at $0.15 and $0.17, with a potential extension to $0.202 if the breakout accelerates.

Spark (SPK) price analysis: TradingView

Spark (SPK) price analysis: TradingViewDo note that the $0.15 resistance didn’t hold much weight during the past rally, but $0.17 did offer considerable resistance as Spark (SPK) attempted another move.

If the SPK price clears $0.13 with momentum, short liquidations could fuel a rapid 70% move toward the $0.17 zone. However, a dip under $0.09, a key support zone, and even the retracement level used to draw the Fib extension would invalidate the bullish hypothesis.